Business

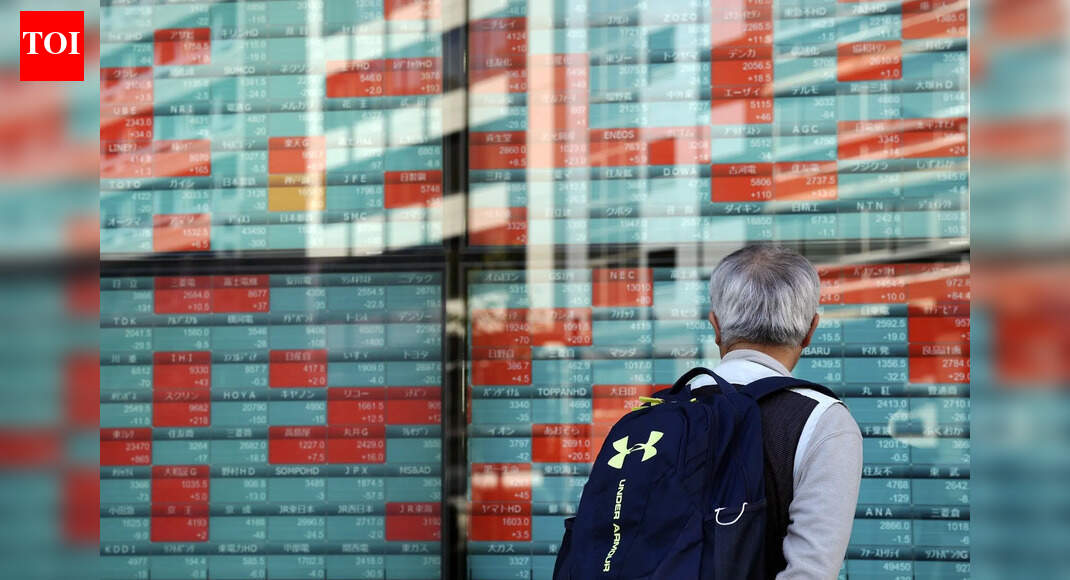

‘Buy America’ to ‘bye America’: Why investors are looking beyond US stocks – The Times of India

US investors are increasingly moving money out of domestic equities and into overseas markets, signalling a shift away from the long-dominant “buy America” trade as returns from Big Tech moderate and global markets outperform.Data from LSEG/Lipper shows US-domiciled investors have withdrawn about $75 billion from US equity products over the past six months, including $52 billion since the start of 2026 — the largest outflow in the first eight weeks of a year since at least 2010, news agency Reuters reported.The trend reflects growing diversification by American investors, even as a weaker dollar makes overseas investments more expensive. Analysts say the shift mirrors earlier moves by global investors who had already begun reducing exposure to US assets.Since the global financial crisis in 2009, strong economic growth and technology-sector dominance helped US equities deliver outsized gains, reinforcing the “buy America” investment strategy. More recently, the artificial intelligence boom pushed the S&P 500 to record highs last year, cushioning markets despite policy uncertainty linked to President Donald Trump’s trade and diplomatic approach.

Investors look beyond US tech dominance

Rising concerns over AI-related risks and elevated valuations of megacap technology stocks have prompted investors to reassess opportunities abroad. Bank of America’s February fund manager survey showed investors rotating from US equities into emerging markets at the fastest pace in five years.“I’ve had lots of conversations with our wealth business in the U.S. this year,” said Gerry Fowler, UBS’s head of European equity strategy and global derivatives strategy. “They’re all talking about investing more offshore because at the end of the year, they looked at the performance of foreign markets in dollars and they’re like, wow, I’m missing out.”So far this year, US investors have invested about $26 billion into emerging-market equities, with South Korea attracting $2.8 billion and Brazil $1.2 billion, according to LSEG/Lipper data.The dollar has declined roughly 10% against a basket of currencies since last January, partly reflecting policy developments under the Trump administration. While this raises the cost of overseas investments, stronger foreign market performance can enhance dollar-denominated returns.Over the past 12 months, the S&P 500 has gained around 14%, compared with a 43% rise in Tokyo’s Nikkei index, a 26% jump in Europe’s STOXX 600, a 23% return from Shanghai’s CSI 300 and a doubling in South Korea’s KOSPI index.

Valuation gap drives global rotation

Investors are increasingly rotating away from high-growth technology stocks towards industrial and defensive sectors, which are more prominent in markets such as Germany, the UK, Switzerland and Japan.Laura Cooper, global investment strategist at Nuveen, told Reuters that the shift reflects a broader reassessment of valuations. “Increasingly we are seeing U.S. investors look at the global landscape from a valuation perspective,” she said, highlighting cyclical growth momentum in Europe and Japan.European banking stocks surged 67% last year and have risen another 4% so far in 2026, illustrating renewed interest in cyclical sectors.US equities continue to trade at higher valuations, with the S&P 500 valued at roughly 21.8 times expected earnings, compared with about 15 times in Europe, 17 times in Japan and 13.5 times in China.Kevin Thozet, portfolio adviser at Carmignac, said flows of US capital into Europe have accelerated since mid-2025. Since Trump’s inauguration last January, US investors have channelled nearly $7 billion into European equity funds, reversing earlier outflows recorded during his first term.“If I’m taking a very long-term view, it’s, maybe, this idea of a great global rotation,” Thozet said.(Disclaimer: Recommendations and views on the stock market, other asset classes or personal finance management tips given by experts are their own. These opinions do not represent the views of The Times of India)

Business

Trump tariffs: The uncertainties facing businesses and consumers after tariff changes

Businesses say questions remain after US President Donald Trump announced he will impose global tariffs of 15%.

Source link

Business

‘Pakistan’s citizens pay high taxes but get nothing in return’

New Delhi: Pakistan’s successive governments, both civil and military, have been imposing higher and regressive taxes, pushing the overwhelming majority of citizens towards an unbearably high cost of living, and adding insult to injury, the state provides nothing in terms of welfare and has total apathy towards the economically vulnerable segments of society, an article in the Pakistani media said.

Pakistan’s fiscal crisis is not simply about deficits and numbers. It is about a broken social contract—a growing disconnect between what citizens pay and what they receive. High taxation without welfare delivery has not only failed to generate effective revenue but also has eroded trust, discouraged investment, and weakened the formal economy, the article in the Lahore-based The Friday Times lamented.

Pakistan’s growth failure is often explained through familiar cliches: low productivity, weak exports, lack of innovation, or insufficient entrepreneurship. These are symptoms, not causes. The real problem lies deeper—in a state-engineered cost structure that has made doing business prohibitively expensive and structurally irrational, it said.

The article cites a recent private sector analysis reported by Nikkei Asia, which has quantified what businesses have been saying for years: operating a business in Pakistan is 34 per cent more expensive than in comparable South Asian economies. According to the study conducted by the Pakistan Business Forum (PBF), the excess cost is not incidental or cyclical. It is structural, cumulative, and policy-induced.

“With only 3.4 million effective taxpayers, a mere 4 per cent of the 85.6 million-strong workforce funding the entire state, we have declared war on the middle class. Having forced this captive minority to bridge a multi-trillion rupee deficit while the informal elite remain untouched, we have classified excellence as a taxable offence and transparency as a path to insolvency, the article states,” the article said.

The tragedy is not that Pakistan collects too little (which is a myth in terms of the tax-to-GDP ratio in our peculiar milieu), it is that it taxes irrationally—high taxes on a narrow tax base with low yield and tax expenditure of nearly Rs 5 trillion. Despite successive mini-budgets, super taxes, levies on petroleum, enhanced withholding regimes, and expanded presumptive taxation, the debt-to-tax ratio remains shocking, over 700 per cent, it noted

A microscopic segment of the population — salaried individuals, documented businesses, corporate entities, and compliant exporters — finances a bloated public apparatus. The informal economy thrives, retail and wholesale sectors remain largely undocumented, agriculture as a sector is scarcely taxed, and real estate speculation continues under preferential regimes. Instead of broadening the base, fiscal managers repeatedly resort to increasing rates on the already documented, it added.

Business

Haryana Govt bars IDFC First Bank, AU Small Finance Bank over alleged Rs 590 crore fraud

New Delhi: The Haryana Government on Sunday de-empanelled IDFC First Bank and AU Small Finance Bank from handling government business with immediate effect after an alleged fraud of around Rs 590 crore came to light.

In an official circular, the state government said both banks have been barred from carrying out any government-related transactions in Haryana until further orders.

It directed all departments, boards, corporations and public sector undertakings to stop using these banks for deposits, investments or any other financial dealings.

Authorities have also been asked to immediately transfer existing balances and close accounts maintained with the two lenders.

The Finance Department pointed out lapses in following fixed deposit instructions. It noted that in some cases, funds that were supposed to be placed in flexible deposits or higher-interest fixed deposit schemes were allegedly kept in savings accounts, leading to lower returns and financial loss to the state.

Departments have been instructed to strictly follow approved deposit terms, regularly verify compliance by banks, conduct monthly reconciliations and report any discrepancies.

All reconciliations must be completed by March 31, 2026, and a certified compliance report has to be submitted by April 4, 2026.

The action comes after IDFC First Bank disclosed in a regulatory filing that it had detected a fraud of about Rs 590 crore involving certain Haryana government-linked accounts operated through its Chandigarh branch.

The bank said there were prima facie unauthorised and fraudulent activities carried out by some employees at the branch, possibly involving other individuals or entities.

According to the bank, the issue surfaced when a Haryana government department requested closure and transfer of its account balance to another bank.

During the process, discrepancies were found between the amount mentioned and the actual balance in the account.

Similar discrepancies were later identified in other government-linked accounts from February 18 onwards.

IDFC First Bank clarified that its preliminary internal review suggests the matter is limited to a specific group of Haryana government-linked accounts handled by the Chandigarh branch and does not affect other customers.

The total amount under reconciliation across the identified accounts is estimated at around Rs 590 crore, and the final figure will be determined after further validation and possible recoveries.

Four bank officials have been suspended pending investigation. The bank said it will take strict disciplinary, civil and criminal action against those found responsible.

It has also issued recall requests to certain beneficiary banks to lien-mark balances in suspicious accounts as part of recovery efforts. The statutory auditors have been informed and an independent external agency will carry out a forensic audit.

-

Entertainment5 days ago

Entertainment5 days agoQueen Camilla reveals her sister’s connection to Princess Diana

-

Tech5 days ago

Tech5 days agoRakuten Mobile proposal selected for Jaxa space strategy | Computer Weekly

-

Politics5 days ago

Politics5 days agoRamadan moon sighted in Saudi Arabia, other Gulf countries

-

Entertainment5 days ago

Entertainment5 days agoRobert Duvall, known for his roles in "The Godfather" and "Apocalypse Now," dies at 95

-

Politics5 days ago

Politics5 days agoTarique Rahman Takes Oath as Bangladesh’s Prime Minister Following Decisive BNP Triumph

-

Sports5 days ago

Sports5 days agoUsman Tariq backs Babar and Shaheen ahead of do-or-die Namibia clash

-

Business5 days ago

Business5 days agoTax Saving FD: This Simple Investment Can Help You Earn And Save More

-

Tech5 days ago

Tech5 days agoBusinesses may be caught by government proposals to restrict VPN use | Computer Weekly