Business

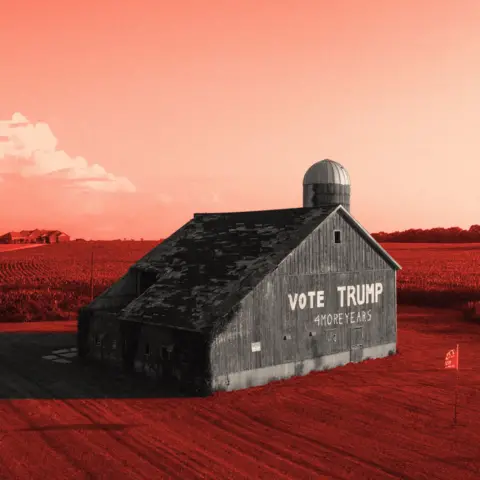

Farmers are being squeezed – it’s testing their loyalty to Trump

Luke MintzBBC News and

Anna JonesPresenter of Corn Belt People

BBC

BBCOn a scorchingly hot day in the American Midwest, Tim Maxwell is voicing his fears about the future of farming.

The 65-year-old has worked the fields since he was a teenager. He now owns a grain and hog farm near Moscow, Iowa – but he’s unsure about its prospects.

“I’m in a little bit of a worried place,” says Mr Maxwell, who wears a baseball cap bearing the logo of a corn company.

He is concerned that American farmers aren’t able to sell their crops to international markets in the way they could in previous years, in part because of the fallout from President Trump’s tariffs.

“Our yields, crops and weather are pretty good – but our [interest from] markets right now is on a low,” he says. “It’s going to put stress on some farmers.”

Bloomberg via Getty Images

Bloomberg via Getty ImagesHis fears are not unique. US agricultural groups warn that American farmers are facing widespread difficulty this year, mostly due to economic tensions with China. Since April, the two countries have been locked in a trade war, causing a sharp fall in the number of Chinese orders for American crops.

American farmers are wounded as a result, economists say. The number of small business bankruptcies filed by farmers has reached a five-year high, according to data compiled by Bloomberg in July.

With all this economic pain, rural areas could well have turned against Trump. But that doesn’t seem to be happening.

Rural Americans were one of the president’s most loyal voting blocs in last year’s election, when he won the group by 40 percentage points over Kamala Harris, beating his own margins in 2020 and 2016, according to Pew Research analysis.

Polling experts say that in the countryside, he is still broadly popular.

Mr Maxwell says he is sticking with Trump, despite his own financial worries. “Our president told us it was going to take time to get all these tariffs in place,” he says.

“I am going to be patient. I believe in our president.”

So why do so many farmers and other rural Americans broadly continue to back Trump even while feeling an economic squeeze that is driven in part by tariffs – the president’s signature policy?

Farmers on a ‘trade and financial precipice’

If you want a window into rural America, the Iowa State Fair is a good start. The agricultural show attracts more than one million visitors over 10 days.

There is candy floss; deep-fried hot dogs on a stick for $7 (£5) – known as “corn dogs”; an antique tractor show; a competition for the biggest boar.

But when the BBC visited last month, there was another topic of conversation: tariffs.

“A lot of people say he’s just using tariffs as a bargaining chip, as a bluff,” says Gil Gullickson, who owns a farm in South Dakota and edits an agriculture magazine.

“But I can say: history proves that tariffs don’t end well.”

In April, what he termed “liberation day”, Trump imposed sweeping tariffs on most of the world, including a 145% tariff on China.

In response, China put a retaliatory 125% tariff on American goods – a blow to farmers in the American Midwest, sometimes known as the “corn belt”, many of whom sell crops to China.

Last year Chinese companies bought $12.7bn (£9.4bn) worth of soybeans from America, mostly to feed their livestock.

September is harvest season, and the American Soybean Association (ASA) has warned that soybean orders from China are way below where they should be at this point in the year.

Tariffs have fluctuated dramatically since they were introduced – and the uncertainty is proving tough for farmers, says Christopher Wolf, a professor of agricultural economics at Cornell University.

“China is just so big that when they buy things, it matters – and when they don’t, it matters.”

The cost of fertiliser has rocketed, too – partly because of trade disputes with Canada, which has raised the cost of potash, a salt imported from Canada by American farmers and used in fertiliser.

Jon Tester, a former Democrat Senator of Montana, who is a third-generation farmer, told a US news station earlier this month: “With all these tariffs the president’s put on, it’s interrupted our supply chain… it’s increased the cost of new equipment… and because of the trade and tariffs, a lot of customers have said to heck with the United States…

“The people who are new to agriculture, those young farmers who haven’t saved money for times like this, they’re going to be in trouble and a lot of those folks are going to go broke.

“And if this continues, a lot of folks like me are going to go broke too.”

American farmers already suffer from high levels of stress. They are more than three times more likely than average to die by suicide, according to a paper by a charity, the National Rural Health Association, which analysed a period before Trump’s presidency.

In a letter to the White House, Caleb Ragland, president of the ASA, warned of a tipping point: “US soybean farmers are standing at a trade and financial precipice.”

Trump: ‘Our farmers are going to have a field day’

Supporters of President Trump say that his tariffs will help American farmers in the long run, by forcing countries like China to come to the negotiating table and agree new deals with the US over agriculture.

And they point to other ways this White House has helped farmers. Over the summer, as part of Trump’s tax and spend bill, his administration expanded federal subsidies for farmers by $60bn (£44bn), and boosted funding for federal crop insurance.

In his annual speech to Congress in March, Trump warned farmers of a “little bit of an adjustment period” following the tariffs, adding: “Our farmers are going to have a field day… to our farmers, have a lot of fun, I love you.”

Getty Images

Getty ImagesSid Miller, commissioner of the Texas Department of Agriculture, is among those who have praised Trump for his “vital support”.

“We finally have an administration that is prioritising farmers and ranchers,” he wrote in a statement earlier this year. “They advocate for farmers, challenge China … and ensure America’s producers are receiving fair treatment.”

And it is possible the president’s tariff strategy could eventually work, according to Michael Langemeier, a professor of agricultural economics at Purdue University.

But he also worries that uncertainty is inflicting long-term damage. “Your trading partner doesn’t know exactly what your position’s going to be next year, because it seems like we’re changing the goalposts.

“That is a problem.”

Tariffs will make us great again

There’s an old adage in American politics that says people “vote with their pocketbooks” – and turn against politicians if they appear to harm their finances.

Yet despite financial pressures, the rural Americans we spoke to are firmly sticking with Trump.

Experts say they haven’t seen any evidence of meaningful change in support among rural voters since last year. A survey by Pew last month found that 53% of rural Americans approve of the job Trump is doing, far higher than the 38% figure for the country as a whole.

Though a survey by ActiVote earlier this month did find a small decline in Trump’s approval among rural voters from 59% in August to 54% in September. Analysts warn not to pay too much attention to those shifts, however, because the number of rural voters included in those polls is so small.

“The data I’ve seen suggests Trump is still heavily supported in rural communities,” says Michael Shepherd, a political science professor at the University of Michigan who focuses on rural politics.

For some farmers at the state fair, the explanation is simple: they believe the US president when he tells them that tariffs will help them in the long run.

“We think the tariffs eventually will make us great again,” says John Maxwell, a dairy farmer and cheese producer from Iowa.

“We were giving China a lot, and [previously] we paid tariffs when we sold to them. Let’s make it fair. What’s good for the goose is good for the other goose.”

Some may also hold onto hope that the president will bail farmers out. During Trump’s first term he gave farmers a $28bn (£20.7bn) grant amid a tariff dispute with China.

A case of selective blame attribution?

For Nicholas Jacobs, a politics professor at Colby College and author of The Rural Voter, there’s a deeper reason at play.

“It’s easy for an outsider to ask, ‘Why the hell are you still with this guy?'” he says. “But you have to understand that across rural America, the move towards Republicans long predates Donald Trump.”

Starting in the 1980s, he says, rural Americans started to feel alienated and left behind while cities benefited from globalisation and technological change.

What he calls a “rural identity” formed, based on a shared grievance and an opposition to urban liberals. The Republicans seemed like their natural champion, while he says the Democrats became “the party of the elite, technocrats, the well-educated, the urbane”.

Bloomberg via Getty Images

Bloomberg via Getty ImagesSome repeat that sentiment at the state fair. Joan Maxwell, a dairy farmer from Davenport in Iowa, says that her area is too often viewed as “flyover country”.

“We are not looked at very positively for the most part from the media,” she says. “We’ve been called deplorables, uneducated,” – a reference to Hillary Clinton’s description of half of Trump’s supporters as a “basket of deplorables”.

Ms Maxwell added: “A lot of times they ignore us or make fun of us.”

Prof Shepherd, of Michigan University, believes there’s another factor: in his view, America has become so polarised – with voters from both sides entrenched in their camps – that many are willing to forgive much more than they would previously, as long as it’s a policy implemented by their own side.

He calls this “selective blame attribution… they might be really angry about some things that are happening, but they’re reticent to blame Trump for them.”

‘We’re giving him a chance – there’d better be results’

Mr Wolf has his own view on the “best case scenario” from here. “What I hope happens is that he [Trump] just declares victory and leaves it [tariffs] alone.”

But he warns that even if the policy is dropped, the damage to American farmers could be long-term due to the shake-up to supply chains. Some Chinese firms are now buying their soybeans from Brazil rather than America, he says; they may not quickly return.

Many of the analysts we spoke to believe that rural America’s support for Trump is not a blank cheque, despite their current support.

Mr Shepherd points to the Great Depression and rural “Dustbowl” of the 1930s, which forced millions of farmers to migrate to American cities, causing a long-term realignment in politics – though nobody expects it to get anywhere near that bad this time. The farm crisis of the 1980s also saw thousands of farms go under.

Back at the state fair, Ms Maxwell, the Iowan dairy farmer, makes this point clear.

“We’re giving him the chance to follow through with the tariffs, but there had better be results. I think we need to be seeing something in 18 months or less.

“We understand risk – and it had better pay off.”

Additional reporting: Florence Freeman

BBC InDepth is the new home on the website and app for the best analysis and expertise from our top journalists. Under a distinctive new brand, we’ll bring you fresh perspectives that challenge assumptions, and deep reporting on the biggest issues to help you make sense of a complex world. And we’ll be showcasing thought-provoking content from across BBC Sounds and iPlayer too. We’re starting small but thinking big, and we want to know what you think – you can send us your feedback by clicking on the button below.

Business

Warner Bros Discovery Inks USD110 Billion Deal with Paramount Skydance

Last Updated:

Warner Bros Discovery signed a SUD 11 billion deal with Paramount Skydance Friday morning, as revealed in a global town hall audio clip.

Warner Bros signs USD 110 billion deal with Paramount (Image for representation)

Warner Bros Discovery (WBD.O) signed a SUD 110 billion deal with Paramount Skydance (PSKY.O) Friday morning, the two companies announced, marking one of the most consequential media mergers in recent history.

“Netflix had the legal right to match the PSKY offer. As you all know, they ultimately decided not to do that. That then resulted in a signed agreement with PSKY as of this morning. So that’s where everything stands,” Bruce Campbell, Warner Bros’ chief revenue and strategy officer, said, as quoted by news agency Reuters.

The companies revealed that the deal is expected to close in the third quarter of 2026.

The deal was inked as Netflix declined to match Paramount’s latest USD 31-per-share offer, pulling out of the bidding war for Warner Bros. Discovery’s studio and streaming assets.

According to the Reuters report, citing sources, Warner Bros received the contracts from Paramount on Saturday and within the following two days, it announced that Paramount’s offer was superior.

The deal was immediately approved by board of directors of both media giants, said the companies in a joint statement.

The deal is “subject to customary closing conditions, including regulatory clearances and approval by WBD shareholders, with a vote expected in the early spring of 2026″, the statement read.

Interestingly, Paramount Skydance is headed by David Ellison, the son of Silicon Valley billionaire Larry Ellison, a close ally of President Donald Trump.

“By bringing together these world-class studios, our complementary streaming platforms, and the extraordinary talent behind them, we will create even greater value for audiences, partners and shareholders — and we couldn’t be more excited for what’s ahead,” David Ellison said in a statement.

NOT A ‘MUST HAVE’

In a stunning move hours later, Netflix announced it would not match Paramount Skydance’s latest offer to acquire Warner Bros Discovery. Netflix co-CEOs Ted Sarandos and Greg Peters asserted that “this transaction was always a nice to have at the right price, not a ‘must have’ at any price.”

TRUMP YET TO COMMENT

At one point, President Donald Trump said he might weigh in on the agreement. However, he told NBC News in early February that he would not be “involved” in the proceedings.

Then, last week, he issued a warning to Netflix, saying it would “pay the consequences” if it did not fire board member Susan Rice, an ex-official of the Biden administration.

During a podcast, Rice had said the entities that “take a knee” to the President would be “held accountable” when Democrats return to the office.

Meanwhile, the President is yet to comment on the deal.

Follow News18 on Google. Join the fun, play games on News18. Stay updated with all the latest business news, including market trends, stock updates, tax, IPO, banking finance, real estate, savings and investments. To Get in-depth analysis, expert opinions, and real-time updates. Also Download the News18 App to stay updated.

Washington D.C., United States of America (USA)

February 28, 2026, 07:48 IST

Read More

Business

UAE makes history: Central Bank launches world’s first sovereign financial cloud with AI for secure digital finance – The Times of India

In a bold leap that could redefine how modern financial systems operate, the Central Bank of the United Arab Emirates (CBUAE) has announced the launch of what it calls the world’s first sovereign financial cloud services infrastructure, a secure and AI-powered digital backbone designed specifically for the nation’s financial sector. This initiative, developed in partnership with Core42 (a subsidiary of AI and technology group G42), aims to position the UAE at the forefront of secure, sovereign digital finance and bolster its reputation as a global hub for innovative financial services.The platform, known as the Sovereign Financial Cloud Services Infrastructure (SFCSI), is set apart from traditional cloud environments by its focus on data sovereignty, integrated cybersecurity and unified multi-cloud management, all underpinned by advanced artificial intelligence and real-time analytics. In practical terms, this means the UAE’s financial sector will be able to process, analyse and automate critical banking functions with unprecedented speed and regulatory control, securely within national borders.

What makes the UAE’s sovereign financial cloud revolutionary

Unlike most cloud services, which are operated by global providers and often host data far from the jurisdictions that regulate them, the SFCSI is built on a fully isolated and centralised infrastructure that ensures critical financial data remains within the UAE’s legal and security perimeter. Governments and regulators see this as key not just for privacy but for economic and strategic sovereignty in a world where data and finance increasingly intersect.This approach mirrors broader global trends toward digital sovereignty, where countries aim to protect sensitive infrastructure from foreign interference, whether from geopolitical tensions or shifting international data laws. By embedding regulatory controls and governance tools directly into the cloud platform itself, the CBUAE is seeking to reduce reliance on foreign systems and strengthen confidence in the nation’s financial resilience.Core42’s involvement is not just as a technical builder; the partnership brings integrated artificial intelligence and advanced analytics directly into the financial backbone. This allows licensed financial institutions and the CBUAE to automate operational processes intelligently, analyse real-time data for risk and performance insights, improve decision-making with predictive models and enhance customer service through automated, data-driven workflows.In a world where financial services are rapidly becoming more complex and interconnected, AI integration at the infrastructure level offers both competitive edge and stronger defences against threats like fraud, system failure or cyber-attacks. The new system also provides a single management framework for multiple cloud services, giving licensed financial institutions the flexibility to administer a range of cloud environments, including private and hybrid setups, seamlessly and securely. This capability is particularly valuable for institutions that need to balance agility and innovation with strict regulatory compliance.

Implications for the UAE and global financial landscape

For the UAE’s banks, insurers and fintech startups, the SFCSI represents a foundational piece of digital transformation. Regulatory oversight will be more immediate and nuanced, while institutions can scale new digital products, from personalised banking apps to smart payment systems, without compromising on security or compliance.Officials from the CBUAE emphasised that the platform will serve the entire licensed financial sector, reinforcing not just operational resilience but also long-term sustainable growth as financial services evolve. The central bank’s leadership views this as a pivotal step in strengthening the nation’s competitiveness on the world stage.The UAE’s move toward a sovereign financial cloud resonates with a broader global push for digital control over critical infrastructure. Various countries are debating how to balance openness to global technology with the need to protect sensitive financial and governmental data, a tension that’s only grown more pronounced as cyber threats increase and geopolitical competition around tech intensifies. By being among the first to embed sovereign control, AI capabilities and cloud innovation at this scale, the UAE is signalling that it intends to lead in secure, regulated digital finance, not just participate in it.While this cloud platform is targeted at the financial sector, its development aligns with the UAE’s wider strategy of integrating AI and digital infrastructure across governance, public services and enterprise systems. The inclusion of AI, real-time analytics and automation at a national infrastructure level could help catalyse further technological development in related fields such as central bank digital currencies (CBDCs), national payments innovation and cross-border financial integration.

What UAE’s sovereign financial cloud platform means for everyday users and institutions

For banks and financial firms, the SFCSI offers a more efficient way to innovate and comply with regulations, potentially making services faster, more secure and easier to tailor to customer needs. For consumers and businesses, the shift could translate into:

- More secure banking services with enhanced protections.

- Better digital experiences built on real-time insights.

- Faster product rollouts as institutions leverage automated, AI-powered infrastructure.

- Greater confidence in data privacy and national sovereignty

The rollout of such an infrastructure may also attract international finance players, tech investors and startups looking to base operations in a secure, innovation-friendly jurisdiction. The Central Bank of the UAE (CBUAE) has unveiled what it calls the world’s first sovereign financial cloud services infrastructure, developed with technology partner Core42.The Sovereign Financial Cloud Services Infrastructure (SFCSI) is designed to ensure data sovereignty, robust cybersecurity, AI integration, and unified multi-cloud management for the UAE’s financial sector. Built with advanced AI and analytics, it will enhance automation, real-time decision-making and innovation within licensed financial institutions. The move reinforces the UAE’s ambitions to be a global leader in secure, digital finance, aligning with broader global trends toward sovereign digital infrastructure.

Business

What the Warner Bros deal could mean for streaming, cinemas and news

Rodney Benson, a media professor at New York University, called the deal “concerning”, would leave America’s largest media companies further concentrated in the hands of conservatives. Many of those owners, including the Ellison family, have separate, non news-related business interests that depend on government contracts or regulation and are therefore particularly vulnerable to pressure, he adds.

-

Tech1 week ago

Tech1 week agoA $10K Bounty Awaits Anyone Who Can Hack Ring Cameras to Stop Sharing Data With Amazon

-

Business1 week ago

Business1 week agoUS Top Court Blocks Trump’s Tariff Orders: Does It Mean Zero Duties For Indian Goods?

-

Fashion1 week ago

Fashion1 week agoICE cotton ticks higher on crude oil rally

-

Tech1 week ago

Tech1 week agoDonald Trump Jr.’s Private DC Club Has Mysterious Ties to an Ex-Cop With a Controversial Past

-

Business7 days ago

Business7 days agoEye-popping rise in one year: Betting on just gold and silver for long-term wealth creation? Think again! – The Times of India

-

Entertainment1 week ago

Entertainment1 week agoThe White Lotus” creator Mike White reflects on his time on “Survivor

-

Politics6 days ago

Politics6 days agoPakistan carries out precision strikes on seven militant hideouts in Afghanistan

-

Politics1 week ago

Politics1 week agoUS Supreme Court strikes down Trump’s trade tariff measures