Business

FTSE 100 edges up after Trump backs down on Greenland tariffs threat

The FTSE 100 made modest progress on Thursday after Donald Trump walked back on threats to impose tariffs, but underperformed European peers amid soft mining, energy and defence stocks.

The FTSE 100 index closed up 11.96 points, 0.1%, at 10,150.05.

The FTSE 250 ended 299.64 points higher, 1.3%, at 23,370.93, and the AIM All-Share closed up 9.08 points, 1.1%, at 817.67.

US President Trump said late on Wednesday that he had reached a framework for a deal over Greenland following a meeting with Nato chief Mark Rutte and would waive tariffs scheduled to hit European allies.

“We have formed the framework of a future deal with respect to Greenland and, in fact, the entire Arctic region,” Mr Trump said in a post on Truth Social.

The US president did not provide any details on the framework, but added that his threatened tariffs against European countries who were resisting his quest to acquire Greenland were now off the table.

Kathleen Brooks, research director at XTB, said: “The tariff risk is now on the back burner, and this week’s price action tells us that financial markets fear tariffs more than geopolitical risks.”

Ms Brooks said there is still a way to go before markets reverse overall losses for this week, but noted the selloff in recent days “sent a jolt of volatility through financial markets, but it did not lead to a rout”.

This suggests that investors remain “dip buyers” and that the fundamentals for markets “remain strong”.

In European equities on Thursday, the CAC 40 in Paris closed up 1.0%, while the DAX 40 in Frankfurt ended 1.2% higher.

In New York, financial markets were higher at the time of the London equity market close.

The Dow Jones Industrial Average was up 0.9%, the S&P 500 was 0.7% higher, while the Nasdaq Composite climbed 1.0%.

The yield on the US 10-year Treasury was quoted at 4.27%, unchanged from Wednesday. The yield on the US 30-year Treasury was quoted at 4.87%, narrowed from 4.89%.

Data showed US third-quarter economic growth was slightly stronger than expected, according to numbers from the Bureau of Economic Analysis (BEA).

US gross domestic product expanded by 4.4% on an annualised basis, quarter-on-quarter, in the three months to September 30. The prior BEA estimate said growth was 4.3%.

“The increase in real GDP in the third quarter reflected increases in consumer spending, exports, government spending, and investment. Imports, which are a subtraction in the calculation of GDP, decreased,” the BEA said.

The pound was quoted higher at 1.3498 US dollars at the time of the London equities close on Thursday, compared to 1.3437 dollars on Wednesday.

The euro stood at 1.1749 dollars, higher against 1.1707 dollars. Against Japan’s yen, the dollar was trading at 158.27 yen, higher from 158.18 yen.

In London, figures showed UK public sector net borrowing rose in December by less than expected.

According to the Office for National Statistics, net borrowing was £11.58 billion in December, below the FXStreet-cited market consensus estimate of £13.5 billion.

The December total was above November’s net borrowing of £10.94 billion, which was revised downwards from £11.65 billion. But it was down 38% from December 2024.

Danni Hewson, AJ Bell head of financial analysis, said: “The significant fall in government borrowing in December will be a relief for the Treasury, especially since January’s numbers are likely to look even better with a surge in self-assessment receipts expected.”

Ms Hewson pointed out spending “nudged up” compared with the previous year, primarily because of increases to benefit payments and pay rises, but that was more than offset by an increase in the cash coming into the government’s coffers.

However, she noted the picture “isn’t quite as rosy” for the full financial year to date “with total borrowing to the end of December at levels only seen twice before”.

“The deficit is reducing, but the pace of the reduction is glacially slow. With further increases to benefit payments on the way in April, the pressure on the public purse is still uncomfortable,” Ms Hewson added.

On the FTSE 100, defence stocks BAE Systems and Babcock International gave up 3.7% and 1.4% on the cooler geopolitical temperature.

Miners were another weak feature after recent gains. Antofagasta fell 2.2%, Glencore dropped 2.0% and Anglo America eased 1.7%.

Insurer Admiral fell a further 4.6% as RBC Capital Markets downgraded to “sector perform” from “outperform”, the day after Goldman Sachs lowered the stock.

While the weaker oil price weighed on BP, down 1.9% and Shell, down 2.2%.

Brent oil traded lower at 64.26 US dollars a barrel on Thursday, down from 64.82 dollars late on Wednesday.

On the FTSE 250, Computacenter led the way, up 10%, after better than expected trading in 2025.

The services provider, based in Hatfield, Hertfordshire, said business performance in the fourth quarter, and 2025 as a whole, was ahead of its expectations.

As a result, the FTSE 250-listing expects full-year adjusted pre-tax profit to be no less than £270 million, “comfortably ahead” of market expectations which the firm put at £253.6 million. It would represent growth of as much 6.3% from £254 million reported in 2024.

“This is a strong pre-announcement, with results ahead of expectations, earnings upgrades to come and encouraging messaging on the pipeline and outlook,” analysts at JPMorgan said.

Senior rose 8.8% as it said it expects full year adjusted pre-tax profit to be “comfortably above previous expectations”, boosting guidance for the second time in three months.

The company, based in Royston, Hertfordshire, makes components and systems for aerospace and defence, land vehicle, and power and energy customers.

It said trading since the November update has been “stronger than expected trading, notably in Aerospace”.

On AIM, Kitwave soared 33% as it accepted a £251 million takeover offer from New York investment company OEP Capital Advisers.

The cash bid values each share in the food wholesaler, based in North Shields, North Tyneside, at 295 pence.

Gold was quoted at 4,874.80 US dollars an ounce on Thursday, after hitting another record high, up from 4,833.66 dollars on Wednesday.

The biggest risers on the FTSE 100 were: St James’s Place, up 62.5 pence at 1,511.0p; Hikma Pharmaceuticals, up 48.0p at 1,568.0p; JD Sports Fashion, up 2.56p at 84.62p; Spirax, up 220.0p at 7,370.0p; and ConvaTec, up 7.0p at 236.6p.

The biggest fallers on the FTSE 100 were: Admiral Group, down 136.0p at 2,812.0p; BAE Systems, down 77.0p at 1,985.0p; ICG, down 52.0p at 1,940.0p; Rio Tinto, down 155.0p at 6,486.0p; and Shell, down 59.5p at 2,674.0p.

Friday’s global economic calendar has a raft of flash composite PMI readings, an interest rate call in Japan overnight, plus UK consumer confidence and retail sales data.

Friday’s UK corporate calendar has a trading statement from currency and asset manager Record.

Contributed by Alliance News

Business

More people have adopted the four-day work week – here’s why

More than 50 organisations collectively employing over 1,400 individuals transitioned to a four-day working week in 2025, according to new figures.

The 4 Day Week Foundation revealed that the total number of employees now benefiting from this model stands at over 6,000 across 253 accredited businesses.

The newly certified employers represent a broad spectrum of industries, including business, consulting, management, charities, technology, retail, housing, engineering, marketing, arts and entertainment, manufacturing, gaming, recruitment, heritage, healthcare, and education.

London saw the highest number of these new accreditations, with Scotland and the North West also showing significant adoption.

Joe Ryle, campaign director for the foundation, said the latest figures show that UK employers no longer have any practical barriers to making the shift.

“These companies are proving that there is nothing stopping organisations in the UK from moving to a four-day week,” he said.

“Across virtually every sector and region, employers are showing that shorter working weeks boost productivity, improve wellbeing and help attract and retain talent – all without cutting pay.

“The question is no longer whether it works, but how quickly others will follow.”

A total of 53 newly accredited organisations permanently adopted a four-day week with no loss of pay last year, the foundation said.

Researchers in the US found last year that working four days a week can help workers protect their mental health.

A team at Boston College said their landmark study had revealed the shift was associated with a high level of satisfaction on the part of both employers and employees.

More than 100 companies and nearly 2,900 workers in the U.S., U.K. Australia, Canada, and Ireland were involved in the study.

That included an improvement in productivity and growth in revenue, a positive impact on physical and mental health, and less stress and burnout.

A 2024 poll of more than 2,000 full-time U.S. workers found that more than half of respondents reported feeling exhausted from chronic workplace stress within the past year.

The main reason that employees had maintained productivity, according to their assessment, is that companies have decreased or cut activities with questionable or low value, including meetings. Instead, meetings became phone calls and conversations via messaging apps.

Another key factor was that employees would use their third day off for doctor’s appointments and other personal errands that they might otherwise try to cram into a work day.

The study, published Monday in the journal Nature Human Behaviour, builds on previous research that has found similar benefits, and comes on the heels of a recent study that found long working hours may alter brain structure.

Business

Bank depositors’ role in funding credit growth on decline: RBI data – The Times of India

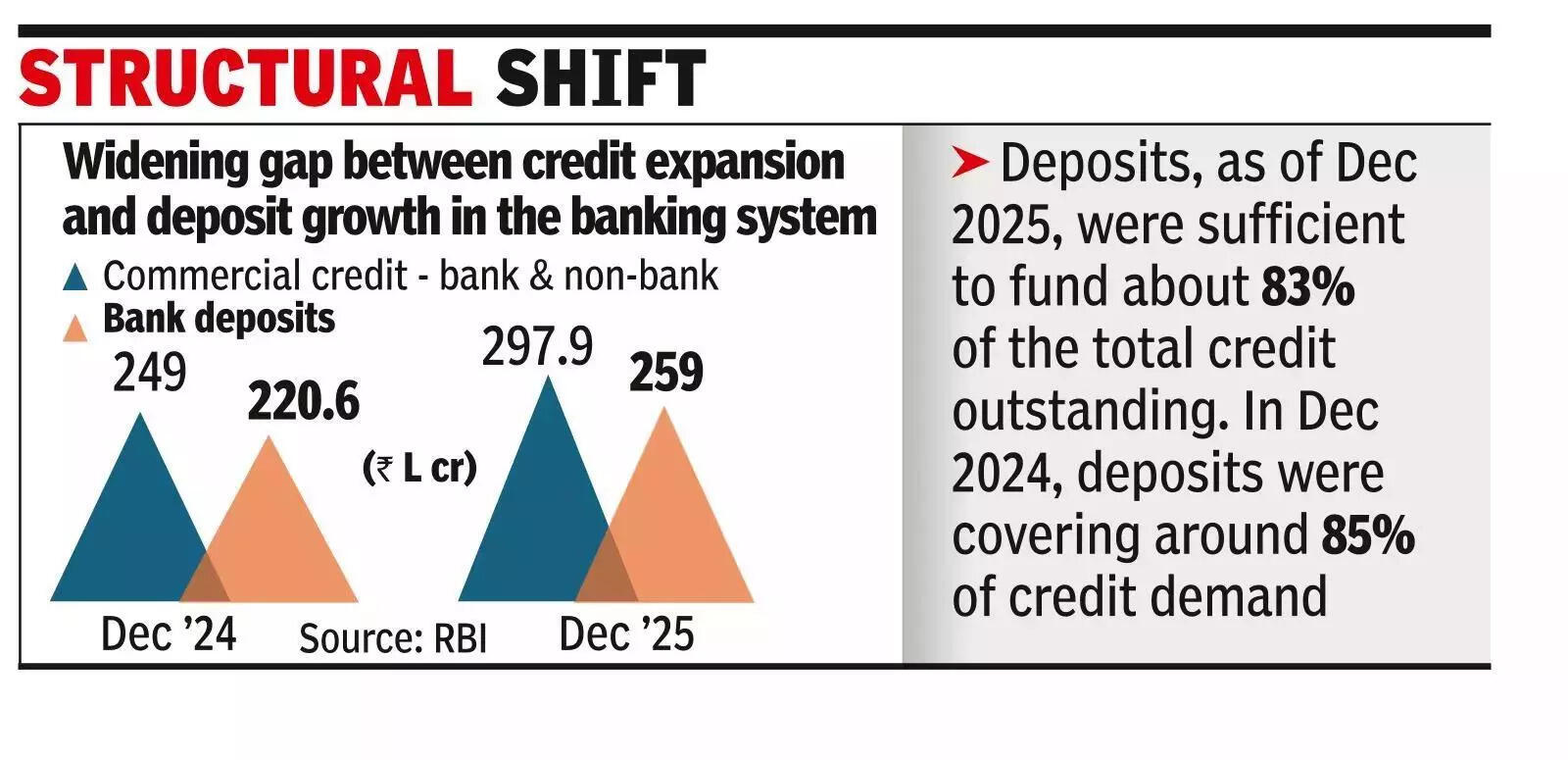

MUMBAI: India’s bank depositor remains the predominant source of credit to the commercial sector, but their relative contribution is steadily declining as credit growth outpaces deposit mobilisation, data for Dec 2025 show.As of Dec 2025, total outstanding credit to the commercial sector (bank and non-bank) rose to Rs 297.9 lakh crore, while bank deposits stood at Rs 249 lakh crore. Deposits were sufficient to fund only about 83% of the total credit outstanding. A year earlier, in Dec 2024, bank deposits amounted to Rs 220.6 lakh crore against total credit of Rs 259.01 lakh crore, covering around 85% of credit demand. The data point to a widening gap between credit expansion and deposit growth in the banking system.

.

The trend reveals a structural shift in India’s credit landscape. Banks remain central to financing the commercial sector, but their deposit base is no longer keeping pace with the demand for credit. The growing reliance on NBFCs, bond markets and foreign borrowings reflects both deeper financial markets and mounting pressure on bank balance sheets as credit demand continues to surge.The first nine months of 2025-26 saw a sharp acceleration in credit flow to the commercial sector. While banks continue to anchor the system, the pace of credit creation has increasingly relied on non-bank channels.Non-food bank credit remained the single largest source of incremental funding. Between Dec 2024 and Dec 2025, bank credit expanded by Rs 25.5 lakh crore, accounting for 65.5% of the total increase in commercial sector credit. Outstanding non-food bank credit stood at Rs 202.3 lakh crore at end-Dec 2025, reflecting a year-on-year growth of 14.4%.

Business

Video: Why Trump’s Reversal on Greenland Still Leaves Europe on Edge

new video loaded: Why Trump’s Reversal on Greenland Still Leaves Europe on Edge

By Andrew Ross Sorkin, Rebecca Suner, Coleman Lowndes and Laura Salaberry

January 22, 2026

-

Politics6 days ago

Politics6 days agoSaudi King Salman leaves hospital after medical tests

-

Sports1 week ago

Sports1 week agoPak-Australia T20 series tickets sale to begin tomorrow – SUCH TV

-

Business7 days ago

Business7 days agoTrump’s proposed ban on buying single-family homes introduces uncertainty for family offices

-

Fashion6 days ago

Fashion6 days agoBangladesh, Nepal agree to fast-track proposed PTA

-

Tech1 week ago

Tech1 week agoTwo Thinking Machines Lab Cofounders Are Leaving to Rejoin OpenAI

-

Tech1 week ago

Tech1 week agoMeta’s Layoffs Leave Supernatural Fitness Users in Mourning

-

Tech6 days ago

Tech6 days agoPetlibro Offers: Cat Automatic Feeders, Water Fountains and Smart Pet Care Deals

-

Fashion6 days ago

Fashion6 days agoWhoop and Samuel Ross MBE unveil multiyear design partnership