Business

Energy standing charge plans could backfire, MPs told

Kevin PeacheyCost of living correspondent and

Joshua NevettPolitical reporter

Getty Images

Getty ImagesEnergy bosses have given a cool reception to regulator Ofgem’s plan to overhaul standing charges.

Under Ofgem’s plans announced in September, all suppliers in England, Scotland and Wales will offer at least one tariff in which standing charges are lower but customers then pay more for each unit of energy used.

But appearing before a committee of MPs, the chief executives and senior management of the UK’s biggest suppliers questioned the outcome of such a move.

Some called for the abolition of standing charges, while others say the proposals would make the issue worse for customers.

Rachel Fletcher, director of regulation and economics at the UK’s largest supplier Octopus Energy, said: “I think a lot of the concern about standing charges is just that people can’t afford to pay their bill.

“Where Ofgem is going is not going to solve any problems, it could make things worse.”

The bosses, giving evidence to the Energy Security and Net Zero Committee, pointed out that the major problem for some customers is that the cost of energy was unaffordable, and some could make the wrong choice when choosing tariffs with low standing charges.

Many called for a social tariff, in which those who are on low incomes receive a discount which is likely to be paid for by other billpayers.

Energy UK, which represents suppliers, recently called for “enduring” government support for those struggling to pay their bills.

Ministers have pointed to the extension of the Warm Home Discount to those on benefits, which knocks £150 off winter bills for one in five households. It is funded by a rise for all billpayers.

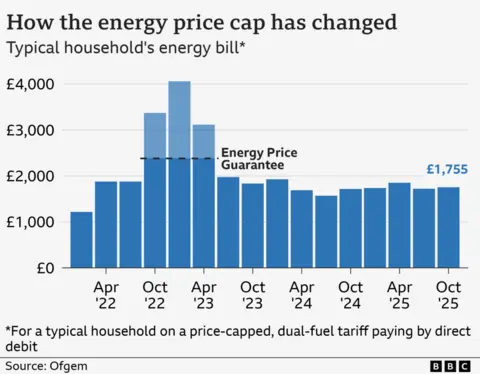

Ofgem’s price cap, which sets a maximum price per unit of energy for millions of people in England, Scotland and Wales who are on variable tariffs, rose by 2% in October.

The amount owed to energy suppliers by customers has already increased to a new record high of £4.4bn.

The data, which covers the period from April to June, shows that more than one million households have no arrangement to repay their debt, also a record high.

At the hearing, Simone Rossi, chief executive of EDF UK, was among the bosses who told MPs asking about the climate challenge that the price of electricity compared with a gas was a disincentive to customers wanting to go electric. It was also expensive in the UK compared with other countries.

On Tuesday, Energy Secretary Ed Miliband told the BBC shifting green levies from electricity bills to gas was one option being considered to lower energy costs for households.

But Miliband said no decisions had been made and insisted he would not change energy policy costs “in a way that damages the finances of ordinary people”.

While rebalancing energy policy costs could lower electricity bills, it could increase them for householders using gas boilers.

When asked if the rebalancing of energy bills was being reviewed by the UK government, Miliband said: “We’ve always said we will look at ways of lowering bills for people and that’s obviously one of the options.

“I just want to say on that, we will only ever do that in a way that’s fair and genuinely reduces bills for people.”

‘Fair’ bills

Policy costs are effectively government taxes used to fund environmental and social schemes, such as subsidies for renewables.

These costs made up about 16% of an electricity bill and 6% of a gas bill last year, according to research by the charity Nesta.

The Climate Change Committee has long recommended removing policy costs from electricity bills to help people feel the benefits of net-zero transition.

The government’s climate adviser said the move would make switching to electric technologies, such as heat pumps, cheaper and encourage take-up.

One option – backed by Energy UK – is shifting policy costs from electricity bills to gas.

Energy UK analysis shows that over 15 years, households using an air source heat pump, which is an electrically powered system, could save up to £7,000, compared to those with gas boilers, if energy bills were fully rebalanced.

But such a move would result in an increase in bills for households that use gas for heating.

When asked if that was one option the government was considering, Miliband said: “I’m not going to get into any of the detail of this.

“All I am saying is I’ve always said I’m cautious about this issue because fairness is my watchword.

“So if we can do it in a way that’s fair, that’s obviously something we’re seriously looking at.

“But no decisions have been made on that. I’m not going to do it in a way that damages the finances of ordinary people.”

At the committee, Chris O’Shea, chief executive of Centrica, said this would be a subsidy from the poor to the rich.

Business

Serial rail fare evader faces jail over 112 unpaid tickets

One of Britain’s most prolific rail fare dodgers could face jail after admitting dozens of travel offences.

Charles Brohiri, 29, pleaded guilty to travelling without buying a ticket a total of 112 times over a two-year period, Westminster Magistrates’ Court heard.

He could be ordered to pay more than £18,000 in unpaid fares and legal costs, the court was told.

He will be sentenced next month.

District Judge Nina Tempia warned Brohiri “could face a custodial sentence because of the number of offences he has committed”.

He pleaded guilty to 76 offences on Thursday.

It came after he was convicted in his absence of 36 charges at a previous hearing.

During Thursday’s hearing, Judge Tempia dismissed a bid by Brohiri’s lawyers to have the 36 convictions overturned.

They had argued the prosecutions were unlawful because they had not been brought by a qualified legal professional.

But Judge Tempia rejected the argument, saying there had been “no abuse of this court’s process”.

Business

John Swinney under fire over ‘smallest tax cut in history’ after Scottish Budget

John Swinney has been pressed over whether this week’s Scottish Budget gives some workers the “smallest tax cut in history” – with Tory leader Russell Findlay branding the reduction “miserly” and “insulting”.

The Scottish Conservative leader challenged the First Minister after Tuesday’s Holyrood Budget effectively cut taxes for lower earners, by increasing the threshold for the basic and intermediate bands of income tax.

But Mr Findlay said that would leave workers at most £31.75 a year better off – saying this amounts to a saving of just £61p a week

“That wouldn’t even buy you a bag of peanuts,” the Scottish Tory leader said.

“John Swinney’s Budget might even have broken a world record, because a Scottish Government tax adviser says it ‘maybe the smallest tax cut in history’.”

Raising the “miserly cut” at First Minister’s Questions in the Scottish Parliament, Mr Findlay demanded to know if the SNP leader believed his “insulting tax cut will actually help Scotland’s struggling households”.

The attack came as the Tory accused the SNP government of increasing taxes on higher earners, with its freeze on higher income tax thresholds, which will pull more Scots into these brackets.

This is needed to pay for the “SNP’s out of control, unaffordable benefits bill”, the Conservative added.

Mr Findlay said: “The Scottish Conservatives will not back and cannot back a Budget that does nothing to help Scotland’s workers and businesses.

“It hammers people with higher taxes to fund a bloated benefits system.”

Hitting out at Labour – whose leader Anas Sarwar has already declared they will not block the government’s Budget – Mr Findlay said: “It is absolutely mind-blowing that Labour and other so-called opposition parties will let this SNP boorach of a budget pass.

“Don’t the people of Scotland deserve lower taxes, fairer benefits and a government focused on economic growth?”

Mr Swinney said the Budget “delivers on the priorities of the people of Scotland” by “strengthening our National Health Service and supporting people and businesses with the challenges of the cost of living”.

He insisted income tax decisions in the Budget would mean that in 2026-27 “55% of Scottish taxpayers are now expected to pay less income tax than if they lived in England”.

The First Minister went on to say that showed “the people of Scotland have a Government that is on their side”.

Referring to polls putting his party on course to win the Holyrood elections in May, the SNP leader added that “all the current indications show the people of Scotland want to have this Government here for the long term”.

Benefits funding is “keeping children out of poverty”, he told MSPs, adding the Budget contained a “range of measures” that would build on existing support.

The First Minister said: “What that is a demonstration of is a Government that is on the side of the people of Scotland and I am proud of the measures we set out in the Budget on Tuesday.”

Meanwhile he said the Tories wanted to make tax cuts that would cost £1 billion, with “not a scrap of detail about how that would be delivered”.

With the weekly leaders’ question time clash coming less than 48 hours after the draft 2026-27 Budget was unveiled, the First Minister also faced questions from Scottish Labour’s Anas Sarwar, who insisted that the proposals “lacks ambition for Scotland”.

Pressing his SNP rival, the Scottish Labour leader said: “While he brags about his £6 a year tax cut for the lowest paid, one million Scots including nurses, teachers and police officers face being forced to pay more.

“Even his own tax adviser says this is a political stunt. So why does John Swinney believe that someone earning £33,500 has the broadest shoulders and therefore should pay more tax in Scotland?”

Mr Swinney, however, said that many public sector workers would be better off in Scotland.

He told the Scottish Labour leader: “A band six nurse at the bottom of the scale will take home an additional £1,994 after tax compared to the same band in England.

“A qualified teacher at the bottom of the band will take home £6,365 more after tax in Scotland than the equivalent in England. There are the facts for Mr Sarwar.”

Business

BP cautions over ‘weak’ oil trading and reveals up to £3.7bn in write-downs

BP has warned it expects to book up to five billion dollars (£3.7 billion) in write-downs across its gas and low-carbon energy division as it also said oil trading had been weak in its final quarter.

The oil giant joined FTSE 100 rival Shell, after it also last week cautioned over a weaker performance from trading, which comes amid a drop in the cost of crude.

BP said Brent crude prices averaged 63.73 dollars per barrel in the fourth quarter of last year compared with 69.13 dollars a barrel in the previous three months.

Oil prices have slumped in recent weeks, partly driven lower due to US President Donald Trump’s move to oust and detain Venezuela’s leader and lay claim to crude in the region, leading to fears of a supply glut.

In its update ahead of full-year results, BP also said it expects to book a four billion dollar (£3 billion) to five billion dollar (£3.7 billion) impairment in its so-called transition businesses, largely relating to its gas and low-carbon energy division.

But it said further progress had been made in slashing debts, with its net debt falling to between 22 billion and 23 billion dollars (£16.4 billion to £17.1 billion) at the end of 2025, down from 26.1 billion dollars (£19.4 billion) at the end of September.

It comes after the firm’s surprise move last month to appoint Woodside Energy boss Meg O’Neill as its new chief executive as Murray Auchincloss stepped down after less than two years in the role.

Ms O’Neill will start in the role on April 1, with Carol Howle, current executive vice president of supply, trading and shipping at BP, acting as chief executive on an interim basis until the new boss joins.

Ms O’Neill’s appointment has made history as she will become the first woman to run BP – and also the first to head up a top five global oil company – as well as being the first ever outsider to take on the post at BP.

Shares in BP fell 1% in morning trading on Wednesday after the latest update.

-

Politics1 week ago

Politics1 week agoUK says provided assistance in US-led tanker seizure

-

Entertainment1 week ago

Entertainment1 week agoDoes new US food pyramid put too much steak on your plate?

-

Entertainment1 week ago

Entertainment1 week agoWhy did Nick Reiner’s lawyer Alan Jackson withdraw from case?

-

Business1 week ago

Business1 week agoTrump moves to ban home purchases by institutional investors

-

Sports5 days ago

Sports5 days agoClock is ticking for Frank at Spurs, with dwindling evidence he deserves extra time

-

Sports1 week ago

Sports1 week agoPGA of America CEO steps down after one year to take care of mother and mother-in-law

-

Business1 week ago

Business1 week agoBulls dominate as KSE-100 breaks past 186,000 mark – SUCH TV

-

Sports6 days ago

Commanders go young, promote David Blough to be offensive coordinator