Business

Brands make ‘swadeshi’ pitch, pick at US tariffs – The Times of India

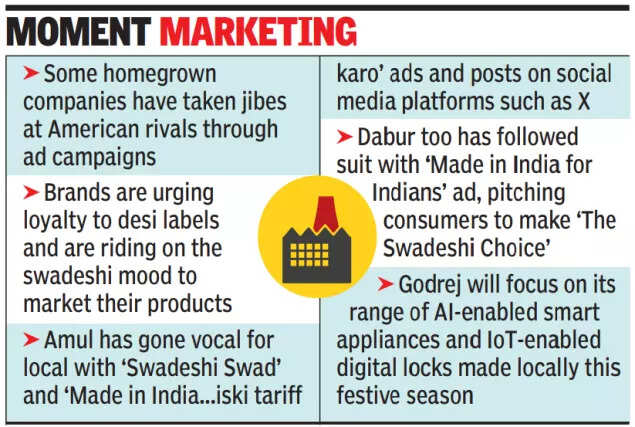

MUMBAI/NEW DELHI: You have read about it in history books and several decades later, you are seeing it play out in the form of hashtags on social media and witty brand campaigns-call for swadeshi is back, thanks to Trump tariffs. Only this time, brands are leading the charge. From homegrown companies taking jibes at American rivals through ad campaigns to brands urging loyalty to desi labels, firms are riding on the swadeshi mood to market their products. Such strategies do not always translate into sales because when Indians shop, they look for value, not typically the brand tag. But some amount of moment marketing doesn’t harm, especially ahead of the festive season.

“Such marketing moves by brands are more of an opportunism but Indians are very arm-chair patriotic. If by buying a local product, they think they are being patriotic, they will do it. Such campaigns tend to work in small towns, they rally behind such products,” said Abhijat Bharadwaj, chief creative officer at Dentsu Creative Isobar.Whether it is, Amul’s ‘Swadeshi Swad’ and ‘Made in India…iski tariff karo’ ads and posts on social media platforms such as X or Dabur’s ‘Made in India for Indians’ ad, pitching consumers to make ‘The Swadeshi Choice’, vocal for local is the brand flavour of the season. “Amidst tariff imposition by the USA, India stands strong,” said Amul in a recent post on X. Some corporate chiefs have also backed the call for swadeshi. “Be vocal for local, Buy Swadeshi, Build India,” Gautam Singhania, chairman and managing director at Raymond, which will celebrate its centenary this month posted recently. Several Indian brands today are not only making in India but also taking local products global. In fact, many global brands are expanding their India sourcing capabilities and setting up shops here. Call it an irony but India is now America’s biggest smartphone source, having shipped more smartphones to the US than any other country in Q2 2025, data from Canalys showed.Brands are tapping into the sentiment to strategise. Godrej Enterprises Group (GEG) will focus on its range of AI-enabled smart appliances and IoT-enabled digital locks made locally this festive season. The vocal for local sentiment reflects a powerful shift in India’s consumer mindset, one that celebrates homegrown innovation and self-reliance, said Sumeet Bhojani, head of brand & strategic insights at GEG. “If the stiff tariff issue settles down or the 50% tariff is brought to a much more reasonable number, even this moment shall pass. If not, expect a fair number of Indian brands coming to the fore either overtly, covertly or subliminally and each one wanting to establish their identity,” said business and brand strategy specialist Harish Bijoor, adding that consumers may or may not embrace the moment. Be Indian, buy Indian has been tried many times in India but consumers will not get easily swayed to buy a brand just because of its Indian roots. “They will buy for value. Patanjali had tried the local vs MNC pitch but it didn’t work,” said branding and advertising coach Ambi Parameswaran. Unless there is a crusade to join, nationalism in personal consumption is not an active driver for consumers, added Sandeep Goyal, chairman at Rediffusion.

Business

Amazon To Invest $35 Billion In India By 2030 With Focus On AI-Driven Digitalisation

Last Updated:

“Amazon to date has invested USD 40 billion in India since 2010. Now we will invest another USD 35 billion by 2030 across all our businesses in India,” Agarwal said.

Amazon To Invest USD 35 Bn In India By 2030 With Focus On AI-Driven Digitalisation

E-commerce giant Amazon is set to invest a mega-investment of USD 35 billion, over Rs 3.14 lakh crore, in India by 2030 across its businesses with a focus on AI-driven digitisation, export growth and job creation, a senior company official said on Wednesday.

Senior VP Emerging Markets, Amit Agarwal, made the announcement during the Amazon Smbhav Summit, saying the company has set a target to quadruple exports from India to USD 80 billion from about USD 20 billion.

“Amazon to date has invested USD 40 billion in India since 2010. Now we will invest another USD 35 billion by 2030 across all our businesses in India,” Agarwal said.

Amazon’s investment plan is two times of Microsoft’s investment plan of USD 17.5 billion and close to 2.3 times that of Google’s USD 15 billion investment plan by 2030.

With this investment, Amazon will become the largest foreign investor in India, according to a Keystone report compiled from publicly available data.

In May 2023, Amazon announced plans to invest USD 12.7 billion in India by 2030 into its local cloud and AI infrastructure across Telangana and Maharashtra. The company has already invested USD 3.7 billion in India between 2016 and 2022.

The company has invested at scale towards building physical and digital infrastructure, including fulfilment centres, transportation networks, data centres, digital payments infrastructure and technology development.

According to the Keystone report, Amazon has digitized over 12 million small businesses and enabled USD 20 billion in cumulative ecommerce exports, while supporting approximately 2.8 million direct, indirect, induced and seasonal jobs across industries in India in 2024.

(With inputs from agencies)

December 10, 2025, 10:58 IST

Read More

Business

Stock market today: Nifty50 opens above 25,850; BSE Sensex up over 100 points – The Times of India

Stock market today: Nifty50 and BSE Sensex, the Indian equity benchmark indices, opened in green on Wednesday. While Nifty50 was above 25,850, BSE Sensex was up over 100 points. At 9:17 AM, Nifty50 was trading at 25,865.25, up 26 points or 0.099%. BSE Sensex was at 84,804.28, up 138 points.Dr. VK Vijayakumar, Chief Investment Strategist, Geojit Investments Limited says, “As the year slowly draws to a close the market structure is becoming challenging. Heavy selling in the broader market is justified since valuations have been elevated and kept high only on the strength of liquidity. This is unsustainable. But the weakness in the overall market and sustained selling by FIIs are a bit disappointing. A major concern is the excessive delay in the finalisation of the US-India trade deal. A remark by President Trump yesterday that action should be taken on India for dumping rice in the US hurt sentiments further.”“Fundamentals are turning in favour of India. Higher growth and corporate earnings are achievable in the quarters ahead. The fiscal and monetary stimulus provided this year have started producing results. The excessively low inflation rate, which impacted nominal GDP growth, also will start rising in the coming quarters. This is significant since corporate earnings growth will be influenced more by nominal GDP growth rather than by real GDP growth. The fact that valuations in the large cap segment have become fair is another positive. These positive factors will start weighing on the market soon. Investors have to keep faith and wait patiently for the fundamentals to play out.”The S&P 500 declined on Tuesday as investors anticipated hawkish Federal Reserve messaging despite potential rate cuts. JPMorgan contributed significantly to the benchmark index’s decline following the bank’s announcement of substantial 2026 expenses.Asian markets showed modest gains following Wall Street’s subdued session, with investors awaiting the Federal Reserve’s final interest rate decision of the year.Foreign portfolio investors recorded net sales of Rs 3,760 crore on Tuesday, whilst domestic institutional investors showed net purchases of Rs 6,225 crore.(Disclaimer: Recommendations and views on the stock market, other asset classes or personal finance management tips given by experts are their own. These opinions do not represent the views of The Times of India)

Business

Video: The Battle for Warner Bros. Discovery

new video loaded: The Battle for Warner Bros. Discovery

By Nicole Sperling, Edward Vega, Laura Salaberry, Jon Hazell and Chris Orr

December 9, 2025

-

Business1 week ago

Business1 week agoCredit Card Spends Ease In October As Point‑Of‑Sale Transactions Grow 22%

-

Fashion1 week ago

Fashion1 week agoModella eyeing another acquisition, this time it’s the Wynsors footwear chain

-

Tech1 week ago

Tech1 week agoHow to build a data dream team | Computer Weekly

-

Tech1 week ago

Tech1 week agoI Test Amazon Devices for a Living. Here’s What to Buy This Cyber Monday Weekend

-

Business1 week ago

Business1 week agoIndiGo Receives Rs 117.52 Crore Penalty Over Input Tax Credit Denial

-

Tech1 week ago

Tech1 week agoThe 171 Very Best Cyber Monday Deals on Gear We Loved Testing

-

Fashion1 week ago

Fashion1 week agoEastpak appoints Marie Gras as vice president, global brand

-

Business1 week ago

Business1 week agoGold And Silver Prices Today, December 2: Check 24 & 22 Carat Rates In Delhi, Mumbai And Other Cities