Business

Can India Trust Chairman XI? How China Is Still A Long Term Systematic Threat Despite Recent Thaw In Relationship

New Delhi: Prime Minister Narendra Modi’s presence at the recent Shanghai Cooperation Organisation (SCO) summit signaled a subtle recalibration in New Delhi’s approach towards Beijing. His participation — and the brief exchange with Chinese President Xi Jinping on the sidelines — underscored attempts by both sides to stabilise relations after years of border tensions and trade friction. While no major breakthroughs were announced, the optics of Modi’s visit have been read as an opening for a cautious thaw, setting the stage for renewed diplomatic and economic engagement between the two Asian giants.

Yet, for Indian policymakers, history casts a long shadow over such gestures. Since the 1950s, India has experienced several episodes where agreements or friendly overtures with China were followed by sharp reversals or conflict. The most striking example remains the 1962 Sino-Indian war, which erupted just a few years after the “Hindi-Chini Bhai Bhai” phase and the signing of the Panchsheel Agreement. Subsequent decades have witnessed repeated flare-ups despite ongoing talks and confidence-building measures — from the Sumdorong Chu standoff in 1987, to the Doklam crisis in 2017, and the deadly Galwan clashes in 2020. Each time, India’s expectations of a stable border were shaken by Chinese military maneuvers, reinforcing a pattern of mistrust.

This legacy of caution influences not just border diplomacy but also how India views its massive trade relationship with China. As geopolitical tensions ease tentatively, economic realities remain stark. China’s manufacturing overcapacity poses a serious threat to the Indian economy by undermining local industries, widening trade deficits, and destabilizing market conditions in several sectors. Despite India’s rapid industrial growth and emerging status as a manufacturing hub, the flood of cheap, subsidized Chinese goods disrupts domestic markets and jeopardies the viability of homegrown businesses.

China produces about 30 percent of the world’s manufactured goods but consumes only around 18 percent domestically. This mismatch fuels an export push, often at low prices backed by state subsidies. India has borne the brunt: a trade deficit of about USD 99.2 billion in the 2024-25 fiscal year, and intense pressure on sectors such as steel, solar panels and electric vehicles. Cheaper Chinese imports erode market share, squeeze profit margins, and slow domestic industrial growth — directly threatening the government’s “Make in India” ambitions.

At the same time, global supply chains are diversifying. Many multinational firms are adopting a “China-plus-one” strategy that includes India, recognizing its large workforce, improving digital infrastructure and strategic location. To convert this window into a long-term advantage, India must couple its diplomatic outreach with robust trade policy actions, targeted industrial reforms and stronger WTO-aligned measures to counter dumping and subsidies.

The current establishment has consistently approached trade with China with caution, fully aware of the risks posed by overreliance on a complex and often unpredictable partner. This cautious stance has allowed India to benefit from engagement while minimizing vulnerabilities. Moving forward, this approach must remain steadfast: any thaw in geopolitical tensions should be matched by strategic vigilance in economic dealings. Strengthening domestic industries, diversifying supply chains, and learning from past breaches of trust will ensure that India’s engagement with China continues to serve national interests, rather than exposing the country to avoidable risks. Only by balancing opportunity with prudence can India maintain leverage and safeguard its long-term economic and strategic goals.

Business

FTSE 100 moves ahead amid surprise US growth jump

The FTSE 100 was in festive mood on Tuesday, closing higher after a report showed improved UK business confidence and the US economy grew more than forecast in the third quarter.

The FTSE 100 index closed up 23.25 points, 0.2%, at 9,889.22. The FTSE 250 ended up just 6.83 points at 22,349.55, while the AIM All-Share closed down 1.67 points, 0.2%, at 758.81.

UK business confidence increased to 47% in December, rising five points from last month and standing 10 points higher than the start of 2025, according to the latest Lloyds Business Barometer.

In addition, optimism towards the wider economy reached a four-month high, up 11 points to 42%. The renewed economic optimism offset a slight dip in firms’ expectations for their own trading prospects, which decreased by one point to 52%.

“It is great to see business confidence ending the year on a higher note,” said Hann-Ju Ho, senior economist at Lloyds Commercial Banking.

Construction saw the sharpest improvement, up 22 points to 61%, its highest level seen this year.

Manufacturing also was up five points to 49%, while retail firms edged higher to 47%, likely reflecting seasonal demand.

In European equities, the CAC 40 in Paris closed down 0.2%, while the DAX 40 ended up 0.2%.

In Copenhagen, Novo Nordisk jumped 9.2% after the US Food and Drug Administration approved its once‑daily Wegovy pill, the first oral glucagon‑like peptide‑1 therapy cleared for weight management.

“As the first oral GLP-1 treatment for people living with overweight or obesity, the Wegovy pill provides patients with a new, convenient treatment option that can help patients start or continue their weight loss journey,” said Novo chief executive Mike Doustdar in a statement late on Monday.

The company expects to launch the Wegovy pill in the US in early January 2026.

Stocks in New York were higher at the time of the London equity market close. The Dow Jones Industrial Average was up 0.2%, while the S&P 500 and the Nasdaq Composite were both 0.3% higher.

The yield on the US 10-year Treasury was quoted at 4.18%, widened from 4.17%. The yield on the US 30-year Treasury was quoted at 4.84%, stretched from 4.83%.

Figures showed US economic growth accelerated in the third quarter of the year, markedly outperforming expectations.

According to Bureau of Economic Analysis data, US gross domestic product expanded 4.3% on an annualised basis quarter-on-quarter in the three months to September 30, easily beating the 3.3% growth predicted by consensus cited by FXStreet, and accelerating from a 3.8% expansion in the second quarter.

ING said the figure was “eye-popping”, primarily due to a strong performance from net trade with exports rising 8.8% and imports falling 4.7%, while consumer spending grew a robust 3.5% versus the 2.7% rate expected.

But while it was a “fantastic outcome”, ING noted fourth-quarter GDP is likely to record growth that is considerably slower, thanks in part to the effects of the month-long government shutdown.

“We also can’t see the net trade component continuing to make such a strong contribution while consumer spending is also set to slow,” ING added.

Other US data was mixed, with industrial production beating expectations, but consumer confidence and durable goods orders falling short of hopes.

The pound was quoted at 1.3481 US dollars at the time of the London equities close on Tuesday, up from 1.3452 on Monday.

The euro stood at 1.1777 dollars, higher against 1.1759 dollars. Against the yen, the dollar was trading lower at 156.37 yen compared to 156.95.

Back in London, Metlen Energy & Metals was the best FTSE 100 performer, rising 6.8%.

It said it has completed the sale of a portfolio of solar farms and co-located battery energy storage systems in Chile to a subsidiary of Glenfarne Group at enhanced terms.

Metlen is an Athens-based aluminium producer and electricity generator. Glenfarne is a New York and Houston-based developer, owner, operator, and industrial manager of energy and infrastructure assets.

In April, Metlen had said Glenfarne unit GAC RS Chile II Spa would pay 815 million dollars (£606 million) for the assets.

On Tuesday, Metlen said the final price to be paid is 865 million dollars (£643 million), reflecting the “value creation opportunities emerging in the Chilean market”.

Videndum plunged 56% as the provider of broadcasting hardware and software said a planned refinancing will, if successful, see current shareholdings “very significantly diluted”, while completion is also not guaranteed.

The firm said the main components of a refinancing proposal have now been agreed in principle with the revolving credit facility lenders and its two largest shareholders.

But the firm warned any share issue would be “very significantly below” their current nominal value of 20p per share.

Gut Gulf Marine Services fared better, climbing 11% after reporting a new contract award that covers two of its large-class vessels in Europe.

Neither the name of the client nor the financial terms of the contract were disclosed, but Gulf Marine Services said the award increases its contracted backlog to 540 million dollars.

Brent oil was quoted at 62.09 dollars a barrel at the time of the London equities close on Tuesday, up from 61.87 dollars late on Monday.

Gold traded at 4,462.05 dollars an ounce, up from 4,440.54 on Monday.

The biggest risers on the FTSE 100 were Metlen Energy & Metals, up 2.80 euro cents at 44.00 euro, Anglo American, up 88.00 pence at 2,993.00p, Antofagasta, up 67.00p at 3,235.00p, BT, up 2.80p at 185.05p and Airtel Africa, up 4.80p at 337.80p.

The biggest fallers on the FTSE 100 were Diageo, down 29.00p at 1,588.00p, Ashtead Group, down 78.00p at 5,192.00p, Convatec, down 3.20p at 238.60p, Burberry, down 16.00p at 1,261.50p and easyJet, down 6.29p at 506.80p.

Wednesday’s economic calendar includes US weekly jobless claims data.

There are no significant events scheduled in Wednesday’s UK corporate calendar.

– Contributed by Alliance News

Business

How Senior Living Homes Are Addressing A Silent Health Risk In India And Helping The Ageing Population

With India’s elderly population projected to reach nearly 35 crore by 2050, retirement is no longer about slowing down. Increasingly, people in their late fifties and sixties are seeking communities where they can stay active, socialize, and enjoy a secure, independent lifestyle. Families, too, are encouraging parents to consider senior living homes that offer support, companionship, and a sense of purpose. The pandemic underscored the risks of isolation, highlighting the need for safe housing, reliable medical care, and built-in social networks.

Recent industry studies, including the latest JLL-ASLI senior living report, show that demand for organised retirement communities is rising sharply across India. The report also notes that India has 22,157 organised senior living units against a potential demand of 1.7 million senior households, underscoring how early the market still is. The country is witnessing the early formation of a silver economy, a new growth frontier driven by rising longevity, changing family structures, and a growing appetite for independent, age-ready living.

Over the past decade, falls have emerged as a serious health risk for senior citizens.According to the US Centers for Disease Control and Prevention (CDC), one in four people aged 65 and above experiences a fall each year. In 2018 alone, nearly 36 million falls were reported among older adults, resulting in about 8.4 million fall-related injuries and more than 32,000 deaths. The severity of these injuries depends largely on how the fall occurs, ranging from hip fractures to traumatic brain injuries. Dr Julius Cheng, Associate Professor in the Department of Surgery at URMC, has cautioned that seemingly minor incidents such as slipping on a wet floor should not be underestimated, as even low-level falls can have serious consequences for elderly patients. Another CDC study found that nearly half of all fall-related deaths among those aged 65 and above involved head injuries, while even less severe injuries often lead to complex treatment and prolonged recovery for seniors.

Senior living homes focus on ease and safety. Flats feature non-slip flooring, wider spaces, grab rails, and pathways designed for safe movement. Medical support is always accessible, with doctors on call and regular wellness checks incorporated into daily routines. But the real draw is the social life. Yoga sessions, music groups, afternoon games, reading clubs, and hobby rooms and travel opportunities. Friendships form naturally, and there’s a sense of belonging.

Residents report that senior living communities give them a renewed sense of routine. Shared meals, morning walks, hobby clubs, and small celebrations prevent days from feeling repetitive while providing the social fabric they may have missed at home.

“After retirement, the biggest fear for many of us is loneliness and losing our sense of routine. Moving into a senior living community changed that completely. I have my morning walks, yoga sessions, friends to share meals with, and medical help close by if I ever need it. It feels like living independently—but with the comfort of knowing you’re never alone,” said M. Laxmi, a retired government officer living in a senior housing near Bengaluru.

Buyers of these projects are typically over the age of 55. Many live alone or have children in other cities or abroad. They are looking for communities where medical support and emergency assistance are readily available. The rapidly growing senior population and nuclear family system in India have further increased the demand for these homes.

Ankur Gupta, Co-founder (Association of Senior Living India) & JMD of Ashiana Housing, said that retirement in India is no longer about stepping back. He says seniors want structure, purpose and a vibrant social setting. “They want to stay engaged, stay fit and stay connected. Senior living communities provide mix of privacy and dependable support, which makes them appealing,” he said.

Anantharam V. Varayur, co-founder of Manasum Senior Living said, “Seniors require more care. In such societies, the health and safety of the elderly is a top priority.”Developers and investors are increasingly viewing the segment as both socially responsible and economically resilient.The rise of senior living in India is, at its core, a story of empowerment of creating environments that allow people to age with dignity, purpose, and belonging.Nearly one in four elderly Indians now live either alone or only with their spouse, reflecting a shift from dependence to choice. This generation of seniors is financially aware, socially active, and seeks spaces that encourage connection, not confinement.We have curated the senior living projects across Bengaluru, Goa &Tirupati.

The demand for organised senior communities has grown sharply in the last few years. This is not just a real estate product. This is social infrastructure. Developers believe that seniors are increasingly vocal about what they want in later life – dignity, independence, and companionship. With more families embracing the concept of community-based living for elders, poised to redefine retirement living in India.

“In 2026, the senior living industry is expected to consolidate further, with rising demand and greater acceptance shaping a more structured and service-oriented market. Assisted living, in particular, will emerge as a high-growth segment as more organised players explore opportunities in care-led residential models. We anticipate stronger competition as well as better quality standards across the board. We see 2026 as a year where service-based real estate, especially in the elder care segment, strengthens its position as a vital part of India’s real estate landscape,” said Shreya Anand, Director, Vedaanta Senior Living.

According to experts, one of the biggest challenges facing the senior living sector in India is the deeply rooted social myth around it. Senior living is often perceived as a last resort or, worse, as a sign of neglect by families, rather than a conscious lifestyle choice made by seniors themselves. Many families still worry about social judgement, believing that a parent moving into a senior living community may be viewed negatively by society. Changing this mindset takes time, storytelling, and visible examples of thriving, independent senior communities, feel the experts.

Business

Tariff jitters: US consumer confidence slips in December; inflation and jobs worries deepen – The Times of India

US consumer confidence weakened in December, sliding to its lowest level since President Donald Trump rolled out sweeping tariffs earlier this year, as households grew more anxious about high prices, trade levies and job prospects, according to a survey by the Conference Board.The Conference Board said its consumer confidence index fell 3.8 points to 89.1 in December from an upwardly revised 92.9 in November, AP reported. The reading is close to the 85.7 level recorded in April, when the Trump administration introduced import taxes on key US trading partners, AP reported.Consumers’ assessment of current economic conditions saw a sharper drop. The present situation index fell 9.5 points to 116.8, reflecting growing unease about inflation and employment conditions. Write-in responses to the survey showed that prices and inflation remained the biggest concern for consumers, alongside tariffs.Short-term expectations for income, business conditions and the labour market were little changed at 70.7, but remained well below 80 — a threshold that can signal a recession ahead. This was the 11th straight month that expectations stayed under that level.Perceptions of the job market also weakened. The share of consumers who said jobs were “plentiful” fell to 26.7% in December from 28.2% in November, while those who said jobs were “hard to get” rose to 20.8% from 20.1%.The softer sentiment follows recent labour market data showing mixed signals. Government figures released last week showed the US economy added 64,000 jobs in November after losing 105,000 jobs in October. The unemployment rate climbed to 4.6% last month, its highest level since 2021.Economists say the labour market is stuck in a “low hire, low fire” phase, as companies remain cautious amid uncertainty over tariffs and the lingering effects of high interest rates. Since March, average monthly job creation has slowed to about 35,000, down from 71,000 in the year ended March. Federal Reserve chair Jerome Powell has said he suspects those figures could be revised even lower, AP reported.

-

Business1 week ago

Business1 week agoStudying Abroad Is Costly, But Not Impossible: Experts On Smarter Financial Planning

-

Fashion6 days ago

Fashion6 days agoIndonesia’s thrift surge fuels waste and textile industry woes

-

Business1 week ago

Business1 week agoKSE-100 index gains 876 points amid cut in policy rate | The Express Tribune

-

Sports1 week ago

Sports1 week agoJets defensive lineman rips NFL officials after ejection vs Jaguars

-

Business6 days ago

Business6 days agoBP names new boss as current CEO leaves after less than two years

-

Tech6 days ago

Tech6 days agoT-Mobile Business Internet and Phone Deals

-

Entertainment1 week ago

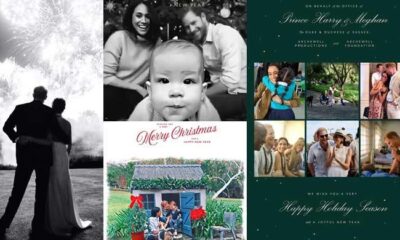

Entertainment1 week agoPrince Harry, Meghan Markle’s 2025 Christmas card: A shift in strategy

-

Sports6 days ago

Sports6 days agoPKF summons meeting after Pakistani player represents India in kabaddi tournament