Business

International student levy could lead to £1.8bn loss in first year, report warns

The Government’s proposed international student levy could mean a £1.8 billion loss to the economy in the first year alone, analysis has suggested.

A report by policy consultancy Public First has estimated nine out of 12 regions in the UK would face a wider loss of more than £100 million in the first year of a levy because of the likely loss in international students.

The impact would be largest in London, at £480 million, followed by Scotland (£197 million) and then the South East (£163 million).

The 10 parliamentary constituencies most affected by the proposed levy would lose an average of £40 million in gross value added (GVA), modelling suggests.

Holborn and St Pancras is estimated to face the biggest loss at £72 million, followed by the cities of London and Westminster (£57 million), and then Coventry South (£44 million).

- Greater London – £480 million

- Scotland – £197 million

- South East – £163 million

- West Midlands – £141 million

- North West – £139 million

- Yorkshire and the Humber – £134 million

- East of England – £120 million

- East Midlands – £115 million

- South West – £102 million

- North East – £87 million

- Wales – £64 million

- Northern Ireland – £42 million

Of the 50 most impacted constituencies, 37 are held by Labour, researchers said.

Mark Hilton, policy delivery director at Business LDN, said: “At a moment when the Government is rightly making growth its number one mission, a new higher education levy will hit one of our key export sectors to the tune of hundreds of millions of pounds.

“This levy would mean further cuts across universities in London and across the UK when they are already financially stretched, with world-leading research programmes a likely casualty.”

Earlier this week, Public First said 16,100 international students in the first year, and more than 77,000 in the first five years, could be deterred by a raise in university fees to cover the cost of levy contributions.

This could result in 33,000 fewer places in the first year of a levy for domestic students because of how international fees cross-subsidise domestic fees, findings suggest, growing to 135,000 across five years.

Henri Murison, chief executive of the Northern Powerhouse Partnership and chairman of the Growing Together Alliance, said: “The international student levy is opposed by all of England’s major regional employer organisations, from the west of England to Cambridge and the central south to the North West, because the resulting decline in international students would be hugely damaging to all the regions of the country.

“In the north alone, constituencies including Manchester Rusholme, Leeds Central, Sheffield Central and Newcastle upon Tyne Central and West would lose around or significantly more than £30 million of GVA apiece alongside seats in Scotland, the West Midlands and London.”

CBI Yorkshire and Humber regional director Beckie Hart said the impact of a levy would go “far beyond lost tuition fee income” as regions see a hit to the spending and tax contributions international students would have made in local businesses.

The impact of fewer international students could see the UK economy lose £2.2 billion in international fee income alone in the first five years, the report, which was commissioned by a consortium of universities, found.

Jonathan Simons, report author and partner at Public First, said the impact of a levy on international student numbers “will hit our universities, around 40% of whom are already in deficit, and that could lead to a further loss of jobs, a loss of university places for UK students and a loss of vital research investment.”

Vivienne Stern, chief executive of Universities UK, said the findings “raise further concern with possible proposals for an international student levy and show the multi-billion pound hit to the economy which could be felt as a result”.

“The report is also a reminder of the importance of international students to high streets, workplaces and campuses across the country,” she added.

The Government’s immigration white paper, published in May, said ministers would explore introducing a levy on higher education income from international students.

Current proposals are understood to be looking at a 6% levy on universities’ income on international students.

After the white paper was published, which also said the Government would reduce graduate visas to 18 months, sector leaders warned the plans could deter international students from coming to the UK and exacerbate financial challenges for universities.

A Government spokesperson said: “This Government is determined to ensure that investment in our higher education and skills system is more widely shared, and its contributions felt throughout our communities.

“We have taken tough but fair decisions to put universities on a secure financial footing through our plan for change, increasing tuition fees for the 2025/26 academic year in line with inflation and refocusing the Office for Students to monitor the financial health of the sector.

“We will fix the foundations of higher education to deliver change for students, restoring universities as engines of aspiration, opportunity and growth.”

Business

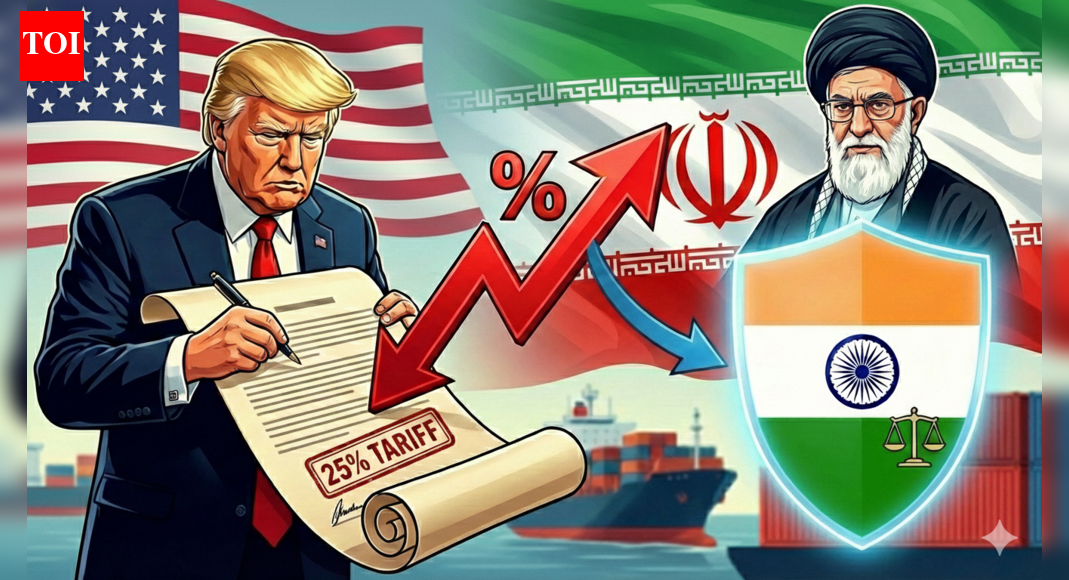

US sanctions Iran: Additional 25% tariffs to have minimal impact on India, say government sources – here’s why – The Times of India

India is unlikely to face any major impact from the 25 per cent tariff announced by the US President Donald Trump on countries doing business with Iran, as per government sources cited by news agency ANI, who pointed to India’s limited trade exposure with Tehran.Newly announced US tariffs are ‘likely to have minimal impact on India’ as Iran does not feature among the nation’s top 50 trading partners, the government sources said. India’s total trade with Iran stood at around $1.6 billion last year, accounting for just 0.15 per cent of India’s overall trade. This figure is expected to decline further in the current financial year due to broader external economic factors. Of Iran’s total imports of about $68 billion in 2024, the UAE, China, Turkiye and the European Union together accounted for the bulk, while India’s share was only $1.2 billion, or 2.3 per cent.Exporters have also downplayed concerns. Ajay Sahai, director general of the Federation of Indian Export Organisations (FIEO), said Indian companies and banks remain fully compliant with US Office of Foreign Assets Control norms and engage only in permitted humanitarian trade, mainly food items and pharmaceuticals, reported news agency PTI.“There is, therefore, no basis to anticipate any adverse impact on India,” Sahai said.He noted that India’s trade with Iran largely falls outside the scope of sanctions due to its humanitarian nature. In 2024-25, India’s total trade with Iran was $1.68 billion, including $1.24 billion in exports, primarily from the farm and pharmaceutical sectors, as per PTI.Industry representatives, however, flagged other challenges. Sahai said the sharp depreciation of the Iranian currency is a bigger concern for exporters, as it weakens consumer purchasing power and raises risks of cancelled contracts. Rice exporters also said their current exposure to Iran is limited and increasingly routed through the UAE to manage risks, reported ANI.Overall, exporters remain cautious but believe the proposed US tariff will have little direct effect on India, given the small trade volumes and the humanitarian nature of most shipments.

Business

Jerome Powell: World central bank chiefs declare support for US Fed chair

Central banks across the world have joined together to declare that they stand in “full solidarity” with the Federal Reserve’s chair after the US launched a criminal investigation into Jerome Powell.

The heads of the Bank of England, the European Central Bank and the Bank of Canada are among 11 senior bankers who have signed a statement highlighting the importance of independence in setting interest rates.

“Chair Powell has served with integrity, focused on his mandate and an unwavering commitment to the public interest,” they said.

The Department of Justice is conducting the probe. President Donald Trump has said he did not “know anything” about the investigation.

The probe is linked to testimony Powell gave to a Senate committee about renovations to Federal Reserve buildings.

It follows a year of relentless attacks on the Fed chair by Trump.

As well as criticising Powell’s decisions on interest rates, Trump has made personal comments, calling the Fed chair a “major loser” and a “numbskull”.

Commenting on the Fed chair, the global central bankers said in their joint statement: “To us, he is a respected colleague who is held in the highest regard by all who have worked with him.”

Until the weekend, Powell had stayed largely silent in the face of Trump’s attacks but on Sunday, he publicly pushed back and warned that the independence of the US central bank was at stake.

“This is about whether the Fed will be able to continue to set interest rates based on evidence and economic conditions, or whether instead monetary policy will be directed by political pressure or intimidation,” Powell said.

In their joint statement on Tuesday, the senior financial institutions said: “The independence of central banks is a cornerstone of price, financial and economic stability in the interest of the citizens that we serve.

“It is therefore critical to preserve that independence, with full respect for the rule of law and democratic accountability.”

Powell, who Trump nominated as Fed chair in 2017 during his first term in the White House, is set to step down in May.

Trump is expected to name his successor in the coming weeks.

North Carolina Senator Thom Tillis, a Republican who is a member of the Senate Banking Committee, said he would oppose the nomination of Powell’s replacement by Trump, and any other Fed Board nominee, until the matter was “fully resolved”.

Powell has also been backed by three former chairs of the Fed – Janet Yellen, Ben Bernanke and Alan Greenspan. A number of other eminent former officials have publicly declared their support for him and the bank’s independence.

Yellen, who was Powell’s immediate predecessor, said the criminal investigation was “extremely chilling”, adding that investors should be concerned.

“You have a president that says the Fed should be cutting rates to lower rate payments on the federal debt… It is the road to banana republic,” she told CNBC.

The signatories in full are:

- Andrew Bailey, governor of the Bank of England

- Christine Lagarde, president of the European Central Bank

- Erik Thedéen, governor of Sveriges Riksbank

- Christian Kettel Thomsen, chairman of the Danmarks Nationalbank

- Martin Schlegel, chairman of the Swiss National Bank

- Michele Bullock, governor of the Reserve Bank of Australia

- Tiff Macklem, governor of the Bank of Canada

- Chang Yong Rhee, governor of the Bank of Korea

- Gabriel Galípolo, governor of the Banco Central do Brasil

- François Villeroy de Galhau, chair of the Bank for International Settlements

- Pablo Hernández de Cos, general manager of the Bank for International Settlements

Business

Stock Market Updates: Sensex Down 400 Points, Nifty Below 25,700; SMIDs Trade Mixed

Last Updated:

Indian benchmark indices, BSE Sensex and NSE Nifty, were higher at the open as investors have their eyes peeled for the US-India trade talks

Stock Market Today

Sensex Today: Indian benchmark indices — the BSE Sensex and NSE Nifty — extended their decline on Tuesday as investors stayed cautious ahead of the much-awaited US–India trade talks. On Monday, US Ambassador to India Sergio Gor had said that the two countries would engage in discussions today.

At 1:00 PM, the Sensex was trading at 83,428, down 450 points or 0.54 per cent, while the Nifty 50 slipped 128 points, or 0.50 per cent, to 25,661.

Eternal, Tech Mahindra, SBI, BEL, HDFC Bank, Maruti Suzuki, HUL, Titan Company, ICICI Bank, ITC and Axis Bank were among the top gainers, rising up to 3 per cent.

On the other hand, L&T, Reliance Industries, Tata Steel, M&M, Trent, TCS, IndiGo, Bharti Airtel and Sun Pharma were trading in the red.

In the broader market, the Nifty Midcap index declined 0.76 per cent, while the Nifty Smallcap index bucked the trend to trade 0.24 per cent higher.

Among sectoral indices, Nifty Media, IT and select financial stocks led the gains. However, most other sectors were under pressure, with Nifty Realty, Pharma and Consumer Durables emerging as the top laggards, each down over 1 per cent.

Global Cues

Asian markets were trading in the green as investors looked past geopolitical tensions in Iran and Venezuela, as well as the criminal investigation into US Federal Reserve Chair Jerome Powell. Mainland China’s CSI 300 gained 0.54 per cent, Hong Kong’s Hang Seng advanced 1.32 per cent, and South Korea’s KOSPI rose 1.04 per cent.

Japan’s Nikkei surged 3.22 per cent amid reports that the ruling Liberal Democratic Party may dissolve the Lower House this month for a snap election in February.

On Wall Street, the S&P 500 and the Dow Jones closed at fresh record highs overnight. The S&P 500 edged up 0.16 per cent, the Dow gained 0.17 per cent, and the Nasdaq climbed 0.26 per cent. Investors are now awaiting the US Consumer Price Index (CPI) for December, scheduled for release later today.

Separately, US President Donald Trump stated on Monday evening that any country doing business with Iran will face a 25 per cent US tariff.

January 13, 2026, 09:02 IST

Read More

-

Entertainment1 week ago

Entertainment1 week agoMinnesota Governor Tim Walz to drop out of 2026 race, official confirmation expected soon

-

Sports1 week ago

Sports1 week agoVAR review: Why was Wirtz onside in Premier League, offside in Europe?

-

Politics6 days ago

Politics6 days agoUK says provided assistance in US-led tanker seizure

-

Entertainment6 days ago

Entertainment6 days agoDoes new US food pyramid put too much steak on your plate?

-

Business1 week ago

Business1 week ago8th Pay Commission: From Policy Review, Cabinet Approval To Implementation –Key Stages Explained

-

Entertainment6 days ago

Entertainment6 days agoWhy did Nick Reiner’s lawyer Alan Jackson withdraw from case?

-

Business6 days ago

Business6 days agoTrump moves to ban home purchases by institutional investors

-

Sports1 week ago

Sports1 week agoFACI invites applications for 2026 chess development project | The Express Tribune