Business

Here’s what to expect for commercial real estate in 2026

A version of this article first appeared in the CNBC Property Play newsletter with Diana Olick. Property Play covers new and evolving opportunities for the real estate investor, from individuals to venture capitalists, private equity funds, family offices, institutional investors and large public companies. Sign up to receive future editions, straight to your inbox.

The 2025 economy wasn’t as robust as anticipated — and that’s shaping the commercial real estate outlook for 2026. The economy has slowed down, unemployment is up and construction has taken a bit of a breather across most sectors.

This year saw increases in both tariffs and immigration restrictions. Together, those have raised costs for builders and developers. But interest rates have also come down, which is starting to unlock more capital, albeit slowly and cautiously.

Here’s what you can expect for the year ahead.

General investment

The many and varied outlook reports from just about every commercial real estate firm out there, as well as related consulting and financial services firms, use words like “new equilibrium” (Colliers), “firmer fundamentals” (Cushman & Wakefield), “ongoing recovery” (KBW) and “signs of price stability” (CoStar).

Looking at specifics for the year ahead, CRE leaders are slightly less optimistic than they were ahead of 2025, according to a Deloitte survey of 850 global chief executives and their direct reports at major real estate owner and investor organizations across 13 countries. Eighty-three percent of respondents said they expect their revenues to improve by the end of 2026 compared with 88% last year. Fewer respondents said they plan to increase spending, while more expect to keep spending flat. Still, 68% said they anticipate higher expenses in 2026.

Most respondents said they do expect the cost of capital to improve, and growth is expected across most asset classes. Overall sentiment is down from last year but well above that of 2023, according to the Deloitte survey.

Looking specifically at the U.S., the commercial real estate sector is entering 2026 with renewed momentum, clearer visibility, and growing optimism across both leasing and the capital markets landscape, according to a forecast from Cushman & Wakefield. It notes that despite uncertainty surrounding tariffs, a volatile policy backdrop, tightening immigration and episodes of financial market stress this year, the economy was more resilient than expected, driven in large part by artificial intelligence.

“As we head into 2026, the tone has shifted meaningfully,” said Kevin Thorpe, chief economist at Cushman & Wakefield. “There is still risk on both sides of the outlook, but we’ve moved past the peak levels of uncertainty, and confidence in the CRE sector is building. Capital is flowing again, interest rates are moving lower, and leasing fundamentals are generally stabilizing or improving. If 2025 was a test of resilience, 2026 has real potential to reward it.”

Capital is reengaging, according to Colliers, which predicts the industry is, “entering a new equilibrium.” Forecasters there point to the bottoming out of office demand and new growth in industrial, thanks, again, to AI.

PwC also emphasizes that capital began flowing again in the second half of this year, “but selectively.”

“The deal environment rewards those who can combine data-driven insight with strategic conviction. For clients, the challenge—and the opportunity—is to navigate a landscape where liquidity, technology, and consolidation are redefining the meaning of value creation in real assets,” according to a PwC report.

The share of investors who say they expect to increase their commercial real estate investments over the next six months fell in the fourth quarter of this year from the previous quarter in every sector except retail, according to a survey from John Burns Research and Consulting. Multifamily investor sentiment weakened for the fourth consecutive quarter.

“Investors cited headwinds that included elevated interest rates, economic uncertainty, and local regulatory burdens. 49% of investors expect to hold their CRE exposure at the current level over the next 6 months, in line with the past two quarters,” according to the report.

Capital markets

“Capital Markets Reawakening” – that’s the headline from Colliers, which says pricing has found a floor and deal velocity is rising. Colliers forecasts a 15% to 20% increase in sales volume in 2026 as institutional and cross-border capital reenters the market.

Capitalization rates seem to be ready to move lower next year, according to a forecast from CoStar. Its data is already showing hints of this in the multifamily and industrial sectors, where vacancies have peaked and rent growth is picking up.

CoStar also notes deal activity is picking up, with third-quarter sales volume up more than 40% year over year, and banks are “easing back into commercial real estate lending,” according to the report.

Bond markets are following suit, showing new appetite for risk. CoStar points to the narrowing spread between government and corporate bond yields to roughly 1 percentage point (well below the historical average), “typically a precursor to greater real estate investment and firming prices.”

This tracks with the Cushman & Wakefield outlook, which also notes that in 2025 debt costs eased, lenders reentered the market and institutional capital returned, “supporting a broad-based revival in deal activity.”

Lending was up 35% year over year, institutional sales activity increased 17% through October, and pricing has “largely reset, presenting the market with compelling opportunities for yield and income generation,” Cushman & Wakefield found.

Specific sectors

The office market is now widely believed to have bottomed, and assets are showing early signs of price stability.

Vacancy rates are expected to drop below 18% as more tenants return to the market, leverage expiring leases and prioritize hospitality-driven workplaces that support hybrid work, according to Colliers.

There will continue to be a flight to quality in office, as Class A buildings in many markets are now nearly fully occupied. Office construction is also at its lowest level in more than three decades, according to Yardi.

Cushman & Wakefield forecasts continued growth in San Francisco; San Jose, California; Austin, Texas; New York; Atlanta; Dallas; and Nashville, Tennessee, which posted strong positive absorption in 2025, supported by AI expansion and diversified job growth.

“For large office users looking to secure high-quality space, the message is clear: if you find the right space, act decisively,” said James Bohnaker, principal economist at Cushman & Wakefield. “There is strong demand for new, high-quality space and not enough of it to go around. And given the limited construction pipeline, it’s going to get even tighter.”

Industrial has also seen a huge drop in construction, down 63% since 2022, according to the Colliers report. Vacancy is peaking and net absorption is set to jump to 220 million square feet, as reshoring, manufacturing and data centers fuel demand.

Retail is already undergoing a major shift in how and where companies are leasing space, according to Brandon Svec, national director of U.S. retail analytics at CoStar.

He points to nearly 26 million square feet of ground floor retail leased in nontraditional properties in the first three quarters of 2025, including multifamily, student housing, hospitality and office.

Retailers are embracing smaller footprints, with the average retail lease signed over the past four quarters falling below 3,500 square feet for the first time since CoStar began tracking this in 2016. This is being driven largely by restaurant and service operators such as Starbucks, Chipotle, Chick-fil-A, Jersey Mike’s, Dunkin’ and McDonald’s, according to Svec, who noted the growing appeal of walkable, mixed-use retail environments over traditional big-box formats. He does have a warning though.

“Significant uncertainty remains around the impact of tariffs on an already fragile consumer. While suppliers and retailers have largely absorbed these costs to date, many have signaled that price increases are imminent. With consumers already showing some signs of spending fatigue, tariff-related price hikes could further strain household budgets and dampen discretionary spending,” Svec wrote in a report.

Multifamily rents are starting to ease, as a record level of new supply continues to make it through the pipeline.

“Multifamily has led investment sales volume since 2015, and there are no signs of this changing. However, its share of total volume is expected to ease somewhat as investors allocate more capital to office, data centers, and retail,” according to the Colliers report.

Data centers have been the darling of 2025, with demand significantly outpacing supply. Deloitte called the sector, “a clear bright spot in the U.S. commercial real estate landscape.” It pointed to nine major global markets where 100% of the new construction pipeline is already fully pre-leased.

Data centers do, however, face headwinds in financing, grid capacity, zoning and local politics.

“Friction is building as communities push back on data center development. A few projects have already been abandoned, and more are expected to be shelved in 2026,” according to the Colliers forecast.

REITs

Public-to-private REIT transactions and portfolio mergers are likely to dominate in the year ahead as listed valuations lag private market pricing, according to a report from PwC. That will be driven by considerations of scale, governance credibility and cost of capital.

“Expect accelerated M&A as capital concentrates, AI exposes inefficiencies, and platforms converge—real assets are entering a new phase defined by intelligence, integration, and scale-driven opportunity,” wrote Tim Bodner, global real estate deals leader at PwC.

As for the real estate investment trust stocks, they were the real laggards of 2025, but could be poised to outperform in 2026, according to a forecast from Nareit, the REIT industry association. It points to a divergence between stock market valuations and REIT valuations and an ongoing divergence between public and private real estate valuations.

“These will close, and one or both could happen in 2026. If they do, we expect REITs to outperform based on our own historical analysis and their ongoing strong operational performance and balance sheets,” the report said.

Business

Your SBI YONO App Will Be Blocked If You Don’t Update Your Aadhaar? Details You Need To Know

New Delhi: A viral message is circulating in the social media regarding SBI, claiming that users must download and install an APK file to update their Aadhaar. The viral message has further claimed that if Aadhaar is not updated, the SBI YONO app will be blocked.

Fact-checking agency PIB has refuted the social media claim. PIB has stated that the claim being made in this post is misleading and FAKE.

PIB has further cautioned users to not fall prey to such fake messages. It tweeted, “Do NOT download any APKs or share personal, banking, or Aadhaar details. SBI does NOT ask for such information.”

It has also advised consumers to report suspicious messages to report.phishing@sbi.co.in for necessary action.

How to get messages fact-checked by PIB

If you get any such suspicious message, you can always know its authenticity and check if the news is for real or it is a fake news. For that, you need to send the message to https://factcheck.pib.gov.in. Alternatively you can send a WhatsApp message to +918799711259 for fact check. You can also send your message to pibfactcheck@gmail.com. The fact check information is also available on https://pib.gov.in.

Business

Stock market today: Nifty50 opens below 26,150; BSE Sensex down over 100 points – The Times of India

Stock market today: Nifty50 and BSE Sensex, the Indian equity benchmark indices, opened in red on Wednesday. While Nifty50 went below 26,150, BSE Sensex was down over 100 points. At 9:18 AM, Nifty50 was trading at 26,132.00, down 47 points or 0.18%. BSE Sensex was at 84,953.09, down 110 points or 0.13%.Analysts believe that equity markets are expected to move in a narrow range in the near term, as optimism from encouraging third-quarter business updates is offset by lingering geopolitical risks.Dr. VK Vijayakumar, Chief Investment Strategist, Geojit Investments Limited says, “The recent market movements have been devoid of any trend and clear direction. Actions in a few mega stocks are influencing the overall market disproportionately. For instance, yesterday despite positive institutional buying Nifty drifted down by 71 points, mainly due to sharp declines in two stocks- Reliance and HDFC Bank. The large volumes in these two stocks in the derivative and cash market indicate activity associated with settlement day. In other words, the sharp dips in these stocks have nothing to do with their fundamentals; it is more technical in nature.” “Going forward, there is scope for high volatility caused by events and news. Trump tweets and actions can always influence the market. Another important event which investors should closely watch is a possible Supreme Court verdict on Trump tariffs very soon. If the verdict goes against the reciprocal tariffs it will create huge volatility in stock markets.”Global cues were mixed. Wall Street closed higher on Tuesday, supported by a strong rally in semiconductor stocks driven by renewed enthusiasm around artificial intelligence. Shares of Moderna also advanced, while the Dow Jones Industrial Average climbed to a fresh record high.Asian markets paused on Wednesday after a strong start to the year. Japanese equities declined amid rising tensions with China, prompting some investors to turn cautious despite the broader strength seen in global stocks so far this year.On the institutional front, foreign portfolio investors were net sellers of Indian equities worth Rs 107 crore on Tuesday, according to exchange data. Domestic institutional investors, however, continued to provide support to the market, recording net purchases of Rs 1749 crore.(Disclaimer: Recommendations and views on the stock market, other asset classes or personal finance management tips given by experts are their own. These opinions do not represent the views of The Times of India)

Business

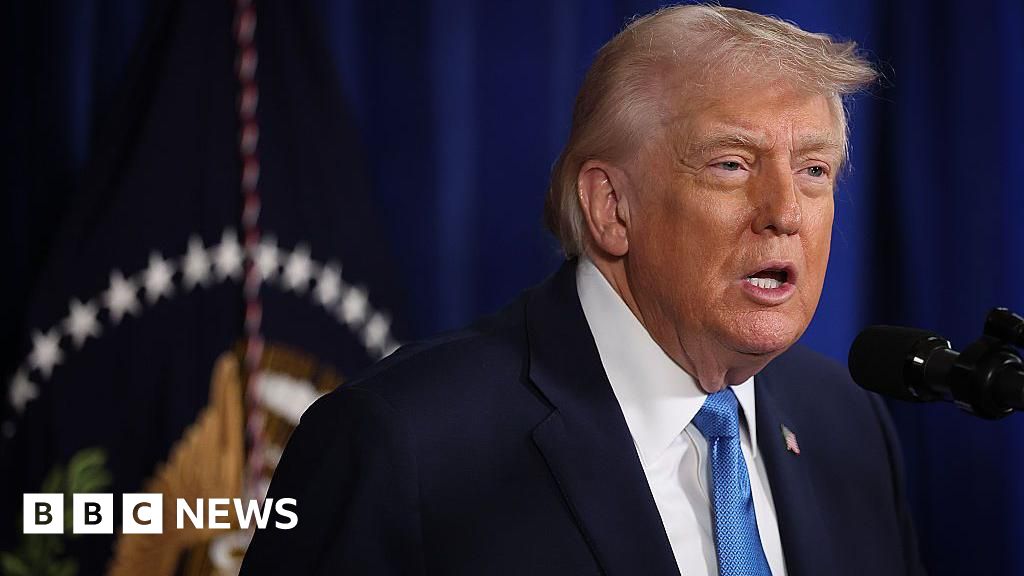

Trump says Venezuela will be ‘turning over’ up to 50m barrels of oil to US

Kayla Epsteinand

Osmond Chia

Getty Images

Getty ImagesUS President Donald Trump has said Venezuela “will be turning over” up to 50m barrels of oil to the US, after a surprise military operation that removed President Nicolás Maduro from power.

The oil will be sold at its market price, Trump posted on social media, adding that the money would be controlled by himself and used to benefit the people of Venezuela and the US.

His comments come after he said the US oil industry would be “up and running” in Venezuela within 18 months and that he expected huge investments to pour into the country.

Analysts previously told the BBC it could take tens of billions of dollars, and potentially a decade, to restore Venezuela’s former output.

Trump posted on Truth Social on Tuesday: “I am pleased to announce that the Interim Authorities in Venezuela will be turning over between 30 and 50 MILLION Barrels of High Quality, Sanctioned Oil, to the United States of America.

“This Oil will be sold at its Market Price, and that money will be controlled by me, as President of the United States of America, to ensure it is used to benefit the people of Venezuela and the United States!”

His comment came a day after Delcy Rodríguez, formerly Venezuela’s vice-president, was sworn in as its interim president. Maduro has been brought to the US to face drug-trafficking and weapons charges.

On Monday the US president told NBC News: “Having a Venezuela that’s an oil producer is good for the United States because it keeps the price of oil down.”

Representatives from major US petroleum companies planned to meet the Trump administration this week, the BBC’s US partner CBS reported.

Analysts who previously spoke to the BBC were sceptical that Trump’s plans would have a major impact on the global supply – and therefore price – of oil.

They suggested that firms would look for reassurance that a stable government was in place, and even when they did invest, their projects would not deliver for years.

Trump has argued in recent days that American oil companies can fix Venezuela’s oil infrastructure.

The country has an estimated 303bn barrels – the world’s largest proven reserve – but its oil production has been in decline since the early 2000s.

The Trump administration sees significant potential for its own energy prospects in Venezuela’s reserves.

Increasing the country’s production of oil would be expensive for US firms.

Venezuelan oil is also heavy and more difficult to refine. There is only one US firm, Chevron, currently operating in the country.

Asked for comment about Trump’s plans for US oil production in Venezuela, Chevron spokesman Bill Turenne said the company “remains focused on the safety and wellbeing of our employees, as well as the integrity of our assets”.

“We continue to operate in full compliance with all relevant laws and regulations,” Turenne added.

ConocoPhillips, a major US oil company that no longer has a presence in Venezuela, “is monitoring developments in Venezuela and their potential implications for global energy supply and stability”, said spokesman Dennis Nuss.

“It would be premature to speculate on any future business activities or investments,” Nuss said.

A third company, Exxon, did not immediately respond to requests for comment.

While justifying the seizure of Maduro from Caracas, Trump also claimed that Venezuela “unilaterally seized and stole American oil”.

Vice-President JD Vance echoed those claims on X after Maduro was taken, writing that “Venezuela expropriated American oil property and until recently used that stolen property to get rich and fund their narcoterrorist activities”.

The reality is more complex.

US oil companies have a long history in Venezuela, extracting oil under licence agreements.

Venezuela nationalised its oil industry in 1976 and in 2007, President Hugo Chavez exerted more state control over the remaining foreign-owned assets of US oil firms operating in the country.

In 2019, a World Bank tribunal ordered Venezuela to pay $8.7 billion to ConocoPhillips in compensation for this 2007 move.

That sum has not been paid by Venezuela, so at least one US oil company has outstanding compensation which is owed to it.

But BBC Verify’s Ben Chu said the claim Venezuela has “stolen” American oil is too simplistic, as experts said the oil itself was never actually owned by anyone except Venezuela.

-

Entertainment1 week ago

Entertainment1 week agoGeorge Clooney, his wife Amal and their twins granted French citizenship

-

Sports1 week ago

Sports1 week agoMorocco reach AFCON last 16 | The Express Tribune

-

Politics1 week ago

Politics1 week agoThree Turkish police officers, six Daesh militants killed in clash, amid national crackdown

-

Business1 week ago

Business1 week agoA major drop in the prices of petroleum products is likely with the arrival of the New Year. – SUCH TV

-

Fashion1 week ago

Fashion1 week agoUK year-end review 2025: Seeking new avenues

-

Entertainment1 week ago

Entertainment1 week agoPrince George to shine as key royal figure in 2026

-

Entertainment1 week ago

Entertainment1 week agoBeyoncé is now a billionaire, according to Forbes

-

Sports1 week ago

Sports1 week agoICC rates MCG pitch ‘unsatisfactory’ after two-day Test