Business

Disney dominated the 2025 box office. Here’s how it could keep the crown in 2026

Courtesy of Disney Enterprises Inc.

Blue aliens, a family of superheroes and a city of talking animals boosted the Walt Disney Company to the top of the domestic box office in 2025.

Full-year ticket sales in the United States and Canada rose about 4% from 2024 to $9.05 billion. Disney accounted for the highest share of that haul with $2.49 billion in ticket sales, or 27.5%, according to data from Comscore.

It’s closest competitors were Warner Bros. Discovery, which tallied $1.9 billion domestically, or 21%, and Universal, which took in $1.7 billion, or 19.7%. Together, these three studios accounted for nearly 70% of the domestic box office market share.

No other studio surpassed $1 billion in domestic ticket sales or accounted for more than 7% of the total box office haul.

“[Warner Bros., Disney and Universal] have the advantage of having at least two or more distinct and successful sub-brands labels — such as Marvel under Disney, New Line under WB and Illumination under Universal — under their corporate umbrella that enables these studios to dominate at least in terms of the overall box office and percentage of the marketplace that they control,” said Paul Dergarabedian, head of marketplace trends at Comscore.

Disney’s standout performance came on the backs of already popular intellectual property. Four of its films were part of the top 10 highest-grossing domestic releases of the year, including the live-action remake of “Lilo & Stitch,” a sequel to 2016’s “Zootopia,” another entrant in the Marvel Cinematic Universe with “Fantastic Four: First Steps” and a third “Avatar” film.

“Most years at the box office are dominated by known IP and non-original content; films that have the baked in brand name recognition that theoretically gives those films a leg up in terms of marketing and potential box office success,” Dergarabedian said.

In fact, nine of the 10 biggest movies at the domestic box offices were from existing IP. Warner Bros.’ “Sinners” was the only original title to make the list.

“In 2025 there were some big budget originals that did incredibly well … but lest anyone think that trend is going away, 2026 looks to eclipse 2025 in terms of the number of high-profile sequels and known IP on the slate for the year,” Dergarabedian said.

That’s especially true for Disney.

The studio is set to release its first Star Wars film in theaters since 2019 called “The Mandalorian and Grogu” after the popular characters of its “The Mandalorian” series on Disney+; “Toy Story 5” is will hit theaters in June followed by a live-action “Moana” in July; then the hotly anticipated “Avengers: Doomsday” arrives in December.

A new Spider-Man film will also sling into theaters in 2026, but as part of a deal with Sony to have the character as part of Disney’s MCU, Sony keeps the majority of box office profits while Disney gets merchandise sales.

The box office will also get a boost from Warner Bros.’ “Supergirl” and “Dune: Part Three,” Universal’s “Minions 3,” “The Super Mario Galaxy Movie” and “The Odyssey,” Lionsgate’s “Hunger Games: Sunrise on the Reaping” and Sony’s third “Jumanji” film.

“As we look into 2026, there’s plenty of optimism to go around,” said Shawn Robbins, director of analytics at Fandango and founder of Box Office Theory “The slate is packed with top-tier franchises, some fan-driven and others family-oriented, alongside filmmaker-driven tentpoles … plus an inevitable crop of strong or potentially surprising performers out of horror, comedy, indie, and other genres.”

Disclosure: Versant is the parent company of CNBC and Fandango.

Business

Aviva flags potential for Iran conflict to send claims costs rising

The boss of insurer Aviva has cautioned that a lengthy conflict in the Middle East could send the cost of vehicle parts and repairs surging in an echo of the aftermath seen after Russia’s invasion of Ukraine.

Chief executive Amanda Blanc said the group has seen limited claims so far relating to the US-Israel war with Iran, but flagged the potential for claims costs to jump if supply chains are badly disrupted for a long time.

She said: “We have a good case study on this in terms of the Ukraine situation back in 2022 and the impact on the supply chain, which had an inflationary impact on vehicle parts and replacement vehicles.

“Obviously, if this goes on for a prolonged period of time, we would expect that this could have some impact, but to speak about this from an Aviva perspective, we are very well placed to manage that with our supply chain and our owned garage network.”

Ms Blanc added: “We will take action as necessary to make sure we look after our customers and price accordingly for any new inflationary impact.”

She said there had been “very limited” travel claims so far.

Ms Blanc added: “We have had calls from customers asking about whether they should travel and those sorts of things, and we are pointing them to the Foreign Office guidance on that.”

Full-year results from Aviva on Thursday showed annual earnings leaped 25% higher, while the firm also announced it was resuming share buybacks as it continues to benefit from its £3.7 billion takeover of Direct Line.

The group unveiled an earnings haul of £2.2 billion for 2025, up from £1.8 billion in 2024, including a £174 million contribution from Direct Line, helping the group hit its financial targets a year early.

Aviva unveiled a £350 million share buyback after putting these on hold due to the Direct Line deal, which completed last year.

Ms Blanc cheered an “outstanding performance”.

She said: “We have transformed Aviva over the last five years and whilst we have made significant progress, there is so much more to come.”

Artificial intelligence (AI) is also a big area of focus for the firm, according to Ms Blanc.

“We have clear strengths in artificial intelligence which are creating major opportunities to transform claims, underwriting and customer experience,” she said.

Business

South East Water faces £22m fine for supply failures

The firm was unable to cope during high demand, Ofwat says, leading to “immense stress” for customers.

Source link

Business

Middle East heat may ripple across India’s energy supply chain, flags Goldman Sachs – The Times of India

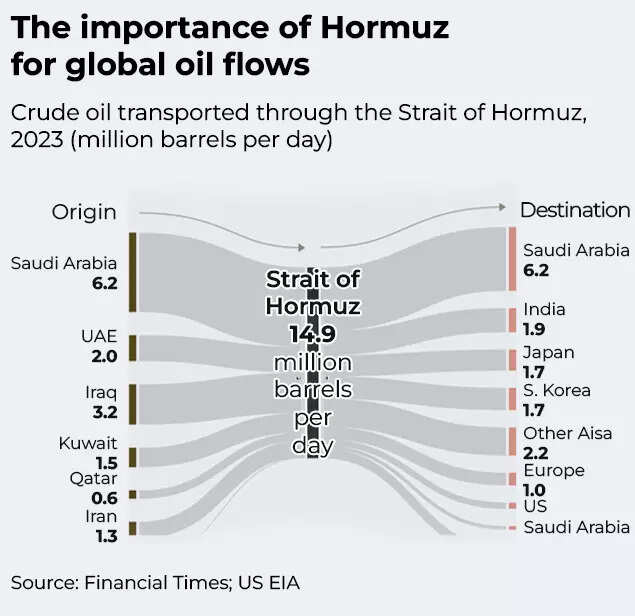

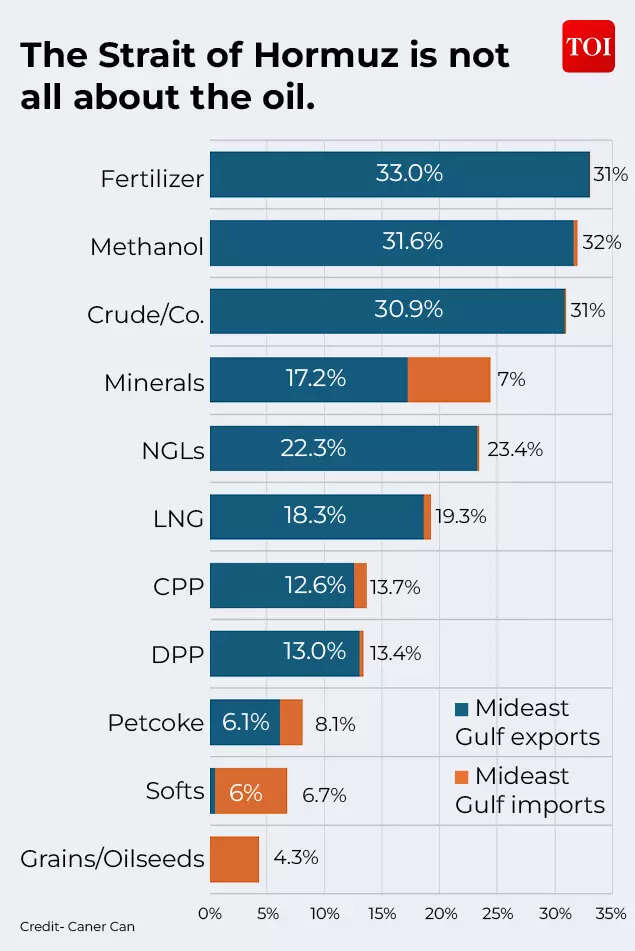

As tensions continue to heat up in the Middle East, concerns are raising about disruptions to one of the world’s most critical energy shipping routes, the Strait of Hormuz. Any disruption could significantly affect major oil-importing countries such as India, as the narrow Strait of Hormuz is central to global energy trade. The strait sees almost 20 million barrels of oil passing through each day, or about a fifth of the world’s consumption, pass through the route. The waterway also carries roughly 19% of global liquefied natural gas (LNG) shipments, making it a crucial corridor for energy-importing economies.A recent report by Goldman Sachs has flagged early signs of stress in the region. The report warned that tanker traffic through the Strait of Hormuz has already begun showing signs of disruption, with shipping firms, oil producers and insurers adopting a cautious approach following reports of damaged vessels in nearby waters.According to the firm, financial markets have already begun factoring in the geopolitical risk. Oil prices currently carry an estimated risk premium of $18-per-barrel, reflecting the potential market impact if energy flows through the Strait of Hormuz were disrupted for about a month.

Even is the oil facilities are not directly damaged, a shutdown of the shipping route could expose a significant portion of global supply. The report estimates that in an event of full closure, about 16 million barrels per day of oil flows could be affected, despite the availability of some pipeline routes designed to bypass the strait.And the risks are not limited to crude oil shipments with almost 80 million tonnes of LNG exports annually, much of it from Qatar, moving through the passage. Any prolonged disruption could tighten gas supply globally and potentially drive European benchmark gas prices back to levels seen during the 2022 energy crisis.

Asian economies stand among the most exposed to such disruptions. Major importers such as China, India, Japan and South Korea depend heavily on oil and LNG shipments that transit through the strategic corridor.While global oil inventories and spare production capacity could help cushion short-term shocks, the report warned that sustained disruption to Gulf shipping routes could trigger sharp volatility in global energy markets and push prices higher across oil, gas and refined fuel products.Market participants and governments are closely watching tanker traffic in the Strait of Hormuz, along with diplomatic and military developments involving the United States, Iran and Gulf nations, to assess whether the current disruptions remain temporary or escalate into a broader energy supply shock.

-

Politics1 week ago

Politics1 week agoWhat are Iran’s ballistic missile capabilities?

-

Business6 days ago

Business6 days agoIndia Us Trade Deal: Fresh look at India-US trade deal? May be ‘rebalanced’ if circumstances change, says Piyush Goyal – The Times of India

-

Business7 days ago

Business7 days agoAttock Cement’s acquisition approved | The Express Tribune

-

Politics1 week ago

Politics1 week agoUS arrests ex-Air Force pilot for ‘training’ Chinese military

-

Business1 week ago

Business1 week agoHouseholds set for lower energy bills amid price cap shake-up

-

Fashion7 days ago

Fashion7 days agoPolicy easing drives Argentina’s garment import surge in 2025

-

Sports6 days ago

Sports6 days agoLPGA legend shares her feelings about US women’s Olympic wins: ‘Gets me really emotional’

-

Fashion6 days ago

Fashion6 days agoTexwin Spinning showcasing premium cotton yarn range at VIATT 2026