Business

FTSE 100 up as Fed sounds softer tone than feared

The FTSE 100 forged ahead on Thursday as a less “hawkish” than feared rate cut by the US Federal Reserve and a brighter US economic outlook spurred stocks, despite some fresh AI worry.

The FTSE 100 index closed up 47.63 points, 0.5%, at 9,703.16. The FTSE 250 ended 21.13 points higher, 0.1%, at 21,852.10, and the AIM All-Share ended up 1.04 points, 0.1%, at 747.66.

In Europe on Thursday, the CAC 40 in Paris closed up 0.8%, while the DAX 40 in Frankfurt ended 0.7% higher.

After Europe’s close on Wednesday, the US central bank cut interest rates by 25 basis points as expected and chairman Jerome Powell struck a softer tone than some had feared.

Bank of America called it an “unintentionally dovish cut”, Citi said markets “had overestimated how hawkish Mr Powell would sound,” while JPMorgan noted Mr Powell’s opening remarks were “less forceful than those used in October”.

“Relative to markets that were looking for Powell to push back more strongly at the potential for further cuts, this was a dovish outcome,” Citi said.

Goldman Sachs said “dovish labour market comments” and the “lack of a stronger lean toward a January pause led to a dovish market reaction”.

In addition, the Federal Reserve raised expectations for economic growth in the US for 2026 through to 2028, expecting a bounce back after the government shutdown.

Sarah House, analyst at Wells Fargo, said: “Our base case remains that the current easing cycle is not over yet but rather that it is entering a slower phase.”

Stocks in New York were mixed at the time of the London equity close after rising sharply on Wednesday in the wake of the Fed’s rate call.

The Dow Jones Industrial Average was up 1.0%, the S&P 500 index was 0.4% lower, while the Nasdaq Composite was down 1.1%.

Oracle knocked the more optimistic market mood after hours on Wednesday by warning of higher capital expenditure as it grapples with buoyant artificial intelligence demand.

Shares in the Texas-based cloud technologies-focused company were 14% lower in New York on Thursday around the time of the London close.

Stifel noted shares are being hit by “continued uncertainty around exactly how Oracle is going to fund its data centre build-out requirements”.

The Fed rate call saw bond yields drop and the dollar fade.

The yield on the US 10-year Treasury was quoted at 4.12%, down from 4.18% on Wednesday. The yield on the US 30-year Treasury was at 4.77%, trimmed from 4.78%.

The pound was quoted higher at 1.3416 dollars at the time of the London equities close on Thursday, compared with 1.3332 dollars on Wednesday.

The euro stood at 1.1746 dollars, up against 1.1647 dollars. Against the yen, the dollar was trading lower at 155.24 yen compared with 156.36 yen.

Figures showed the US trade deficit unexpectedly decreased markedly in September.

According to data published by the US Census Bureau and the US Bureau of Economic Analysis the country’s trade deficit narrowed by 11% monthly in September to 52.8 billion dollars, from 59.3 billion dollars in August.

The FXStreet-cited consensus was for the trade deficit to increase to 63.3 billion dollars in September.

The last time the US’s trade deficit was lower was in June 2020, when it was at 49.16 billion dollars.

US exports climbed 3.0% to 289.3 billion dollars, while imports edged up 0.6% to 342.1 billion dollars.

In London, renewed strength in the gold price lifted Endeavour Mining, up 3.2%, and Fresnillo, up 3.0%.

Magnum Ice Cream continued its strong first week of trading, rising a further 5.6%, while an AI collaboration with IBM supported Pearson, up 2.0%.

Grocer J Sainsbury was lifted 2.1% by an upgrade by Citi to “buy” but the same broker reiterated a “sell” rating on Primark owner Associated British Foods, helping push shares down 1.6%.

Also on the wane, betting operator Entain, which fell 2.2% after stating Rob Wood, its chief financial officer and deputy chief executive, will step down in 2026 after 13 years at the firm.

On the FTSE 250, RS Group took the spoils, up 6.2%, after netting an upgrade to “overweight” from JPMorgan.

But Ceres Power slid 11% after a scathing attack from activist short-seller Grizzly Research.

In a report, Grizzly Research said Ceres is “hiding a flawed business model with abysmally small revenue potential behind a facade of big-name announcements and lofty projections”.

Grizzly said its research shows that Ceres has a history of “ambitious partnerships and unrealistic projections that keeps repeating”.

Faring better, Drax Group advanced 1.4% after stating it expects full-year adjusted earnings before interest, tax, depreciation and amortisation to be at the top end of the consensus forecast range of £892 million to £909 million.

In addition, the electricity generator said it is looking at opportunities to maximise value from the Drax Power Station site, which covers 1,000 acres in North Yorkshire.

Brent oil was quoted at 60.91 dollars a barrel at the time of the London equities close on Thursday, down from 61.42 dollars late Wednesday.

The biggest risers on the FTSE 100 were Magnum Ice Cream, up 63.20 pence at 1,186.20p, Ashtead Group, up 225.00p at 5,010.00p, JD Sports Fashion, up 2.80p at 81.72p, Endeavour Mining, up 110.00p at 3,544.00p and IAG, up 12.00p at 397.60p.

The biggest fallers on the FTSE 100 were Informa, down 30.60p at 899.00p, Smith & Nephew, down 34.50p at 1,214.50p, Entain, down 16.60p at 743.20p, AB Foods, down 33.00p at 2,097.50p and Centrica, down 2.20p at 165.30p.

Friday’s economic calendar has CPI prints in France and Germany and UK GDP and industrial production figures.

Friday’s UK corporate calendar has half-year results from Taylor Maritime.

– Contributed by Alliance News

Business

How inflation rebound is set to affect UK interest rates

Interest rates are widely expected to remain at 3.75% as Bank of England policymakers prioritise curbing above-target inflation while also monitoring economic growth, according to expert analysis.

The Bank’s Monetary Policy Committee (MPC) is anticipated to leave borrowing costs unchanged when it announces its latest decision on Thursday, marking its first interest rate setting meeting of the year.

This follows a rate cut delivered before Christmas, which was the fourth such reduction.

At the time, Governor Andrew Bailey noted that the UK had “passed the recent peak in inflation and it has continued to fall”, enabling the MPC to ease borrowing costs. However, he cautioned that any further cuts would be a “closer call”.

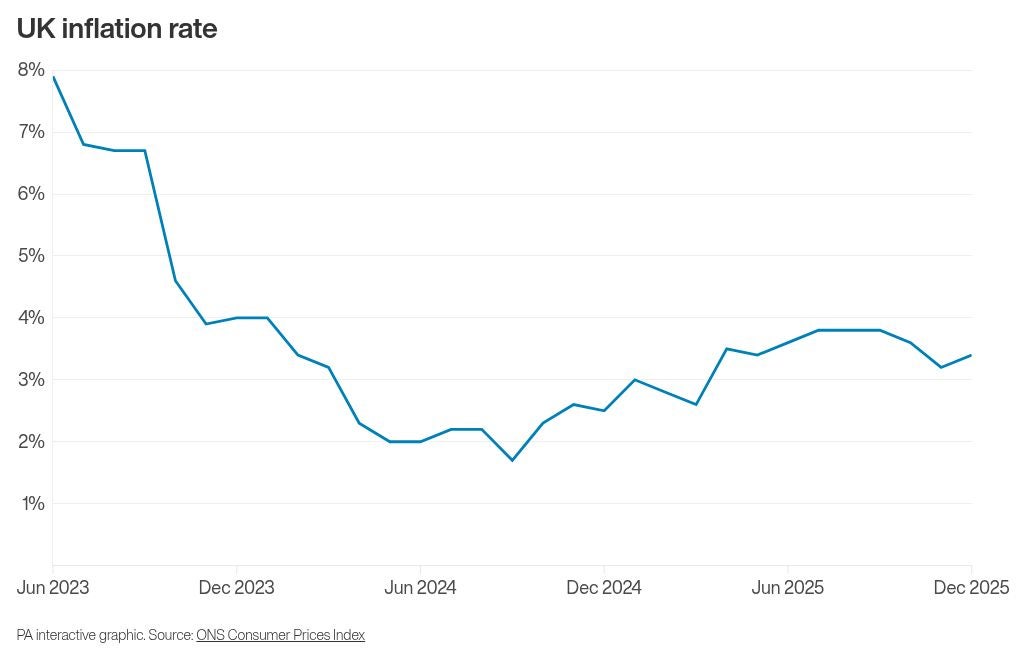

Since that decision, official data has revealed that inflation unexpectedly rebounded in December, rising for the first time in five months.

The Consumer Prices Index (CPI) inflation rate reached 3.4% for the month, an increase from 3.2% in November, with factors such as tobacco duties and airfares contributing to the upward pressure on prices.

Economists suggest this inflation uptick is likely to reinforce the MPC’s inclination to keep rates steady this month.

Philip Shaw, an analyst for Investec, stated: “The principal reason to hold off from easing again is that at 3.4% in December, inflation remains well above the 2% target.”

He added: “But with the stance of policy less restrictive than previously, there are greater risks that further easing is unwarranted.”

Shaw also highlighted other data points the MPC would consider, including gross domestic product (GDP), which saw a return to growth of 0.3% in November – a potentially encouraging sign for policymakers.

Matt Swannell, chief economic advisor to the EY ITEM Club, affirmed: “Keeping bank rate unchanged at 3.75% at next week’s meeting looks a near-certainty.”

He noted that while some MPC members who favoured a cut in December still have concerns about persistent wage growth and inflation, recent data has not been compelling enough to prompt back-to-back reductions.

Edward Allenby, senior economic advisor at Oxford Economics, forecasts the next rate cut to occur in April.

He explained: “The MPC will continue to face a delicate balancing act between supporting growth and preventing inflation from becoming entrenched, with forthcoming data on pay settlements likely to play a decisive role in shaping the next policy move.”

The Bank’s policymakers have consistently voiced concerns regarding the pace of wage increases in the UK, which can fuel overall inflation.

Business

Budget 2026: India pushes local industry as global tensions rise

India’s budget focuses on infrastructure and defence spending and tax breaks for data-centre investments.

Source link

Business

New Income Tax Act 2025 to come into effect from April 1, key reliefs announced in Budget 2026

New Delhi: Finance Minister Nirmala Sitharaman on Sunday said that the Income Tax Act 2025 will come into effect from April 1, 2026, and the I-T forms have been redesigned such that ordinary citizens can comply without difficulty for ease of living.

The new measures include exemption on insurance interest awards, nil deduction certificates for small taxpayers, and extension of the ITR filing deadline for non-audit cases to August 31.

Individuals with ITR 1 and ITR 2 will continue to file I-T returns till July 31.

“In July 2024, I announced a comprehensive review of the Income Tax Act 1961. This was completed in record time, and the Income Tax Act 2025 will come into effect from April 1, 2026. The forms have been redesigned such that ordinary citizens can comply without difficulty, for) ease of living,” she said while presenting the Budget 2026-27

In a move that directly eases cash-flow pressure on individuals making overseas payments, the Union Budget announced lower tax collection at source across key categories.

“I propose to reduce the TCS rate on the sale of overseas tour programme packages from the current 5 per cent and 20 per cent to 2 per cent without any stipulation of amount. I propose to reduce the TCS rate for pursuing education and for medical purposes from 5 per cent to 2 per cent,” said Sitharaman.

She clarified withholding on services, adding that “supply of manpower services is proposed to be specifically brought within the ambit of payment contractors for the purpose of TDS to avoid ambiguity”.

“Thus, TDS on these services will be at the rate of either 1 per cent or 2 per cent only,” she mentioned during her Budget speech.

The Budget also proposes a tax holiday for foreign cloud companies using data centres in India till 2047.

-

Sports5 days ago

Sports5 days agoPSL 11: Local players’ category renewals unveiled ahead of auction

-

Tech1 week ago

Tech1 week agoStrap One of Our Favorite Action Cameras to Your Helmet or a Floaty

-

Sports1 week ago

Sports1 week agoWanted Olympian-turned-fugitive Ryan Wedding in custody, sources say

-

Entertainment1 week ago

Entertainment1 week agoThree dead after suicide blast targets peace committee leader’s home in DI Khan

-

Tech1 week ago

Tech1 week agoThis Mega Snowstorm Will Be a Test for the US Supply Chain

-

Sports1 week ago

Sports1 week agoStorylines shaping the 2025-26 men’s college basketball season

-

Fashion1 week ago

Fashion1 week agoSpain’s apparel imports up 7.10% in Jan-Oct as sourcing realigns

-

Entertainment1 week ago

Entertainment1 week agoUFC Head Dana White credits Trump for putting UFC ‘on the map’