Business

FASTag Annual Pass 2025: Diwali Gift For Travellers: How To Activate, Cost, And How To Make Payment Via NHAI’s Rajmargyatra App

FASTag Annual Pass 2025: The government announced on Saturday that the National Highways Authority of India (NHAI) ‘Rajmargyatra’ app now allows users to gift the FASTag annual pass, calling it the “perfect gift for travellers” this Diwali and festive season.

How To Activate FASTag Annual Pass

Users can activate the FASTag annual pass by selecting the “Add Pass” option in the app, entering the recipient’s vehicle number and contact details, and completing a simple OTP verification. Once activated, the pass is linked to the vehicle’s FASTag, enabling hassle-free travel without frequent recharges, an official statement said.

The FASTag annual pass offers a seamless and cost-effective travel option for National Highway users and is accepted at approximately 1,150 toll plazas across India.

FASTag Annual Pass Cost

The FASTag annual pass costs Rs 3,000 and is valid for one year or up to 200 toll plaza crossings. It is available for all non-commercial vehicles with a valid FASTag and gets activated within two hours on the existing FASTag after a one-time payment via the ‘Rajmargyatra’ app.

Once the limit is reached, the FASTag automatically switches to standard pay-per-trip mode. For point-based toll plazas, each one-way crossing counts as a trip, while a return counts as two. In closed or ticketed systems, a complete entry-to-exit journey counts as one trip.

Some FASTags, especially for new vehicles, may only be registered with the chassis number. The annual pass cannot be activated on such FASTags unless they are updated with the complete vehicle registration number.

FASTag Annual Pass: How Make Payment

Payment for the pass can be made via UPI, debit or credit card, or net banking, and the FASTag wallet balances cannot be used for this purpose. The statement from the Ministry of Road Transport and Highways said that the FASTag annual pass has gained over 25 lakh users and processed approximately 5.67 crore transactions within its first two months of launch. (With IANS Input)

Business

India–US trade deal: Textile, leather players see revival in volumes – The Times of India

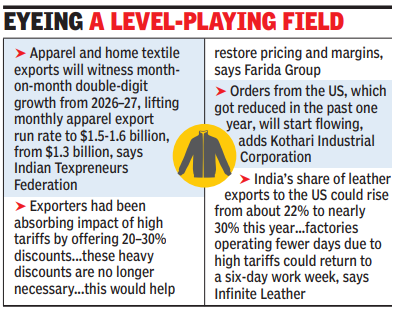

CHENNAI: India’s textile, apparel and leather exporters are expecting a sustained recovery in orders from the US, following tariff reductions under the proposed India–US trade deal. Industry representatives said the move will restore competitiveness, improve margins and revive volumes that were under pressure over the past year.Textile and apparel exporters are now expecting an increased sourcing by global brands as India will now enjoy one of the lowest tariff regimes among major Asian manufacturing hubs, with a marginal advantage over competitors, such as Bangladesh, Sri Lanka, Vietnam and China. The tariff relief is expected to create a level-playing field, particularly for small and medium exporters in clusters such as Surat, Gurugram and Tirupur.Prabhu Dhamodharan, convenor of the Indian Texpreneurs Federation, said sourcing interest of US from India is rising and exports are likely to improve steadily. “The apparel and home textile exports will witness month-on-month double-digit growth from the 2026–27 fiscal, lifting the monthly apparel export run rate to $1.5 to $1.6 billion, from the current $1.3 billion.”

Eyeing a level-playing field

A Sakthivel, chairman of the Apparel Export Promotion Council, said improved trade terms would significantly enhance the competitiveness of Indian apparel products in the US market.The leather sector has termed the US decision to reduce tariffs to 18% a “double dhamaka”, coming soon after India’s strategic trade deal with the European Union. Israr Ahmed, former vice-president of the Federation of Indian Export Organisations (Fieo) and managing director of the Farida Group, said exporters had been absorbing the impact of high tariffs by offering discounts of 20–30%. “With the US now reducing tariffs on Indian goods to 18%— a rate lower than those faced by key South Asian competitors, such as Bangladesh and Vietnam — these heavy discounts are no longer necessary,” he said, adding that this would help restore pricing and margins.Rafiq Ahmed, chairman of Kothari Industrial Corporation, noted that competition in the US market has intensified over the past year but said long-standing relationships would help Indian exporters regain lost ground. “The orders from the US, which got reduced in the past one year, will start flowing,” he said.Yavar Dhala, vice-president of the Indian Shoe Federation and CEO of Infinite Leather, said India’s share of leather exports to the US could rise from about 22% to nearly 30% this year, adding that factories operating fewer days due to high tariffs could return to a six-day work week.

Business

Disney names Josh D’Amaro as new chief executive

The media giant chooses the head of its amusement park business to replace longtime boss Bob Iger.

Source link

Business

India-US trade deal: How New Delhi’s 18% tariff compares with rival nations – The Times of India

India and the United States have agreed on a framework for a bilateral trade deal under which Washington will reduce tariffs on Indian goods to 18% from the current 50%.The announcement is significant as the US had imposed steep duties on Indian exports entering American markets, effective August 27, 2025.

In August 2025, Washington announced a 25% tariff along with an additional 25% punitive duty on India for purchasing Russian crude oil and military equipment. These duties were imposed over and above existing tariffs on Indian goods. Under the new framework, the overall duty has now been brought down to 18% .Prime Minister Narendra Modi welcomed the move, saying he was delighted that “made in India products will now have a reduced tariff of 18%.”Tariffs are customs or import duties imposed by a country on goods bought from other nations.

How India compares globally

A comparison of US tariff rates across major economies places India in the middle of the global tariff spectrum, with an 18% duty on its exports.Brazil faces the steepest tariff at 50% , followed by Myanmar and Laos at 40% each. China attracts a 37% tariff, while South Africa faces a 30% levy.Several manufacturing hubs in Southeast Asia are subject to duties in the 19–20% range, including Vietnam and Bangladesh at 20% , and Malaysia, Cambodia and Thailand at 19% each.With an 18% tariff, India is now placed below most emerging-market competitors, offering it a relative pricing advantage in the US market.Advanced economies enjoy significantly lower tariffs. The European Union, Switzerland, Japan and South Korea each face a 15% duty, while the United Kingdom has the lowest rate at 10% .The reduction in tariffs is expected to benefit India’s labour-intensive sectors, as exporters will be able to price their products more competitively in the US market.

Why the US imposed tariffs

The US has argued that it faces a significant trade deficit with India, blaming New Delhi for imposing high tariffs on American goods, which it says restrict US exports to the Indian market.Under the proposed pact, India is expected to eliminate duties on certain goods immediately, phase out duties on others, reduce tariffs in some sectors, and offer quota-based tariff concessions for select products.However, sensitive sectors such as agriculture and dairy remain completely outside the ambit of the agreement, PTI reported.An executive order from the US is expected to provide greater clarity on tariff changes, while a joint statement from both countries will outline the sectors covered under the deal. Both are awaited.

-

Sports1 week ago

Sports1 week agoPSL 11: Local players’ category renewals unveiled ahead of auction

-

Sports7 days ago

Sports7 days agoCollege football’s top 100 games of the 2025 season

-

Entertainment7 days ago

Entertainment7 days agoClaire Danes reveals how she reacted to pregnancy at 44

-

Business1 week ago

Business1 week agoBanking services disrupted as bank employees go on nationwide strike demanding five-day work week

-

Politics7 days ago

Politics7 days agoTrump vows to ‘de-escalate’ after Minneapolis shootings

-

Sports7 days ago

Sports7 days agoTammy Abraham joins Aston Villa 1 day after Besiktas transfer

-

Tech1 week ago

Tech1 week agoBrighten Your Darkest Time (of Year) With This Smart Home Upgrade

-

Entertainment7 days ago

Entertainment7 days agoK-Pop star Rosé to appear in special podcast before Grammy’s