Fashion

Global GDP growth to be resilient at 3.3% in 2026; India above US: IMF

The United States accounts for 9.9 per cent of projected worldwide GDP expansion, while China ranks higher at 26.6 per cent.

Global growth is projected at 3.3 per cent in 2026 and at 3.2 per cent in 2027, the IMF’s World Economic Outlook January 2026 Update said.

India accounts for 17 per cent of projected worldwide GDP expansion, the US accounts for 9.9 per cent, while China ranks higher at 26.6 per cent.

Global headline inflation may drop from 4.1 per cent in 2025 to 3.8 per cent in 2026 and 3.4 per cent in 2027.

The update marks a small upward revision for 2026 and no change for 2027 compared with that in the October 2025 WEO.

“This steady performance on the surface results from the balancing of divergent forces. Headwinds from shifting trade policies are offset by tailwinds from surging investment related to technology, including artificial intelligence (AI), more so in North America and Asia than in other regions, as well as fiscal and monetary support, broadly accommodative financial conditions, and adaptability of the private sector,” the report said.

Global headline inflation is expected to decline from an estimated 4.1 per cent in 2025 to 3.8 per cent in 2026 and further to 3.4 per cent in 2027, the IMF said. The inflation projections are also broadly unchanged from those in October and envisage inflation returning to target more gradually in the United States than in other large economies.

For India specifically, growth has been revised upward by 0.7 percentage points to 7.3 per cent for 2025, reflecting a better-than-expected third quarter and strong momentum in the fourth quarter. Growth in the country is projected to moderate to 6.4 per cent in 2026 and 2027 as cyclical and temporary factors fade.

While inflation in China is expected to rise gradually from low levels, inflation in India is likely to return close to target after a sharp decline in 2025.

Risks to the global outlook remain tilted to the downside. Re-evaluation of productivity growth expectations about AI could lead to a decline in investment and trigger an abrupt financial market correction, spreading from AI-linked companies to other segments and eroding household wealth, noted the report.

Trade tensions could flare up, prolonging uncertainty and weighing more heavily on activity.

Domestic political tensions or geopolitical tensions could erupt, introducing new layers of uncertainty and disrupting the global economy through their impact on financial markets, supply chains and commodity prices, the latest WEO said.

Larger fiscal deficits and high public debt could put pressure on long-term interest rates and, in turn, on broader financial conditions.

On the upside, activity could be further lifted by AI-related investment and eventually transform into sustainable growth if faster AI adoption translates into strong productivity gains and increased business dynamism.

Activity could also be supported by a sustained easing in trade tensions, it added.

Fibre2Fashion (DS)

Fashion

South Korea’s apparel imports decline to $12 bn in 2025

Imports of knitted apparel and clothing accessories (Chapter **) were valued at $*.*** billion in ****, marginally higher than $*.*** billion a year earlier. Knitted categories remained relatively resilient, supported by steady year-round demand for basics and athleisure, even as overall apparel spending moderated amid cautious consumer sentiment.

By contrast, imports of non-knitted apparel and clothing accessories (Chapter **) totalled $*.*** billion, down *.** per cent from $*.*** billion in ****. These segments, which are more dependent on fashion-driven seasonal collections, faced sharper pullbacks as retailers trimmed orders to manage slower sell-through, higher inventories and increased promotional activity.

Fashion

Gordon Brothers acquires UK’s LK Bennett brand & global IP

Fashion

Sri Lanka clears Renewable Energy Resources Development Plan 2025-2030

The target is to achieve 70 per cent of the country’s national electricity demand through renewable energy sources by 2030, and carbon neutrality by 2050.

Sri Lanka’s cabinet recently approved a Renewable Energy Resources Development Plan for 2025-2030, prepared by the Sri Lanka Sustainable Energy Authority, Minister of Health and Mass Media Nalinda Jayatissa announced.

The target is to achieve 70 per cent of the country’s national electricity demand through renewable energy sources by 2030, and carbon neutrality by 2050.

This report provides the prioritisation of large-scale renewable energy development projects, and the planned projects for the upcoming periods, based on resource maps of the particular energy sources.

Potential sites of different types of renewable energy resources have been identified, and taken for prioritisation for future development based on resource potential, land use, distance to roads, slope, distance to grid substations (GSS), urban centres and exclusionary conservation areas.

Resource potential was rated as the most important criterion. Access to GSS was not considered as a criterion for wind and solar plants above 100 MW.

Fibre2Fashion (DS)

-

Business1 week ago

Business1 week agoPSX witnesses 6,000-point on Middle East tensions | The Express Tribune

-

Tech1 week ago

Tech1 week agoThe Surface Laptop Is $400 Off

-

Tech1 week ago

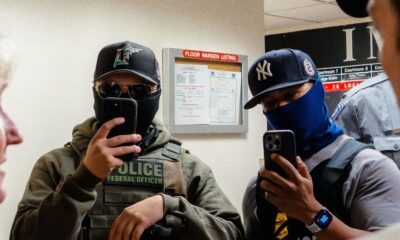

Tech1 week agoHere’s the Company That Sold DHS ICE’s Notorious Face Recognition App

-

Business1 week ago

Business1 week agoBudget 2026: Defence, critical minerals and infra may get major boost

-

Tech4 days ago

Tech4 days agoHow to Watch the 2026 Winter Olympics

-

Tech6 days ago

Tech6 days agoRight-Wing Gun Enthusiasts and Extremists Are Working Overtime to Justify Alex Pretti’s Killing

-

Business6 days ago

Business6 days agoLabubu to open seven UK shops, after PM’s China visit

-

Sports1 week ago

Sports1 week agoDarian Mensah, Duke settle; QB commits to Miami