Business

Brexit has made UK economy and productivity ‘weaker’ than thought, says Reeves

Rachel Reeves has said Brexit made the UK’s economy and productivity “weaker” than initially forecast when the UK voted to leave the European Union.

But the Chancellor expressed determination that “the past doesn’t define our future” as she set out plans to scrap paperwork and red tape for thousands of UK businesses in a bid to boost lacklustre economic growth at the Regional Investment Summit in Birmingham on Tuesday.

The gathering of business leaders and investors came after more gloomy news for the Chancellor as Government borrowing in September hit the highest level for the month in five years.

The data from the Office for National Statistics piles more pressure on Ms Reeves ahead of the November 26 Budget, in which she will have to fill a black hole estimated at around £50 billion by some economists.

Ms Reeves said the autumn statement will detail her “plans based on the world as it is, not necessarily the world as I might like it to be” as global volatility and a hike in defence spending “puts pressure on our economy”.

She said exiting the EU had caused more damage than forecasters had expected at the time, with the expected downgrade of the budget watchdog’s previous assumptions likely to make her task of balancing the books even harder.

The Chancellor told reporters: “The Office for Budget Responsibility do the forecasts for the economy. When we left the European Union, or when we voted to leave, they made an estimate about the impact that would have.

“What they’ve done this summer is go back to all of their forecasts and look at what actually happened compared to what they forecast.

“What that shows – and what they will set out – is that the economy has been weaker and productivity has been weaker than they forecast, despite the fact that they forecast that the economy would be weaker because of leaving the EU…

“I am determined that the past doesn’t define our future and that we do achieve that economic growth and productivity with good jobs in all parts of the country.”

Ms Reeves highlighted more than £10 billion in investment commitments secured at the summit, as well as deregulation and reform to planning and capital markets.

The OBR’s assessment will be published in detail alongside the Budget, in which the Chancellor has already acknowledged she is looking at potential tax rises and spending cuts.

The National Institute of Economic and Social Research has suggested Ms Reeves will need to find around £50 billion a year by 2029-39 to meet her goal of balancing day-to-day spending with tax revenues while maintaining “headroom” of around £10 billion against that target.

Asked about her promise not to deliver another tax-raising statement, Ms Reeves said: “This year has been particularly volatile in terms of world events, from Ukraine to the Middle East, to the higher trade tariffs that countries around the world including the UK face. We’re not immune to that, despite the fact that we’re doing trade deals with the EU, India and with the US.

“Of course, that puts pressure on our economy, as does the increased defence spending to keep us safe in an uncertain world.

“I’ll set out all my plans based on the world as it is, not necessarily the world as I might like it to be, in the Budget on November 26.”

Addressing business leaders at Edgbaston Stadium earlier, the Chancellor detailed measures to reform the company merger process, regulations for drones and reforms for artificial intelligence (AI).

She said a cross-economy AI “sandbox” would allow firms to develop new products “under supervision by regulators”.

This would speed up the approval of AI for use in areas including “legal services, planning assessments and advanced manufacturing”.

The Civil Aviation Authority will set out steps towards launching commercial drone operations which could allow unmanned aerial vehicles to be widely used for tasks from “surveying sites for development to delivering blood supplies for the NHS”.

Panels reviewing company mergers will be reformed to “provide greater certainty on whether transactions will be subject to merger control”.

She also confirmed plans to create simpler corporate reporting rules for more than 100,000 businesses, including removing the need for small business owners to submit lengthy director reports to Companies House.

Tory shadow business secretary Andrew Griffith said it was “laughable to hear Labour talk about scrapping red tape when they have created countless new quangos” and piled “burdens and costs on employers’ shoulders” through business tax hikes.

Business

How inflation rebound is set to affect UK interest rates

Interest rates are widely expected to remain at 3.75% as Bank of England policymakers prioritise curbing above-target inflation while also monitoring economic growth, according to expert analysis.

The Bank’s Monetary Policy Committee (MPC) is anticipated to leave borrowing costs unchanged when it announces its latest decision on Thursday, marking its first interest rate setting meeting of the year.

This follows a rate cut delivered before Christmas, which was the fourth such reduction.

At the time, Governor Andrew Bailey noted that the UK had “passed the recent peak in inflation and it has continued to fall”, enabling the MPC to ease borrowing costs. However, he cautioned that any further cuts would be a “closer call”.

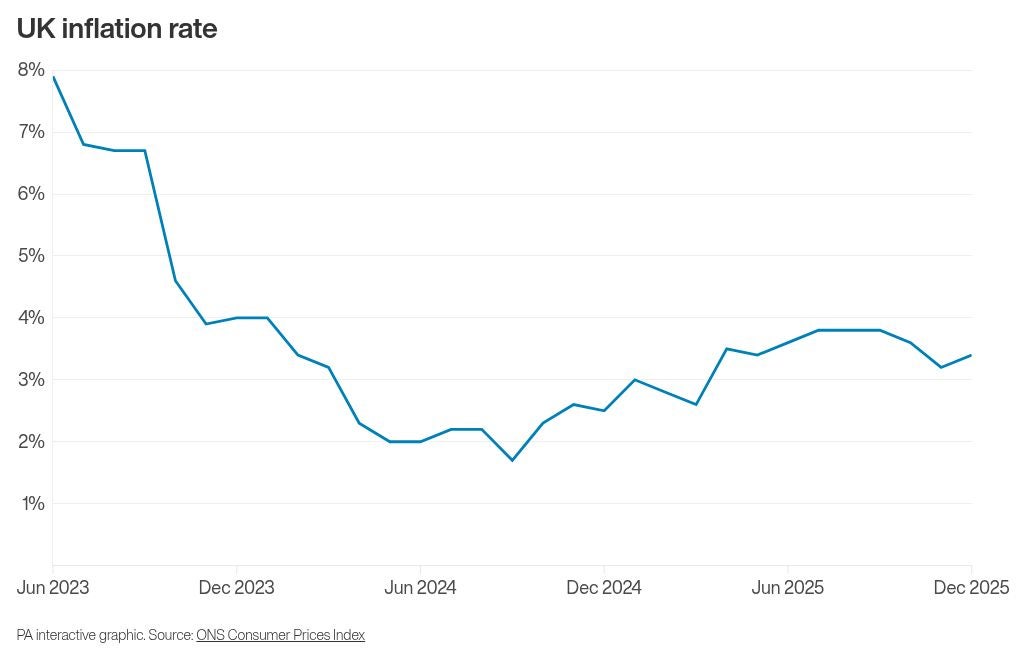

Since that decision, official data has revealed that inflation unexpectedly rebounded in December, rising for the first time in five months.

The Consumer Prices Index (CPI) inflation rate reached 3.4% for the month, an increase from 3.2% in November, with factors such as tobacco duties and airfares contributing to the upward pressure on prices.

Economists suggest this inflation uptick is likely to reinforce the MPC’s inclination to keep rates steady this month.

Philip Shaw, an analyst for Investec, stated: “The principal reason to hold off from easing again is that at 3.4% in December, inflation remains well above the 2% target.”

He added: “But with the stance of policy less restrictive than previously, there are greater risks that further easing is unwarranted.”

Shaw also highlighted other data points the MPC would consider, including gross domestic product (GDP), which saw a return to growth of 0.3% in November – a potentially encouraging sign for policymakers.

Matt Swannell, chief economic advisor to the EY ITEM Club, affirmed: “Keeping bank rate unchanged at 3.75% at next week’s meeting looks a near-certainty.”

He noted that while some MPC members who favoured a cut in December still have concerns about persistent wage growth and inflation, recent data has not been compelling enough to prompt back-to-back reductions.

Edward Allenby, senior economic advisor at Oxford Economics, forecasts the next rate cut to occur in April.

He explained: “The MPC will continue to face a delicate balancing act between supporting growth and preventing inflation from becoming entrenched, with forthcoming data on pay settlements likely to play a decisive role in shaping the next policy move.”

The Bank’s policymakers have consistently voiced concerns regarding the pace of wage increases in the UK, which can fuel overall inflation.

Business

Budget 2026: India pushes local industry as global tensions rise

India’s budget focuses on infrastructure and defence spending and tax breaks for data-centre investments.

Source link

Business

New Income Tax Act 2025 to come into effect from April 1, key reliefs announced in Budget 2026

New Delhi: Finance Minister Nirmala Sitharaman on Sunday said that the Income Tax Act 2025 will come into effect from April 1, 2026, and the I-T forms have been redesigned such that ordinary citizens can comply without difficulty for ease of living.

The new measures include exemption on insurance interest awards, nil deduction certificates for small taxpayers, and extension of the ITR filing deadline for non-audit cases to August 31.

Individuals with ITR 1 and ITR 2 will continue to file I-T returns till July 31.

“In July 2024, I announced a comprehensive review of the Income Tax Act 1961. This was completed in record time, and the Income Tax Act 2025 will come into effect from April 1, 2026. The forms have been redesigned such that ordinary citizens can comply without difficulty, for) ease of living,” she said while presenting the Budget 2026-27

In a move that directly eases cash-flow pressure on individuals making overseas payments, the Union Budget announced lower tax collection at source across key categories.

“I propose to reduce the TCS rate on the sale of overseas tour programme packages from the current 5 per cent and 20 per cent to 2 per cent without any stipulation of amount. I propose to reduce the TCS rate for pursuing education and for medical purposes from 5 per cent to 2 per cent,” said Sitharaman.

She clarified withholding on services, adding that “supply of manpower services is proposed to be specifically brought within the ambit of payment contractors for the purpose of TDS to avoid ambiguity”.

“Thus, TDS on these services will be at the rate of either 1 per cent or 2 per cent only,” she mentioned during her Budget speech.

The Budget also proposes a tax holiday for foreign cloud companies using data centres in India till 2047.

-

Sports5 days ago

Sports5 days agoPSL 11: Local players’ category renewals unveiled ahead of auction

-

Tech1 week ago

Tech1 week agoStrap One of Our Favorite Action Cameras to Your Helmet or a Floaty

-

Sports1 week ago

Sports1 week agoWanted Olympian-turned-fugitive Ryan Wedding in custody, sources say

-

Entertainment1 week ago

Entertainment1 week agoThree dead after suicide blast targets peace committee leader’s home in DI Khan

-

Tech1 week ago

Tech1 week agoThis Mega Snowstorm Will Be a Test for the US Supply Chain

-

Sports1 week ago

Sports1 week agoStorylines shaping the 2025-26 men’s college basketball season

-

Fashion1 week ago

Fashion1 week agoSpain’s apparel imports up 7.10% in Jan-Oct as sourcing realigns

-

Entertainment1 week ago

Entertainment1 week agoUFC Head Dana White credits Trump for putting UFC ‘on the map’