Business

Banking services disrupted as bank employees go on nationwide strike demanding five-day work week

New Delhi: Bank employees across the country went on strike on Tuesday to protest for their demands, including the immediate implementation of a five-day work week in the sector, leading to widespread disruption of banking services, including cash deposits, withdrawals, cheque clearances and other routine transactions.

The nationwide strike was called by the United Forum of Bank Unions (UFBU).

In Gujarat’s Vadodara, employees of nationalised banks joined the strike in large numbers. Protesters said that memoranda regarding the demand for a five-day work week had been submitted to the government on multiple occasions, but no concrete steps had been taken so far, forcing employees to resort to a strike. Due to the agitation, customers faced inconvenience as several bank branches remained closed or operated with minimal staff.

A protesting employee said: “More than eight lakh bank employees across India are participating in today’s strike. Our demand for a five-day banking week has been pending since 2015. Institutions such as the LIC, state governments and the Central government already follow a five-day work week. We were assured that banks would also shift to this system, but nothing has been implemented yet.”

In West Bengal’s Cooch Behar, bank employees’ unions held protests in front of the State Bank of India and other banks, reiterating their demand for a five-day work week.

A protester said: “Banks across the world and most offices in India, whether under the Central or state governments, function for five days a week. From the Reserve Bank of India to NABARD and LIC, all follow a five-day schedule, but nationalised and private banks have been left out. We had an agreement with the Indian Banks’ Association (IBA) on this issue.”

Similar scenes were witnessed in Murshidabad district, where banks and ATM branches in Berhampore and other areas remained closed. Posters highlighting the demands of the bank unions were displayed outside bank premises.

A protester said the demand for five-day banking had been pending for nearly three years and was repeatedly postponed by the government.

“The government keeps saying it will be implemented soon, but nothing has happened so far. That is why we are protesting today,” he said.

In Uttar Pradesh’s Ghazipur district, over 10,000 bank employees from nearly 250 banks joined the nationwide strike, disrupting transactions worth over Rs 150 crore. Banking activities across the district came to a standstill, causing inconvenience to customers and businesses alike.

In Lucknow, All India Bank Officers’ Confederation (AIBOC) Senior Vice-President Ramnath Shukla said: “There is only one demand, and that is five-day banking. This demand has been ongoing for the past ten years. When the second and fourth Saturdays were declared holidays, it was promised that the remaining Saturdays would also be closed in the next settlement. Other departments were given five-day working without even demanding it.”

Indian Bank employee Anshika Singh Visen said: “In the last bipartite settlement, it was decided that bankers would be given five-day banking, with work from Monday to Friday and weekends off. However, while other proposals were accepted, the five-day banking proposal was not implemented.”

In Chandigarh, the one-day strike also affected normal banking operations. Bank employees staged protests outside bank branches, raising slogans in support of their demand for a five-day work week.

In Chhattisgarh’s Raipur, around 25,000 bank employees from nearly 2,500 banks participated in the strike. Banking services across the state were severely affected as employees gathered in large numbers to protest and press for their long-pending demand.

In Patna, Punjab National Bank employee Dimple said the strike was not an “out-of-work” protest.

“The government had agreed under the bipartite settlement that five-day banking would be implemented within six months. However, even after two years, the demand has not been fulfilled. The RBI, the SIDBI, the SEBI, and the NABARD all function for five days. We want the same to be implemented in banks immediately,” she said.

Another PNB employee, Ritika, said: “The 12th Bipartite Settlement clearly stated that five-day banking would be implemented within six months. It has been two years since the agreement, but nothing has been done. That is why we are on strike today.”

In Rajasthan’s Dholpur, banks across the district remained completely closed, severely affecting essential services such as cash transactions, deposits, withdrawals and cheque clearances, causing significant inconvenience to the public.

Business

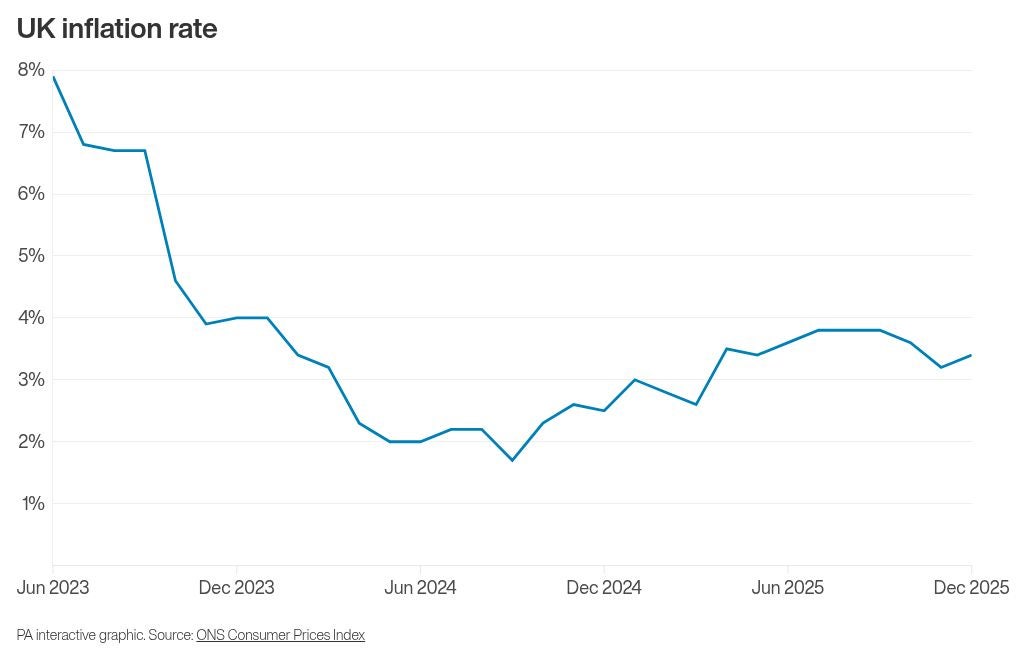

How inflation rebound is set to affect UK interest rates

Interest rates are widely expected to remain at 3.75% as Bank of England policymakers prioritise curbing above-target inflation while also monitoring economic growth, according to expert analysis.

The Bank’s Monetary Policy Committee (MPC) is anticipated to leave borrowing costs unchanged when it announces its latest decision on Thursday, marking its first interest rate setting meeting of the year.

This follows a rate cut delivered before Christmas, which was the fourth such reduction.

At the time, Governor Andrew Bailey noted that the UK had “passed the recent peak in inflation and it has continued to fall”, enabling the MPC to ease borrowing costs. However, he cautioned that any further cuts would be a “closer call”.

Since that decision, official data has revealed that inflation unexpectedly rebounded in December, rising for the first time in five months.

The Consumer Prices Index (CPI) inflation rate reached 3.4% for the month, an increase from 3.2% in November, with factors such as tobacco duties and airfares contributing to the upward pressure on prices.

Economists suggest this inflation uptick is likely to reinforce the MPC’s inclination to keep rates steady this month.

Philip Shaw, an analyst for Investec, stated: “The principal reason to hold off from easing again is that at 3.4% in December, inflation remains well above the 2% target.”

He added: “But with the stance of policy less restrictive than previously, there are greater risks that further easing is unwarranted.”

Shaw also highlighted other data points the MPC would consider, including gross domestic product (GDP), which saw a return to growth of 0.3% in November – a potentially encouraging sign for policymakers.

Matt Swannell, chief economic advisor to the EY ITEM Club, affirmed: “Keeping bank rate unchanged at 3.75% at next week’s meeting looks a near-certainty.”

He noted that while some MPC members who favoured a cut in December still have concerns about persistent wage growth and inflation, recent data has not been compelling enough to prompt back-to-back reductions.

Edward Allenby, senior economic advisor at Oxford Economics, forecasts the next rate cut to occur in April.

He explained: “The MPC will continue to face a delicate balancing act between supporting growth and preventing inflation from becoming entrenched, with forthcoming data on pay settlements likely to play a decisive role in shaping the next policy move.”

The Bank’s policymakers have consistently voiced concerns regarding the pace of wage increases in the UK, which can fuel overall inflation.

Business

Budget 2026: India pushes local industry as global tensions rise

India’s budget focuses on infrastructure and defence spending and tax breaks for data-centre investments.

Source link

Business

New Income Tax Act 2025 to come into effect from April 1, key reliefs announced in Budget 2026

New Delhi: Finance Minister Nirmala Sitharaman on Sunday said that the Income Tax Act 2025 will come into effect from April 1, 2026, and the I-T forms have been redesigned such that ordinary citizens can comply without difficulty for ease of living.

The new measures include exemption on insurance interest awards, nil deduction certificates for small taxpayers, and extension of the ITR filing deadline for non-audit cases to August 31.

Individuals with ITR 1 and ITR 2 will continue to file I-T returns till July 31.

“In July 2024, I announced a comprehensive review of the Income Tax Act 1961. This was completed in record time, and the Income Tax Act 2025 will come into effect from April 1, 2026. The forms have been redesigned such that ordinary citizens can comply without difficulty, for) ease of living,” she said while presenting the Budget 2026-27

In a move that directly eases cash-flow pressure on individuals making overseas payments, the Union Budget announced lower tax collection at source across key categories.

“I propose to reduce the TCS rate on the sale of overseas tour programme packages from the current 5 per cent and 20 per cent to 2 per cent without any stipulation of amount. I propose to reduce the TCS rate for pursuing education and for medical purposes from 5 per cent to 2 per cent,” said Sitharaman.

She clarified withholding on services, adding that “supply of manpower services is proposed to be specifically brought within the ambit of payment contractors for the purpose of TDS to avoid ambiguity”.

“Thus, TDS on these services will be at the rate of either 1 per cent or 2 per cent only,” she mentioned during her Budget speech.

The Budget also proposes a tax holiday for foreign cloud companies using data centres in India till 2047.

-

Sports5 days ago

Sports5 days agoPSL 11: Local players’ category renewals unveiled ahead of auction

-

Tech1 week ago

Tech1 week agoStrap One of Our Favorite Action Cameras to Your Helmet or a Floaty

-

Sports1 week ago

Sports1 week agoWanted Olympian-turned-fugitive Ryan Wedding in custody, sources say

-

Entertainment1 week ago

Entertainment1 week agoThree dead after suicide blast targets peace committee leader’s home in DI Khan

-

Tech1 week ago

Tech1 week agoThis Mega Snowstorm Will Be a Test for the US Supply Chain

-

Sports1 week ago

Sports1 week agoStorylines shaping the 2025-26 men’s college basketball season

-

Entertainment5 days ago

Entertainment5 days agoClaire Danes reveals how she reacted to pregnancy at 44

-

Entertainment1 week ago

Entertainment1 week agoUFC Head Dana White credits Trump for putting UFC ‘on the map’