Business

British Gas boss concerned for Scotland’s energy industry jobs

Michael Race & Sean FarringtonBusiness reporter & business presenter

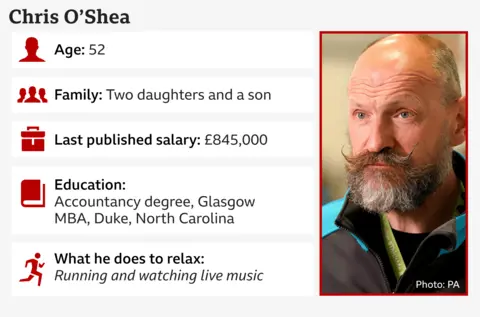

Chris O’Shea hasn’t lived in Scotland for decades but the boss of Centrica, the owner of British Gas, is worried over the future of the energy industry in his homeland.

He is concerned that the “demise” of drilling for gas and oil in the North Sea and the move to green energy will not create new roles quickly enough to offset job losses.

His wide-ranging interview with us follows a series of difficult moments for the industry as soaring energy prices pushed household bills up and saw bumper dividends to shareholders and pay packets to bosses – including him. British Gas also faced a scandal over force-fitting prepayment meters in the homes of vulnerable people who fell behind on bills, something he says the company doesn’t do anymore.

Today O’Shea says his big concern is the decline in jobs in the North Sea oil and gas industry. The UK’s largest oil and gas producer, Harbour Energy, announced job cuts earlier this year. And this month, the Port of Aberdeen said it would cut roles in the face of what it described as a “staggering” fall in North Sea oil and gas activity.

“The energy transition is the right thing for us to do. It’s essential,” says O’Shea, pointing out that British Gas no longer explores for oil and gas in the North Sea and benefits more from energy being imported from overseas.

That’s not to say he doesn’t think there should be more drilling in the North Sea.

“Whether you look at this from a cost point of view or whether you look at this from a carbon point of view or environmental point of view, the gas that you produce domestically will often be cheaper than the gas you import, and it will definitely be cleaner than the gas you import,” he says.

But going back to the transition to green energy, he tells the BBC’s Big Boss Interview that the question is over the pace at which it needs to happen, drawing on personal experience.

“I grew up in the town of Fife, which was surrounded by coal mines. I saw the devastation when the coal mines were closed during the miners’ strike and people that had incredibly well-paid jobs – they went to no work at all.

“You’ve got second, third-generation people that are not in work now. And I desperately want to avoid that through this transition.”

He says he found it quite hard to get a job after university and “got loads of rejection letters”.

“I know what it’s like to be a bit worried about getting a job,” he says.

“I also know what it’s like to get a job that you like, and you find out that you’re good at, it can change your life – it certainly did for me.”

However, the chief executive is no stranger to cutting roles, having axed the best part of 5,000 soon after he took charge during the height of the Covid pandemic in April 2020.

“I wasn’t sure the company was actually going to survive,” he says. “The only way I could justify that to myself was I was trying to protect 20,000 jobs, I couldn’t protect them all.”

Since then, Centrica has taken on 1,700 apprentices and has committed to taking on one more every day for this decade at least.

Much like energy prices in recent years, it’s been a volatile time in the hotseat for O’Shea.

As wholesale energy prices soared in part due to supply issues following the outbreak of war in Ukraine, many small suppliers went bust as they were unable to afford the fixed-price deals they’d locked into with customers.

“It’s all down to poor regulation,” O’Shea says, arguing that energy regulator Ofgem should have been stricter on making sure suppliers had enough cash to manage risks.

“You cannot have a system whereby the profits are privatised and the losses are socialised,” he says.

Ofgem told the BBC its regulation meant the sector “now holds around £7.5bn in assets, a significant reverse from -£1.7bn during the crisis, meaning they are now better protected against failure, and the impact this has on customer’s bills”.

As energy bills surged, there were questions over bumper dividends to shareholders, and O’Shea’s own salary and bonuses which hit £8.2m in 2023.

“Investors invest and they want a return,” he says. “People don’t put money in the bank and say, ‘it’s ok, don’t give me any interest’ and investors don’t buy shares and say, ‘it’s ok, don’t give me any return’.”

Those dividends, O’Shea argues, are not generated from British Gas customers, and are as a result of other parts of Centrica’s diversified business.

“There is very little profit that’s made in the energy retail business. You’re capped on the profit that you can make at 2.4% of your revenue,” he says.

The 52-year-old faced a huge public backlash after it emerged that debt agents working for British Gas were breaking into people’s homes to fit prepayment meters.

“We are not doing that at the moment,” he says when asked if this has resumed.

But he argues the regulator Ofgem needs to tell firms how to act when people don’t pay and how to find out who cannot pay and who refuses to.

“My heart goes out to those people who can’t pay, but those people who choose not to pay are freeloaders and we have to find a way to differentiate and go after the people who choose not to pay, and to remove the distress from people who are unable to pay,” he adds.

He seems supportive of potential plans for the chancellor to announce relief for billpayers in the Budget, such as cutting the current 5% rate of VAT charged on energy.

“Anything that reduces the cost of energy, I would welcome.

“But the reality is we have got to pay for it in some way,” he warns.

Business

From first salary to first investment — Why young Indians are choosing gold

New Delhi: Gold continues to remain the most trusted investment option among young Indians, even as access to financial products like mutual funds, stocks, and cryptocurrencies expands, according to a recent consumer survey.

The Smytten PulseAI survey, conducted among 5,000 consumers aged 18–39, found that 62 percent of respondents chose gold as their preferred investment, highlighting the metal’s enduring appeal among Gen Z and Millennials.

When asked how they would invest Rs 25,000, about 61.9 percent said they would choose gold, far ahead of mutual funds (16.6 percent), fixed deposits (13 percent), stocks (6.6 percent), and crypto (1.9 percent), the survey showed.

The findings also indicate that gold buying is becoming more personal and investment-driven rather than tradition-led. Around 66.7 percent of respondents said their gold purchases were primarily their own decision, reflecting a shift in mindset among younger investors.

Another notable trend is the move toward smaller and more frequent purchases. Nearly 62 percent of recent gold purchases were below 5 grams, suggesting that younger buyers are entering the market gradually instead of making large, occasional purchases.

Gold’s appeal becomes even stronger during uncertain economic conditions. The survey found that 65.7 percent of respondents consider gold the safest investment option compared with bank savings, mutual funds, or equities.

For many young earners, gold is no longer bought only for weddings or family occasions. Nearly 24 percent said their first gold purchase was linked to receiving their first salary, while 23.9 percent bought gold as an investment decision, signalling changing motivations behind gold ownership.

Overall, the survey highlights that while investment behaviour among young Indians is evolving, gold continues to play a central role as a trusted store of value and financial safety net.

Business

PPF account rules: Why you can open only one PPF account and what it means for your tax savings

New Delhi: The Public Provident Fund (PPF) is one of India’s most popular long-term, government-backed savings schemes. But many investors often wonder whether they can open multiple PPF accounts to increase their tax-saving investments. The government’s rules are clear — an individual can hold only one PPF account in their own name.

Opening additional PPF accounts in different banks or post offices is not permitted under the PPF Scheme. If more than one account is discovered in the same person’s name, the extra account will be treated as irregular and may have to be closed, with interest on the additional account typically not paid.

However, the rules allow parents or guardians to open a separate PPF account for a minor child. Even in such cases, the total annual contribution across the individual’s own account and the minor’s account cannot exceed Rs 1.5 lakh in a financial year, which is the maximum investment limit under Section 80C.

The PPF scheme remains a long-term savings instrument with a 15-year maturity period, offering tax-free interest and government-guaranteed returns. Investors can deposit a minimum of Rs 500 and up to Rs 1.5 lakh annually, making it a widely used option for retirement and tax planning.

In short, while you cannot open more than one PPF account in your own name, you can still invest in separate accounts for eligible family members such as minor children, within the overall contribution limits set by the government.

Business

‘Very successful emerging economy’: UN chief António Guterres hails India as AI Impact Summit host – The Times of India

UN Secretary-General Antonio Guterres on Saturday endorsed India as the perfect host for the AI Impact Summit 2026 starting Sunday, praising the nation’s growing global influence and successful economy. The first-ever AI summit in the Global South will be held from February 16-20, bringing together world leaders, tech CEOs, and policymakers to discuss artificial intelligence’s future while ensuring its benefits reach everyone globally.In an exclusive interview with PTI, Guterres strongly backed India’s initiative, saying “I strongly congratulate India for organising this Summit. It’s absolutely essential that AI develops itself to the benefit of everybody, everywhere and that countries in the Global South are part of the benefits of AI.”

The UN chief warned against AI becoming a privilege of developed nations or limited to superpowers like the US and China. He emphasized that AI must serve as “a universal instrument for the benefit of humankind.”Speaking about India’s role in global affairs, Guterres praised the country’s position as a key emerging economy. He highlighted recent developments like India’s trade agreement with the European Union as positive steps toward true global multipolarity. “The role of India, (which) is today a very successful emerging economy that is having a bigger and bigger role in not only the global economy but in its influence in global affairs, India is the right place to have this Summit and to make sure that AI (is) being discussed in depth, in all its enormous potential and also in all its risks, but that AI belongs to the whole world and not only to a few,” he said.Further praising India, he added, “I see India in the centre of those emerging economies, and this is something I would be delighted to discuss with Prime Minister Modi because I have a lot of hope for the role that India can play in shaping this multipolar world.”The UN chief expressed his “frustration” with the Security Council’s ineffectiveness and called for fundamental reforms to better represent today’s world, referring to India playing a central role in shaping a multipolar world order.“There are two things we need to avoid in the world. We need to avoid the system in which there is total hegemony by only one power or a system in which the world is divided between two superpowers,” Guterres also said.Guterres also shared his personal appreciation for India, describing his fascination with the country’s rich history and cultural influence. He mentioned how he’s currently reading about India’s historical impact on various regions, from China to Southeast Asia and even the Mediterranean during the Roman Empire.The summit will see presence from various world leaders, including French President Emmanuel Macron, Brazilian President Luiz Inacio Lula da Silva, and tech leaders like Google CEO Sundar Pichai, Adobe CEO Shantanu Narayen, and Anthropic CEO Dario Amodei.The summit will also feature other UN leaders, including Human Rights Commissioner Volker Turk and Technology Envoy Amandeep Singh Gill, focusing on the summit’s core themes of ‘People, Planet and Progress’.

-

Entertainment1 week ago

Entertainment1 week agoHow a factory error in China created a viral “crying horse” Lunar New Year trend

-

Business5 days ago

Business5 days agoAye Finance IPO Day 2: GMP Remains Zero; Apply Or Not? Check Price, GMP, Financials, Recommendations

-

Tech1 week ago

Tech1 week agoNew York Is the Latest State to Consider a Data Center Pause

-

Tech1 week ago

Tech1 week agoNordProtect Makes ID Theft Protection a Little Easier—if You Trust That It Works

-

Fashion5 days ago

Fashion5 days agoComment: Tariffs, capacity and timing reshape sourcing decisions

-

Business1 week ago

Business1 week agoMandelson’s lobbying firm cuts all ties with disgraced peer amid Epstein fallout

-

Tech5 days ago

Tech5 days agoRemoving barriers to tech careers

-

Fashion5 days ago

Fashion5 days agoADB commits $30 mn to support MSMEs in Philippines