Business

Charity shortlisted for helping people heat their homes

Jasmine Ketibuah-Foleyand

Alastair McKee,West of England

BBC

BBCA charity has been shortlisted for an award after helping vulnerable households keep warm during the winter months.

Gloucestershire charity Severn Wye started its Warm Homes Prescription pilot in 2022. Patients with respiratory, coronary, or complex health conditions, on low incomes, are given grants to help with their energy bills, using government funding.

The charity said the aim of the project is to help prevent the need for hospital care.

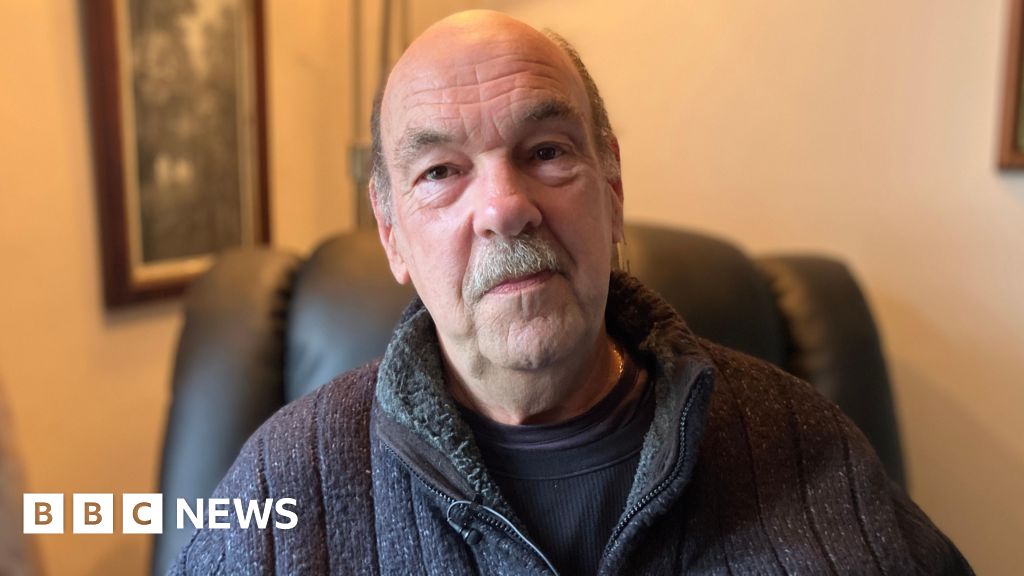

Anton Hammer, 72, who suffers from Chronic obstructive pulmonary disease said he was constantly visiting his GP with recurrent chest infections before the charity helped him.

After stopping work two years ago, following a heart attack, Hammer said he struggled to heat his home.

“You think I can’t afford to do this, so you keep the heating off. You put more layers on, or you try to heat one room in the entire house,” he said.

“It can be very depressing. It can make you feel very down.”

His GP at Brockworth Surgery put him in touch with Severn Wye who visited him at home and offered help.

“I’ve got to say they’ve been fantastic,” he added.

Hammer said his chest infections have since alleviated dramatically meaning fewer GP visits.

The ‘Warmth on Prescription’ scheme has been running alongside the NHS Retrofit project funded by NHS Gloucestershire Integrated Care Board, which provided up to £20,000 per property to install measures to improve home energy efficiency.

Both projects are finalists in the Health Service Journal Partnership Awards.

Last winter, patients on the scheme reported fewer clinical visits and fewer hospital visits, according to Severn Wye.

‘Patients feel supported’

NHS Gloucestershire deputy chief medical officer, Dr Hein Le Roux said he is “pleased to see” the partnership with the charity “recognised”.

“Patients tell us they feel more confident and supported through winter, which is exactly the impact we set out to achieve,” he said.

Winners for the Health Service Journal Partnership Awards will be announced in March.

Business

Stock Market Updates: Sensex Down 400 Points, Nifty Below 25,700; SMIDs Trade Mixed

Last Updated:

Indian benchmark indices, BSE Sensex and NSE Nifty, were higher at the open as investors have their eyes peeled for the US-India trade talks

Stock Market Today

Sensex Today: Indian benchmark indices — the BSE Sensex and NSE Nifty — extended their decline on Tuesday as investors stayed cautious ahead of the much-awaited US–India trade talks. On Monday, US Ambassador to India Sergio Gor had said that the two countries would engage in discussions today.

At 1:00 PM, the Sensex was trading at 83,428, down 450 points or 0.54 per cent, while the Nifty 50 slipped 128 points, or 0.50 per cent, to 25,661.

Eternal, Tech Mahindra, SBI, BEL, HDFC Bank, Maruti Suzuki, HUL, Titan Company, ICICI Bank, ITC and Axis Bank were among the top gainers, rising up to 3 per cent.

On the other hand, L&T, Reliance Industries, Tata Steel, M&M, Trent, TCS, IndiGo, Bharti Airtel and Sun Pharma were trading in the red.

In the broader market, the Nifty Midcap index declined 0.76 per cent, while the Nifty Smallcap index bucked the trend to trade 0.24 per cent higher.

Among sectoral indices, Nifty Media, IT and select financial stocks led the gains. However, most other sectors were under pressure, with Nifty Realty, Pharma and Consumer Durables emerging as the top laggards, each down over 1 per cent.

Global Cues

Asian markets were trading in the green as investors looked past geopolitical tensions in Iran and Venezuela, as well as the criminal investigation into US Federal Reserve Chair Jerome Powell. Mainland China’s CSI 300 gained 0.54 per cent, Hong Kong’s Hang Seng advanced 1.32 per cent, and South Korea’s KOSPI rose 1.04 per cent.

Japan’s Nikkei surged 3.22 per cent amid reports that the ruling Liberal Democratic Party may dissolve the Lower House this month for a snap election in February.

On Wall Street, the S&P 500 and the Dow Jones closed at fresh record highs overnight. The S&P 500 edged up 0.16 per cent, the Dow gained 0.17 per cent, and the Nasdaq climbed 0.26 per cent. Investors are now awaiting the US Consumer Price Index (CPI) for December, scheduled for release later today.

Separately, US President Donald Trump stated on Monday evening that any country doing business with Iran will face a 25 per cent US tariff.

January 13, 2026, 09:02 IST

Read More

Business

India In Goldilocks Phase Of High Growth, Economists Urge Neutral Policy Path

New Delhi: India appears to be in a Goldilocks phase of high growth and low inflation, a report said on Tuesday, with economists urging a shift towards a near‑neutral policy.

The report from HSBC Global Investment Research said that a near‑neutral policy, combining fiscal restraint with continued monetary ease, would best support markets and the broader economy in 2026.

“A combination of tight fiscal and easy monetary policy which creates a better economic balance should be positive for all asset classes,” it said.

The research firm, however cautioned that underlying weaknesses such as insufficient corporate investment and foreign inflows must be carefully addressed.

Bond markets have already priced higher state borrowing for early 2026, and that RBI bond purchases, fiscal prudence in the budget and potential global bond‑index inclusion could attract foreign inflows, the report said.

The report further stated that equities may gain from recent reform momentum, rising nominal GDP and more reasonable valuations, and cautioned that durable gains require structural reforms to boost corporate capex and foreign investment.

Pranjul Bhandari, Chief India Economist and Strategist, argued that the research firm’s estimate suggests inflation will remain just under the 4 per cent target next year, removing pressure on the Reserve Bank of India to tighten and leaving room for further easing if growth softens.

“In fact, there is space for further easing if growth dips. And this is where we are polar opposite of what markets are currently expecting (tight monetary policy, loose fiscal policy),” Bhandari noted.

There is a lot going on globally that impacts Indian markets, such as news on tariffs and bond index inclusion, and steepening DM yield curves, she added.

The central government aims to lower public debt ratios to pre-pandemic levels by FY31, which will require continued fiscal consolidation over the next five years.

The report highlighted that such consolidation at the central level could restore balance and be offset by privatisation to limit growth drag.

Public debt ratios are expected to rise in several states despite the 3 per cent fiscal ceiling which will keep deficits in check, the report said.

Business

Gold Prices Rise Today: Check 24K And 22K Gold Rates In Your City On January 13

Last Updated:

Gold and silver prices in India stayed steady on January 13 amid US-India trade deal hopes, with Mumbai 24K gold at Rs 1,42,160 per 10 grams and silver futures up 0.25 percent.

Gold and Silver Rates Today, January 13.

Gold and Silver Rates Today, January 13: Gold and silver prices in India are marginally up on Tuesday despite rising fresh hopes on the US-India trade deal after the new US Ambassador to India, Sergio Gor, on Monday shared an update on the progress. In Mumbai, 24K gold price stood at Rs 1,42,160 per 10 grams, while for 22K, the price remained at Rs 1,30,310 per 10 grams.

On Multi-commodity exchange (MCX), gold futures with expiry in February traded in red at Rs 1,41,825 per 10 grams. Meanwhile, silver futures with expiry in March inched up 0.25 per cent to Rs 2,69,648 per kg.

At the international spot market, gold and silver jumped over 7 per cent to touch a new record. Gold surged almost 2 per cent to slightly shy off $4,600 per ounce. Meanwhile, silver surged 7.21 per cent to touch a new record of $85 per ounce.

What Is The Price Of 22kt, 24kt Gold Rates Today In India Across Key Cities On January 13?

| City | 22K Gold (per 10gm) | 24K Gold (per 10gm) |

|---|---|---|

| Delhi | Rs 1,27,860 | Rs 1,39,470 |

| Jaipur | Rs 1,27,860 | Rs 1,39,470 |

| Ahmedabad | Rs 1,27,760 | Rs 1,39,370 |

| Pune | Rs 1,27,710 | Rs 1,39,320 |

| Mumbai | Rs 1,30,310 | Rs 1,42,160 |

| Hyderabad | Rs 1,30,310 | Rs 1,42,160 |

| Chennai | Rs 1,30,310 | Rs 1,42,160 |

| Bengaluru | Rs 1,30,310 | Rs 1,42,160 |

| Kolkata | Rs 1,30,310 | Rs 1,42,160 |

Indian dealers this week charged a premium of up to $6 per ounce over official domestic prices, inclusive of 6% import and 3% sales levies, below last week’s premium of up to $15. Domestic gold prices were trading around 138,000 rupees per 10 grams on the day, not far from the record high Rs 1,40,465.

Jewellers were reporting very thin footfall and only marginal demand for coins and bars, said a Mumbai-based bullion dealer with a private bank.

In top consumer China, bullion traded at premiums as high as $21 an ounce above the global benchmark spot price this week. That compares with premiums of $3 an ounce charged last week.

Strong demand for safe-haven assets, US interest rate cuts and a weaker dollar drove global gold prices up 67% so far this year and saw them hitting a record high of $4,549.7 per troy ounce on December 26.

Indian domestic gold prices climbed 77% this year, outpacing the Nifty 50 index’s 9.7% gain, aided by a 5% fall in the rupee against the dollar.

What Factors Affect Gold Prices In India?

International market rates, import duties, taxes, and fluctuations in exchange rates primarily influence gold prices in India. Together, these factors determine the daily gold rates across the country.

In India, gold is deeply cultural and financial. It is a preferred investment option and is key to celebrations, particularly weddings and festivals.

With constantly changing market conditions, investors and traders monitor fluctuations closely. Staying updated is crucial for effectively navigating dynamic trends.

January 13, 2026, 09:45 IST

Read More

-

Sports1 week ago

Sports1 week agoVAR review: Why was Wirtz onside in Premier League, offside in Europe?

-

Entertainment1 week ago

Entertainment1 week agoMinnesota Governor Tim Walz to drop out of 2026 race, official confirmation expected soon

-

Politics6 days ago

Politics6 days agoUK says provided assistance in US-led tanker seizure

-

Entertainment6 days ago

Entertainment6 days agoDoes new US food pyramid put too much steak on your plate?

-

Business1 week ago

Business1 week ago8th Pay Commission: From Policy Review, Cabinet Approval To Implementation –Key Stages Explained

-

Entertainment6 days ago

Entertainment6 days agoWhy did Nick Reiner’s lawyer Alan Jackson withdraw from case?

-

Business6 days ago

Business6 days agoTrump moves to ban home purchases by institutional investors

-

Sports1 week ago

Sports1 week agoFACI invites applications for 2026 chess development project | The Express Tribune