Business

Energy bills: What is happening to gas and electricity prices?

Getty Images

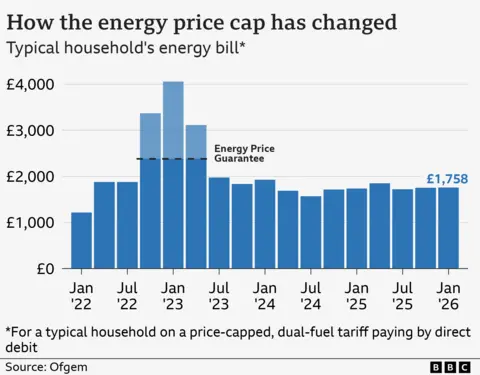

Getty ImagesTypical household energy costs will increase slightly on Thursday when the new energy price cap takes effect.

Separately, the regulator Ofgem has said customer bills will rise by around £30 a year over the next six years to help fund a major investment in the UK’s energy network.

However, that announcement followed an earlier government pledge in the Budget to remove some other costs from annual energy bills, worth about £150 to a typical household.

What is the energy cap and how is it changing?

The energy cap covers around 19 million households in England, Wales and Scotland and is set by Ofgem every three months.

It fixes the maximum amount customers can be charged for each unit of gas and electricity on a standard – or default – variable tariff for a typical dual-fuel household which pays by direct debit.

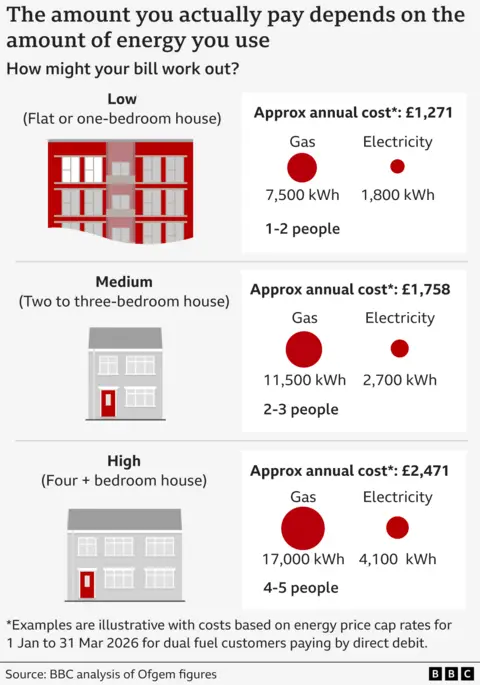

Actual bills depend on the amount of energy used.

What is a typical household?

The price cap sets the unit prices for gas and electricity, but your household’s actual bill depends on the overall amount you use, and how you pay for it.

The type of property you live in, how energy efficient it is, how many people live there and the weather all make a difference.

The Ofgem cap is based on a “typical household” using 11,500 kWh of gas and 2,700 kWh of electricity a year with a single bill for gas and electricity, settled by direct debit.

The vast majority of people pay their bill this way to help spread payments across the year. Those who pay every three months by cash or cheque are charged more.

Why has Ofgem said energy bills will rise?

In December, Ofgem said it had approved a £28bn investment to improve the electricity and gas grids in Great Britain.

It says this will strengthen the energy supply, and better shield customers from volatile energy prices. It will also reduce Britain’s dependence on gas.

Customers will foot part of the cost, through an additional £108 added to energy bills by 2031. Bills will start to rise from April 2026.

However, Ofgem says the investment will make wholesale energy cheaper overall, saving households about £80 a year, leading to a net energy bill rise of about £30 a year.

What did the government say about energy costs in the Budget?

In the November Budget, Chancellor Rachel Reeves announced measures to cut energy costs from April 2026.

At the moment, energy bills in England, Scotland and Wales already include additional charges to help fund insulation for low-income households, and subsidise green energy projects such as wind farms and solar panels.

Reeves said the insulation scheme – called the Energy Company Obligation – would be scrapped, and for three years, renewable energy projects will be 75%-funded by general taxation instead of a levy on energy bills.

She said this would take £150 off average annual dual-fuel bills.

After taking into account the increase as a result of the Ofgem announcement, it means average energy bills should fall by about £120 a year.

Should I take a meter reading when the energy cap changes?

Submitting a meter reading when the cap changes means you are not charged for estimated usage at the wrong rate.

This is especially important when prices go up.

Customers with working smart meters do not need to submit a reading as their bill is calculated automatically.

What is happening to prepayment customers?

About six million households have prepayment meters, according to the latest Ofgem figures.

Prepayment customers were previously charged more than those who settle their bill by direct debit, but now pay slightly less.

Between 1 January and 31 March 2026, the typical annual bill for prepayment customers is £1,711.

Getty Images

Getty ImagesMany pre-payment meters have been in place for years, but some were installed more recently after customers struggled to pay higher bills.

Rules introduced in November 2023 mean suppliers must give customers more opportunity to clear their debts before switching them to a meter. They cannot be installed at all in certain households.

Can I fix my energy prices?

Fixed-price deals are not affected by the energy price cap, which changes every three months and can rise and fall.

They offer certainty for a set period – often a year, or longer – but if energy prices drop when you are on the deal, you could be stuck at a higher price. You may also have to pay a penalty to leave a fixed deal early if you change your mind.

Ofgem, the energy regulator, says customers who want the security of knowing what their bill will be should consider moving to a fixed deal. However, it says they should make sure they understand all the costs.

Martin Lewis, founder of Money Saving Expert, recommends checking whole-of-market energy price comparison sites to help find the best deal.

What are standing charges and how are they changing?

Ofgem also controls standing charges, which are a fixed daily fee to cover the costs of connecting households to gas and electricity supplies. These vary slightly by region.

Between 1 January and 31 March 2026, standing charges will typically be 55.75p a day for electricity and 35.09p a day for gas.

Campaigners have long argued that standing charges are unfair because they make up a bigger proportion of the bill of low energy users.

In response, Ofgem said that by the end of January 2026, it wants all energy firms to offer at least one tariff that has a low standing charge but higher cost per unit of energy.

The regulator said this would give some customers more choice and control, but acknowledged it would not be suitable for everyone.

Charities, campaigners and the suppliers’ trade body criticised the proposal for just shifting the cost from one part of the bill to another rather than cutting it.

What help can I get with energy bills?

Suppliers must offer customers affordable payment plans or repayment holidays if necessary. Most also offer hardship grants.

Under plans Ofgem hopes to introduce in early 2026, nearly 200,000 people on benefits could have their debts to their energy supplier cancelled – as long as they have made some effort to pay what is owed.

The scheme could see up to £500m knocked off the £4.4bn currently owed to suppliers. But covering the cost will require an extra £5 being added to everyone’s gas and electricity bill.

A number of existing government schemes also help people on low incomes with their energy bills.

The Household Support Fund, which was introduced in September 2021 to help vulnerable customers, has been extended until March 2026.

The Warm Home Discount scheme is also being overhauled.

From winter 2025, anyone on means-tested benefits in Great Britain will get £150 taken off their bills, no matter what size of property they live in.

The discount will be applied automatically for people in England or Wales and some in Scotland. However, those on a low income in Scotland will need to apply via their energy supplier. Letters are being sent to people with information on the discount.

The Fuel Direct Scheme lets people repay an energy debt directly from their benefit payments.

About nine million pensioners will also get the Winter Fuel Payment in 2025/2026, worth £200 or £300, after a government U-turn over eligibility.

Business

Petrol and diesel prices likely to rise – SUCH TV

Oil and Gas Regulatory Authority (OGRA) forwarded a summary to the federal government suggesting an increase of Rs4.39 per liter in petrol price for the next fortnight.

After approval from the federal government, one liter of petrol will be sold at Rs257.56 instead of Rs253.17 per liter.

The price of high-speed diesel (HSD) will be increased by Rs5.40 per liter.

After approval, the price of one liter of high-speed diesel will increase by Rs268.38 to Rs273.78.

The proposal to increase the price of kerosene by Rs4 per liter is also on the cards.

The OGRA also recommended increasing the price of one liter of light diesel by Rs6.55.

The new prices of petroleum products will be effective from February 16, 2026.

Due to tension between the USA and Iran, petroleum prices are likely to increase further.

Business

RBI Proposes 4 Major Changes In Kisan Credit Card Scheme: What Beneficiaries Must Know

Last Updated:

RBI releases draft to revise Kisan Credit Card Scheme, standardizing crop cycles, extending loan tenure to six years, and aligning credit limits with cultivation costs.

From Crop Cycles To Loan Tenure: 4 Key Changes In RBI’s KCC Proposal

Kisan Credit Card Scheme: The Reserve Bank of India (RBI) has released draft directions to revise the Kisan Credit Card (KCC) Scheme, aiming to expand coverage, streamline operations, and align credit norms with evolving agricultural needs.

Standardized Crop Cycles And Extended Loan Tenure

As outlined in the draft, crop seasons have been standardized to introduce uniformity in loan sanctioning and repayment schedules. Short-duration crops will now be treated under a 12-month cycle, while long-duration crops will follow an 18-month cycle.

Example:

A farmer growing paddy or wheat (harvested in a few months) will follow a 12-month loan cycle.

A farmer growing sugarcane (which takes 12–18 months) will get an 18-month cycle.

To better align loan tenure with these crop cycles, especially for longer-duration crops, the overall tenure of the KCC facility has been extended to six years. The move is expected to provide farmers with greater flexibility in repayment and reduce rollover pressures.

Example:

If a farmer growing sugarcane faces a bad monsoon in Year 2, he doesn’t have to rush repayment immediately. The 6-year window gives more breathing space and reduces pressure to take fresh loans to repay old ones.

The draft directions apply to Commercial Banks, Small Finance Banks, Regional Rural Banks, and Rural Co-operative Banks, indicating a system-wide implementation once finalized.

Drawing Limits Linked To Cost Of Cultivation

The RBI has proposed aligning drawing limits under the KCC scheme with the scale of finance for each crop season . This adjustment aims to ensure that farmers receive credit in line with the actual cost of cultivation, addressing concerns around under-financing.

Example:

If growing cotton in a district costs Rs 60,000 per acre (as per agriculture department data), banks will align KCC limits accordingly — instead of giving a lower, outdated amount like Rs 40,000.

In addition, the draft expands eligible components under the KCC framework. Expenses related to technological interventions—such as soil testing, real-time weather forecasts, and certification for organic or good agricultural practices—have been included within the existing 20% additional component earmarked for repairs and maintenance of farm assets .

Example:

If a farmer wants to:

- Test soil before sowing

- Subscribe to real-time weather alerts

- Get organic farming certification

These costs can now be covered under KCC instead of paying from pocket.

What Is Kisan Credit Card Scheme?

The Kisan Credit Card scheme aims at providing adequate and timely credit support from the banking system under a single window with flexible and simplified procedures to the farmers for their cultivation and other needs.

The KCC scheme was introduced in 1998 for the issue of Kisan Credit Cards to farmers on the basis of their holdings for uniform adoption by the banks so that farmers may use them to readily purchase agriculture inputs such as seeds, fertilizers, pesticides etc. and draw cash for their production needs.

KCC covers post-harvest expenses, produce marketing loan, consumption requirements of farmer households, working capital for maintenance of farm assets and activities allied to agriculture, investment credit requirement for agriculture and allied activities.

February 14, 2026, 12:49 IST

Read More

Business

Four ports under construction in Andhra Pradesh, Centre tells Lok Sabha – The Times of India

The Centre is pushing port-led infrastructure expansion in Andhra Pradesh, with four ports currently under construction, even as it steps up nationwide port modernisation and efficiency measures.As per information shared on Friday in Parliament, the ports under construction in Andhra Pradesh are Mulapeta Port (formerly Bhavanapadu Port) in Srikakulam district, Machilipatnam Port in Krishna district, Ramayapatnam Port in SPSR Nellore district, and Kakinada SEZ Port in Kakinada district.The government said it is undertaking measures such as mechanisation of berths and terminals, digitalisation and logistics integration, new berth construction, capital dredging for larger vessels, and connectivity upgrades across road, rail and waterways.It has also rolled out initiatives including elimination of manual forms, direct port delivery and entry, container scanners, e-delivery of documents and payments, RFID-based gate automation and Maritime Single Window platform SagarSetu 2.0 to cut vessel turnaround time.Two new ports — Vadhavan Port in Maharashtra and Galathea Bay Port in Andaman and Nicobar Islands — have been notified as major ports. At present, 12 major ports operate under the central government, while 68 other-than-major ports are under state governments.Under the Sagarmala scheme, financial assistance is provided across five pillars including port modernisation, connectivity, port-led industrialisation, coastal community development and inland water transport.The government has also launched HaritSagar green port guidelines, the Green Tug Transition Programme (GTTP), and the Cruise Bharat Mission to promote sustainability and cruise tourism.The information was given by Union Minister of Ports, Shipping and Waterways Sarbananda Sonowal in a written reply to the Lok Sabha.At present, 12 major ports operate under the administrative control of the central government, while 68 operational other-than-major ports are under state governments.The government said it has launched multiple national programmes for port development, expansion and upgradation. Under the Sagarmala scheme, financial assistance is provided under five pillars — port modernisation, port connectivity, port-led industrialisation, coastal community development, and coastal shipping and inland water transport.Green and sustainability-linked initiatives have also been introduced. The government has launched HaritSagar green port guidelines to promote environment-friendly port ecosystems and initiated the Green Tug Transition Programme (GTTP) to shift harbour tugs towards greener fuel alternatives.Further, the Cruise Bharat Mission has been launched to prioritise cruise tourism development across the country.

-

Entertainment1 week ago

Entertainment1 week agoHow a factory error in China created a viral “crying horse” Lunar New Year trend

-

Tech1 week ago

Tech1 week agoNew York Is the Latest State to Consider a Data Center Pause

-

Business4 days ago

Business4 days agoAye Finance IPO Day 2: GMP Remains Zero; Apply Or Not? Check Price, GMP, Financials, Recommendations

-

Tech1 week ago

Tech1 week agoNordProtect Makes ID Theft Protection a Little Easier—if You Trust That It Works

-

Tech1 week ago

Tech1 week agoPrivate LTE/5G networks reached 6,500 deployments in 2025 | Computer Weekly

-

Fashion4 days ago

Fashion4 days agoComment: Tariffs, capacity and timing reshape sourcing decisions

-

Business1 week ago

Business1 week agoStock market today: Here are the top gainers and losers on NSE, BSE on February 6 – check list – The Times of India

-

Business1 week ago

Business1 week agoMandelson’s lobbying firm cuts all ties with disgraced peer amid Epstein fallout