Business

Blame game over Air India crash goes on

Theo LeggettInternational Business Correspondent

Getty Images

Getty ImagesNearly five months after a plane crash in India which killed 260 people, the investigation has become mired in controversy – with the country’s Supreme Court the latest to weigh in.

Flight 171 was en route to London from Ahmedabad in western India on 12 June. It crashed into a building just 32 seconds after taking off.

An interim report was released in July, but critics argue it unfairly focused on the actions of the pilots, diverting attention away from a possible fault with the aircraft.

On Friday, a judge in India’s Supreme Court insisted that nobody could blame the aircraft’s captain.

His comments came a week after the airline’s boss insisted there was no problem with the aircraft.

During a panel discussion at the Aviation India 2025 summit in New Delhi in late October, Air India’s chief executive Cambell Wilson admitted that the accident had been “absolutely devastating for the people involved, for the families of those involved, and the staff”.

But he stressed that initial investigations by Indian officials, summed up in a preliminary report, had “indicated that there was nothing wrong with the aircraft, the engines or the operation of the airline”.

He added although Air India was working with investigators it was not involved directly.

Because the accident happened in India, the investigation is being led by the country’s Air Accident investigation Bureau (AAIB). However, because the aircraft and its engines were designed and built in America, US officials are also taking part.

A month after the accident, the AAIB published a preliminary report. This is standard procedure in major accident investigations and is meant to provide a summary of the known facts at the time of publication.

The report will typically draw on information gleaned from examination of the crash site, for example, as well as basic material downloaded from the flight data recorder. It will not normally make firm conclusions about the cause of the accident.

However, the 15-page report into Air India 171 has proved controversial. This is largely due to the contents of two short paragraphs.

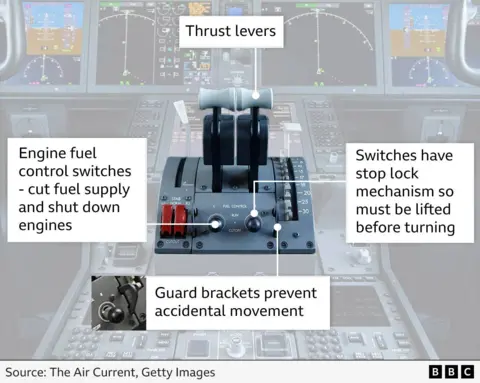

First, it notes that seconds after takeoff, the fuel cutoff switches – normally used when starting the engines before a flight and shutting them down afterwards – had been moved from the “run” to the cutoff position.

This would have deprived the engines of fuel, causing them to lose thrust rapidly. The switches were moved back to restart the engines, but too late to prevent the disaster.

It then says: “In the cockpit voice recording, one of the pilots is heard asking the other why did he cutoff. The other pilot responded that he did not do so.”

That indirectly-reported exchange sparked intense speculation about the role of the two pilots, Captain Sumeet Sabharwal and his first officer Clive Kunder, who was flying the plane at the time.

A former chair of the National Transportation Safety Board, Robert Sumwalt, claimed the report showed “this was not a problem with the airplane or the engines”.

“Did somebody deliberately shut down the fuel, or was it somehow or another a slip that they inadvertently shut off the fuel?” he said during an interview with the US network CBS.

Indian aviation safety consultant Capt. Mohan Ranganathan strongly implied that pilot suicide could have caused the accident, in an interview with the country’s NDTV channel.

“I don’t want to use the word. I’ve heard the pilot had some medical history and… it can happen,” he said.

Mike Andrews, a lawyer acting on behalf of victims’ families, thinks the way in which information has been released has “led people unfairly and inappropriately to blame those pilots without all the information”.

“An aircraft like this – that is so complex – has so many things that could go wrong,” he explains.

“To seize upon those two very small, decontextualised pieces of information, and automatically blame pilots for suicide and mass murder… is unfair and wrong.”

That view is echoed by Capt. Amit Singh, founder of the Safety Matters Foundation, an organisation based in India that works to promote a safety culture in aviation.

He has produced a report which claims the available evidence “strongly supports the theory of an electrical disturbance as the primary cause of the engine shutdown” that led to the disaster.

He believes an electrical fault may have caused the Full Authority Digital Engine Control (FADEC), a computerised system which manages the engines, to trigger a shutdown by cutting off the fuel supply.

Meanwhile the flight data recorder, he suggests, may have registered the command to shut off the fuel supply, rather than any physical movement of the cutoff switches in the cockpit.

In other words, the switches themselves may not have been touched at all, until the pilots tried to restart the engines.

Capt. Singh has also challenged the way in which the investigation has been carried out in India’s Supreme Court.

He told the BBC the way in which the preliminary report was framed was biased because it “appears to suggest pilot error, without disclosing all the technical anomalies that occurred during the flight”.

Meanwhile the Supreme Court itself has already commented on the issue.

It has been considering a petition filed by Pushkarraj Sabharwal, the father of Capt. Sumeet Sabharwal. The 91-year-old has been seeking an independent judicial inquiry into the tragedy.

“It’s extremely unfortunate, this crash, but you should not carry this burden that your son is being blamed. Nobody can blame him for anything,” Justice Surya Kant told him.

A further hearing is expected on 10 November.

‘Flat out wrong’

The theory that an electrical fault could have caused the accident is supported by the US-based Foundation for Aviation Safety (FAS).

Its founder is Ed Pierson, a former senior manager at Boeing, who has previously been highly critical of safety standards at the US aerospace giant.

He believes the preliminary report was “woefully inadequate… embarrassingly inadequate”.

His organisation has spent time examining reports of electrical issues on board 787s. They include water leaks into wiring bays, which have previously been noted by the US regulator, the Federal Aviation Authority. Concerns have also been voiced in some other quarters.

“There were so many of what we consider electrical oddities on that plane, that for them to come out and to all intents and purposes direct the blame to the pilots without exhaustively going through and examining potential system failures, we just thought was flat out wrong,” he says.

He believes there was a deliberate attempt to divert attention away from the plane and on to the pilots.

The FAS has called for wholesale reform of current international air accident investigation procedures, citing “outdated protocols, conflicts of interest and systemic failures that endanger public trust and delay life-saving safety improvements”.

‘Keeping an open mind’

Mary Schiavo, an attorney and former inspector general at the US Department of Transportation, disagrees that the pilots have been deliberately put under the spotlight.

She thinks the preliminary report was flawed, but only because investigators were under intense pressure to provide information, with worldwide attention focused on them.

“I think they were just in a hurry, because this was a horrific accident and the whole world was watching. They were just in a hurry to push something out,” she says.

“Then, in my opinion, the whole world jumped to conclusions and right away was saying, ‘this is pilot suicide, this was intentional’.

“If they had to do it over again, I don’t think they would have put those little snippets from the cockpit voice recording in,” she says.

Her own view is that “a computer or mechanical failure… is the most likely scenario”.

International rules for air accident investigations stipulate that a final report should appear within 12 months of the event, but this is not always adhered to. However, until it is published, the true causes of the accident will remain unknown.

A former air accident investigator who spoke to the BBC emphasised the importance of “keeping an open mind”, until the process has been completed.

Boeing has always maintained that the 787 is a safe aircraft – and it does have a strong record.

The company told the BBC it would defer to India’s AAIB to provide information about the investigation.

Business

SEBI Proposes Overhaul Of Gold And Silver ETF Price Bands After Sharp Swings

Last Updated:

SEBI proposes stricter base price and band rules for gold, silver ETFs, including cooling-off periods after sharp global price swings to curb volatility.

Amid Global Commodity Volatility, SEBI Plans New Price Band Rules for Gold, Silver ETFs

The market regulator has sought to curb extreme volatility in gold and silver Exchange Traded Funds (ETFs) by proposing changes to the base price and price band framework. Currently, there are no separate price bands for ETFs aligned with their underlying assets, making them vulnerable to sharp price movements.

The proposal comes after sharp volatility in gold and silver ETFs triggered by fluctuations in global commodity prices. On some days, these ETFs fell by over 15%, while on others, they recorded sharp gains.

Stock exchanges currently apply a fixed price band of plus or minus 20% on the base price of ETFs, except for Overnight ETFs investing only in TREPs, which have a price band of plus or minus 5%.

Moreover, the base price for applying price bands to ETFs is taken as the T-2 day closing Net Asset Value (NAV) by exchanges, instead of the T-1 day closing NAV or price, as is the case with indices and individual stocks. This creates a challenge, as the closing NAV of ETFs typically differs between T-1 and T-2 days. Corporate actions such as bonuses and dividends are adjusted manually, increasing the risk of errors.

What Are the Key Proposals?

SEBI has proposed that the base price be determined using either the closing price of the ETF on T-1 day (weighted average price of the last 30 minutes), the closing NAV of T-1 day, or the average indicative NAV (iNAV) of the last 30 minutes of T-1 day.

Further, the regulator has proposed an initial price band of plus or minus 10% for equity and debt ETFs, which can be flexed up to plus or minus 20%. A cooling-off period of 15 minutes will apply, and up to two flexes will be allowed in a day.

For gold and silver ETFs, the regulator has proposed an initial price band of plus or minus 6%, which can be flexed up to plus or minus 20%. This will also include a 15-minute cooling-off period.

February 14, 2026, 16:08 IST

Read More

Business

Petrol and diesel prices likely to rise – SUCH TV

Oil and Gas Regulatory Authority (OGRA) forwarded a summary to the federal government suggesting an increase of Rs4.39 per liter in petrol price for the next fortnight.

After approval from the federal government, one liter of petrol will be sold at Rs257.56 instead of Rs253.17 per liter.

The price of high-speed diesel (HSD) will be increased by Rs5.40 per liter.

After approval, the price of one liter of high-speed diesel will increase by Rs268.38 to Rs273.78.

The proposal to increase the price of kerosene by Rs4 per liter is also on the cards.

The OGRA also recommended increasing the price of one liter of light diesel by Rs6.55.

The new prices of petroleum products will be effective from February 16, 2026.

Due to tension between the USA and Iran, petroleum prices are likely to increase further.

Business

Rising vet costs leave Birmingham charity with £400k bill

The group, based in Solihull and Wolverhampton, says its vet bills are costing them more.

Source link

-

Entertainment1 week ago

Entertainment1 week agoHow a factory error in China created a viral “crying horse” Lunar New Year trend

-

Tech1 week ago

Tech1 week agoNew York Is the Latest State to Consider a Data Center Pause

-

Business4 days ago

Business4 days agoAye Finance IPO Day 2: GMP Remains Zero; Apply Or Not? Check Price, GMP, Financials, Recommendations

-

Tech1 week ago

Tech1 week agoNordProtect Makes ID Theft Protection a Little Easier—if You Trust That It Works

-

Tech1 week ago

Tech1 week agoPrivate LTE/5G networks reached 6,500 deployments in 2025 | Computer Weekly

-

Fashion4 days ago

Fashion4 days agoComment: Tariffs, capacity and timing reshape sourcing decisions

-

Business1 week ago

Business1 week agoStock market today: Here are the top gainers and losers on NSE, BSE on February 6 – check list – The Times of India

-

Business1 week ago

Business1 week agoMandelson’s lobbying firm cuts all ties with disgraced peer amid Epstein fallout