Business

PM says CPEC-2 is Pakistan’s last big chance | The Express Tribune

ISLAMABAD:

Prime Minister Shehbaz Sharif has warned ministries and divisions of strict action for causing delays in executing over $8 billion worth of CPEC 2 projects.

Chairing a recent high-level meeting, the prime minister said that although the Pakistan-China B2B Conference was a tremendous success, agreements signed must be followed up meticulously by the concerned ministries to convert them into binding joint venture contracts, ensuring that Chinese investment materialises.

PM Sharif stressed that no complacency or undue delay would be tolerated, and unlike in the past, no project should be delayed. He said China had agreed to launch the CPEC 2.0 programme, which would focus on agriculture, Special Economic Zones, investment in mines and minerals, and the upgradation of the Karakoram Highway.

The premier cautioned that while China remained Pakistan’s great friend and brother, this was the last opportunity to benefit from Chinese expertise and investment. He urged ministries to work wholeheartedly to ensure success, stressing that the government was answerable to the people and accountable for results. “History will never forgive us if we fail to take advantage of this opportunity,” he said.

The PM highlighted his recent visit to China, where he attended the SCO Tianjin Summit 2025 and met President Xi Jinping, Premier Li Qiang, and other world leaders. He commended federal ministers, secretaries, SEPC, and officials for their role in organising the Pakistan-China B2B Investment Conference in Beijing on September 4, where MOUs worth $8.5 billion were signed.

The prime minister also pointed to recent MOUs with US-based companies in gemstones, mines, and minerals. He said these partnerships would bring technical expertise while reflecting growing Pakistan-US ties. He added Pakistan was pursuing good relations with the US without compromising its strategic partnership with China.

Business

Mandelson’s lobbying firm cuts all ties with disgraced peer amid Epstein fallout

A lobbying firm co-founded by Peter Mandelson has severed all connections with the peer.

Its chief executive, Benjamin Wegg-Prosser, has also announced his departure.

The decision follows mounting pressure on Global Counsel over Lord Mandelson’s association with convicted sex offender Jeffrey Epstein.

The firm confirmed that the former US ambassador no longer holds a stake in the business nor exerts any influence.

Mr Wegg-Prosser said he was stepping down as it was “time to draw a line” between the firm and Lord Mandelson’s “actions”.

Global Counsel added in a statement that it had reached an agreement to fully divest the peer’s shares, thereby ending all connections with him.

Its chair, Archie Norman, said: “With the completion of this process today, Peter Mandelson no longer has any shareholding, role or association with Global Counsel and has no influence over the firm in any capacity.”

Mr Wegg-Prosser said: “With the completion of the divestment of Peter Mandelson’s stake in the business, I feel that now is the time to draw a line between Global Counsel and his actions.

“I have nothing but immense pride in the business I founded and the work our amazing team deliver every day.”

He has been replaced as head of the firm by its managing director Rebecca Park, and his page on the company’s website has already been taken down.

Ms Park has also acquired the remaining shares that were held by Lord Mandelson.

Lord Mandelson co-founded the London-based firm with Mr Wegg-Prosser in 2010 after Labour lost the general election.

It is understood that Barclays has cut ties with Global Counsel amid the scrutiny.

Lord Mandelson was sacked as US ambassador in late 2025 after it emerged that he had maintained ties with Epstein after the financier was jailed for a child sex offence.

Epstein killed himself in a prison cell in 2019 while awaiting trial on further child sex charges.

Business

Stock market today: Here are the top gainers and losers on NSE, BSE on February 6 – check list – The Times of India

Equity markets ended slightly higher on Friday after the Reserve Bank of India left interest rates unchanged, a move that was widely expected, and announced a proposal to allow banks to lend to Real Estate Investment Trusts (REITs) under prudential safeguards.The 30-share BSE Sensex rose 266.47 points, or 0.32 per cent, to close at 83,580.40. The index recovered sharply in the final hour, jumping over 650 points from the day’s low of 82,925.35, helped by late buying in select stocks. The NSE Nifty also finished higher, gaining 50.90 points, or 0.20 per cent, to settle at 25,693.70 after a volatile session.

Nifty50 top gainers

| Company Name | Current Price (Rs) | Price Change | % Change |

|---|---|---|---|

| ITC | 326.35 | +16.20 | +5.21% |

| Kotak Bank | 422.35 | +13.60 | +3.33% |

| HUL | 2,424 | +69.80 | +2.97% |

| Bajaj Finance | 982.00 | +17.30 | +1.79% |

| Bharti Airtel | 2,023 | +30.60 | +1.54% |

| Power Grid | 292.80 | +3.45 | +1.20% |

| Titan Company | 4,141 | +43.20 | +1.06% |

| Bajaj Finserv | 2,021 | +20.70 | +1.04% |

| Shriram Finance | 1,001 | +9.00 | +0.91% |

| ICICI Bank | 1,408 | +11.50 | +0.83% |

Nifty50 top losers

| Company Name | Current Price (Rs) | Price Change | % Change |

|---|---|---|---|

| HDFC Life | 703.50 | -17.21 | -2.39% |

| Tech Mahindra | 1,616 | -30.21 | -1.84% |

| TCS | 2,940 | -51.20 | -1.72% |

| SBI Life | 1,987 | -31.00 | -1.54% |

| Tata Motors PV | 368.90 | -5.25 | -1.41% |

| Bajaj Auto | 9,519 | -129.00 | -1.34% |

| Adani Ports SEZ | 1,550 | -20.71 | -1.32% |

| Wipro | 230.40 | -2.99 | -1.29% |

| Eternal | 283.55 | -3.31 | -1.16% |

| Asian Paints | 2,405 | -27.10 | -1.12% |

Sensex top gainers

| Company Name | Current Price (Rs) | Price Change | % Change |

|---|---|---|---|

| ITC | 326.35 | +16.20 | +5.21% |

| Kotak Bank | 422.35 | +13.60 | +3.33% |

| HUL | 2,424 | +69.80 | +2.97% |

| Bajaj Finance | 982.00 | +17.30 | +1.79% |

| Bharti Airtel | 2,023 | +30.60 | +1.54% |

| Power Grid | 292.80 | +3.45 | +1.20% |

| Titan Company | 4,141 | +43.20 | +1.06% |

| Bajaj Finserv | 2,021 | +20.70 | +1.04% |

| ICICI Bank | 1,408 | +11.50 | +0.83% |

| Axis Bank | 1,342 | +11.00 | +0.83% |

Sensex top losers

| Company Name | Current Price (Rs) | Price Change | % Change |

|---|---|---|---|

| Tech Mahindra | 1,616 | -30.21 | -1.84% |

| TCS | 2,940 | -51.20 | -1.72% |

| Adani Ports SEZ | 1,550 | -20.71 | -1.32% |

| Eternal | 283.55 | -3.31 | -1.16% |

| Asian Paints | 2,405 | -27.10 | -1.12% |

| HCL Tech | 1,594 | -16.30 | -1.02% |

| Infosys | 1,506 | -14.50 | -0.96% |

| HDFC Bank | 941.00 | -8.71 | -0.92% |

| Trent | 4,095 | -36.31 | -0.88% |

| SBI | 1,066 | -7.50 | -0.70% |

Earlier in the day, markets had opened cautiously and slipped into the red before staging a modest recovery.On the policy front, the RBI’s six-member Monetary Policy Committee unanimously voted to keep the repo rate unchanged at 5.25 per cent. The central bank also retained its neutral stance, indicating it may stay on hold for now. The decision came as inflation remained under control and growth concerns eased following higher government spending in the Budget and reduced tariff pressures after a trade deal with the United States, news agency PTI reported.Announcing the policy, RBI Governor Sanjay Malhotra said, “To further promote financing to the real estate sector, it is proposed to allow banks to lend to REITs with certain prudential safeguards.” Market participants said this move could improve long-term funding visibility for the real estate sector and the broader credit ecosystem.Among Sensex stocks, ITC was the top gainer, jumping over 5 per cent. Kotak Mahindra Bank, Hindustan Unilever, Bharti Airtel, Bajaj Finance, Power Grid and Bajaj Finserv also ended higher. On the other hand, Tata Consultancy Services, Tech Mahindra, Adani Ports, Asian Paints, Eternal and HCL Tech were among the laggards.Commenting on the session, Vinod Nair, head of research at Geojit Investments Limited, said domestic markets remained subdued for most of the day before recovering on the back of buying in FMCG and private banking stocks.“The RBI’s policy announcement was broadly in line with expectations, maintaining status quo on interest rates while reiterating a constructive growth outlook,” he said, as quoted by news agency ANI.However, he added that markets had expected a slightly more dovish tone. The RBI’s decision to retain a neutral stance led to a rise in India’s 10-year bond yields. Nair also pointed out that global investors remain focused on US-Iran negotiations, crude oil prices, and developments in artificial intelligence and technology.Foreign institutional investors sold shares worth Rs 2,150.51 crore on Thursday, according to exchange data.In global markets, Asian indices such as South Korea’s Kospi, Shanghai’s SSE Composite and Hong Kong’s Hang Seng ended lower, while Japan’s Nikkei closed higher. European markets were mostly trading in the green. In the US, stocks had ended sharply lower overnight, with the Nasdaq falling 1.59 per cent.Meanwhile, Brent crude rose 1.20 per cent to $68.34 per barrel. On Thursday, the Sensex had dropped over 500 points, while the Nifty had declined more than half a per cent.

Business

Head of firm founded by Mandelson to quit after Epstein release

Benjamin Wegg-Prosser concluded his association with Lord Mandelson – and references to them both in the Epstein files – was doing the business Global Counsel harm.

Source link

-

Business1 week ago

Business1 week agoPSX witnesses 6,000-point on Middle East tensions | The Express Tribune

-

Tech1 week ago

Tech1 week agoThe Surface Laptop Is $400 Off

-

Tech1 week ago

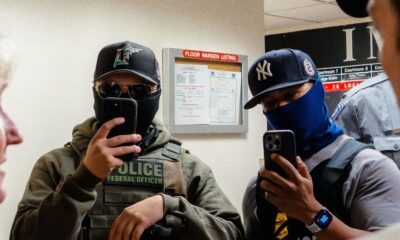

Tech1 week agoHere’s the Company That Sold DHS ICE’s Notorious Face Recognition App

-

Tech4 days ago

Tech4 days agoHow to Watch the 2026 Winter Olympics

-

Business1 week ago

Business1 week agoBudget 2026: Defence, critical minerals and infra may get major boost

-

Tech7 days ago

Tech7 days agoRight-Wing Gun Enthusiasts and Extremists Are Working Overtime to Justify Alex Pretti’s Killing

-

Entertainment1 week ago

Entertainment1 week agoPeyton List talks new season of "School Spirits" and performing in off-Broadway hit musical

-

Sports1 week ago

Sports1 week agoDarian Mensah, Duke settle; QB commits to Miami