Business

FTSE 100 down as AI worries knock data providers

The FTSE 100 closed lower on Tuesday as a rally in mining stocks was offset by hefty falls in software, data analytics and advertising companies amid perceived AI threats.

The FTSE 100 index closed down 26.97 points, or 0.3%, at 10,314.59.

The FTSE 250 ended down 135.68 points, or 0.6%, at 23,290.37, and the AIM All-Share closed up 3.99 points, 0.5%, at 818.33.

On the FTSE 100, Relx slid 14%, London Stock Exchange Group tumbled 13%, Experian slumped 8.3%, Sage Group declined 6.5% and Pearson 7.7%.

The sharp falls came after US artificial intelligence firm Anthropic released new ‘agentic AI’ tools for corporate legal teams, including a legal plug-in for its Claude generative AI chatbot.

The US AI company said the tool can automate legal work such as reviewing contracts, triaging non-disclosure agreements, composing briefings and providing templated responses.

The roll-out renewed fears that AI will threaten existing business models, hitting sales and growth.

Relx owns LexisNexis, a provider of information and analytics to law firms, while London Stock Exchange is a financial data provider.

Experian is a credit checker, Pearson a provider of educational content and assessments while Sage sells accountancy software.

In Europe, Dutch publisher Wolters Kluwer fell 13%, while losses spread to the advertising world where WPP slumped 8.7%, and Publicis, which also reported fourth quarter results, which was down 8.9% in Paris.

In the US, data provider Thomson Reuters slumped 16%.

In European equities on Tuesday, the CAC 40 in Paris closed down slightly, while the DAX 40 in Frankfurt eased 0.1%.

Heading higher in London were mining stocks, which rallied after recent falls.

Gold was quoted higher at 4,971.16 dollars an ounce on Tuesday, up against 4,696.11 dollars at the same time on Monday.

Silver rebounded 12% and copper strengthened 4.5%.

The top five blue chip risers were all miners, with Anglo American up 7.3%. Fresnillo up 6.4%, Antofagasta up 6.3%, Endeavour Mining, up 3.9% and Glencore up 3.3%.

“The sharp sell-off in gold over the past few days has encouraged investors to buy on the dip, scooping up the precious metal in their droves and making it sparkle again,” said AJ Bell analyst Russ Mould.

Thursday is the deadline day for Rio Tinto to firm up a bid for Glencore.

On Tuesday, Glencore said Orion Critical Mineral Consortium is looking into buying a 40% stake in Glencore’s interests in its Democratic Republic of Congo assets, Mutanda Mining and Kamoto Copper Co for around nine billion dollars.

On the FTSE 250, Plus500 rose 7.0% after it announced the launch of a US prediction markets platform with a regulated business-to-consumer offering.

The Haifa, Israel-based contracts-for-difference trading platform operator said it entered into the US retail prediction markets segment with the launch of the platform which includes products from Kalshi Exchange, which Plus500 says is the first regulated event-based contracts exchange in the US.

AG Barr jumped 5.7% as it said its annual trading was in line with forecasts, and announced the acquisitions of the Fentimans and Frobishers Juices brands.

The Cumbernauld-based soft drinks manufacturing company said revenue for the year ended January 31 increased by around 4% to about £437 million from £420 million the year before.

The Irn-Bru owner delivered “modest growth” in the second half, it said, with “good performances” from Rubicon and Boost.

Stocks in New York were lower. The Dow Jones Industrial Average was down 0.1%, the S&P 500 index was 0.6% lower, and the Nasdaq Composite declined 1.3%.

PayPal sank 19% after naming a new chief executive as fourth quarter results and guidance missed forecasts.

The San Jose, California-based financial transaction processing services company said performance had been “solid”, but execution “has not been where it needs to be, particularly in branded checkout”.

PayPal said some progress has been made in a number of areas over the last two years, but “the pace of change and execution was not in line with the board’s expectations”.

As a result, PayPal appointed Enrique Lores as president and chief executive, effective March 1.

Mr Lores, who has served on the PayPal board for nearly five years and as chairman since July 2024, succeeds Alex Chriss.

Another change at the top came at Disney which announced chief executive officer Robert Iger will step down next month.

The expected move sees Disney Experiences chairman Josh D’Amaro promoted to the role of chief executive, as widely flagged.

Disney, which reported results on Monday, was down 2.4%.

The yield on the US 10-year Treasury was quoted at 4.29%, stretched from 4.25%. The yield on the US 30-year Treasury was quoted 4.92%, widened from 4.85%.

The pound was quoted higher at 1.3695 dollars at the time of the London equities close on Tuesday, compared with 1.3651 dollars on Monday.

The euro stood higher at 1.1818 dollars, against 1.1804 dollars. Against the yen, the dollar was trading higher at 155.73 yen compared with 155.52 yen.

Elsewhere, CyanConnode soared 19% after announcing it had received a takeover approach from Dubai-based Esyasoft Holding.

The Cambridge-based developer of narrowband radio frequency mesh networks said the possible takeover offer would value it at £35 million, around 9.75 pence per share.

Brent oil was quoted at 67.15 dollars a barrel at the time of the London equities close on Tuesday, up from 66.03 dollars late on Monday.

The biggest risers on the FTSE 100 were Anglo American, up 250.0p at 3,700.0p, Fresnillo, up 234.0p at 3,902.0p, Antofagasta, up 228.0p at 3,868.0p, Endeavour Mining, up 162.0p at 4,272.0p and Glencore, up 16.3p at 517.3p.

The biggest fallers on the FTSE 100 were Relx, down 371.0p at 2,214.0p, London Stock Exchange Group, down 1,054.0p at 7,180.0p, ICG, down 148.0p at 1,656.0p, Pearson, down 75.0p at 894.6p and Experian, down 185.0p at 2,555.0p.

Wednesday’s global economic calendar has a slew of composite PMI readings, eurozone PPI figures and ADP payroll data in the US.

Wednesday’s UK corporate calendar has full-year results from pharmaceuticals firm, GSK.

– Contributed by Alliance News

Business

Younger and lower-paid workers hit hardest by rising labour costs, figures show

Younger and entry-level workers are being squeezed the hardest by higher employment costs slowing the rate that firms are hiring, new analysis shows.

Some UK businesses have seen the cost of employing workers rise on the back of recent policy measures, including tax and minimum wage increases and reforms to employment rights, the National Institute of Economic and Social Research (Niesr) said in its latest economic outlook.

These factors have raised the marginal cost of hiring by around 7%, in real terms, for an entry level position, according to its findings.

Niesr warned that sectors most exposed to cost increases were experiencing a bigger impact, pointing to data showing a link between exposure to the national minimum wage and rising unemployment.

This includes typically lower-paid industries such as hotels, hospitality and food chains, which also have a greater concentration of younger and early-career workers.

Its analysis found that, rather than cutting existing jobs, many firms have chosen to slow the rate that they hire staff.

Therefore younger workers and those “at the margins of the labour market” are being disproportionately squeezed, the think tank said.

Official figures at the end of last year showed that the unemployment rate rose to its highest level since early 2021 over the three months to September.

The Office for National Statistics (ONS) said that young people especially were struggling in the tougher hiring climate, with an 85,000 increase in those unemployed aged between 18 to 24 in the three months to October – the biggest jump since November 2022.

The number of young people not in employment, education or training – so-called Neets – has been rising since 2021, and hit the highest level since 2014.

In its report, Niesr said it was “hard to escape the conclusion that the rising cost of labour has deterred full-time job creation, particularly for younger workers”.

Lord Frost, director general of the Institute of Economic Affairs, said the findings “laid bare the costs of the Government’s national insurance and minimum wage hikes, and Employment Rights Act: a spike in the cost of hiring entry-level workers, meaning fewer jobs and opportunities for young people”.

Business

Chipotle stock sinks as restaurant chain reports falling traffic, weak guidance

A Chipotle store stands in the Bronx in New York City on April 23, 2025.

Spencer Platt | Getty Images

Chipotle Mexican Grill on Tuesday reported quarterly earnings and revenue that topped analysts’ expectations, although traffic to its restaurants fell for the fourth straight quarter.

For 2026, the company is projecting flat same-store sales growth, signaling that the burrito chain’s woes are not expected to disappear quickly. Chipotle ended a bumpy 2025 with a full-year same-store sales decline of 1.7%.

Shares of the company fell as much as 11% in extended trading.

Here’s what the company reported compared with what Wall Street was expecting, based on a survey of analysts by LSEG:

- Earnings per share: 25 cents adjusted vs. 24 cents expected

- Revenue: $2.98 billion vs. $2.96 billion expected

The fast-casual chain reported fourth-quarter net income of $330.9 million, or 25 cents per share, down from $331.8 million, or 24 cents per share, a year earlier.

Excluding impairment costs, gains from terminating restaurant leases and other items, Chipotle earned 25 cents per share.

Net sales rose 4.9% to $2.98 billion.

The company’s same-store sales fell 2.5% for the quarter, making this reporting period the third quarter of the year with same-store sales declines. However, Wall Street was anticipating a steeper same-store sales decrease of 3%, according to StreetAccount estimates.

Traffic to Chipotle restaurants fell by 3.2%. Executives have previously said they have seen a pullback in spending from consumers of all income cohorts, although low-income diners have made the most significant shift to their behavior.

Over the past year, shares of Chipotle have lost roughly a third of their value, dragging the company’s market value down to about $51 billion. Investor enthusiasm for the stock waned after the fast-casual chain began reporting shrinking traffic to its restaurants.

To bring back customers, Chipotle is focusing on improving the chain’s operations and adding new menu items, rather than leaning into discounts. In December, at the tail end of the quarter, the company unveiled “protein cups,” with the goal of convincing protein-obsessed customers to stop by for a snack, not just lunch or dinner.

Chipotle opened 132 company-owned locations and seven restaurants run by international licensees during the quarter. That brought its total to 334 company-owned locations and 11 international partner restaurants opened for the year.

In 2026, the company is projecting that it will open 350 to 370 new restaurants, including 10 to 15 international locations that will be run by licensees.

Business

India–US trade deal: Textile, leather players see revival in volumes – The Times of India

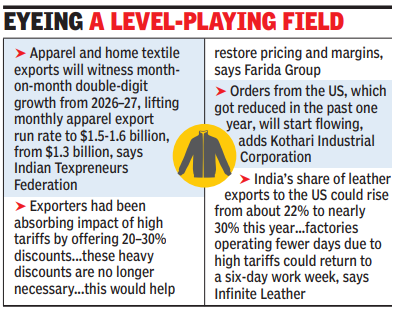

CHENNAI: India’s textile, apparel and leather exporters are expecting a sustained recovery in orders from the US, following tariff reductions under the proposed India–US trade deal. Industry representatives said the move will restore competitiveness, improve margins and revive volumes that were under pressure over the past year.Textile and apparel exporters are now expecting an increased sourcing by global brands as India will now enjoy one of the lowest tariff regimes among major Asian manufacturing hubs, with a marginal advantage over competitors, such as Bangladesh, Sri Lanka, Vietnam and China. The tariff relief is expected to create a level-playing field, particularly for small and medium exporters in clusters such as Surat, Gurugram and Tirupur.Prabhu Dhamodharan, convenor of the Indian Texpreneurs Federation, said sourcing interest of US from India is rising and exports are likely to improve steadily. “The apparel and home textile exports will witness month-on-month double-digit growth from the 2026–27 fiscal, lifting the monthly apparel export run rate to $1.5 to $1.6 billion, from the current $1.3 billion.”

Eyeing a level-playing field

A Sakthivel, chairman of the Apparel Export Promotion Council, said improved trade terms would significantly enhance the competitiveness of Indian apparel products in the US market.The leather sector has termed the US decision to reduce tariffs to 18% a “double dhamaka”, coming soon after India’s strategic trade deal with the European Union. Israr Ahmed, former vice-president of the Federation of Indian Export Organisations (Fieo) and managing director of the Farida Group, said exporters had been absorbing the impact of high tariffs by offering discounts of 20–30%. “With the US now reducing tariffs on Indian goods to 18%— a rate lower than those faced by key South Asian competitors, such as Bangladesh and Vietnam — these heavy discounts are no longer necessary,” he said, adding that this would help restore pricing and margins.Rafiq Ahmed, chairman of Kothari Industrial Corporation, noted that competition in the US market has intensified over the past year but said long-standing relationships would help Indian exporters regain lost ground. “The orders from the US, which got reduced in the past one year, will start flowing,” he said.Yavar Dhala, vice-president of the Indian Shoe Federation and CEO of Infinite Leather, said India’s share of leather exports to the US could rise from about 22% to nearly 30% this year, adding that factories operating fewer days due to high tariffs could return to a six-day work week.

-

Sports1 week ago

Sports1 week agoPSL 11: Local players’ category renewals unveiled ahead of auction

-

Entertainment1 week ago

Entertainment1 week agoClaire Danes reveals how she reacted to pregnancy at 44

-

Sports1 week ago

Sports1 week agoCollege football’s top 100 games of the 2025 season

-

Business1 week ago

Business1 week agoBanking services disrupted as bank employees go on nationwide strike demanding five-day work week

-

Politics1 week ago

Politics1 week agoTrump vows to ‘de-escalate’ after Minneapolis shootings

-

Sports1 week ago

Sports1 week agoTammy Abraham joins Aston Villa 1 day after Besiktas transfer

-

Tech1 week ago

Tech1 week agoBrighten Your Darkest Time (of Year) With This Smart Home Upgrade

-

Entertainment1 week ago

Entertainment1 week agoK-Pop star Rosé to appear in special podcast before Grammy’s