Business

Business news live: The firms bidding for Costa Coffee and Nvidia share price falls

Costa Coffee: How much will it cost and what happens next?

Reports suggest Costa Coffee could be on the market for around £2bn.

That’s half of what it was bought for six years ago but coffee sales in the UK are below the level now from when Coca-Cola bought it.

There are more than 2,000 stores in the UK and Costa operates across 50 different countries, though Coca-Cola have not released figures on total stores or employees worldwide.

Costa has about 38% of the UK coffee market share according to research, but it is under pressure from cheaper alternatives like Gregg’s, and more upmarket offerings such as local specialist coffee boutiques or independent cafes.

Add in increased employer costs this year in the UK and it’s clearly a tough time for many businesses right now – though it’s still one which recorded revenues of £1.2bn in 2023.

Karl Matchett28 August 2025 10:00

Costa Coffee up for sale: Who wants to buy it?

Costa Coffee is a UK high street staple. You see it pretty much everywhere: main shops, inside shopping centres, even within petrol stations in a tiny kiosk or machine.

But it’s not a standalone company; Costa was bought by Coca-Cola in 2019 for nearly £4bn.

Since then the drinks firm has struggled to integrate it properly within its wider ecosystem and doesn’t feel the brand is generating the return it wanted. So, it’s up for sale – potentially at least, as one of several possible outcomes of a review.

At present there are three main parties who seem to be at least exploring a deal.

Apollo Global Management is the eventual parent of restaurants like Wagamama, and Bar Burrito.

KKR is a US-based private equity firm who have also held early talks, according to reports.

And Sky News initially reported a “small number” of firms who may have had exploratory talks.

There’s still a chance a sale doesn’t go through, but bids are expected in October.

Karl Matchett28 August 2025 09:45

Reeves ‘plots tax raid on landlords’ to help plug £40bn Budget black hole

The plans aim to make the Treasury £2bn, as it attempts to avoid breaking the chancellor’s “red lines” outlined before the general election, which included not increasing VAT, income tax or national insurance.

Karl Matchett28 August 2025 09:10

Lottery firm valued at £9.6bn after Czech owner sells part of stake

Czech tycoon Karel Komarek’s investment vehicle has sold a stake in Allwyn in a deal valuing the National Lottery operator at 11.2 billion euros (£9.6 billion).

Allwyn said central European investment fund J&T Arch has snapped up a 4.27% stake in the business from Mr Komarek’s KKCG business, which remains the majority owner.

In 2019, KKCG took 100% control of European lottery group Sazka Group before rebranding it as Allwyn.

It was awarded the licence to run the National Lottery in 2022.

Later that year, Allwyn then agreed a takeover deal for Camelot, which had previously run the UK’s National Lottery licence.

Karl Matchett28 August 2025 08:45

Nvidia: Shares fall despite $46.7bn earnings beating expectations

Last night was a key event in the stock markets as Nvidia reported their earnings for the last quarter.

Without going into the finances in too much detail, $46.7bn in earnings was more than expected and earnings per share was higher than analysts’ anticipated levels too – but the share price fell after data centre revenue fell $0.2bn short of predictions.

It fell around 3 per cent initially but has since bounced back in pre-market trading, with the Nasdaq firm set to open 1.9 per cent lower according to the latest futures markets.

Nvidia is the biggest company in the world, valued at over $4tn, and the share price hit a new all time high at just over $183 earlier this month.

It’ll be around $177-178 later this afternoon when markets open, if it stays down in the 2-3 per cent range.

It’s value is so carefully watched as it makes up a significant chunk of many funds, including a basic tracker of US companies or more specifically tech-focused ones.

Karl Matchett28 August 2025 08:30

Royal Mail launches services to help customers post to US after new charges

Royal Mail has announced it will be the first international postal operator to launch new services so people can continue sending goods to the United States ahead of new customs requirements coming into effect on Friday.

From today, Royal Mail customers can use the company’s new postal delivery duties paid (PDDP) services.

The move follows a US executive order last month which said that goods valued at 800 dollars or less will no longer be exempt from import duties and taxes from August 29.

Karl Matchett28 August 2025 08:15

FTSE 100 in small rise after opening

The FTSE 100 fell yesterday as an afternoon slump left it around 0.1 per cent down for the day – and it’s up by less than that at the start of trading, about 0.06 per cent in the green.

There are no massive names reporting today but a few such as the Macfarlane Group and PPHE Hotel Group – which owns brands like Park Plaza, Radisson Collection and others – are some of the smaller or FTSE 250 firms set for reporting.

Karl Matchett28 August 2025 08:06

Business

West Asia conflict: Govt may ask companies to cut exports, increase auto fuel, LPG supplies – The Times of India

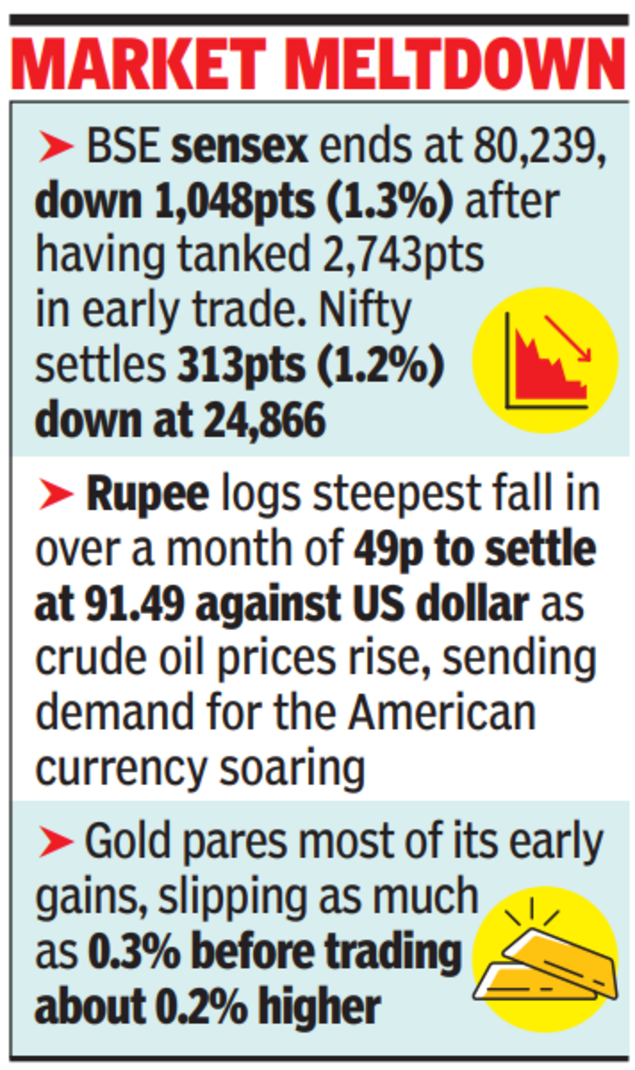

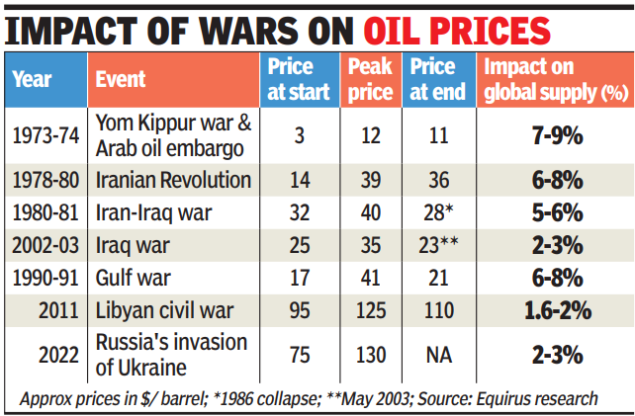

NEW DELHI: Amid fears of a shortage in crude supplies, govt is looking to nudge refiners to divert more auto fuel and LPG to the domestic market by cutting on exports and also increase cooking gas production so that there is no disruption in local supplies.While govt and oil companies insisted there’s no shortage, refiners are looking at alternate sources to partly compensate for crude coming from war-hit West Asia.

The tension has led to a spike in oil and gas prices, and given India’s dependence on imports, inflating the import bill and stoking inflationary pressures. Officials, however, said retail fuel prices may not rise immediately, as oil marketing companies follow a calibrated approach — absorbing losses when global prices are high and recouping them when prices soften. Retail petrol and diesel prices have remained unchanged since April 2022.Mantri meets oil cos to assess availability of crude and gasOn a day when Iranian drones damaged part of Saudi Aramco refinery and Qatar Energy’s facilities, the world’s largest LNG producer, announced an export pause, petroleum minister Hardeep Singh Puri and his team of officials met oil companies on Monday to assess the availability of crude and gas. “We are continuously monitoring the evolving situation, and all steps will be taken to ensure availability and affordability of major petroleum products in the country,” the oil ministry said in a post on X.India imports nearly 90% of its crude requirement. It also meets 60-65% of its LPG demand and about 60% of its LNG needs through imports, largely from West Asia, with shipments routed via Strait of Hormuz, which risks being choked due to the war.

According to the International Energy Agency, in 2023, 5.9% of the country’s production was being exported. Between April and Dec 2025, India exported petroleum products worth nearly $330 billion, with the Netherlands, UAE, the US, Singapore, Australia and China being the main destinations. In 2024, it also exported petroleum gas worth $454 million, mostly to Nepal, China, and Myanmar. The Reliance refinery in Jamnagar is the largest exporter in the country.An oil company executive said refiners are already in contact with traders to tie up capacities amid fears of the blockade of Strait of Hormuz. By Monday, the global market had caught the jitters from Qatar’s decision to suspend gas shipments.An oil executive said while disruption could cause difficulties in the immediate term, Indian players had a wide portfolio that they can tap for LNG, including the US, with vessels being routed through the Suez Canal.“Even if there is a force majeure, we have other sources of supply, which we can tap. Besides, no one is going to stop supplies indefinitely,” the executive said. While oil and gas prices rose Monday, the focus is on ensuring that supply lines remain open.

Business

Travel stocks fall after thousands of flights grounded following Iran strikes

A display board shows canceled flights to Dubai and Doha amid regional airspace closures at Noi Bai International Airport, amid the U.S.-Israel conflict with Iran, in Hanoi, Vietnam, March 2, 2026. Picture taken with a mobile phone.

Thinh Nguyen | Reuters

Airline and travel stocks slipped Monday after airspace closures throughout the Middle East forced carriers to cancel thousands of flights, disrupting trips as far as Brazil and the Philippines.

Cruise lines stocks also fell sharply, with Royal Caribbean Cruises dropping 3% and Carnival Corp. losing more than 7%.

Norwegian Cruise Line Holdings‘ stock fell 10% after its earnings call disappointed investors. Elliott Investment Management said last month that it had built a more than 10% stake in the company and that it’s seeking changes. New CEO John Chidsey told analysts that “our strategy is sound, our execution and coordination have not been, and a culture of accountability is essential and necessary going forward.”

Oil prices also rose, potentially driving up airlines’ biggest cost after labor. Flights through the Middle East were grounded, including to destinations like Tel Aviv and Dubai.

United Airlines, which has the most international exposure of the U.S. carriers, fell nearly 3%. Service to Tel Aviv, Israel, one of the airline’s most profitable routes, was halted, but airlines were also was forced to pause flights to Dubai, in the United Arab Emirates, one of the busiest airport hubs in the world. Dubai is also a home base for the airline Emirates.

Shares of American Airlines lost 4% while Delta Air Lines fell 2%.

More than 11,000 Middle East flights have been canceled since the U.S.-Israeli strikes this weekend, according to aviation-data firm Cirium.

International travel has been a bright spot in the travel sector. In January, international air travel demand jumped 5.9% from a year ago while domestic flight demand was nearly flat, the International Air Transport Association, an airline industry group, said in a report Monday.

— CNBC’s Contessa Brewer contributed to this report.

Business

Brewdog: Bars close and hundreds lose jobs as beer firm sold in £33m deal

Beverage and cannabis company Tilray acquires the brewery, the brand and 11 bars after Brewdog went into administration.

Source link

-

Business6 days ago

Business6 days agoHouseholds set for lower energy bills amid price cap shake-up

-

Politics5 days ago

Politics5 days agoWhat are Iran’s ballistic missile capabilities?

-

Entertainment1 week ago

Entertainment1 week agoTalking minerals and megawatts

-

Sports1 week ago

Sports1 week agoEileen Gu comments on Alysa Liu’s historic gold medal

-

Business6 days ago

Business6 days agoLucid widely misses earnings expectations, forecasts continued EV growth in 2026

-

Sports5 days ago

Sports5 days agoSri Lanka’s Shanaka says constant criticism has affected players’ mental health

-

Tech6 days ago

Tech6 days agoHere’s What a Google Subpoena Response Looks Like, Courtesy of the Epstein Files

-

Politics1 week ago

Politics1 week agoSupreme Court ruling angers Trump: Global tariffs to rise from 10% to 15%