Business

From Rs 1 Lakh To Rs 14 Lakh In A Year: The Multibagger Stock Everyone’s Talking About

Last Updated:

Sian Agro posted a consolidated net profit of Rs 52.21 crore in Q1 FY26 (June 2025 quarter), a dramatic jump from just Rs 9.79 lakh in the same quarter last year

Company posted Rs 52.21 crore net profit in Q1 FY26. (Representational Image)

The small-cap counter Sian Agro Industries and Infrastructure Limited has emerged as one of the most talked-about stocks on Dalal Street, posting an extraordinary rally that has stunned market observers. Once an under-the-radar scrip, it has now transformed into a multibagger phenomenon, multiplying investors’ wealth at an astonishing pace.

According to market data, the company’s share has delivered a 1360% return in just one year, while its gains so far in 2025 stand at over 513%. Even in the past month alone, the stock has surged nearly 125%. Despite a recent 5% dip on Friday, October 17, the stock was still trading at an impressive Rs 3,122.80 on the BSE.

The company is helmed by Nikhil Gadkari, son of Union Minister for Road Transport and Highways Nitin Gadkari. Promoters collectively hold 67.67% of the company’s shares.

In view of the meteoric rise in its stock price, the Bombay Stock Exchange (BSE) has placed Sian Agro Industries under the Long-Term Additional Surveillance Measure (ASM: Stage 4) category, a move aimed at cautioning investors and curbing speculative activity.

The company operates in the packaged food sector, dealing in edible oils, rice, and spices, apart from maintaining a presence in the ethanol business. Its financial performance in recent quarters has been nothing short of spectacular.

As per the firm’s latest earnings report, Sian Agro posted a consolidated net profit of Rs 52.21 crore in Q1 FY26 (June 2025 quarter), a dramatic jump from just Rs 9.79 lakh in the same quarter last year. Revenue from operations also skyrocketed to Rs 510.80 crore, up from a mere Rs 17.47 crore in the same period a year ago. The figures underline the company’s expanding footprint and surging market demand.

From Rs 1 Lakh to Rs 14.6 Lakh in 1 Year

A year ago, Sian Agro Industries was priced at Rs 213.85 per share. At today’s levels, that same investment has multiplied nearly 14.6 times, turning a modest Rs 1 lakh into Rs 14.6 lakh. Even short-term investors have benefited immensely. An investment of Rs 1 lakh just a month ago would now be worth around Rs 2.24 lakh, more than doubling in 30 days.

(Disclaimer: The information presented is based on the company’s market performance. Investments in the stock market are subject to market risks. Readers are advised to consult a certified financial advisor before making investment decisions. The publication will not be responsible for any financial losses.)

October 17, 2025, 17:55 IST

Read More

Business

DGCA slaps IndiGo with fine of Rs 22 crore for flight disruptions – The Times of India

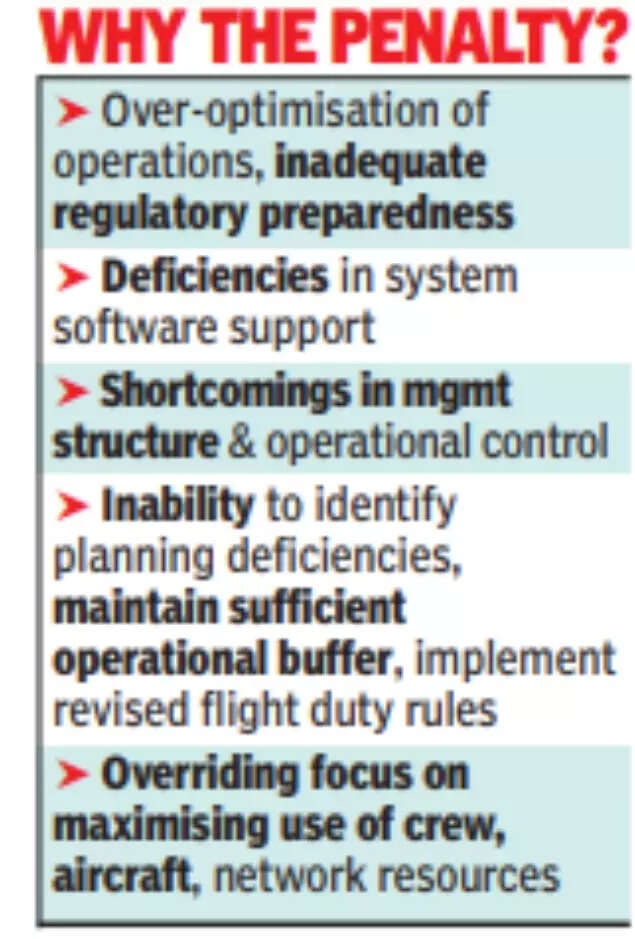

EW DELHI: The Directorate General of Civil Aviation (DGCA) has slapped IndiGo with the steepest fine ever for an Indian carrier – Rs 22.2 crore – for its massive flight disruptions last month.Additionally, the airline has to submit a bank guarantee of Rs 50 crore whose release is tied to implementing, among other things, the more humane flight duty norms for pilots aimed to enhancing flight safety. The regulator has warned senior airline officials, including the CEO & COO. The senior VP of operation control centre has to be removed from his position.

The senior VP of operation control centre has to be removed from his position and not given any accountable position in the future. The aviation ministry has ordered “an internal inquiry to identify and implement systemic improvements within DGCA”.The regulator late on Saturday night released key findings of the report by its four-member panel that probed IndiGo schedule collapse last month. The airline’s unpreparedness and consequent inability to implement DGCA’s new flight duty time limitation (FDTL) for pilots has cost it dear. Each day’s exemption given for its Airbus A320 family pilots to ensure the airline was able to start resuming flights staring the second week of Dec is costing it Rs 30 lakh. This works out to Rs 20.4 crore for 68 days between Dec 5, 2025, & Feb 10, 2026.The airline has been fined one-time Rs 30 lakh each on six more counts, which add up the fine to Rs 22.2 crore. The six failures include failure to comply with new FDTL rules, rest periods, “inadequate buffer margins in roster planning… failure to strike balance between commercial imperatives and crew members’ ability to work effectively and failure of accountable management to ensure overall functioning, financing, and conduct of operations to DGCA standards.“Between Dec 3 and 5, 2,507 IndiGo flights were cancelled and 1,852 were delayed that left over 3 lakh passengers stranded at airports across the airline’s network. Flights had resumed gradually over the next week or so.What caused the crisis:“Over-optimisation of operations, inadequate regulatory preparedness along with deficiencies in system software support and shortcomings in management structure & operational control on the IndiGo”, have been identified as the “primary causes for the disruption” by the DGCA probe panel. “The airline’s management failed to adequately identify planning deficiencies, maintain sufficient operational buffer, and effectively implement the revised FDTL provisions,” the report says.Action against IndiGo:Apart from fines, the airline’s CEO has been cautioned “for inadequate overall oversight of flight ops and crisis management.” Accountable manager & COO, Isidre Porqueras, has been warned for “failure to assess impact of winter schedule 2025 and revised FDTL leading to widespread disruptions.” Senior VP (ops control centre) has been asked to be relieved from the post and not be given any accountable position in future. Warnings have been issued to flight ops and crew resource planning “for operational, supervisory, manpower planning and roster management lapses.”Way ahead:DGCA has asked IndiGo to take appropriate action against any other personnel identified through its inquiry and submit a compliance report regarding the same. Sources say IndiGo has been made aware of the lapses of its senior officials, especially COO, and now the airline is expected to take action against them. “The findings underscore the need for operational planning, and effective management oversight to ensure sustainable operations and passenger safety & convenience,” report says.IndiGo statement:Confirming receipt of DGCA ruling, airline said it is “committed to taking full cognisance of the orders and will, in a thoughtful and timely manner, take appropriate measures… an in-depth review of the robustness and resilience of the internal processes at IndiGo (is) underway to ensure that the airline emerges stronger out of these events in its otherwise pristine record of 19 plus years of operations”.

Business

Amid plans to induct Noel’s son, Tata trust cancels meet – The Times of India

MUMBAI: The Sir Ratan Tata Trust (SRTT) cancelled its Saturday board meeting, which was expected to consider the induction of chairman Noel Tata’s son, Neville Tata, as a trustee. In contrast, board meetings of Sir Dorabji Tata Trust (SDTT) and Tata Education and Development Trust (TEDT) proceeded as scheduled.The cancellation suggests that Neville’s appointment may have been pushed back to give trustees more time for discussions – since appointing a trustee requires unanimous approval. No new date for the SRTT meeting has been notified. An email query to Tata Trusts on the cancellation of the board meeting received no response. Sir Ratan Tata Trust (SRTT), Sir Dorabji Tata Trust (SDTT), and Tata Education and Development Trust (TEDT) have several trustees in common. Except for Jehangir HC Jehangir and Jimmy Tata, the other SRTT trustees — Noel, Venu Srinivasan, Vijay Singh and Darius Khambata — also serve on SDTT’s board and participated in its meeting on Saturday, people familiar with the matter said. Jimmy, Noel’s older half-brother, usually does not attend SRTT meetings.Saturday’s development comes amid unresolved issues from the last round of inductions in Nov 2025 when the inductions of Neville and former Titan MD Bhaskar Bhat were approved by SDTT but failed to secure approval at SRTT. SDTT, together with SRTT, controls India’s largest conglomerate, the Tata Group.At the Nov 11, 2025 SDTT meeting, Khambata proposed Neville’s appointment, while Noel proposed Bhat, as TOI reported in its Nov 12 edition. Neither name was on the formal board agenda. All trustees of SDTT approved the appointments (Srinivasan did not attend the meeting as his term had expired). Later, at SRTT’s meeting on the same day, both proposals were put off for consideration at a later date.Srinivasan, who participated in the SRTT meeting, reportedly expressed reservations, stating that these proposals were not on the agenda and that such matters should not be raised under “any other items for discussion.” While items not listed on the agenda can be introduced with the chairman’s permission, Srinivasan suggested they be considered at the next board meeting, according to a person familiar with the discussion.This time, Neville’s appointment was formally listed on the SRTT agenda but the meeting was cancelled. Bhat’s name did not appear on Saturday’s agenda. Neville participated at the SDTT meeting on Saturday, marking his first formal role at the flagship foundation.

Business

Number of SMEs in Scotland down since 2020, figures from Lib Dems show

New figures from the Scottish Liberal Democrats show that small businesses have declined in Scotland since 2020.

The party’s economy spokesman, Jamie Greene MSP, has called on the SNP Government to urgently boost support for small businesses as he revealed significant drops in the number of small or medium-sized enterprises (SMEs) across Scotland.

Mr Greene asked the Scottish Government to provide the number of SMEs in every Scottish parliamentary constituency in each year since 2015.

The data showed that since 2020, the number of SMEs in Scotland has fallen from 177,020 to 171,660 – a decline of 5,360.

Over the past decade, 24 parliamentary constituencies have seen a fall in the number of SMEs, with notable declines in more rural parts of the country, according to the Scottish Liberal Democrats.

This includes a 13.8% fall in SMEs in constituencies across Aberdeen and Aberdeenshire since 2015, and an 8% fall in Caithness, Sutherland and Ross.

The Scottish Liberal Democrats have secured tens of millions in support for business in this year’s draft Scottish budget, including a new £2.5 million package backing young entrepreneurs and an initial £36 million for business rates relief.

Mr Greene said: “These figures show concerning drops in the number of small and medium-sized businesses across Scotland.

“I’ve spoken to lots of skilled and entrepreneurial people who feel there are too many barriers to starting their own business, from the SNP’s economic incompetence to the crushing burden of red tape.

“I am pleased that Scottish Liberal Democrats secured some support for businesses in the draft budget, but we think the Scottish Government can go further.

“That’s why, in the coming weeks, we will be squeezing the Scottish budget for every penny to deliver for businesses.”

Deputy First Minister Kate Forbes said: “Entrepreneurs and start-up companies are the backbone of our economy and the Scottish Government has been working systematically to develop the pipeline of support required to help them develop, grow and prosper.

“The facts show that we are making clear progress in establishing the right conditions to help business founders succeed.

“There was a 17.9% increase in Scottish start-up businesses in the first half of 2025, while investment deals in Scotland grew by 24% in the first half of 2025 compared to the second half of 2024.

“The Scottish Budget 2026-27 continues to support business, investment and a skilled workforce to accelerate economic growth, including record funding for our entrepreneurs and start-ups as we act to harness Scotland’s strengths and opportunities to drive long-term prosperity.”

-

Tech5 days ago

Tech5 days agoNew Proposed Legislation Would Let Self-Driving Cars Operate in New York State

-

Sports1 week ago

Sports1 week agoClock is ticking for Frank at Spurs, with dwindling evidence he deserves extra time

-

Sports1 week ago

Commanders go young, promote David Blough to be offensive coordinator

-

Entertainment5 days ago

Entertainment5 days agoX (formerly Twitter) recovers after brief global outage affects thousands

-

Fashion1 week ago

Fashion1 week agoSouth India cotton yarn gains but market unease over US tariff fears

-

Fashion1 week ago

Fashion1 week agoChina’s central bank conducts $157-bn outright reverse repo operation

-

Business1 week ago

Business1 week agoSoftBank reduces Ola Electric stake to 13.5% from 15.6% – The Times of India

-

Sports1 week ago

Sports1 week agoUS figure skating power couple makes history with record breaking seventh national championship