Business

Bank of England hold interest rates at 4% amid inflation concerns – live

Bank of England to announce interest rates decision

Just a few minutes to go and then we’ll hear the latest.

Typically, what follows is a bit more discourse on wider economic policy, questions to some of the MPC members on their voting stance and some other aspects of the announcement.

We’ll bring you the consumer-focused element of that, plus reaction from lenders, industry experts and what it all means for you going forward.

Karl Matchett18 September 2025 11:56

Interest rates: From 0 to 5.25% – and back again?

Here’s the interest rates chart over the last 3.5 years from the Bank of England. Remember a time we were at 0.1%?!

Nobody really expects that to happen again any time soon, even if inflation stabilises and rates drop to a more neutral level.

But, also, we’re down some distance from the 2023/24 highs of 5.25 per cent, which caused real shocks for mortgage repayments and loans on variable rates.

Five cuts have happened since then, three this year.

A fourth today would be an extraordinary surprise – but perhaps, we could still see one in December.

Karl Matchett18 September 2025 11:50

Will interest rates go down today?

We’re approaching time for the Bank of England’s interest rates vote announcement and reaction to that, so let’s have a quick check in on what to expect.

Here’s what’s happening and what it will mean for you:

Karl Matchett18 September 2025 11:40

LISA reform on the agenda

Continuing with the data around ISAs, today’s figures show 87,250 people used their Lifetime ISA (LISA) to buy their first home in 2024-25 – that’s up 53.7% from the previous tax year, say money managers Nutmeg.

However, the rate of penalties for early withdrawal also increased across LISAs.

Claire Exley, head of financial advice and guidance at Nutmeg, says that should open debate once more to ensure savers aren’t punished due to increased housing costs and frozen thresholds.

“The Treasury received over £100 million from early LISA withdrawal penalties for the first time, a 35% increase from the previous tax year and the second year in a row it has risen.

“Whether it is rising house prices which have put properties beyond the LISA house price cap or a change in life circumstances that means people need the money in their LISA, more savers are handing over their savings to pay the exit penalty.

“While some friction to withdrawals helps consumers remain focused on goals, there should be a mechanism which ensures the Government gets back any bonus paid to LISA savers but does not excessively harm those who can no longer use a LISA or whose life circumstances change.

“While some are debating the future of the LISA, this data shows that it remains a well-loved and powerful tool for younger savers to accumulate wealth and get on the property ladder.”

Karl Matchett18 September 2025 11:20

Cash ISAs continue to rise – expert advises investing instead

An ongoing theme this: cash ISAs are in use more than ever, but so much money is in them that people could be investing instead to generate far better returns for the long term.

Around 5m people have between £10k and £20k in their cash ISA – it’s recommended for most people that having four months’ costs in a savings account is an ideal buffer. Beyond that, consider investing to help your reach your goals.

A total of around £360bn is thought to now be in cash ISAs.

Claire Trott, head of advice at St. James’s Place, said:

“Today’s HMRC figures are the latest indication that the UK population is over-saved and under-invested. While a cash buffer is important – and no doubt brings comfort to savers, promising safe, guaranteed returns – individuals who chose a cash ISA over a stocks and shares ISA could be missing out on hundreds of thousands of pounds over the long term.

“For individuals saving for long-term goals the cash ISA approach can be risky. As shown by our analysis, inflation can quickly and substantially erode the real value of cash savings.

“Ultimately, those wanting to reap the rewards of their finances over the long term need to be invested in the market. While short term fluctuations and market volatility may deter risk averse savers, history shows that staying invested over time has consistently offered far greater potential for growth, and protected wealth against inflation.

“For those nervous about investing without guidance, speaking to a financial adviser can be a great way to get started, and can provide confidence you’re making the best decisions over the long term.”

Karl Matchett18 September 2025 11:00

Holdings interest rates means repayments, mortgage rates and other costs might not go any higher – but it also means those already struggling with cost of living expenses and rampant inflation will get no relief.

That becomes a real consumer concern as winter and Christmas come closer, says Tamsin Powell, consumer finance expert at Creditspring.

“Although markets are predicting the Bank of England will hold rates, many households will continue to feel the strain of tight budgets. With unemployment at 4.7% and living costs remaining high, day-to-day budgets are under pressure, and borrowing – whether for loans or mortgages – is still expensive.

“Winter is just around the corner, and for many, Christmas will bring additional financial strain. Rising heating bills, combined with the 2% increase in the energy price cap from the 1st of October, mean millions of households will have less money to cover essentials and unexpected costs.

“While stable rates may prevent extra repayment pressure, they don’t provide relief for those already stretched.”

Karl Matchett18 September 2025 10:45

BoE may adjust QT programme

One of the questions the BoE will answer today, aside from interest rates, is on the matter of quantitive tightening programme.

In simple terms, this is the rate at which it’s selling bonds bought during periods when the government needed additional money, such as during the Covid pandemic.

However, selling at the rate it has been has contributed to lowering bond prices, which in turn pushes up bond yields – which for the government means “borrowing costs”.

In other words, the government has to pay back more money when the Bank is selling bonds at such a rate.

Therefore we may get an update on that today.

Karl Matchett18 September 2025 10:31

How much a young person in the UK needs to save in order to retire comfortably

The analysis was conducted by investment and insurance company Shepherds Friendly, using average UK household spending rates, common debt, and a recommended six-month emergency fund.

The investigation also factored in 25 years of rising costs at 2.88 per cent annual inflation and a 5 per cent annual return on savings or investments, to reveal exactly how much would be needed today to enjoy 25 years of financial freedom in retirement.

Karl Matchett18 September 2025 10:00

FTSE 100 rises ahead of Bank of England interest rate vote

With the BoE expected to hold rates at 4% today, UK stocks have risen in early morning trading.

The FTSE 100 is up 0.23 per cent so far, though remains down for the week after a subdued couple of days.

Pest control firm RELX is the leader, up 2.75 per cent, while retailer Next is down 5.7 per cent after its profit release this morning, citing slowing or no growth to come.

Next remains up more than 19 per cent this year, however.

Karl Matchett18 September 2025 09:40

Next delivers profit boost, but cautions over ‘anaemic’ UK economic growth

Next has notched up a surge in half-year profits, but warned UK sales will be weighed on by “anaemic” economic growth and a faltering jobs market as the Government’s tax hike takes its toll.

The fashion and homewares group reported a 13.8% rise in underlying pre-tax profits to £515 million for the six months to the end of July as total full-price sales lifted 10.9%.

But it cautioned that UK sales growth will pull back sharply.

Chief executive Lord Simon Wolfson said: “The medium to long-term outlook for the UK economy does not look favourable.

“To be clear, we do not believe the UK economy is approaching a cliff edge.

“At best we expect anaemic growth.”

Karl Matchett18 September 2025 09:20

Business

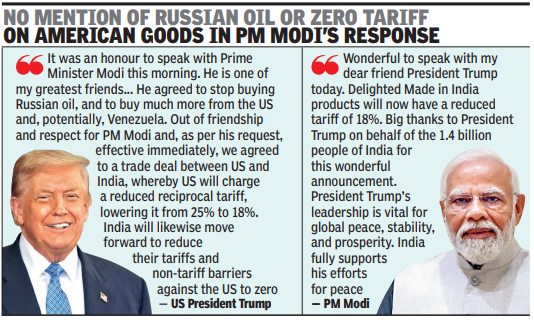

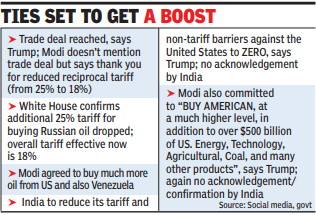

Trade deal done, says Trump; PM Modi thanks him for cutting tariff to 18% – The Times of India

NEW DELHI/ WASHINGTON: After months of bruising trade tensions, India and the US on Monday announced a bilateral trade deal that will see Washington slash additional tariffs on Indian imports to 18%, from the current 50%, making it more competitive for textiles, leather and seafood exporters.While PM Narendra Modi, in a post on X, which followed US President Donald Trump’s announcement on Truth Social, said he had a wonderful conversation with “dear friend” Trump and thanked him on behalf of 1.4 billion people for the reduced tariff of 18% on Indian goods, he did not mention the trade deal at all in his post on X that followed Trump’s “wonderful” announcement.

PM Modi and Trump

Modi also did not comment on Trump’s claim that in their conversation the PM had agreed to stop buying Russian oil and purchase much more energy from the US, and potentially Venezuela. Trump had said Modi had agreed to stop buying Russian oil and to buy much more from the US — $500 billion of energy, technology and farm products — a step that the President claimed would help end the war in Ukraine.According to the American President, Modi also agreed to bring down tariff and non-tariff barriers against the US to zero. A US embassy spokesperson confirmed that the final tariff now on India is 18%, down from the earlier 50%. This is a better deal for India than countries such Vietnam, Bangladesh, Indonesia, South Korea and China, which face higher tariffs. The Trump-Modi conversation coincided with the visit of EAM S Jaishankar to US for a critical minerals ministerial that will be chaired by Secretary of State Marco Rubio this week.The announcement came six days after India and the EU announced the completion of talks for a comprehensive trade agreement.Trump leadership vitalfor global peace: ModiThe deal had drawn sharp comments from some members of the Trump administration, including attacks on the EU.In his X post, PM said, “When two large economies and the world’s largest democracies work together, it benefits our people and unlocks immense opportunities for mutually beneficial cooperation”. He added that Trump’s leadership was vital for global peace, stability, and prosperity. India fully supports his efforts for peace. Modi said he was looking forward to working closely with Trump to take the partnership to unprecedented heights.Apart from reciprocal tariff, Trump had announced an additional 25% tariff on India for its purchase of Russian oil.Trump said the US had agreed to the trade deal with India out of friendship and respect for Modi, and at the latter’s request. “Our amazing relationship with India will be even stronger going forward. PM Modi and I are two people that GET THINGS DONE, something that cannot be said for mos,” he added.Trump in his social media post also said that it was an honour to speak with Modi whom he described as “one of my greatest friends and, a Powerful and Respected Leader of his Country”.

Ties set to get boost

While the US had acknowledged in past few months that India had cut down its Russian purchase, it had not eliminated the additional tariff.Trump also said, “We spoke about many things, including Trade, and ending the War with Russia and Ukraine. He agreed to stop buying Russian Oil, and to buy much more from the US and, potentially, Venezuela. This will help END THE WAR in Ukraine, which is taking place right now, with thousands of people dying each and every week!”Following the announcement last week of the successful conclusion of FTA negotiations with EU, India had suggested that India and US might be close to finalising the trade agreement they have been discussing since Feb last year.Trump’s disclosure of the trade deal was preceded by two India-related posts a few hours before, one of which featured him and Modi on a magazine cover with the caption “The Mover and the Shaker”. Another post featured New Delhi’s India Gate, which Trump called “India’s beautiful Triumphal Arch” and said, “Ours will be the greatest of them all!” — referring to a similar monument he wants to build in Washington DC.

Business

Union Budget 2026: Five changes in rules that could directly affect you

New Delhi: Union Finance Minister Nirmala Sitharaman delivered presented the Budget 2026 on February 1 in Parliament. At first glance, the announcements seemed limited in impact for the average citizen. Closer analysis, however, reveals several changes that could have consequences across investment, property, digital assets and overseas remittances.

The tax slabs were not changed, but multiple announcements received attention for their long-term effects. One of the changes affects Sovereign Gold Bonds. The government removed the capital gains tax exemption on bonds purchased from secondary markets. Investors will now receive tax benefits only if the bonds were bought directly from the Reserve Bank of India during the primary issuance and held until maturity. Bonds purchased on exchanges and held beyond April 1, 2026, will attract tax on gains.

Another major announcement targets derivatives trading. The government increased the Securities Transaction Tax on futures and options. Futures transactions will now attract a 0.05 percent STT instead of 0.02 percent, while options will see the rate rise to 0.15 percent from 0.10 percent. This change increases the cost of each transaction and directly impacts profits on trading.

The budget also eased property purchase procedures for non-resident Indians (NRIs). Indian buyers acquiring property from NRIs no longer need a separate Tax Deduction and Collection Account Number (TAN) for Tax Deducted at Source (TDS) payments. They can use their PAN number, similar to property purchases from domestic sellers. This simplification reduces paperwork and makes transactions smoother.

Cryptocurrency regulations were tightened. From April 1, 2026, failing to provide accurate crypto transaction information will result in a daily penalty of Rs 200. Providing incorrect data without correcting it can attract fines up to Rs 50,000. This move aims to ensure proper reporting and compliance for digital assets.

Overseas education and medical remittances received relief. The Tax Collected at Source (TCS) on funds sent under the Liberalised Remittance Scheme for education and medical needs exceeding Rs 10 lakh has been reduced from 5 percent to 2 percent. This measure lowers costs for students and patients sending funds abroad.

The TCS is collected by banks or authorised dealers when sending money abroad and is adjusted against the total tax liability during income tax filing. Excess payments are refunded. The Liberalised Remittance Scheme allows Indian residents to send up to $2.5 lakh per year for different purposes, including education, medical treatment, travel, gifts or foreign investment.

These five changes in Union Budget 2026 introduce new rules for gold bonds, derivatives, property purchases from NRIs, cryptocurrencies and foreign remittances. Each announcement has the potential to affect citizens and investors in meaningful ways, highlighting the government’s evolving focus on financial regulation, investment and cross-border transactions.

Business

New York AG issues warning around prediction markets ahead of Super Bowl

New York Attorney General Letitia James speaks to the media, after she attended a hearing and pleaded not guilty to charges that she defrauded her mortgage lender, outside the U.S. District Court for the Eastern District of Virginia, in Norfolk, Virginia, U.S., Oct. 24, 2025.

Jonathan Ernst | Reuters

Days before Super Bowl 60, New York Attorney General Letitia James has a message for consumers: Be careful about placing trades on prediction markets.

“New Yorkers need to know the significant risks with unregulated prediction markets,” James said in a statement Monday. “It’s crystal clear: so-called prediction markets do not have the same consumer protections as regulated platforms. I urge all New Yorkers to be cautious of these platforms to protect their money.”

Prediction platforms like Kalshi and Polymarket are expected to generate billions of dollars in trading volume around the Super Bowl.

Consumers can make trades on game events — similar to online sportsbooks like DraftKings or FanDuel — as well as on predetermined outcomes, such as which companies will advertise during the Super Bowl, an issue CNBC Sport reported on last week.

James said the platforms’ products are bets “masquerading” as event contracts.

She warned there are concerns about the nascent prediction market industry, including “upholding prohibitions against insider betting and requiring regulatory review to ensure the financial stability and integrity of gambling operators.”

“Prediction markets may appear as modern, high-tech platforms for speculation or ‘forecasting,’ but in practice, many operate as unregulated gambling without the basic protections New York consumers both deserve and expect from properly licensed operators,” James said in the statement.

Prediction market contracts trade somewhat similarly to all-or-nothing options, with contracts priced between $0 and $1. The contracts trade up or down depending on the action.

In addition to contracts on Super Bowl commercials, both Polymarket and Kalshi are offering other trades related to the game, including on matters like “What songs will be played at the halftime show?,” “Who will attend the big game?,” and more traditional sportsbook “bets” such as “Seattle vs. New England: Most Rushing Yards,” as CNBC reported last week.

There are laws that prohibit insider trading on prediction markets, just as on traditional financial markets. But industry experts say they’re skeptical that the Commodity Futures Trading Commission, recently gutted as part of widespread government cuts, has the will or the means to police those problems.

Last week, CFTC Chairman Michael Selig said he had directed agency staff to withdraw a proposed rule that would have banned prediction trades on sports and politics. He said new rules would be coming.

Disclosure: CNBC has a commercial relationship with Kalshi.

-

Sports6 days ago

Sports6 days agoPSL 11: Local players’ category renewals unveiled ahead of auction

-

Entertainment6 days ago

Entertainment6 days agoClaire Danes reveals how she reacted to pregnancy at 44

-

Sports6 days ago

Sports6 days agoCollege football’s top 100 games of the 2025 season

-

Business7 days ago

Business7 days agoBanking services disrupted as bank employees go on nationwide strike demanding five-day work week

-

Fashion1 week ago

Fashion1 week agoSpain’s apparel imports up 7.10% in Jan-Oct as sourcing realigns

-

Politics6 days ago

Politics6 days agoTrump vows to ‘de-escalate’ after Minneapolis shootings

-

Sports6 days ago

Sports6 days agoTammy Abraham joins Aston Villa 1 day after Besiktas transfer

-

Entertainment6 days ago

Entertainment6 days agoK-Pop star Rosé to appear in special podcast before Grammy’s