Business

Govt to localise lithium-ion battery | The Express Tribune

Pakistan is engaging China in agreements worth $558 million

Lithium-ion batteries are pictured at the production site of Saft Groupe, battery specialists, in Poitiers, France, October 5, 2017.

PHOTO: REUTERS

ISLAMABAD:

Pakistan is engaging China in agreements worth $558 million focused on lithium-ion battery assembly and manufacturing for value addition, officials said on Tuesday.

The government is pursuing business-to-business engagements with Chinese firms to exploit local mineral reserves and reduce import reliance through domestic battery production. A phased domestic supply plan has been identified to address gaps, import dependence, joint-venture opportunities and required policy actions.

This was discussed at a high-level meeting on the Lithium-Ion Battery Policy chaired by Special Assistant to the Prime Minister on Industries and Production Haroon Akhtar Khan. The meeting was attended by Secretary Industries and Production Saif Anjum, Engineering Development Board Chief Executive Hammad Mansoor and private-sector representatives.

Participants reviewed progress on the National Lithium-Ion Battery Manufacturing Policy 20262031. The SAPM said the energy storage policy must be integrated with Pakistan’s national energy security framework, in line with the prime minister’s directives, and underscored the importance of private-sector and global investor partnerships.

Business

Cruise companies cancel Puerto Vallarta stops after violence in Mexico

A satellite image shows cars on fire along a coastal road in Puerto Vallarta, Jalisco, Mexico, Feb. 22, 2026, following the killing of drug lord Nemesio Oseguera, known as “El Mencho,” in a military operation.

Vantor | Via Reuters

American travel companies are scrambling to reroute cruise ships and take care of tourists to Mexico after violence and chaos erupted in several coastal regions in the country following the killing of a cartel leader.

The U.S. State Department broadened its warning to travelers to shelter in place across multiple regions of Mexico, including the popular tourist hot spots of Cancun, Playa del Carmen, Cozumel, Tulum, Tijuana and Puerto Vallarta.

Violence erupted after the Mexican army killed Jalisco New Generation Cartel leader Nemesio Rubén Oseguera Cervantes. Known as “El Mencho,” he led one of fastest-growing criminal networks in Mexico, notorious for trafficking fentanyl, methamphetamine and cocaine to the United States and staging brazen attacks against government officials who challenged it, The Associated Press reported.

As roads were blockaded with burning vehicles, airlines canceled flights and cruise lines rerouted ships to avoid ports with potential problems.

Carnival Corp. said Princess Cruises’ Royal Princess and Holland America Line’s Zuiderdam were bypassing their planned stops in Puerto Vallarta on Monday. Norwegian Cruise Line said its ship the Norwegian Bliss has canceled its plans to call on Puerto Vallarta on Wednesday.

MSC Cruises USA said sailings to Cozumel and Costa Maya, Mexico, are currently operating as planned, but that shore excursions may be adjusted or canceled.

Though Royal Caribbean said it doesn’t have ships currently in the affected areas, CNBC has learned some of its excursions in Ensenada, Mexico, were affected.

Airbnb told CNBC it had activated its “major disruptive events policy” in Jalisco state and other affected regions. That policy overrides the host’s individual cancellation policy, allowing travelers and hosts to cancel reservations without consequences.

“We are monitoring this situation carefully and are focused on supporting guests and hosts in impacted areas,” an Airbnb spokesperson said.

In a note to investors, Truist travel and leisure analyst Patrick Scholes wrote that Hyatt has the most exposure of the international brands, with 8.5% of its room total coming from Mexico. Marriott has the second-highest exposure, with 3.3% of its overall rooms coming from Mexico.

Typical travel insurance policies often carry exclusions for terrorism, political violence or civil unrest.

Squaremouth, an online marketplace for travel insurance, warned would-be travelers that “the violence in Mexico is now a foreseeable event, or what the insurance industry calls a known event. So tourists can’t buy coverage now in order to cancel their trip.”

However, a Squaremouth spokesperson told CNBC, “If you are heading to Mexico soon, especially during spring break, buying CFAR [cancel for any reason] or IFAR [interruption for any reason] as add-ons is a smart decision given the uncertainty.”

Business

Airlines halt Puerto Vallarta flights after violence following Mexican cartel leader’s killing

Smoke billows from burning vehicles amid a wave of violence, with torched vehicles and gunmen blocking highways in more than half a dozen states, following a military operation in which a government source said Mexican drug lord Nemesio Oseguera, known as “El Mencho,” was killed, in Puerto Vallarta, Jalisco, Mexico, February 22, 2026, in this screen grab obtained from a social media video.

Stringer | Reuters

U.S. and Canadian airlines halted flights to Puerto Vallarta and Guadalajara in Mexico after violence broke out in the country in the wake of the Mexican army’s killing of a cartel leader.

The U.S. State Department on Sunday told U.S. citizens to shelter in place, citing “ongoing security operations and related road blockages and criminal activity.”

Air Canada, American Airlines, Delta Air Lines, Southwest Airlines, United Airlines and others canceled flights to Puerto Vallarta, a popular tourist destination on Mexico’s Pacific coast, and to Guadalajara, which is also in the Jalisco state. Airlines waived change fees for affected travelers.

Flights to other major airports in the country, like Mexico City and Cancun, weren’t impacted by the unrest.

Stranded passengers line up at Guadalajara Airport in Tlajomulco, Jalisco, Mexico, on February 23, 2026, to claim compensation for flights that were canceled or postponed the previous day.

Ulises Ruiz | Afp | Getty Images

Several Mexican states also canceled school on Monday after the country’s army killed Nemesio Rubén Oseguera Cervantes. Known as “El Mencho,” he led one of fastest-growing criminal networks in Mexico, notorious for trafficking fentanyl, methamphetamine and cocaine to the United States and staging brazen attacks against government officials who challenged it, The Associated Press reported.

He was killed during a shoot-out in his home state of Jalisco, AP said.

Airlines routinely suspend service due to unrest and infrastructure problems to avoid having passengers, crews and aircraft stranded.

Business

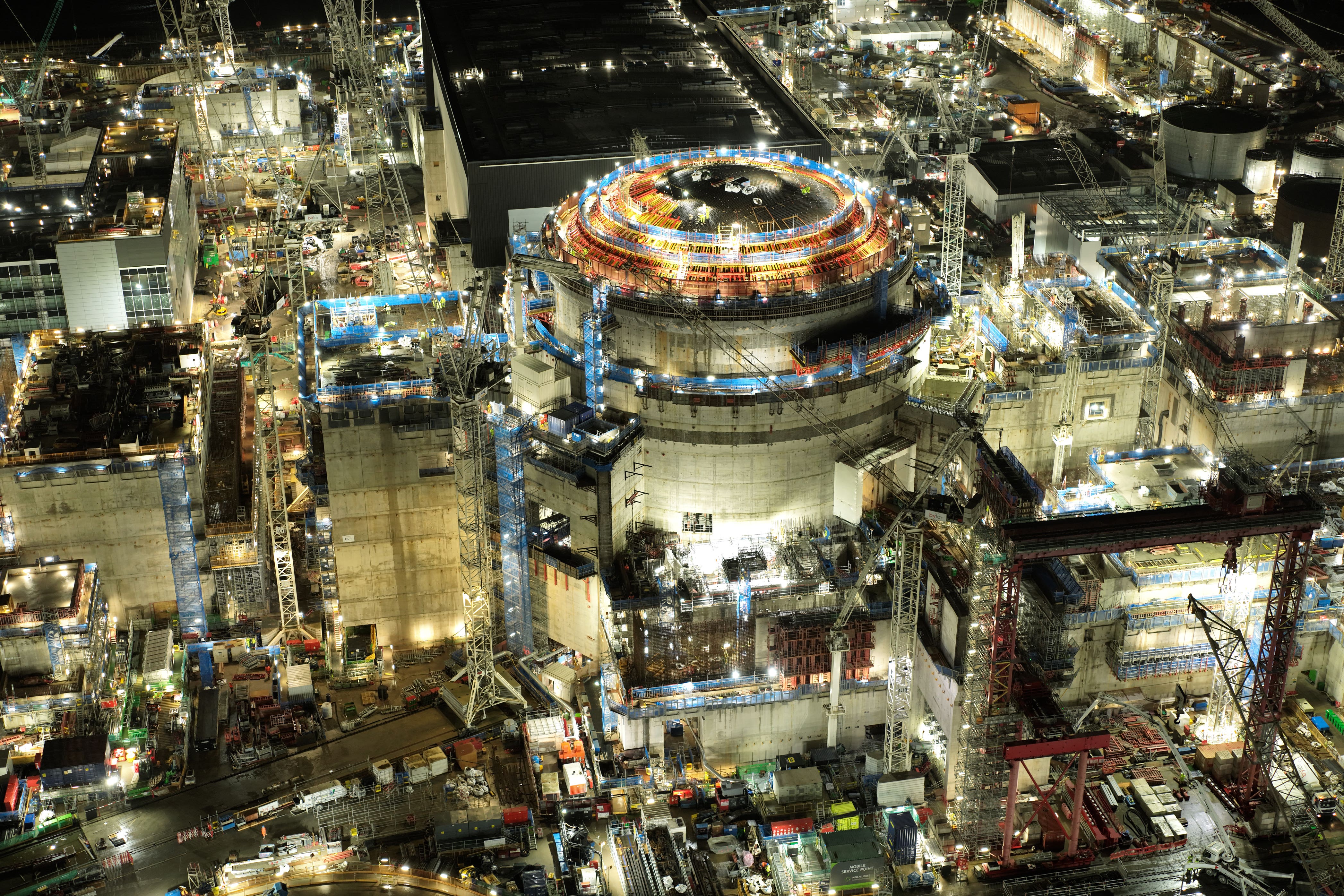

EDF pledges £15bn UK investment as falling energy prices hit profits

French energy giant EDF saw its UK profits decline last year, attributed to a combination of falling energy prices and a significant outage at one of its nuclear power stations.

Despite this setback, the company has announced plans for a substantial £15 billion investment in the country over the next three years.

The energy firm reported a 12 per cent decrease in nuclear output from its five operational power stations during the period.

While its Sizewell B facility in Suffolk and Torness in Scotland performed strongly, the overall output was significantly impacted by an extended outage at the Hartlepool power station.

The Teesside-based station, which began generating power 43 years ago and supplies electricity to approximately two million homes, experienced a prolonged shutdown.

Despite these operational challenges, Hartlepool recently secured a one-year extension to its operational lifespan, now expected to generate electricity until March 2028.

This extended downtime, primarily due to issues affecting one of its two reactor systems, was identified as the main driver for EDF‘s overall decline in nuclear generation last year.

Furthermore, a decline in earnings was also down to the prices it charges for nuclear power being lower than in 2024.

It is understood that average prices were down by approximately 20 per cent.

Energy prices in the UK have been gradually coming down after spiking in the aftermath of Russia’s invasion of Ukraine in 2022.

EDF said that in its UK business, earnings before interest, tax, depreciation and amortisation (EBITDA) were £1.9 billion for 2025, down about a third from £2.9 billion in 2024.

EDF’s nuclear fleet provided about 12 per cent of the UK’s total power demand last year – which it says makes it Britain’s biggest generator of zero carbon electricity.

The company said it invested more than £5 billion in Britain over 2025, 30 per cent more than the year before.

Over the next three years, it plans to plug a further £15 billion into the UK across its different businesses – which also incorporates wind and solar power generation.

A large portion of the funding will go towards the development of the Hinkley Point C power plant which is being built in Somerset.

EDF is separately an investor in the major Sizewell C project in Suffolk, which is backed by the Government.

The two developments are expected to provide low carbon electricity to meet 14% of UK demand and power around 12 million homes.

Simone Rossi, chief executive of EDF in the UK, said: “EDF is continuing to invest heavily in powering, supplying and building an electric Britain.

“Our UK strategy is to deliver a long-term nuclear and renewables generation business, and to meet the evolving needs of our customers as more and more transition away from fossil fuels to using cleaner, more secure and affordable electricity.”

-

Entertainment6 days ago

Entertainment6 days agoQueen Camilla reveals her sister’s connection to Princess Diana

-

Tech7 days ago

Tech7 days agoRakuten Mobile proposal selected for Jaxa space strategy | Computer Weekly

-

Politics6 days ago

Politics6 days agoRamadan moon sighted in Saudi Arabia, other Gulf countries

-

Entertainment6 days ago

Entertainment6 days agoRobert Duvall, known for his roles in "The Godfather" and "Apocalypse Now," dies at 95

-

Politics6 days ago

Politics6 days agoTarique Rahman Takes Oath as Bangladesh’s Prime Minister Following Decisive BNP Triumph

-

Business6 days ago

Business6 days agoTax Saving FD: This Simple Investment Can Help You Earn And Save More

-

Tech7 days ago

Tech7 days agoBusinesses may be caught by government proposals to restrict VPN use | Computer Weekly

-

Sports7 days ago

Sports7 days agoUsman Tariq backs Babar and Shaheen ahead of do-or-die Namibia clash