Business

GST revamp: What are the latest tax rates on cars, gold, mobile phones, EVs, cigarettes? Check details – The Times of India

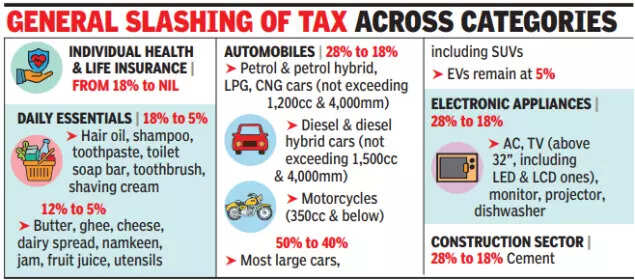

The Goods and Services Tax (GST) Council, chaired by Union finance minister Nirmala Sitharaman, on Wednesday announced the most extensive revamp of the indirect tax system since its rollout in 2017.The reform introduces a simplified two-slab structure of 5% and 18%, alongside a new 40% slab for luxury and sin goods.The new rates, except for tobacco where cess continues, take effect from September 22, the first day of Navratri.

Revenue secretary Arvind Shrivastava estimated the net fiscal implication of the changes at Rs 48,000 crore. He added the measures are designed to spur consumption and improve compliance.

Sitharaman underlined that the reforms were aimed at the common man, stating, “Every tax levied on common man’s daily use items have undergone a rigorous look, and in most cases, the rates have come down drastically”.

Cars

Buyers of small cars stand to benefit the most. Small cars will now attract 18% GST, reduced from the earlier 29% (28% plus 1% cess).For GST purposes, small cars are defined as petrol, LPG or CNG vehicles with an engine capacity of up to 1200 cc and length up to 4000 mm. In the case of diesel cars, the definition covers vehicles with engine capacity up to 1500 cc and length not exceeding 4000 mm.Large vehicles exceeding 1500 cc or longer than 4000 mm will fall into the new 40% GST slab.The same rate will also apply to all utility vehicles, including SUVs, MUVs, MPVs and cross-over vehicles, provided they have an engine capacity above 1500 cc, a length over 4000 mm, and a ground clearance of 170 mm or more.Unlike the earlier regime that combined 28% GST with a 17–22% cess, the new framework consolidates this into a single 40% rate without cess.

Bikes

Two-wheelers have also seen a rationalisation. Motorcycles up to 350 cc engine capacity will attract 18% GST, reduced from 28%. The 18% rate also applies to 350 cc models.Motorcycles exceeding 350 cc engine capacity have been placed in the 40% bracket, aligning them with the treatment of luxury and high-powered vehicles.This change is expected to encourage mass-market two-wheeler sales, especially in rural and urban middle-class markets, while continuing to tax premium motorcycles at a higher rate.

Electric Vehicles

Electric cars remain unchanged, continuing to be taxed at 5%.

Health Insurance

A major relief comes for individuals purchasing life and health insurance. These policies will now be exempt from GST. Earlier, these services attracted 18%, adding to premium costs.Exemption is expected to make policies more affordable, widening insurance coverage in a country where penetration levels remain low.

Cigarettes and tobacco

The GST Council has shifted cigarettes, cigars, pan masala, and chewing tobacco into the 40% slab. However, until compensation cess loans are fully repaid, the existing 28% GST plus cess regime will continue.Analysts noted that revenue neutrality is a priority for the government, as cigarette taxation contributes significantly to exchequer inflows. The move balances public health concerns with the need to curb illicit trade.

Alcohol

Alcohol remains outside the purview of GST altogether. It continues to be taxed separately through state excise duties, meaning the GST overhaul has no bearing on alcohol pricing.States will retain autonomy in setting alcohol taxes, a key revenue source for their budgets.

Gold

There has been no change in the taxation of precious metals. Gold and silver jewellery remain taxed at 3%, with an additional 5% GST on making charges. Gold bars and coins also continue to face 3% GST.With no direct impact from GST 2.0, demand in the bullion market is expected to remain steady, especially during the festive season when purchases peak.

Mobile Phones

Despite repeated industry requests, mobile phones remain taxed at 18%. ET reported that the India Cellular and Electronics Association (ICEA) had sought a 5% slab, calling the current levy “regressive” and reminding that pre-GST state VAT on mobiles was mostly capped at 5%.Despite the wider rate cuts across consumer goods, mobile phones remain at 18% GST, unchanged under the new regime. As per ET, the India Cellular and Electronics Association (ICEA) had urged for a 5% slab, calling the current levy “regressive.”The industry argued that mobile phones are a basic digital necessity, not a luxury.ICEA highlighted that pre-GST, most states had capped VAT at 5%. With domestic production rising to Rs 5.45 lakh crore in FY25 and exports crossing Rs 2 lakh crore, industry bodies stressed that lower GST would have boosted affordability and domestic demand.

Business

Next buys shoe brand Russell & Bromley but 400 jobs still at risk

High street fashion giant Next has bought shoe retailer Russell & Bromley which had collapsed in to administration.

Next paid £2.5m in a rescue deal for the upmarket British footwear and accessories seller — but the future for most of the chain’s current staff and shops remains uncertain

Next will own the brand and three of Russell & Bromley’s 36 stores, as well as some existing stock for which it is paying an additional £1.3m.

Administrators Interpath said it was considering the future of the remaining stores, which for the moment remain open, as well as nine concession stores which all employ around 400 people.

Russell & Bromley’s chief executive Andrew Bromley said it was a “difficult decision” but the sale of the brand was the best way to secure its future.

The company is around 150 years old but has become the latest to struggle in a tough retail environment.

It joins other brands in a familiar path to largely disappearing off the high street via a process of administration, which means companies are often broken up and the highest value assets sold off to the highest bidder.

The Original Factory Shop and accessories retailer Claire’s are both currently going through a process of administration, with site closures and jobs at risk. Around 1,000 people lost their jobs after Bodycare collapsed in September, while River Island will close some stores to avoid a total collapse. The woes all come after a tranche of high profile closures such as Debenhams and Wilko.

In a statement, Next said it secured “the future of a much loved British footwear brand.”

“Next intends to build on this legacy and provide the operational stability and expertise to support Russell & Bromley’s next chapter, allowing it to return to its core mission: the design and curation of world-class, premium footwear and accessories for many years to come.”

The three stores Next will acquire are in high-end shopping destinations in or around London: Chelsea, Mayfair and Kent.

Next has seen relatively solid performance in the current turbulent retail landscape – unlike Russell & Bromley which has been loss-making in recent years.

Its saviour has experience in failing circumstances: last year, Next bought out of administration fashion maternity label Seraphine, and began rolling out its FatFace concessions a few years after snapping it up.

Business

Over 80% of below 40 entrepreneurs self-made – The Times of India

MUMBAI: Nearly four out of five of India’s leading young entrepreneurs are self-made, underscoring a shift in the country’s business landscape from inheritance to merit, according to the Avendus Wealth – Hurun India Uth Series 2025. The report shows that about 80% of business leaders under 40 featured in the ranking are first-generation founders.The study tracks entrepreneurs aged up to 40 whose companies meet minimum valuation thresholds ranging from $25 million to $200 million, based on age cohort and whether the founder is first- or next-generation. Of the 436 entrepreneurs shortlisted, 349 are self-made, pointing to a growing ecosystem driven by new ideas and technology rather than legacy ownership.Among first-generation founders, Ritesh Agarwal, founder of OYO, leads the list. At 31, Agarwal has built one of the most capitalised startups in the country, raising $3.7 billion. He is followed by Aadit Palicha and Kaivalya Vohra, both 22, whose quick-commerce firm Zepto has raised $1.95 billion.Other prominent first-generation entrepreneurs include Nikhil Kamath of Zerodha, now among India’s most-followed entrepreneurs on LinkedIn; Alakh Pandey of Physics Wallah, who disrupted the ed-tech space; and Ghazal Alagh, the most-followed woman entrepreneur on the list.Next-generation leaders account for about 20% of the ranking and continue to shape large family-run businesses. Key names include Isha Ambani of Reliance Retail, which employs more than 2.47 lakh people; Abhyuday Jindal, who is driving sustainability initiatives at Jindal Stainless; and Vidhi Shanghvi, who recently led Sun Pharmaceutical’s $355 million acquisition of US-based Checkpoint Therapeutics.The report categorises entrepreneurs across three age groups—under 30, under 35 and under 40. Together, the companies led by these 436 entrepreneurs are valued at more than $950 billion, higher than Switzerland’s GDP. Bengaluru tops the list with 109 entrants, followed by Mumbai with 87 and New Delhi with 45. Software products and services dominate with 77 entrepreneurs, ahead of financial services and healthcare, highlighting the tilt toward digital and technology-led businesses.

Business

Are UK interest rates expected to fall again?

Kevin PeacheyCost of living correspondent

Getty Images

Getty ImagesThe Bank of England has cut interest rates from 4% to 3.75%, the lowest level since February 2023.

Analysts are divided about whether the Bank will cut again when it next meets in February.

Interest rates affect mortgage, credit card and savings rates for millions of people.

What are interest rates and why do they change?

An interest rate tells you how much it costs to borrow money, or the reward for saving it.

The Bank of England’s base rate is what it charges other banks and building societies to borrow money, which influences what they charge their own customers for mortgages as well as the interest rate they pay on savings.

The Bank moves interest rates up and down in order to keep UK inflation – the rate at which prices are increasing – at or near 2%.

When inflation is above that target, the Bank typically puts rates up. The idea is that this encourages people to spend less, reducing demand for goods and services and limiting price rises.

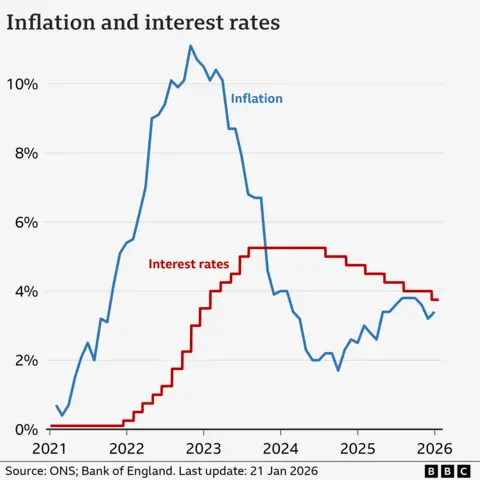

What has been happening to UK interest rates and inflation?

The main inflation measure, CPI, has dropped significantly since the high of 11.1% recorded in October 2022.

However, it was 3.4% in the year to December 2025 – up from 3.2% in November, and slightly higher than analysts had expected.

The Office for National Statistics (ONS) – which measures inflation – said the increase was driven by higher tobacco prices and the cost of airfares over the Christmas and New Year period.

The Bank of England’s base rate reached a recent high of 5.25% in 2023. It remained at that level until August 2024, when the Bank started cutting.

Five cuts brought rates down to 4%, before the Bank held rates at its meetings in September and November 2025 before the December cut.

Are interest rates expected to fall again?

Most analysts had expected the December cut, but the vote among members of the nine-member monetary policy committee (MPC) was divided, with only five in favour.

The Bank said rates were likely to continue dropping in the future, but warned decisions on further cuts in 2026 would be contested.

“We still think rates are on a gradual path downward but with every cut we make, how much further we go becomes a closer call,” said the Bank’s governor Andrew Bailey.

If inflation continues to rise – or just fails to fall – further rate cuts are less likely.

Mr Bailey has also repeatedly warned about the continuing impact of US tariffs, and political uncertainty around the world.

The next interest rate decision is on Thursday 5 February.

How do interest rate cuts affect mortgages, loans and savings rates?

Getty Images

Getty ImagesMortgages

Just under a third of households have a mortgage, according to the government’s English Housing Survey.

About 500,000 homeowners have a mortgage that “tracks” the Bank of England’s rate. A 0.25 percentage point cut is likely to mean a reduction of £29 in the monthly repayments for the average outstanding loan.

For the additional 500,000 homeowners on standard variable (SVR) rates – assuming their lender passed on the benchmark rate cut – there would typically be a £14 a month fall in monthly payments for the average outstanding loan.

But the vast majority of mortgage customers have fixed-rate deals. While their monthly payments aren’t immediately affected by a rate change, future deals are.

Mortgage rates have been falling recently, partly owing to the expectation the Bank would cut rates in December.

As of 21 January, the average two-year fixed residential mortgage rate was 4.77%, according to financial information company Moneyfacts. A five-year rate was 4.87%.

The average two-year tracker rate was 4.41%.

About 800,000 fixed-rate mortgages with an interest rate of 3% or below are expected to expire every year, on average, until the end of 2027. Borrowing costs for customers coming off those deals are expected to rise sharply.

Mortgage calculator

You can see how your mortgage may be affected by future interest rate changes by using our calculator:

Credit cards and loans

Bank of England interest rates also influence the amount charged on credit cards, bank loans and car loans.

Lenders can decide to reduce their own interest rates if Bank cuts make borrowing costs cheaper.

However, this tends to happen very slowly.

Getty Images

Getty ImagesSavings

The Bank base rate also affects how much savers earn on their money.

A falling base rate is likely to mean a reduction in the returns offered to savers by banks and building societies.

The current average rate for an easy access savings account is 2.45%, according to Moneyfacts.

Any further cut in rates could particularly affect those who rely on the interest from their savings to top up their income.

What is happening to interest rates in other countries?

In recent years, the UK has had one of the highest interest rates in the G7 – the group representing the world’s seven largest so-called “advanced” economies.

In June 2024, the European Central Bank (ECB) started to cut its main interest rate for the eurozone from an all-time high of 4%.

At its meeting in June 2025 the ECB cut rates by 0.25 percentage points to 2% where they have remained.

The US central bank – the Federal Reserve – has cut interest rates three times since September 2025, taking them to the current range of 3.5% to 3.75%, the lowest since 2022.

President Trump had repeatedly attacked the Fed for not cutting earlier.

-

Tech1 week ago

Tech1 week agoNew Proposed Legislation Would Let Self-Driving Cars Operate in New York State

-

Entertainment1 week ago

Entertainment1 week agoX (formerly Twitter) recovers after brief global outage affects thousands

-

Sports6 days ago

Sports6 days agoPak-Australia T20 series tickets sale to begin tomorrow – SUCH TV

-

Politics4 days ago

Politics4 days agoSaudi King Salman leaves hospital after medical tests

-

Business5 days ago

Business5 days agoTrump’s proposed ban on buying single-family homes introduces uncertainty for family offices

-

Tech7 days ago

Tech7 days agoTwo Thinking Machines Lab Cofounders Are Leaving to Rejoin OpenAI

-

Tech6 days ago

Tech6 days agoMeta’s Layoffs Leave Supernatural Fitness Users in Mourning

-

Fashion4 days ago

Fashion4 days agoBangladesh, Nepal agree to fast-track proposed PTA