Business

AI demand means data centres are worsening drought in Mexico

Suzanne BearneTechnology Reporter, Querétaro, Mexico

Arterra/Getty Images

Arterra/Getty ImagesLocated in the middle of Mexico, Querétaro is a charming and colourful colonial-style city known for its dazzling stone aqueduct.

But the city, and state of the same name, is also recognised for a very different reason – as Mexico’s data centre capital.

Across the state companies including Microsoft, Amazon Web Services and ODATA own these warehouse-like buildings, full of computer servers.

No one could supply an exact number, but there are scores of them, with more being built.

Ascenty, which claims to be the largest data centre company in Latin America, has two in Querétaro, both around 20,000 sq ft in size, with a third under construction.

It is forecast that more than $10bn (£7.4bn) in data centre-related investment will pour into the state in the next decade.

“The demand for AI is accelerating the construction of data centres at an unprecedented speed,” says Shaolei Ren, associate professor of electrical and computer engineering at the University of California Riverside.

So, what’s the attraction of Querétaro?

“It’s a very strategic region,” explains Arturo Bravo, Mexico country manager at Ascenty.

“Querétaro is right in the middle [of the country], connecting east, west, north and south,” he says.

That means it is relatively close to Mexico City. It is also connected to high-speed data cables, so large amounts of data can be shifted quickly.

Mr Bravo also points out that there is support from the municipality and central government.

“It’s been identified as a technology hub,” he says. “Both provide a lot of good alternatives in terms of permits, regulation and zoning.”

But why are many US companies choosing this state over somewhere closer to home?

“The power grid capacity constraint in the US is pushing tech companies to find available power anywhere they can,” says Shaolei Ren, associate professor of electrical and computer engineering at the University of California Riverside, adding that the cost of land and energy, and business-friendly policies are also attractive.

Shaolei Ren

Shaolei RenData centres host thousands of servers – a specialised type of computer for processing and sending data.

Anyone that’s worked with a computer on their lap will know that they get uncomfortably hot. So to stop data centres melting down, elaborate cooling systems are needed which can use huge amounts of water.

However, not all data centres consume water at the same rate.

Some use water evaporation to dissipate the heat, which works well but is thirsty.

A small data centre using this type of cooling can use around 25.5 million litres of water per year.

Other data centres, like those owned by Ascenty, use a closed-loop system, which circulates water through chillers.

Meanwhile, Microsoft told the BBC it operates three data centres in Querétaro. They use direct outdoor air for cooling approximately 95% of the year, requiring zero water.

It said for the remaining 5% of the year, when ambient temperatures exceed 29.4°C, they use evaporative cooling.

For the fiscal year 2025, its Querétaro sites used 40 million litres of water, it added.

That’s still a lot of water. And if you look at overall consumption at the biggest data centre owners then the numbers are huge.

For example, in its 2025 sustainability report Google stated that its total water consumption increased by 28% to 8.1bn gallons between 2023 to 2024.

The report also said that 72% of the freshwater it used came from sources at “low risk of water depletion or scarcity”.

In addition, data centres also indirectly consume water, as water is needed to produce electricity.

Getty Images

Getty ImagesThe extra water consumption by data centres is a big problem for some in Querétaro which last year endured the worst drought of a century, impacting crops and water supplies to some communities.

At her home in Querétaro, activist Teresa Roldán tells me residents have asked the authorities for more information and transparency about the data centres and the water they use but says this has not been forthcoming.

“Private industries are being prioritised in these arid zones,” she says. “We hear that there’s going to be 32 data centres but water is what’s needed for the people, not for these industries. They [the municipality] are prioritising giving the water they have to the private industry. Citizens are not receiving the same quality of the water than the water that the industry is receiving.”

Speaking to the BBC in Querétaro, Claudia Romero Herrara, founder of water activist organisation Bajo Tierra Museo del Agua, wouldn’t comment directly on the data centres due to a lack of information but says she’s concerned about the state’s water issues.

“This is a state that is already facing a crisis that is so complex and doesn’t have enough water for human disposal. The priority should be water for basic means…that’s what we need to guarantee and then maybe think if there are some resources available for any other economic activity. There has been a conflict of interest on public water policy for the last two decades.”

A spokesperson for the government of the state of Querétaro defended their decision saying: “We have always said and reiterated that the water is for citizen consumption, not for the industry. The municipality has zero faculties to water allocation and even less to assign water quality. Nor the state, nor the municipality can water allocate to any industry or the primary sector, that’s a job for the National Water Commission.”

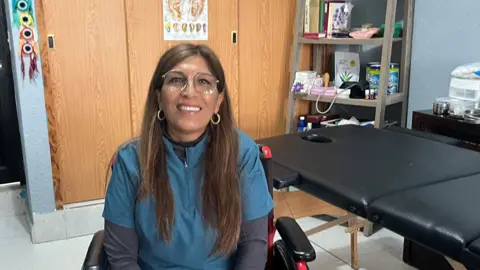

Suzanne Bearne

Suzanne BearneAnother concern for those living near data centres is air pollution.

Prof Ren says data centres typically rely on diesel backup generators that release large amounts of harmful pollutants.

“The danger of diesel pollutants from data centres has been well recognised,” he says, pointing to a health assessment of the air quality surrounding local data centres by the Department of Ecology at the state of Washington.

Mr Bravo responded to those concerns by saying: “We operate under the terms and conditions specified by authorities, which, in turn, in my perspective, are the ones taking care of the fact that those conditions are acceptable for the communities around and the health of everybody.”

As for the future, Ascenty is planning more data centres in the region.

“I do see it just kind of progressing and progressing, with a new data centre there every few years,” says Mr Bravo.

“The industry will continue to grow as AI grows. It’s a great future in terms of what is coming.”

Business

BP cautions over ‘weak’ oil trading and reveals up to £3.7bn in write-downs

BP has warned it expects to book up to five billion dollars (£3.7 billion) in write-downs across its gas and low-carbon energy division as it also said oil trading had been weak in its final quarter.

The oil giant joined FTSE 100 rival Shell, after it also last week cautioned over a weaker performance from trading, which comes amid a drop in the cost of crude.

BP said Brent crude prices averaged 63.73 dollars per barrel in the fourth quarter of last year compared with 69.13 dollars a barrel in the previous three months.

Oil prices have slumped in recent weeks, partly driven lower due to US President Donald Trump’s move to oust and detain Venezuela’s leader and lay claim to crude in the region, leading to fears of a supply glut.

In its update ahead of full-year results, BP also said it expects to book a four billion dollar (£3 billion) to five billion dollar (£3.7 billion) impairment in its so-called transition businesses, largely relating to its gas and low-carbon energy division.

But it said further progress had been made in slashing debts, with its net debt falling to between 22 billion and 23 billion dollars (£16.4 billion to £17.1 billion) at the end of 2025, down from 26.1 billion dollars (£19.4 billion) at the end of September.

It comes after the firm’s surprise move last month to appoint Woodside Energy boss Meg O’Neill as its new chief executive as Murray Auchincloss stepped down after less than two years in the role.

Ms O’Neill will start in the role on April 1, with Carol Howle, current executive vice president of supply, trading and shipping at BP, acting as chief executive on an interim basis until the new boss joins.

Ms O’Neill’s appointment has made history as she will become the first woman to run BP – and also the first to head up a top five global oil company – as well as being the first ever outsider to take on the post at BP.

Shares in BP fell 1% in morning trading on Wednesday after the latest update.

Business

Budget 2026: Kolkata realtors seek tax relief, revised affordable housing cap; eye demand revival – The Times of India

Real estate developers in Kolkata have urged the Centre to use the Union Budget to recalibrate housing policies to reflect rising land and construction costs, calling for higher tax benefits for homebuyers and a long-pending revision of the affordable housing definition to revive demand, especially in the mid-income segment, PTI reported.With the Budget set to be tabled on February 1, industry players said measures such as revisiting price caps for affordable homes, rationalising GST on under-construction properties and easing approval processes could significantly improve affordability and sales momentum.Sushil Mohta, president of CREDAI West Bengal and chairman of Merlin Group, said reforms must align with current market realities. “Revisiting the affordable housing definition, rationalising housing loan interest deductions and streamlining GST rates will significantly improve affordability and demand, especially for middle-income homebuyers,” he told PTI, adding that a policy push for rental housing and wider access to formal housing finance is crucial amid rapid urbanisation.Mahesh Agarwal, managing director of Purti Realty, said continued policy support through tax rationalisation and infrastructure spending remains critical. “A re-evaluation of affordable housing price limits in line with rising land and construction costs, along with adjustments to GST on under-construction property, will enhance affordability,” he said, stressing that simpler tax frameworks and incentives for first-time buyers would help stabilise the market and speed up project execution.Echoing similar concerns, Merlin Group MD Saket Mohta pointed to sharp increases in construction costs since the introduction of GST in 2017, underscoring the need for further rationalisation. He also called for raising the affordable housing price cap from Rs 45 lakh to around Rs 80–90 lakh and expanding unit size norms. “Mid-income housing will be the key demand driver going into 2026, and supportive tax and policy measures are essential to sustain growth,” he said.Eden Realty MD Arya Sumant said the Budget must strike a balance between fiscal discipline and growth-oriented reforms. “Higher home loan interest deductions for mid-income and first-time buyers, an updated affordable housing definition, GST rationalisation and faster approvals will improve project viability and speed-to-market,” he said, adding that sustained urban infrastructure investment would unlock demand across residential and commercial segments.Sahil Saharia, CEO of Bengal Shristi Infrastructure Development Ltd, said policy focus should shift towards large, integrated developments. “Support for mixed-use townships, rental housing and commercial hubs, along with faster clearances and digital single-window mechanisms, can help create self-sustained urban ecosystems and improve execution efficiency,” he said.Developers said clear and stable policy signals in the Budget could help restore homebuyer confidence, attract long-term capital and ensure sustainable growth for the real estate sector in eastern India.

Business

Power sector’s circular debt shoots up by Rs223 billion – SUCH TV

Circular debt in the power sector has increased in the first five months of the ongoing financial year (FY). Sources told that the debt shot up by Rs223 billion since July 2025 to reach Rs1,837 billion in November 2025 within two months of the signing of agreements to reduce the debt by Rs1225 billion.

Despite the fact that the government had signed agreements with banks in September last year to reduce the debt, it increased by Rs144 billion in October and November.

In September, the debt stood at Rs1,693 billion, while it was Rs1,614 billion in June 2025.

Sources informed that compared with November 2024, the debt in November 2025 came down by Rs544 billion.

It was Rs2,381 in November 2024, they added.

-

Politics1 week ago

Politics1 week agoUK says provided assistance in US-led tanker seizure

-

Entertainment1 week ago

Entertainment1 week agoDoes new US food pyramid put too much steak on your plate?

-

Entertainment1 week ago

Entertainment1 week agoWhy did Nick Reiner’s lawyer Alan Jackson withdraw from case?

-

Business1 week ago

Business1 week agoTrump moves to ban home purchases by institutional investors

-

Sports1 week ago

Sports1 week agoPGA of America CEO steps down after one year to take care of mother and mother-in-law

-

Sports4 days ago

Sports4 days agoClock is ticking for Frank at Spurs, with dwindling evidence he deserves extra time

-

Business1 week ago

Business1 week agoBulls dominate as KSE-100 breaks past 186,000 mark – SUCH TV

-

Sports6 days ago

Commanders go young, promote David Blough to be offensive coordinator