Business

Eli Lilly’s obesity pill remains a viable rival to Novo’s oral Wegovy despite data that underwhelmed investors

A sign with the company logo sits outside of the headquarters of Eli Lilly in Indianapolis, Indiana, on March 17, 2024.

Scott Olson | Getty Images

Eli Lilly‘s stock is still recovering after the drugmaker released trial data earlier this month on its closely watched obesity pill that underwhelmed Wall Street.

In a key late-stage trial, Eli Lilly’s pill, orforglipron, caused less weight loss and had higher side effects than what analysts were expecting. The pill’s efficacy also appeared to come in slightly below that of Novo Nordisk‘s oral semaglutide for obesity, which showed strong data in a separate study.

Shares of Eli Lilly fell about 13% on the day the trial results were released, although they’re up about 12% since then.

But some analysts say Eli Lilly’s daily pill, if approved, could still be a viable competitor in the weight loss drug space — even if it will likely be second to enter the market. It’s a highly lucrative area that is eager for more convenient options that could ease the supply shortfalls and access hurdles created by the pricey weekly injections currently dominating it.

Analysts note that Eli Lilly’s pill could have a few advantages over the daily oral version of Novo Nordisk’s weight loss drug semaglutide, which is on track to become the first needle-free alternative for obesity to win approval in the U.S. later this year. Eli Lilly hopes to launch its pill globally “this time next year,” CEO David Ricks told CNBC in early August.

Both drugs work by mimicking a gut hormone called GLP-1 to suppress appetite and regulate blood sugar. But while Novo Nordisk’s pill is a peptide medication, orforglipron is a small-molecule drug.

That means Eli Lilly’s pill is absorbed more easily in the body and doesn’t require dietary restrictions like Novo Nordisk’s does. Orforglipron will also be easier to manufacture at scale, which is crucial as demand for obesity and diabetes injections outpaces supply.

Neither company has released prices for its respective pill, but some analysts said Eli Lilly’s drug could potentially have a lower price than Novo Nordisk’s pill. That would be a notable edge, as many health plans in the U.S. still don’t cover obesity treatments.

“It’s a little bit of an apples and oranges comparison because Novo Nordisk could have difficulty manufacturing enough of the product, given the high cost and requirements to manufacture oral semaglutide,” Leerink Partners analyst David Risinger said in an interview.

“Whereas Lilly plans to blanket the world with orforglipron, and very quickly it will generate dramatically more sales,” he continued. “It can launch globally in an extraordinary manner with lower prices and with no food intake consideration.”

Goldman Sachs analysts seem to agree, based on a note in August. They forecast daily oral pills will capture 24% share — or around $22 billion — of the 2030 global weight loss drug market, which they expect to be worth $95 billion.

The Goldman analysts said they expect Eli Lilly’s pill to have a 60% share — or roughly $13.6 billion — of the daily oral segment of the market in 2030. They expect Novo Nordisk’s oral semaglutide to have a 21% share — or around $4 billion — of that segment. The remaining 19% slice will go to other emerging pills, the analysts said.

The race to develop a more convenient obesity pill has been fraught, as companies such as Pfizer have had to scrap previous contenders and bring forward new ones. Novo Nordisk and Eli Lilly are also exploring other experimental oral drugs, along with a slate of other companies such as Viking Therapeutics, Structure Therapeutics, AstraZeneca and Roche.

In a statement, Novo Nordisk CEO Mike Doustar said “we strongly believe in the efficacy” of the oral drug. The Danish company added it will be “laser-focused on getting this product to patients without supply constraints” in the U.S.

Dr. Mihail “Misha” Zilbermint, director of endocrine hospitalists at Johns Hopkins Community Physicians, said it’s hard to crown a winner between Eli Lilly and Novo Nordisk without knowing how their respective pills will be priced and whether insurance will cover them.

“I think both of the drugs are going to be gamechangers,” he said. “When it comes to which company is going to win the game — cost is the biggest issue.”

Weight loss, side effect comparisons

It’s difficult to directly compare the results of separate clinical trials, especially as investors wait for Eli Lilly and Novo Nordisk to release the full data from their phase three studies.

Eli Lilly’s ATTAIN-1 trial also followed 3,000 patients, while Novo Nordisk’s OASIS 4 study evaluated a much smaller group of roughly 300. There are currently no studies directly comparing the two drugs, a Novo Nordisk spokesperson said.

But Novo Nordisk’s oral semaglutide appears to cause a greater level of weight loss than Eli Lilly’s pill based on the available data, said BMO Capital Markets analyst Evan Seigerman.

In the trial, the highest dose of Eli Lilly’s pill helped patients lose 12.4% of their body weight on average at 72 weeks. The pill’s weight loss was 11.2% when analyzing all patients regardless of discontinuations.

Wall Street had hoped Eli Lilly’s pill would generate weight loss of around 15%, the same level as Novo Nordisk’s blockbuster weight loss injection Wegovy. Semaglutide is the active ingredient in Wegovy and its diabetes counterpart Ozempic.

Novo Nordisk flags flutter outside its office in Bagsvaerd, on the outskirts of Copenhagen, Denmark, on July 14, 2025.

Tom Little | Reuters

Meanwhile, the 25-milligram dose of Novo Nordisk’s oral semaglutide helped patients lose up to 16.6% of their weight on average at 64 weeks, according to results from the trial presented at a medical conference in 2024. That weight loss was 13.6% when the company analyzed all patients regardless of whether they stopped the drug.

A Novo Nordisk spokesperson added that 20% of weight loss was observed in nearly one-third of patients in the trial.

Still, the slightly lower efficacy of Eli Lilly’s pill may not be significant enough to deter patients from taking it.

“For many patients, 12% is a really great number,” said Seigerman. “There’s definitely a market there” for orforglipron.

In a note earlier this month, Bank of America analysts shared a similar sentiment.

“Yes, weight loss fell a bit short, but ask 100 prescribers whether this new data will really make a difference in who they’d put on orforglipron, and our belief is the vast majority would say, ‘not really,'” they wrote, referring to Eli Lilly’s trial data.

Some investors raised concerns about the side effects and discontinuation rates in the trial of Eli Lilly’s pill. But Seigerman said the drug’s tolerability data — how well patients tolerate it — appears to be relatively in line with that of Novo Nordisk’s oral semaglutide.

About 10.3% of patients who took the highest dose of Eli Lilly’s pill — 36 milligrams — discontinued treatment due to side effects, compared with around 2.6% of those who took a placebo.

Those side effects were mainly gastrointestinal, such as nausea and vomiting, and mild to moderate in severity. An estimated 24% of those who took the highest dose of Eli Lilly’s pill reported vomiting, while 33.7% had nausea.

Leerink’s Risinger said he is watching to see how persistent those gastrointestinal issues are once Eli Lilly presents the full data.

The side effects in the trial on Novo Nordisk’s pill were mostly gastrointestinal-related: 30.9% of those who took oral semaglutide reported vomiting and 46.6% reported nausea, according to the trial results.

Johns Hopkins’ Zilbermint said it’s difficult for him to decide which one has a better safety and tolerability profile based on the available data.

Meanwhile, Seigerman pointed to a different factor “that will also matter a lot”: dietary requirements.

Food requirements, manufacturing, price

Unlike Eli Lilly’s pill, patients need to take Novo Nordisk’s oral semaglutide in the morning on an empty stomach with no more than four ounces of plain water. They’re instructed to wait 30 minutes before eating, drinking or taking other oral medicines.

Seigerman said that could be a hurdle for some patients.

For example, “if you’re a parent with kids and you have to take this drug and wait half an hour before you can drink your coffee, you’re going to drive yourself crazy, especially if you have to take this every day,” he said. “I try to think about the real-world use of these drugs in a market like this. It’s going to matter.”

Leerink’s Risinger said oral semaglutide will also be “extremely expensive to manufacture” since it is a peptide medication, and “is likely going to have to be priced higher than orforlipgron.”

A Novo Nordisk spokesperson said the pill will be made mostly in the U.S., and the company is excited about the potential the pill “provides millions of Americans living with obesity.”

“Currently, all typical launch readiness activities [for the pill] are fully underway and building momentum,” the spokesperson said. They added that over the past decade, the company has invested $24 billion in the U.S. to expand manufacturing capacity and fuel research and development. That includes investments aimed at increasing manufacturing of active pharmaceutical ingredients and capacity for the final stages of production for both current and future injectable and oral products.

Small molecules are chemically simpler and easier to produce at scale, making them generally cheaper for companies to formulate. But it is still unclear how Eli Lilly will price orforglipron.

During an earnings call in August, Eli Lilly’s Ricks said the pricing will be based on the value orforglipron brings, considering health-care savings and the comorbidities it can address.

In the note earlier this month, Goldman Sachs analysts said they expect the pill to be “priced at parity” to Eli Lilly’s tirzepatide, the active ingredient in the company’s obesity injection Zepbound and diabetes counterpart Mounjaro, which list for just over $1,000 for a month’s supply.

“They should be cheaper than injections because they are easier to produce. But it does not mean they will be cheaper,” Johns Hopkins’ Zilbermint said. “We just don’t know — for example, we don’t know how much went into research and development.”

Seigerman said commercialization strategies will also be key when the pills compete on the market.

He questioned whether Novo Nordisk will lean into the deal it recently struck with CVS‘s pharmacy benefit manager, Caremark. Under the deal, Caremark started to prioritize Novo Nordisk’s Wegovy on its standard formularies on July 1, making that weekly injection the preferred GLP-1 drug for obesity over Zepbound.

But it is unclear whether oral semaglutide could receive a similar preferential status.

Seigerman also questioned whether Eli Lilly will offer orforglipron through its direct-to-consumer pharmacy, LillyDirect. That offering bypasses insurers and pharmacy benefit managers, allowing patients to directly purchase Zepbound and some of Eli Lilly’s other drugs from the company.

Seigerman said he expects “a lot of nuances in the go-to-market campaign for these drugs,” adding “that’s going to matter.”

Other competitors trail behind

Other obesity pills are in earlier stages of development, making it difficult to directly compare them to the drugs from Eli Lilly and Novo Nordisk without longer and larger trials.

But so far, some experts think they pale in comparison.

For example, Viking Therapeutics on Tuesday released mid-stage trial data that disappointed investors, sending its stock down as much as 40%.

Jared Holz, Mizuho health care equity strategist, said in an email Tuesday that the results on Viking’s drug “look inferior” to those of Eli Lilly’s pill “on almost all metrics.”

Viking’s once-daily pill helped patients lose up to 12.2% of their weight at around three months, with no plateau, which means patients could lose even more in a longer-term study.

Holz pointed to the high rate of patients who discontinued Viking’s drug for any reason over 13 weeks, which was around 28%. Meanwhile, around a quarter of people discontinued Eli Lilly’s pill, orforglipron, for any reason over 72 weeks.

That’s “a much longer trial and therefore [Lilly] looks far better head-to-head,” Holz said.

Business

Shop price inflation eases but food costs still 3.5% up on a year ago

Shop price inflation eased in February but consumers are still paying 3.5% more for food than a year ago, figures show.

Overall shop inflation fell slightly to 1.1% from January’s 1.5%, in line with the three-month average of 1.1%, as fierce competition between retailers kept price rises in check and customers benefited from promotions across health, beauty and fashion, according to the British Retail Consortium (BRC) and NIQ.

Prices of products other than food were down 0.1% year on year, a significant drop from January’s growth of 0.3%.

Overall food inflation fell slightly to 3.5% from 3.9% in January, while fresh food prices remained 4.3% higher than last February, a slight drop from January’s 4.4% and above the three-month average of 4.2%.

However falling global costs pushed ambient food inflation down to 2.3% – its lowest level in four years and a significant fall from January’s 3.1%.

BRC chief executive Helen Dickinson said: “Households got some welcome relief in February as shop price inflation eased.

“While the direction of travel is promising, prices are still rising, and many consumers remain under pressure.”

Mike Watkins, head of retailer and business insight at NIQ, said: “Since the start of the year, we have seen some competitive pricing across both the food and non-food channels which is helping to bring down inflation.

“Whilst the inclement weather and weak sentiment is making consumer demand rather unpredictable for retailers, at least shoppers are now seeing some of their cost-of-living pressures start to ease.”

Business

Chancellor Rachel Reeves urged to scrap fuel duty hike amid oil price fears

The Chancellor has been urged to scrap the proposed hike in fuel duty as concerns have been raised about the conflict in the Middle East.

Rachel Reeves announced last year that the long-held discount in fuel duty would be scrapped from September, with a 1p hike followed by two increases of 2p each in subsequent years.

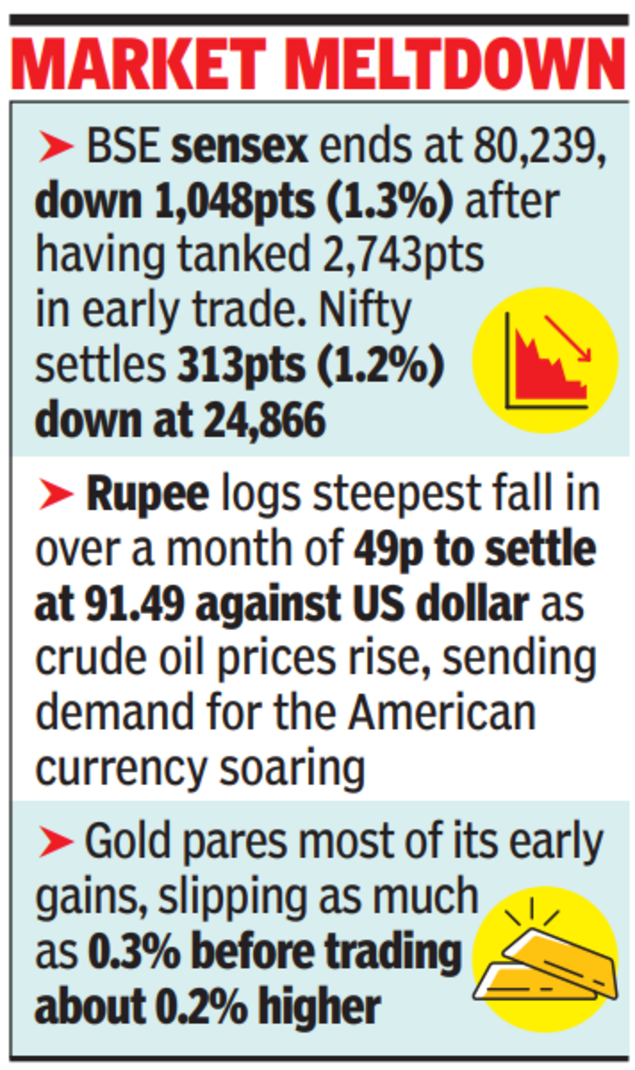

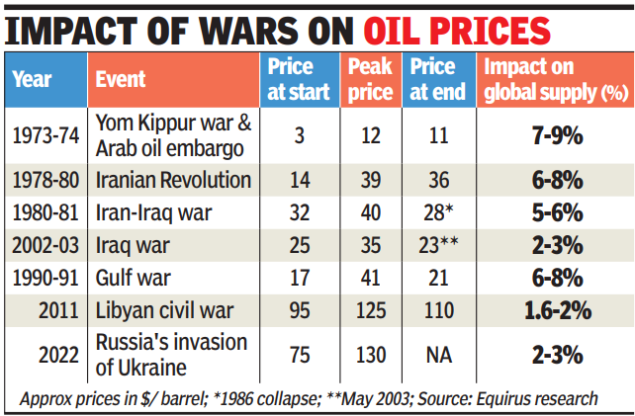

But following the US and Israeli attacks on Iran at the weekend – which killed the country’s Supreme Leader Ayatollah Ali Khamenei – concerns have been raised about the impact of oil price hikes which could hit consumers at the pumps.

Following the attack, the price of oil jumped to 80 US dollars a barrel, with some analysts suggesting it could rise above 100 dollars.

Speaking ahead of the spring statement, SNP economy spokesman Dave Doogan said: ““With real fears that prices at the pump are now set to soar because of the situation in the Middle East – instead of stubbornly doubling down, the Chancellor needs to scrap her price hike plans before motorists face a devastating double hit.

“Oil prices are already spiking – the last thing motorists and businesses now need is another damaging tax hike from the Labour Party.

“The Chancellor needs to see sense, recognise what is unfolding globally, and immediately scrap her plans to hike prices at pumps.

“Everyone knows that Keir Starmer’s Labour Party has broken their promise to cut energy bills by £300 – it would be another slap in the face for families if Labour made the cost-of-living crisis even worse with a plan that will inevitably increase prices.

“After 14 U-turns from this chaotic Labour Government – scrapping their plans to hike fuel duty is one U-turn motorists, businesses and families right across Scotland would actually welcome.”

A spokeswoman for the Treasury said: “We have extended the 5p fuel duty cut from this month to the end of August to support drivers across the country.”

Business

West Asia conflict: Govt may ask companies to cut exports, increase auto fuel, LPG supplies – The Times of India

NEW DELHI: Amid fears of a shortage in crude supplies, govt is looking to nudge refiners to divert more auto fuel and LPG to the domestic market by cutting on exports and also increase cooking gas production so that there is no disruption in local supplies.While govt and oil companies insisted there’s no shortage, refiners are looking at alternate sources to partly compensate for crude coming from war-hit West Asia.

The tension has led to a spike in oil and gas prices, and given India’s dependence on imports, inflating the import bill and stoking inflationary pressures. Officials, however, said retail fuel prices may not rise immediately, as oil marketing companies follow a calibrated approach — absorbing losses when global prices are high and recouping them when prices soften. Retail petrol and diesel prices have remained unchanged since April 2022.Mantri meets oil cos to assess availability of crude and gasOn a day when Iranian drones damaged part of Saudi Aramco refinery and Qatar Energy’s facilities, the world’s largest LNG producer, announced an export pause, petroleum minister Hardeep Singh Puri and his team of officials met oil companies on Monday to assess the availability of crude and gas. “We are continuously monitoring the evolving situation, and all steps will be taken to ensure availability and affordability of major petroleum products in the country,” the oil ministry said in a post on X.India imports nearly 90% of its crude requirement. It also meets 60-65% of its LPG demand and about 60% of its LNG needs through imports, largely from West Asia, with shipments routed via Strait of Hormuz, which risks being choked due to the war.

According to the International Energy Agency, in 2023, 5.9% of the country’s production was being exported. Between April and Dec 2025, India exported petroleum products worth nearly $330 billion, with the Netherlands, UAE, the US, Singapore, Australia and China being the main destinations. In 2024, it also exported petroleum gas worth $454 million, mostly to Nepal, China, and Myanmar. The Reliance refinery in Jamnagar is the largest exporter in the country.An oil company executive said refiners are already in contact with traders to tie up capacities amid fears of the blockade of Strait of Hormuz. By Monday, the global market had caught the jitters from Qatar’s decision to suspend gas shipments.An oil executive said while disruption could cause difficulties in the immediate term, Indian players had a wide portfolio that they can tap for LNG, including the US, with vessels being routed through the Suez Canal.“Even if there is a force majeure, we have other sources of supply, which we can tap. Besides, no one is going to stop supplies indefinitely,” the executive said. While oil and gas prices rose Monday, the focus is on ensuring that supply lines remain open.

-

Business6 days ago

Business6 days agoHouseholds set for lower energy bills amid price cap shake-up

-

Politics5 days ago

Politics5 days agoWhat are Iran’s ballistic missile capabilities?

-

Entertainment1 week ago

Entertainment1 week agoTalking minerals and megawatts

-

Sports1 week ago

Sports1 week agoEileen Gu comments on Alysa Liu’s historic gold medal

-

Business6 days ago

Business6 days agoLucid widely misses earnings expectations, forecasts continued EV growth in 2026

-

Sports5 days ago

Sports5 days agoSri Lanka’s Shanaka says constant criticism has affected players’ mental health

-

Tech6 days ago

Tech6 days agoHere’s What a Google Subpoena Response Looks Like, Courtesy of the Epstein Files

-

Business6 days ago

Business6 days agoIncome Tax Draft Rules 2026: Key Changes On How And When Pan Card Will Be Required?