Business

Liquid foreign reserves rise slightly to $21b | The Express Tribune

SBP injects Rs2.06tr, gold crosses Rs473,000/tola and silver surges past Rs7,900/tola on global rally

Nearly 87% of foreign loans were for budget financing and building foreign exchange reserves, which meant that these had not been utilised for creating assets. PHOTO: FILE

KARACHI:

Pakistan’s foreign exchange reserves held by the State Bank of Pakistan (SBP) increased marginally during the week ended December 19, 2025, rising by $16 million to $15,902.5 million from $15,886.5 million a week earlier, official data released by the central bank showed.

The country’s total liquid foreign reserves stood at $21,022.6 million as of December 19. Of this amount, net foreign reserves held by commercial banks were recorded at $5,120.1 million.

During the week, the SBP injected Rs2.063 trillion into the financial system through reverse repo purchase and Shariah-compliant Mudarabah-based open market operations (OMOs) to manage market liquidity.

According to the central bank, a five-day tenor OMO, reverse repo purchase (injection), was conducted on December 26, 2025, under which Rs1.728 trillion was injected against 15 bids. The remaining Rs335 billion was injected through Shariah-compliant Mudarabah-based OMOs.

For the reverse repo purchase of the five-day tenor, the SBP received 15 bids cumulatively offering Rs1,728.75 billion at rates of return ranging between 10.51% and 10.61%. The central bank accepted the full amount against all 15 quotes at a uniform rate of return of 10.51%.

Separately, the SBP also conducted a Shariah-compliant Mudarabah-based OMO for the same five-day tenor. The central bank received four bids offering Rs335 billion at rates of return between 10.53% and 10.57%, and accepted all four quotes at a rate of return of 10.53%.

Meanwhile, the Pakistani rupee posted a marginal gain against the US dollar on Friday, appreciating by 0.01% in the interbank market.

According to SBP data, the local currency closed at 280.17 per dollar, strengthening by three paisa compared with the previous session. The rupee had ended trading at 280.20 against the greenback on Wednesday.

Gold prices in Pakistan rose sharply on Friday, tracking a strong rally in international bullion markets driven by expectations of US interest rate cuts and heightened geopolitical tensions, which boosted demand for safe-haven assets.

In the local market, the price of gold per tola increased by Rs500 to Rs473,362, according to rates released by the All-Pakistan Gems and Jewellers Sarafa Association (APGJSA). Similarly, the price of 10-gram gold rose by Rs429 to Rs405,831.

The latest increase follows Wednesday’s surge, when gold per tola touched a fresh all-time high of Rs472,862 after gaining Rs2,000 in a single session, underscoring strong upward momentum in domestic bullion prices.

Silver prices also posted a notable increase in the local market, with the per tola rate rising by Rs240 to Rs7,945, reflecting sharp gains in international silver markets.

Globally, spot gold climbed 1.1% to $4,526.92 per ounce, after briefly touching a record high of $4,533.14 earlier in the session. US gold futures for February delivery gained 1.3% to $4,559, according to Reuters.

Silver outperformed other precious metals, breaching the $75 per ounce level for the first time. Spot silver surged 4.5% to $75.20 per ounce by 10:06am ET, after hitting an all-time high of $75.62. The metal is now up 161% year-to-date, supported by persistent supply deficits, its designation as a US critical mineral and strong investment inflows.

Business

New rail tech policy in works; India eyes major boost for domestic manufacturing – The Times of India

India plans to unveil a new “rail tech” policy in the coming weeks to boost domestic manufacturing of next-generation railway technology and equipment. Under the proposed framework, the Railway Board is expected to offer partial funding, technical support, and access to testing facilities to manufacturers. The policy is part of the government’s rail modernisation drive and aims to reduce dependence on imported railway technology, including from China.“A new Rail Tech policy will give much needed impetus to innovation for mass transport,” a senior official told ET, noting that is would encourage collaboration between domestic firms and research institutions. India’s imports of railway and tramway locomotives, rolling stock, and equipment stood at about Rs 6,098 crore in FY25, with locomotive components forming the bulk of the import basket, reflecting reliance on imported sub-systems.Trade data and project reports for 2024–25 estimate that around 55% of railway component imports are for Indian Railways, with 45% for metro and rapid rail systems. Imports account for a limited share of India’s overall railway component requirements. The FY27 Union Budget allocated Rs 52,108.73 crore for rolling stock capital expenditure, up from Rs 50,007.77 crore this fiscal year, primarily for new locomotives, coaches, including Vande Bharat train sets, and wagons as part of fleet modernisation.The government’s proposed rail technology policy builds on the Indian Railway Innovation Policy launched in June 2022, which offered grant support of up to Rs 1.5 crore on a 50:50 cost-sharing basis for startups and smaller companies to develop functional prototypes. The earlier policy focused on improving safety, efficiency, and maintenance, and provided innovators with ownership of their solutions, access to a secure testing environment, and assured procurement for successful low-cost technologies.India plans to be entirely self-sufficient in building seven new bullet train networks, the railway minister said. Currently, China dominates India’s railway equipment imports, followed by Germany and Austria for engineering systems, and the US and Japan for specialised propulsion and signalling components.

Business

SBP currently has 64.76-ton gold reserves worth $10.37b – SUCH TV

After the rollercoaster ride in international bullion markets, the value of gold reserves of State Bank of Pakistan (SBP) has now skyrocketed to over 10 billion dollars.

The State Bank released details regarding the country’s gold reserves, revealing that the total value of the 64.76 tons of gold reserves stood at $10.374 billion.

According to the SBP, the value of Pakistan’s gold reserves increased by $1.279 billion in January 2026.

Over the first seven months of the current fiscal year, the country’s gold reserves have grown by $3.5 billion.

In June 2025, the value of Pakistan’s gold reserves was recorded at $6.84 billion.

The data also indicates that the country holds 20,82,000 ounces or approximately 5.5 million tolas of gold in reserves.

Business

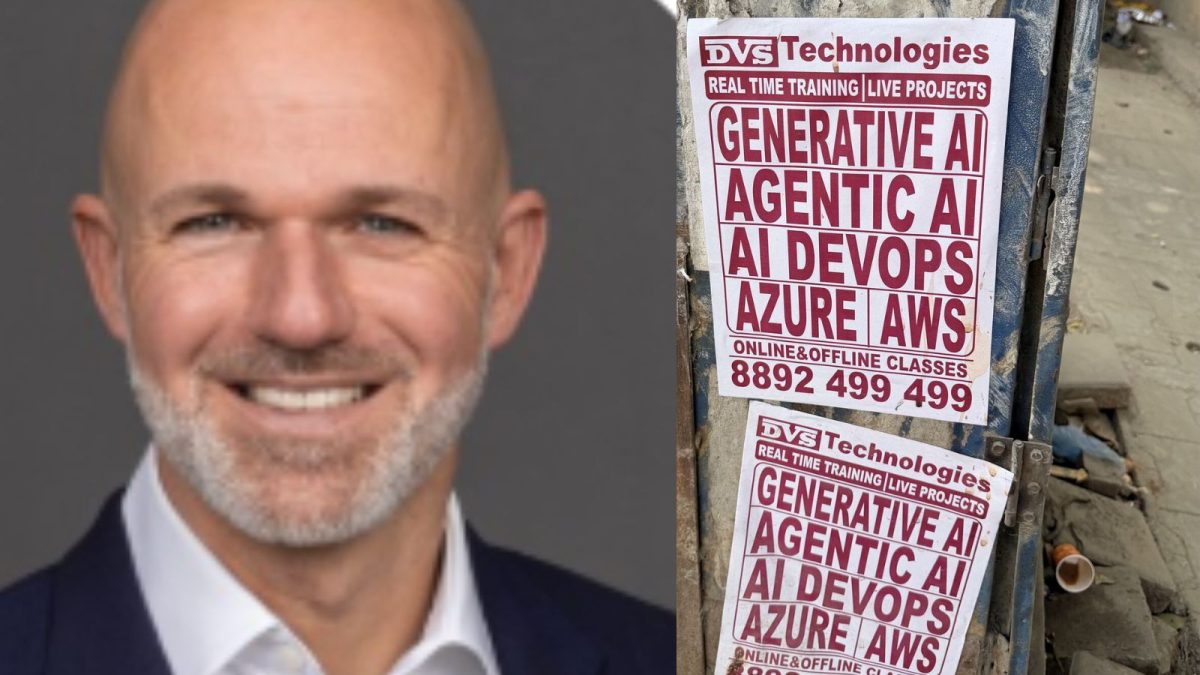

AI Training Poster In India Catches Genpact VP’s Attention As Tech Buzz Hits Streets

Last Updated:

Christian Eich of Genpact highlights India’s rapid AI adoption, stressing that workforce adaptability, not just technology, will drive competitive advantage in supply chain.

AI Impact Summit 2026 begins today in India

A senior supply chain executive has spotlighted the growing visibility of artificial intelligence adoption in India, arguing that the real competitive edge lies not in AI itself, but in how quickly professionals learn to work alongside it.

In a recent LinkedIn post, Christian Eich, Vice President Supply Chain and Partner at Genpact, reflected on the rapid pace of AI integration during a visit to India. “Let’s face it, AI will replace some jobs. But it’s also reshaping roles, creating new ones, and raising the bar on skills,” he wrote, adding that the key differentiator will be how fast people adapt to the technology.

AI company leaders are arriving in India to mark their presence in AI Impact Summit 2026, which is happening between February 16-20, 2026.

AI Momentum Becomes Increasingly Visible In India

Eich noted that while jobs in India are not directly comparable to those in other regions, the momentum around AI adoption is “striking” and increasingly visible. His comments align with broader industry observations that India is emerging as a major hub for AI experimentation and deployment, particularly in technology services and global capability centers.

India’s large digital workforce, expanding startup ecosystem, and growing enterprise investment in automation have accelerated the shift. From AI-powered customer service platforms to advanced analytics in supply chains and manufacturing, the technology is being embedded across functions rather than confined to pilot projects.

Skills, Not Software, As The Real Differentiator

Eich emphasized that AI’s impact goes beyond generating social media content or creative avatars — uses that have become common in professional networks. Instead, he challenged professionals to consider how they are deploying AI tools in daily workflows to improve productivity and decision-making.

As head of the European Supply Chain Managed Services & Analytics practice at Genpact, Eich leads initiatives focused on AI-enabled operating models designed to enhance cost efficiency and agility. His remarks reflect a growing consensus among transformation leaders that workforce upskilling and human-machine collaboration will define the next phase of enterprise AI adoption.

The message is clear: the technology itself may be widely accessible, but the ability to harness it effectively could determine who leads — and who lags — in the evolving labor market.

Check JEE Mains Result 2026 Link Here

February 16, 2026, 11:52 IST

Read More

-

Business6 days ago

Business6 days agoAye Finance IPO Day 2: GMP Remains Zero; Apply Or Not? Check Price, GMP, Financials, Recommendations

-

Fashion6 days ago

Fashion6 days agoComment: Tariffs, capacity and timing reshape sourcing decisions

-

Tech6 days ago

Tech6 days agoRemoving barriers to tech careers

-

Fashion6 days ago

Fashion6 days agoADB commits $30 mn to support MSMEs in Philippines

-

Entertainment6 days ago

Entertainment6 days ago‘Harry Potter’ star David Thewlis doesn’t want you to ask him THIS question

-

Sports6 days ago

Sports6 days agoWinter Olympics opening ceremony host sparks fury for misidentifying Mariah Carey, other blunders

-

Fashion6 days ago

Fashion6 days agoSaint Laurent retains top spot as hottest brand in Q4 2025 Lyst Index

-

Entertainment1 week ago

Entertainment1 week agoPrince William worries on royal family's image: watch

1733130350-0/Untitled-design-(76)1733130350-0-640x480.webp)