Business

Full list of Morrisons cafe and store closures revealed

Morrisons has said it will shut 52 of its in-store cafes along with some of its convenience stores, florists, meat and fish counters and pharmacies.

Eighteen market kitchens, 17 convenience stores, 13 florists, 35 meat counters, 35 fish counters and four pharmacies will also be affected.

The supermarket said the closures are part of a shake-up which will result in 365 people facing redundancy.

Full Morrisons store closure list

Cafes

Bradford Thornbury – West Yorkshire

Paisley Falside Rd – Renfrewshire, Scotland

London Queensbury – Greater London

Portsmouth – Hampshire

Great Park – Tyne and Wear

Banchory North Deeside Rd – Aberdeenshire, Scotland

Failsworth Poplar Street – Greater Manchester

Blackburn Railway Road – Lancashire

Leeds Swinnow Rd – West Yorkshire

London Wood Green – Greater London

Kirkham Poulton St – Lancashire

Lutterworth Bitteswell Rd – Leicestershire

Stirchley – West Midlands

Leeds Horsforth – West Yorkshire

London Erith – Greater London

Crowborough – East Sussex

Bellshill John St – North Lanarkshire, Scotland

Dumbarton Glasgow Rd – West Dunbartonshire, Scotland

East Kilbride Lindsayfield – South Lanarkshire, Scotland

East Kilbride Stewartfield – South Lanarkshire, Scotland

Glasgow Newlands – Glasgow, Scotland

Largs Irvine Rd – North Ayrshire, Scotland

Troon Academy St – South Ayrshire, Scotland

Wishaw Kirk Rd – North Lanarkshire, Scotland

Newcastle upon Tyne Cowgate – Tyne and Wear

Northampton Kettering Road – Northamptonshire

Bromsgrove Buntsford Ind Pk – Worcestershire

Solihull Warwick Rd – West Midlands

Brecon Free St – Powys, Wales

Caernarfon North Rd – Gwynedd, Wales

Hadleigh – Suffolk

Harrow, Hatch End – Greater London

High Wycombe Temple End – Buckinghamshire

Leighton Buzzard Lake St – Bedfordshire

London Stratford – Greater London

Sidcup Westwood Lane – Greater London

Welwyn Garden City Black Fan Rd – Hertfordshire

Warminster Weymouth St – Wiltshire

Oxted Station Yard – Surrey

Reigate Bell St – Surrey

Borehamwood – Hertfordshire

Weybridge, Monument Hill – Surrey

Bathgate – West Lothian, Scotland

Erskine Bridgewater SC – Renfrewshire, Scotland

Gorleston Blackwell Road – Norfolk

Connah’s Quay – Flintshire, Wales

Mansfield Woodhouse – Nottinghamshire

Elland – West Yorkshire

Gloucester – Metz Way – Gloucestershire

Watford – Ascot Road – Hertfordshire

Littlehampton – Wick – West Sussex

Helensburgh – Argyll and Bute, Scotland

Morrisons Daily convenience stores

Gorleston Lowestoft Road – Norfolk

Peebles 3-5 Old Town – Scottish Borders, Scotland

Shenfield 214 Hutton Road – Essex

Poole Waterloo Estate – Dorset

Tonbridge Higham Lane Est – Kent

Romsey The Cornmarket – Hampshire

Stewarton Lainshaw Street – East Ayrshire, Scotland

Selsdon Featherbed Lane – Greater London

Haxby Village – North Yorkshire

Great Barr Queslett Rd – West Midlands

Whickham Oakfield Road – Tyne and Wear

Worle – Somerset

Goring-By-Sea Strand Parade – West Sussex

Woking Westfield Road – Surrey

Wokingham 40 Peach Street – Berkshire

Exeter 51 Sidwell Street – Devon

Bath Moorland Road – Somerset

Business

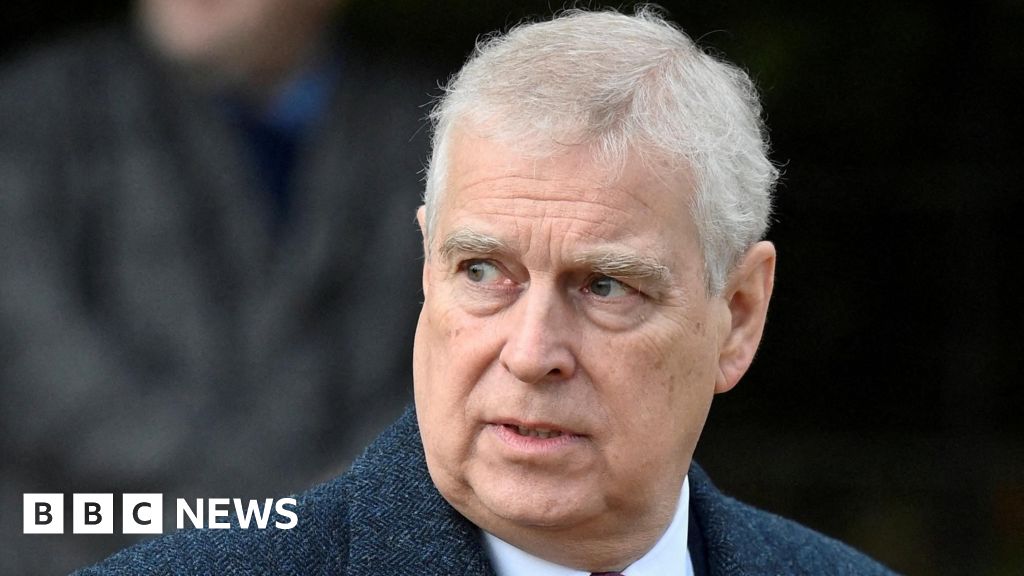

Andrew’s time as trade envoy should be investigated, says Vince Cable

The former prince’s alleged actions were “totally unacceptable”, the ex-business secretary says.

Source link

Business

Gender pay gap won’t close until 2056, warns Trades Union Congress

The average woman employee “effectively works for 47 days of the year for free,” according to the Trades Union Congress.

Source link

Business

Gold, Silver likely to consolidate in coming week amid Fed rate-cut uncertainty: Analysts – The Times of India

Precious metal prices are expected to remain volatile and witness further consolidation in the coming week as investors track key US economic indicators, including inflation data, GDP readings and signals from the Federal Reserve, analysts said.Traders are also likely to monitor US labour market data, the minutes of the Federal Open Market Committee (FOMC) meeting and speeches from Fed officials for clarity on the timing and pace of potential rate cuts, as per news agency PTI.

Volatility to persist on US GDP, PCE data

Pranav Mer, vice president, EBG – commodity & currency research at JM Financial Services Ltd, said gold and silver prices may continue to witness consolidative moves, though volatility is expected to persist.“Gold and silver prices may continue to see more consolidative moves but volatility will prevail with focus on incoming US data on GDP and the Personal Consumption Expenditures (PCE) inflation numbers and Federal Reserve official’s commentary,” he said, as per PTI.On the domestic front, silver futures on the Multi Commodity Exchange (MCX) declined Rs 5,532, or 2.2 per cent, over the past week, while gold rose Rs 444, or 0.3 per cent.

Gold corrects sharply in February

Prathamesh Mallya, DVP – research, non-agri commodities and currencies at Angel One, said gold prices have corrected in February.“Gold prices have fallen in February 2026, with prices correcting from highs of Rs 1,80,000 per 10 grams to around Rs 1,53,800 per 10 grams as on February 13,” he said, as per PTI.He attributed the weakness to stronger-than-expected US employment data, which has reduced expectations of near-term rate cuts and weighed on gold prices in the past week.“However, the yellow metal’s safe haven appeal remains intact on account of geopolitical tensions, and strong buying ahead of the Lunar New Year. It’s a tug of war between bears and bulls this week, and the volatility will continue in the week ahead,” Mallya added.

International trends and market drivers

In the international market, Comex gold futures gained $84, or 1.7 per cent, during the week, while silver edged up marginally to close at $77.27 per ounce.Mer said gold prices moved between gains and losses through most of the trading sessions but managed to end the week higher.“Gold prices see-sawed between gains and losses for most part of the trading session, but managed to close the week in positive and above $5,000 per ounce in the overseas market.“The bullions are passing through a phase of consolidation amid a lack of clarity among traders as they remain divided over the price direction and look for fresh fundamental triggers,” he said.Analysts noted that central bank buying, safe-haven demand amid a sharp sell-off in global technology and AI stocks, and a softer dollar index provided support to bullion prices.However, mixed physical demand from India and China, profit-booking by ETF investors and strong US macroeconomic data capped the upside.Mer said silver also experienced two-way price movements during the week.“The white metal was weighed by corrections in industrial metals and profit-booking after failing to breach key technical resistance. It also faced pressure from the tech-led global equity sell-off, which reduced risk appetite across asset classes,” he added.Analysts said both gold and silver are likely to remain range-bound in the near term as investors await clearer signals on the Federal Reserve’s monetary policy trajectory and broader global economic trends.

-

Business5 days ago

Business5 days agoAye Finance IPO Day 2: GMP Remains Zero; Apply Or Not? Check Price, GMP, Financials, Recommendations

-

Fashion5 days ago

Fashion5 days agoComment: Tariffs, capacity and timing reshape sourcing decisions

-

Tech6 days ago

Tech6 days agoRemoving barriers to tech careers

-

Fashion5 days ago

Fashion5 days agoADB commits $30 mn to support MSMEs in Philippines

-

Entertainment5 days ago

Entertainment5 days ago‘Harry Potter’ star David Thewlis doesn’t want you to ask him THIS question

-

Fashion5 days ago

Fashion5 days agoSaint Laurent retains top spot as hottest brand in Q4 2025 Lyst Index

-

Sports5 days ago

Sports5 days agoWinter Olympics opening ceremony host sparks fury for misidentifying Mariah Carey, other blunders

-

Entertainment1 week ago

Entertainment1 week agoVictoria Hervey calls out Andrew’s powerful circle in Epstein revelations