Business

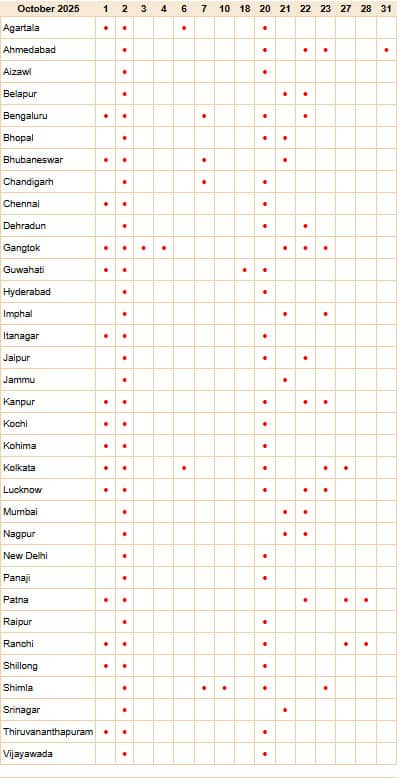

Bank Holiday October 2025: Branches To Be Closed For Upto 21 Days Next Month; Check Dates And State Wise List

)

New Delhi: In the month of October, bank branches will remain closed for upto 21 days. The Reserve Bank of India (RBI) has mentioned some days when the banking operations will remain closed in the month of October 2025, although online banking activities will continue to work.

While some bank holidays will be observed nation-wide, some others will be local holidays. Several bank branches will remain closed in various states owing to these festivities. Before visiting your bank branch in the month of October, you must note down the list of important days during which banks will remain closed.

Banks will remain closed for total 21 days in the month of October– 15 as per the Reserve Bank of India (RBI) holiday calendar list and the remaining days are that of weekends. However, you must note that the banks will NOT be closed for 21 days in all states or regions. This is the total number of days when banks in different parts of the country will remain closed for state-observed holidays.

For example bank branches might be closed for Kati Bihu in Assam but not closed for the same in other states.

Reserve Bank of India places its Holidays under three brackets –Holiday under Negotiable Instruments Act; Holiday under Negotiable Instruments Act and Real Time Gross Settlement Holiday; and Banks’ Closing of Accounts. However, it must be noted that the bank holidays vary in various states as well not observed by all the banking companies. Banking holidays also depend on the festivals being observed in specific states or notification of specific occasions in those states.

Here is an elaborate list of bank holidays falling in the month of October 2025. Check out the list.

Navaratri Ends/Maha Navami/Dussehra/Ayudhapooja, Vijayadasami/Durga Puja (Dasain): October 1

Mahatma Gandhi Jayanti/Dasara/Vijaya Dashami/Dussehra/Durga Puja (Dasain)/Janmotsav of Sri Sri Sankardeva: October 2

Durga Puja (Dasain): October 3

Durga Puja (Dasain): October 4

Lakshmi Puja: October 6

Maharshi Valmiki Jayanti/Kumar Purnima: October 7

Karva Chauth: October 10

Kati Bihu: October 18

Diwali (Deepavali)/Naraka Chaturdashi/Kali Puja: October 20

Diwali Amavasya (Laxmi Pujan)/Deepawali/Govardhan Pooja: October 21

Diwali (Bali Pratipada)/Vikram Samvant New Year Day/Govardhan Pooja/Balipadyami, Laxmi Puja (Deepawali): October 22

Bhai Bij/Bhaidooj/Chitragupt Jayanti/Laxmi Puja (Deepawali)/Bhratridwitiya/Ningol Chakkouba: October 23

Chath Puja (Evening Puja): October 27

Chath Puja (Morning Puja): October 28

Sardar Vallabhbhai Patel’s Birthday: October 31

Apart from the above bank holidays, the second and fourth Saturdays, Sundays of the month are falling on the following dates:

Sunday: October 5

Second Saturday: October 11

Sunday: October 12

Sunday: October19

Fourth Saturday: October 25

Sunday: October 26

Check Dates And State Wise List Of Bank Holidays In October 2025

Holidays of the mentioned days will be observed in various regions according to the state declared holidays, however for the gazetted holidays, banks will be closed all over the country.

If you keep a track of these holidays, you would be able to plan bank transaction activities in a better way. For long weekends, you can even plan your holidays well.

Business

Critical Illness Claim Rejected? Here’s How You Can Fight Back

Last Updated:

A rejected critical illness claim may not be the final word if the policy clearly covers the condition.

Policyholders can successfully challenge unfair decisions.(Representative Image)

A policyholder recently faced trouble after his/her spouse was diagnosed with a serious brain-related illness. The condition was identified as bacterial meningitis with encephalitis. Believing the illness was covered, the family filed a critical illness claim with their insurer.

However, the insurance company turned down the request. The reason given was that the illness did not fall under the list of covered conditions. This left the family confused and unsure about the next step, especially at a time when medical stress and costs were already high.

Why A Rejected Claim May Still Be Valid

A claim rejection does not always mean the insurer is right. The first step is to read the policy document carefully. Most critical illness plans clearly list the illnesses they cover. In many policies, bacterial meningitis is included, but only if certain medical conditions are met.

In a similar case, a close review of the policy showed that the illness was listed among 32 covered conditions. The medical records also clearly confirmed the diagnosis and seriousness of the disease. When both the policy terms and medical proof match, the rejection can be questioned.

How To Raise The Issue With The Insurer

The next step is to approach the insurer’s grievance team. This means sending a clear written request that explains why the claim should be accepted. It is important to point out the exact policy clauses and attach all medical reports.

In the case mentioned, the policyholder shared hospital records, diagnosis details, and proof of treatment. Despite this, the insurer stuck to its earlier decision and did not provide any new explanation. This is when many people give up, but there is still another option available.

When The Insurance Ombudsman Can Help

If the insurer does not resolve the issue, the policyholder can approach the insurance ombudsman. Filing a complaint here does not cost anything. The ombudsman reviews both the policy terms and the medical evidence.

During the hearing in this case, the policyholder submitted hospital documents and a doctor’s certificate. The records confirmed that the patient had a lasting brain-related problem for over six weeks, which is an important requirement in many critical illness policies. The insurer failed to provide proof to challenge these findings.

What This Case Teaches Policyholders

After reviewing all details, the ombudsman ruled in favour of the policyholder and asked the insurer to pay the claim amount to the nominee. This shows that unfair claim rejections can be overturned if the policy terms are clear and the documents are in order.

It is always wise to read your policy closely, keep complete medical records, and use the grievance and ombudsman process when needed. Many rejected claims can be resolved because the facts and the policy are on the customer’s side.

December 27, 2025, 09:33 IST

Read More

Business

India’s Forex Reserves Surge $4.36 Billion To $693 Billion, Gold Holding Rises $2.6 Billion

Last Updated:

India’s Latest Forex Reserves: The value of the gold reserves jumps $2.623 billion to $110.365 billion during the week ended December 19.

India’s Latest Forex Reserves.

India’s foreign exchange (forex) reserves surged $4.368 billion to $693.318 billion during the week ended December 19, according to the latest data from the Reserve Bank of India (RBI). The value of the gold reserves jumped $2.623 billion to $110.365 billion during the week.

The overall kitty had increased by $1.689 billion to $688.949 billion in the previous week.

For the week ended December 19, foreign currency assets, a major component of the reserves, increased by $1.641 billion to $559.428 billion, according to the Reserve Bank of India’s latest ‘Weekly Statistical Supplement’ data.

Expressed in dollar terms, the foreign currency assets include the effects of appreciation or depreciation of non-US units, such as the euro, pound, and yen, held in the foreign exchange reserves.

The special drawing rights (SDRs) were up by $8 million to $18.744 billion.

India’s reserve position with the IMF was up by $95 million to $4.782 billion in the week, according to the RBI data.

The price of the safe-haven asset gold has been on a sharp uptrend over recent months, perhaps amid heightened global uncertainties and robust investment demand.

After the last monetary policy review meeting, the RBI had said that the country’s foreign exchange reserves were sufficient to cover more than 11 months of merchandise imports. Overall, India’s external sector remains resilient, and the RBI is confident it can comfortably meet external financing requirements.

In 2023, India added around $58 billion to its foreign exchange reserves, contrasting with a cumulative decline of $71 billion in 2022. In 2024, reserves rose by just over $20 billion. So far in 2025, the forex kitty has increased by about $47-48 billion, according to data.

Foreign exchange reserves, or FX reserves, are assets held by a nation’s central bank or monetary authority, primarily in reserve currencies such as the US dollar, with smaller portions in the Euro, Japanese Yen, and Pound Sterling.

December 27, 2025, 08:17 IST

Read More

Business

Irdai fines Reliance General Insurance over ‘commission’ – The Times of India

MUMBAI: The Irdai on Friday, fined Reliance General Insurance Rs 1 crore in Hyderabad for routing unauthorised payouts through marketing and awareness expenses that amounted to disguised commissions. The penalty follows Irdai’s examination of transactions across FY19, FY20 and FY21. According to the regulator, the insurer channeled payments to brokers, agents, corporate agents and unlicensed entities under labels such as consumer awareness, marketing and advertising.

-

Fashion1 week ago

Fashion1 week agoIndonesia’s thrift surge fuels waste and textile industry woes

-

Tech1 week ago

Tech1 week agoT-Mobile Business Internet and Phone Deals

-

Business1 week ago

Business1 week agoBP names new boss as current CEO leaves after less than two years

-

Sports1 week ago

Sports1 week agoPKF summons meeting after Pakistani player represents India in kabaddi tournament

-

Entertainment1 week ago

Entertainment1 week agoIndia streamlines visa rules in boost for Chinese professionals

-

Sports1 week ago

Sports1 week agoUWCL grades for all 18 teams: Leuven get A+; Barça an A-, PSG fail

-

Sports7 days ago

Alabama turned Oklahoma’s College Football Playoff dream into a nightmare

-

Entertainment1 week ago

Entertainment1 week agoRadiation fears rise after cracks found in $2 billion Chernobyl shield