Business

PSX roars back with 5,700-point rally | The Express Tribune

Trade volumes fell to 175 million shares compared with Monday’s tally of 181 million. PHOTO: FILE

KARACHI:

The Pakistan Stock Exchange (PSX) delivered a powerful performance on Wednesday as it staged a strong comeback, driven by heavy buying in banking and fertiliser stocks amid strong corporate earnings.

The benchmark KSE-100 index surged 5,702.68 points, or 3.29%, and settled at 178,853.10. It touched the intra-day high of 178,974 and low of 174,329, reflecting heightened volatility.

The rally was primarily led by major banking and fertiliser stocks as investors responded positively to encouraging earnings announcements. Institutional participation and renewed investor confidence helped push the market sharply higher after recent hefty losses.

KTrade Securities wrote in its market wrap that the PSX staged a strong comeback as the KSE-100 index closed at 178,853, gaining 5,703 points. The rebound came after consecutive weak sessions, driven by settlement transition concerns, margin pressure and political noise. With some of those pressures easing, the market witnessed aggressive covering of positions and renewed buying interest, it said.

The recovery was broad-based, led by banks and fertiliser firms, while strong corporate earnings further supported sentiment. Notably, Habib Bank announced impressive results along with a dividend of Rs6 per share, boosting confidence across the banking space alongside other major names.

Overall sentiment has turned constructive after the sharp pullback. If stability continues and corporate results remain supportive, this rebound could sustain in the near term. However, sustainability will depend on liquidity flows and clarity on the broader political and macro environment, KTrade added.

Topline Securities noted that the KSE-100 index posted a gain of 5,703 points, reflecting recovery in the market. The index moved within a band, touching intra-day high of 178,974 and low of 174,329. Support from heavyweights such as United Bank, Habib Bank, Meezan Bank, National Bank and MCB Bank underpinned the market’s performance, adding 2,699 points. In contrast, Pakistan Oilfields, Pioneer Cement and Adamjee Insurance weighed on the index, trimming 163 points, it said.

JS Global analyst Muhammad Hasan Ather commented that the KSE-100 staged a massive recovery as the index surged 5,703 points. The bullish reversal erased nearly all losses from the prior four sessions.

The rally was triggered by the State Bank reporting a $121 million current account surplus for January and anticipation of a federal relief package for the construction sector. While banking and energy stocks led the charge, the outlook remains cautiously optimistic. Further gains hinge on sustained macroeconomic stability and the rollout of industrial policy support, Ather said.

Arif Habib Limited (AHL) reported that stocks experienced a solid bounce following a 10% drawdown with a 3.3% gain day-on-day. Some 91 shares rose while seven fell with United Bank (+7.41%), Habib Bank (+10%) and Meezan Bank (+5.9%) contributing the most to index gains. In contrast, Pioneer Cement (-9.51%), Pakistan Oilfields (-1.01%) and Adamjee Insurance (-2.81%) were the biggest index drags.

HBL announced CY25 earnings per share of Rs48.48, up 14% year-on-year, and dividend of Rs20. Earnings were in line and the payout – the highest-ever – was above expectations. The sharp rally brings 180k back into focus for the remaining week, AHL added.

Overall trading volumes decreased to 698 million shares compared with Tuesday’s tally of 716 million. The value of traded stocks stood at Rs50 billion.

Shares of 484 companies were traded. Of these, 334 stocks closed higher, 103 fell and 47 remained unchanged.

K-Electric continued to lead the volumes chart with trading in 117 million shares, rising Rs0.57 to close at Rs8.39. It was followed by The Bank of Punjab with 71.1 million shares, gaining Rs1.66 to close at Rs35.78 and Pakistan Petroleum with 27.6 million shares, higher by Rs1.92 to close at Rs236.86. Foreign investors sold shares worth Rs2.3 billion, the National Clearing Company reported.

Business

‘No reason to believe’: Russia says India has not changed stance on buying oil, rejects US claims – The Times of India

Russia’s foreign ministry firmly claimed on Wednesday that it has “no reason to believe” that India changed its stance on purchasing Russian oil, despite US claims suggesting otherwise. The ministry emphasised that the oil trade benefits both nations and helps maintain global energy market stability, while dismissing recent statements by US President Donald Trump and Secretary of State Marco Rubio about India agreeing to stop Russian oil imports.“We have no reason to believe that India has changed its position on buying Russian hydrocarbons. India’s purchase of Russian hydrocarbons benefits both countries and helps maintain stability in the international energy market,” said Russian Foreign Ministry spokesperson Maria Zakharova during her weekly briefing.

Zakharova further criticised US leadership, saying, “There is nothing new in the claims of US President Donald Trump, as well as US Secretary of State Marco Rubio, who have grabbed the right to dictate to independent nations.”The issue gained attention after the US recently reduced tariffs on Indian goods from 50 per cent to 18 per cent. This included removing a 25 per cent tariff that Trump had imposed on India last August due to its Russian oil purchases. Following a phone call between Prime Minister Modi and President Trump, US officials claimed India had committed to stopping Russian oil imports.India has maintained silence on these US claims, neither confirming nor denying them. MEA had previously stated that “national interests” would guide its energy procurement decisions.Meanwhile, Russia has accused the US of using various pressure tactics, including tariffs, sanctions, and direct prohibitions, to prevent India and other countries from buying Russian oil.In her briefing, Zakharova also took aim at Ukraine’s European allies, suggesting they are not interested in pursuing peaceful solutions to ongoing conflicts.

Russian imports at a low?

India’s crude sourcing pattern is reportedly shifting, with Russian oil imports falling to their lowest levels in over two years. Data cited by Reuters claims Russian shipments accounted for just 21.2 per cent of India’s total imports in January, the smallest share since late 2022, at around 1.1 million barrels per day, down sharply from December and about one-third lower year-on-year.Russia had become India’s top supplier after 2022, with its share once nearing 40 per cent, driven by discounted crude. However, tightening Western sanctions and growing US trade engagement appear to have weighed on purchases. China has now overtaken India as Russia’s largest seaborne crude buyer.To compensate, Indian refiners increased purchases from other regions. Middle Eastern crude rose to roughly 55 per cent of imports in January, while Latin American supplies hit a 12-month high. Saudi Arabia has regained its position as India’s leading supplier, with February volumes tracking at record levels.Read more: Share of Russian crude in India’s oil imports falls to lowest since November 2022; Middle East supplies riseAnalysts expect Russian flows to decline further in the coming months, though not cease entirely, as India continues to emphasise its policy of “strategic autonomy” in energy procurement.

Business

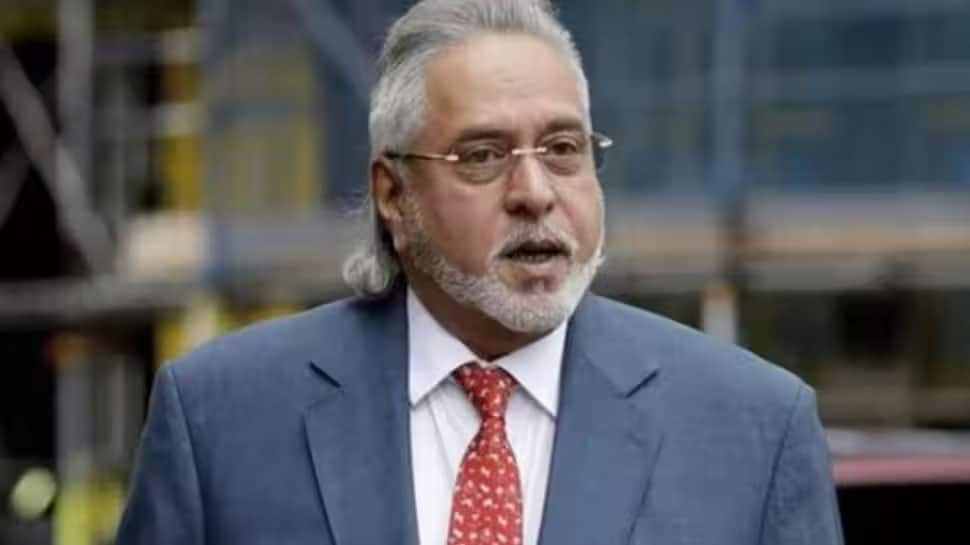

Vijay Mallya tells Bombay HC he cannot say when he will return to India

Mumbai: UK-based businessman Vijay Mallya on Wednesday informed the Bombay High Court that he is not in a position to specify when he would return to India. He cited restrictions imposed by courts in England that he said prevented him from leaving the country.

The matter was heard by a Bench comprising Chief Justice Shree Chandrashekhar and Justice Gautam Ankhad, in connection with two petitions filed by Mallya. One petition challenges his designation as a “Fugitive Economic Offender” under the Fugitive Economic Offenders Act (FEOA), while the other contests a court order formally declaring him a fugitive.

Senior advocate Amit Desai, appearing for Mallya, referred to Supreme Court judgments where writ petitions were heard even in the absence of petitioners.

He submitted that extradition proceedings against Mallya are ongoing in the UK and that his client is aware of them but is unable to leave English jurisdiction due to binding court orders.

The Chief Justice, however, questioned Mallya’s intent to appear before the court, observing that he appeared to be relying on UK court orders without clarifying whether those orders had been challenged. The Bench indicated that such reliance could not be treated as a blanket justification.

The court directed Solicitor General Tushar Mehta to file a response to Mallya’s affidavit. It also asked Desai to submit a detailed affidavit placing on record all statements made during the hearing so that the Union of India could respond accordingly.

Granting three weeks’ time for further proceedings, the Bench noted that the petitions have been pending since 2019 and remarked that no sincere efforts appeared to have been made for their early disposal. The matter is now scheduled for a hearing on March 11.

According to the Finance Ministry, Mallya — former promoter of Kingfisher Airlines — is among 15 individuals declared Fugitive Economic Offenders as of October 31, 2025, allegedly causing losses of thousands of crores of rupees to Indian banks.

Earlier, the Enforcement Directorate (ED) submitted before the court that Mallya had filed affidavits disputing banks’ claims and was attempting to turn money laundering proceedings into recovery litigation. The agency further argued that he challenged the FEO declaration only after being declared a fugitive and when extradition proceedings in London had reached an advanced stage.

Business

The two farms in Senegal that supply many of the UK’s vegetables

Between January and March, if you browse the fresh produce aisles of the UK’s biggest food retailers, including Tesco, Sainsbury’s, Asda, Aldi and Lidl, you’re likely to see spring onions, radishes, green beans, chillis, butternut squash, and cobs of corn, all labelled Produce of Senegal.

-

Business1 week ago

Business1 week agoAye Finance IPO Day 2: GMP Remains Zero; Apply Or Not? Check Price, GMP, Financials, Recommendations

-

Business1 week ago

Business1 week agoGold price today: How much 18K, 22K and 24K gold costs in Delhi, Mumbai & more – Check rates for your city – The Times of India

-

Fashion1 week ago

Fashion1 week agoComment: Tariffs, capacity and timing reshape sourcing decisions

-

Business6 days ago

Business6 days agoTop stocks to buy today: Stock recommendations for February 13, 2026 – check list – The Times of India

-

Fashion7 days ago

Fashion7 days agoIndia’s PDS Q3 revenue up 2% as margins remain under pressure

-

Politics7 days ago

Politics7 days agoIndia clears proposal to buy French Rafale jets

-

Fashion1 week ago

Fashion1 week agoSaint Laurent retains top spot as hottest brand in Q4 2025 Lyst Index

-

Tech1 week ago

Tech1 week agoRemoving barriers to tech careers