Entertainment

Gwyneth Paltrow admits being conscious of marking comeback with ‘Marty Supreme’

Gwyneth Paltrow has been away from the big screen since her last film Avengers: Endgame in 2019.

After seven years, the actress is all set to mark her comeback to Hollywood with upcoming sports-based film Marty Supreme alongside Timothee Chalamet.

While talking about returning to the big screen, Paltrow confessed that she had doubts if she will be able to act the same way she did before or not.

In an interview she said, “Acting is so weird. It’s so hard to explain how you do it. It’s not a skillset that… it’s not a trade that you learn, and you get onboarded into how to do something.”

Gwyneth opened that she was conscious about acting as she was out of practice considering her years long break.

During the chat on Entertainment weekly’s The Awardist podcast, the Iron Man actress added, “It’s so weird and ephemeral and kind of magic. So I was like, how did I used to do this? And am I still going to be able to do this? Am I going to be able to access all that stuff and energy and in the moment?”

Directed by Josh Safdie, Marty Supreme is based on the 1950s young man named Marty Mauser, who pursues his dream of becoming a table tennis champion.

It is slated to release in theatres globally on December 25.

Entertainment

Apple to ditch traditional SMS, expand RCS support with iOS 26.4

Tech giant Apple is preparing to almost retire old-style text messaging in some of the most significant updates to its Messages app in years, with the upcoming iOS 26.4 this spring.

The new iOS update would expand Apple’s support for RCS (Rich Communication Services) in a move to ditch the limitations of traditional SMS.

The update aims to create a modern, cross-platform messaging experience that aligns with modern communication practices.

RCS is said to be the telecom industry’s long-awaited successor to SMS and MMS, offering features that users expect from modern messaging apps like WhatsApp. It facilitates high-quality media sharing, read receipts, typing indicators, and reliable delivery over Wi-Fi or mobile data.

A noteworthy point for iPhone users is that RCS reduces the gap between Apple’s iMessage ecosystem and Android devices, replacing the unreliable “green bubble” SMS experience with a native chat experience.

“End-to-end encryption is a powerful privacy and security technology that iMessage has supported since the beginning, and now we are pleased to have helped lead a cross-industry effort to bring end-to-end encryption to the RCS Universal Profile,” Apple stated.

This means that encrypted conversations, previously limited to iMessage-to-iMessage chats, will now be converted into iPhone-to-Android texts, with privacy protections ensured across platforms.

iOS 26.4 has been reported to bring a series of functional improvements that were missing in earlier RCS implementations. Features such as inline replies, message editing, unsending, and richer reactions will definitely boost user experience and bring Apple’s RCS offering in line with its competitors.

These developments point to a clear shift in Apple’s approach to cross-platform communication, as internal beta builds indicate active collaboration with mobile networks to support this transition.

Entertainment

Sarah Ferguson departure from Royal Lodge: Unusual details unveiled

Princess Beatrice and Princess Eugenie’s mother sparked reactions after unusual details about her departure from Royal Lodge were made public.

There are questions about Fergie’s whereabouts since Andrew Mountbatten-Windsor ‘kicked out’ from Royal Lodge to Wood Farm on the Sandringham Estate.

Now, an insider revealed to Daily Mail that Sarah has been “creeping back and forth” from Royal Lodge.

The former Duchess of York “smuggled in and out by car while lying prone on the back seat” in order to avoid media and public sightings.

On the other hand, Andrew moved to a new place after King Charles and Prince William’s secret discussions.

However, a source told Hello! Magazine that Sarah won’t be moving with Andrew, as she is “ready to spread her wings” after supporting her ex-husband for years.

“She won’t be moving in with him to the new house on the Sandringham Estate. She won’t be moving into Beatrice’s Cotswolds home, though. Eugenie’s home in Portugal is a contender while she finds somewhere,” added the source.

Entertainment

Andrew exposed for leaking trade secrets as calls for police probe grow

Andrew Mountbatten-Windsor’s friendship to Jeffrey Epstein was not only based on alleged wild parties, illicit activities, paedophilia and debauchery, it was also an exchange of important information that impacted global trade and international relations.

More revelations are coming out of the three million documents released by the US Department of Justice last week in the Epstein files. And apart from the disturbing email exchange with the convicted paedophile, one correspondence indicated that Andrew had been leaking crucial information.

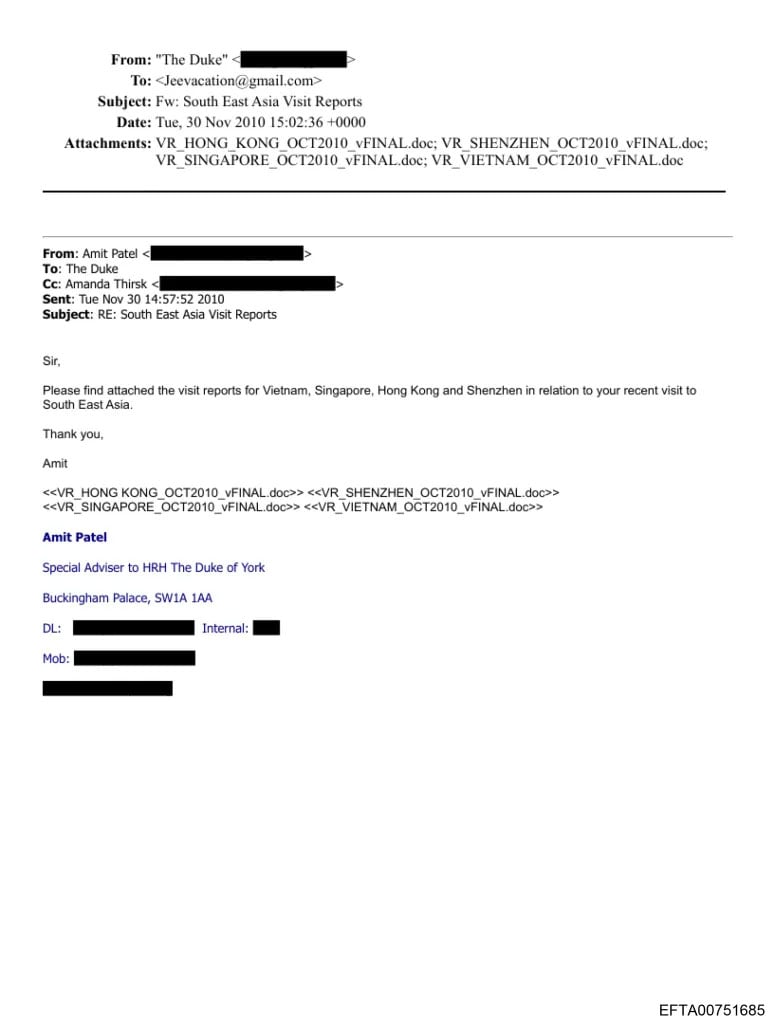

The former Duke of York’s ‘Special Adviser’ Amit Patel seemed to have sent Andrew four attachments which were “visit reports for Vietnam, Singapore, Hong Kong and Shenzhen in relation to your recent visit to South East Asia”. After five minutes of receiving the email, he forwarded it to the convicted financier.

The email had crucial and confidential information from at least four assessments in 2010 when Andrew was acting as a UK global trade envoy.

Former royal police commander Dai Davies asserts that a criminal investigation of King Charles’s brother is imminent now

“The failure to investigate Andrew across a range of alleged activity is a national scandal on the same scale as Mandelson. These emails show he abused his position,” he told The Sun. “The police simply have to know what was in these emails.”

He continued, “If he has divulged information of national importance, in a position of public trust, when he was funded by taxpayers, that must be investigated as a criminal act.”

-

Tech7 days ago

Tech7 days agoHow to Watch the 2026 Winter Olympics

-

Entertainment3 days ago

Entertainment3 days agoHow a factory error in China created a viral “crying horse” Lunar New Year trend

-

Business7 days ago

Business7 days agoPost-Budget Session: Bulls Push Sensex Up By Over 900 Points, Nifty Reclaims 25,000

-

Entertainment7 days ago

Entertainment7 days agoThe Traitors’ winner Rachel Duffy breaks heart with touching tribute to mum Anne

-

Tech1 week ago

Tech1 week agoI Tested 10 Popular Date-Night Boxes With My Hinge Dates

-

Fashion7 days ago

Fashion7 days agoCanada could lift GDP 7% by easing internal trade barriers

-

Business6 days ago

Business6 days agoNew York AG issues warning around prediction markets ahead of Super Bowl

-

Business7 days ago

Business7 days agoInvestors suffer a big blow, Bitcoin price suddenly drops – SUCH TV