Business

Here’s what you could do with your money after cash ISA cut in Reeves’s Budget

.jpeg?width=1200&height=800&crop=1200:800)

Rachel Reeves is set to cut the cash ISA limit in Wednesday’s Budget, with the cap poised to drop from £20,000 to £12,000.

The proposed move, seen as a bid to encourage more people towards investing rather than only saving in cash, has prompted a mixed reaction from consumers and businesses.

Many savers will not feel the impact of a cut on a day to day (or year to year, more specifically) limit, bearing in mind the difficulty many people have in saving upwards of £1,000 per month. But they could still be hit when they come into a lump sum – through inheritance, for example, or a property sale.

Either way, some people clearly want to move money before limits are cut. One cash ISA provider, Plum, told The Independent they’d seen a 49 per cent spike in the amount deposited into accounts between 15 October and 15 November.

Follow our live Budget updates HERE

So what are the next possible moves for your cash, what are the rules around the different options and – the question the chancellor wants people to answer “yes” to – should you be starting to invest?

ISA limits and rules

First things first, the full ISA limit of £20,000 is not being reduced. It’s just the cash ISA limit which is (apparently) coming down.

Similar to how you can put a maximum of £4,000 into a lifetime ISA and still put another £16,000 elsewhere, you will still be able to utilise the additional £8,000 of your annual allowance in different tax-free products.

So, for example, if you had the full amount to use, you might opt to save £12,000 in a cash ISA, £4,000 in a lifetime version and the remaining £4,000 in a stocks and shares investing ISA.

Saving still an option

If you have more than £12,000 annually to put away into savings and you want it to stay in accessible cash, you still can – you just need to be aware of tax implications.

Get a free fractional share worth up to £100.

Capital at risk.

Terms and conditions apply.

ADVERTISEMENT

Get a free fractional share worth up to £100.

Capital at risk.

Terms and conditions apply.

ADVERTISEMENT

Basic rate taxpayers can earn £1,000 in interest before paying any tax, which is known as the personal savings allowance.

Given that top interest-paying easy access accounts right now are about 4.5 per cent, it means you could have £22,000 in an account paying that rate and yielding £990 in interest. Nothing would be payable on that (assuming it didn’t push you into the next tax band, added to your total income).

For higher rate taxpayers, it’s a £500 limit, and additional rate payers get no PSA at all.

Interest earned beyond that threshold becomes taxable – and remember it’s all interest earned, so if you have multiple accounts or income from trust funds, government bonds and even some life insurance contracts, that all goes towards the total.

The wider question from these amounts is how much you need in accessible savings. There’s more on that below.

Pension payments

Although many people have a workplace pension, that is one area which also faces probable disruption during the Budget, with limits set on how much salary sacrifice can be made before national insurance contributions are no longer exempt.

But you can also put spare cash towards your retirement if you don’t need it in savings.

Self-invested personal pensions (SIPPs) are ones you manage yourself, while many providers offer ready-made pensions or different styles depending on your age and other factors – you just pay in, and they decide where your money goes, to grow over time before you need it in retirement.

Pending any changes to this type of pension in the Budget, it remains tax-efficient over time as gains inside pensions are tax-free – though be aware of rules around tax for when it comes time to take money out of your pension.

Investing and ‘risk’

And so to investing. Some people have an aversion to the word itself and think “it’s not for me” – sometimes without realising it’s already what they do when they have a pension.

It simply means your money is in other types of assets rather than just cash – but if you are risk-averse and want £20,000 in your ISA each year, there are still ways around that.

For example, some providers pay interest on uninvested cash in an investing ISA. Or, you could buy what’s known as money market funds – these are designed to be low-risk assets made up of things like Treasury bonds, short-term securities and other things. They are seen as short-term options if you don’t want to leave cash earning nothing at all, as you can still get a return and the market for them is usually liquid – in other words, you can sell them quickly when you need the cash.

But this misses the wider point of investing, which is that over time, it usually can give better returns than just cash alone.

Experts generally agree that people need between three and six months of essential costs in easily accessible cash – exactly how much depends on your circumstances (secure job industry, how many dependents, and so on) and your tolerance of having a safety net.

Beyond that, extra cash which you don’t need in the next few years – if you plan to buy a house next year, for example, it’s probably not for you – can often be better put to use by investing.

When products, adverts or companies talk about investing being more risky, it’s because they are legally obligated to. It doesn’t mean “you risk losing everything”; it’s more that when you take on more risk with your money, you expect to be paid more in return for that additional risk.

As such, while it can carry more risk to invest in a single company which could lose value on the stock market – or could double in value – it’s less risk to invest in a fund, a group of companies which share a common trait, such as being listed on the London Stock Exchange. So a fund is less likely to go up or down in value by as much as a single stock might do.

Whatever you decide to do with your money, it’s important to get all the details and facts first, have a clear assessment of your own needs and likely requirements in the future, and then act with a plan in mind.

Business

Gas prices rocket as Qatar halts production after Iranian attacks

Gas prices have leapt at the fastest pace since the outbreak of war in Ukraine, after Qatar halted production of liquified natural gas after attacks by Iran.

Oil prices also soared and global financial markets reeled from the fallout of an intensifying conflict between Iran and US-Israeli forces.

European whole gas prices soared by 52% on Monday, marking the sharpest rise since prices were pushed dramatically higher by the Russian invasion of Ukraine in March 2022.

The surge came after Qatar’s state-backed energy company QatarEnergy said it “ceased production” because of attacks on its facilities.

Qatari ministers had said earlier on Monday that an Iranian drone had attacked one of the company’s production facilities.

Qatar is a major producer of LNG, cooled gas which can be transported via ships, responsible for about a fifth of global supplies.

On Monday in London, the price of natural gas for delivery in April was up by about 43% to 115p per therm.

In the UK, gas prices are a key driver for the cost of domestic energy bills, indicating that a sustained spike could affect households in the coming months.

Neil Wilson, Saxo UK investor strategist, said: “Qatar is a top three LNG exporter, controlling roughly a quarter of expected supply over the next decade.

“Looks like Iran’s tactic is to pressure Gulf states so they in turn pressure the US and Israel to back off.

“I am much more concerned about European natural gas prices than oil prices, in terms of seeing a repeat of the 2022 European energy crisis.”

Global financial markets faltered after intense strikes across the Middle East and attacks on ships drove fears of energy supply disruption.

London’s FTSE 100 was weaker as trading was knocked by the growing conflict between Iran and US-Israeli forces.

The blue chip share index shed 130 points, closing 1.2% lower at 10,780.11.

Other European indexes suffered bigger drops with France’s Cac 40 down about 2.2% and Germany’s Dax tumbling 2.4% on Monday.

But it was a more tentative start to trading over on Wall Street with the S&P 500 relatively flat, and Dow Jones dipping by about 0.1% by the time European markets had closed.

Israel launched strikes on Lebanon’s capital Beirut on Monday after missiles were fired by militant group Hezbollah.

The latest strikes came after the US and Israel hit targets across Iran on Sunday as part of an intensifying military campaign which followed the killing of Supreme Leader Ayatollah Ali Khamenei.

Oil supplies could be affected by the conflict after Iran reportedly warned tankers on the strait of Hormuz that no ships would be allowed to pass through.

UK Maritime Trade Operations Centre officials said that two vessels have been struck near to the key trade artery.

The Strait of Hormuz is used by tankers carrying about one fifth of the world’s oil supplies and seaborne gas.

On Monday, the price of Brent crude oil soared by as much as 13%, rising above 82 dollars a barrel, before paring back.

It was 8.4% higher at 79.2 dollars a barrel shortly before 2pm, before easing slightly to be 5.5% higher at 76.9 dollars a barrel by early evening.

Nevertheless, City analysts have said the markets have been relatively contained so far in reaction to the conflict.

Chris Beauchamp, chief market analyst at IG, said: “While we have seen a significant surge in oil prices since markets opened last night, the gains appear contained for now as we wait to see if shipping through Hormuz can continue at lower levels or will be blocked entirely.

“Oil and gas infrastructure in the region has not yet been extensively targeted, keeping oil well south of the 100 dollar barrel range that many expected as a result of the weekend.”

Meanwhile, the pound dipped in value against the US dollar to its weakest level since December.

The fall is partly linked to the strength of the dollar, with investors pouring funds into the US “safe haven” currency.

The pound was down about 0.8% at 1.338 versus the dollar during the day, before parring back some losses to be down around 0.3% at 1.34 against the dollar by early evening.

London stocks were broadly weaker, with travel stocks among those dropping particularly sharply.

Cruise giant Carnival slid by 8%, while airline firm IAG, the parent firm of British Airways, dipped by 7.6%.

Rival Wizz Air, which typically runs flights to Dubai and Abu Dhabi, was also down 7.3% in early trading on Monday, while travel-focused retail groups SSP and WH Smith were also firmly lower.

However, defence stocks were among the gainers, with BAE Systems lifting by 7.4% to 2,268p.

Elsewhere, oil and energy stocks were also stronger – Shell and BP rose by 4.5% and 3.5% respectively as prices lift.

International stock markets also opened weaker after the start of trading, with the Nikkei 225 in Tokyo falling by 1.5% after Asian markets opened.

Business

Oil prices spike! Will petrol, diesel rates be hiked in India as crude nears $80 mark on Middle East tensions? – The Times of India

Internationally, oil prices have risen by around 9-10% following Israel-US strikes on Iran, and amid the rising tensions in the Middle East are likely to remain elevated. Does that mean that petrol and diesel prices in India will go up?Brent crude, the international benchmark, moved close to $80 per barrel, while US crude futures advanced 8.6 per cent to $72.79, compared with roughly $67 on Friday.

India, which meets about 88% of its crude oil demand through imports before refining it into fuels such as petrol and diesel, faces a higher import burden when global prices rise, along with possible inflationary effects.

Middle East tensions : Will petrol, diesel prices go up?

Despite the sharp increase in global oil prices, retail petrol and diesel prices in India are not expected to be revised upward in the immediate future, according to a PTI report.According to sources quoted in the report, the government is maintaining a calibrated approach that allows oil marketing companies to improve margins during periods of lower international prices while protecting consumers when global rates increase.Also Read | Middle East oil shock risks: How much do China, India, Japan depend on Middle Eastern crude, gas?Pump prices for petrol and diesel have remained unchanged since April 2022. During this period, state-run retailers including Indian Oil Corporation, Bharat Petroleum Corporation Ltd and Hindustan Petroleum Corporation Ltd have absorbed losses when crude prices were elevated and benefited when prices declined.As a result, domestic fuel prices have stayed steady even when global fuel rates climbed due to higher crude costs. Likewise, when international fuel prices softened in line with lower crude, retail rates in India did not see a reduction.Sources added that the government intends to continue shielding consumers under this policy framework, unless crude prices witness an exceptionally sharp surge.With assembly elections approaching in key states such as West Bengal, Tamil Nadu and Assam, the government is keen to avoid developments that could provide political ammunition to the opposition, the report said.

India assesses oil security

Amid intensifying hostilities in the Middle East, Oil Minister Hardeep Singh Puri on Monday assessed the crude oil, LPG and petroleum products situation in a meeting with senior officials from his ministry and executives of public sector oil companies.

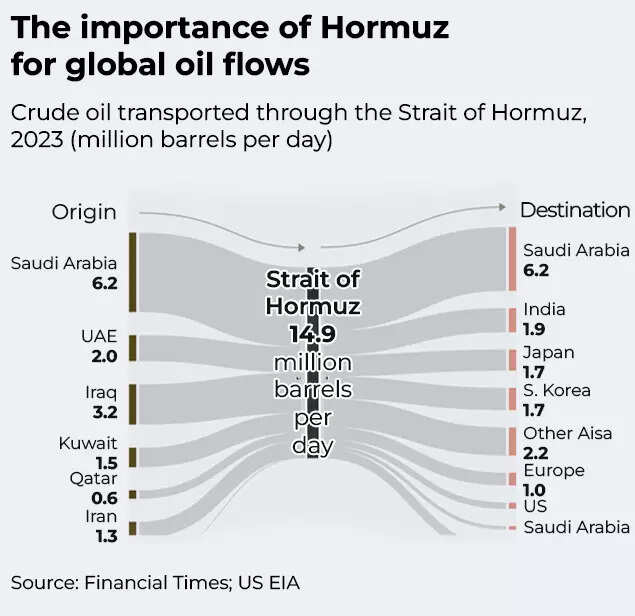

Importance of Hormuz for global oil flows

Much of India’s crude oil and gas supplies transit through the Strait of Hormuz, which Iranian authorities have threatened to close following US and Israeli strikes.“They have sufficient buffers to manage this kind of price spike,” a source with direct knowledge of the matter said, referring to oil companies. “We witnessed crude touching $119 per barrel in June 2022 after Russia’s invasion of Ukraine. That year their profits were modest, but in FY24 they recorded a record profit of Rs 81,000 crore.”Should interruptions continue, cargoes may need to be diverted around the Cape of Good Hope, resulting in longer transit durations and higher transportation expenses, along with increased freight and insurance costs.According to media accounts, the ongoing hostilities have in effect shut down the Strait of Hormuz, the vital artery for worldwide energy transportation. Nearly one-third of global seaborne crude oil exports and around 20 per cent of liquefied natural gas cargoes pass through this narrow channel.Also Read | 1970s-style oil shock loading? Crude may hit $100 if Strait of Hormuz shuts amid Middle East tensions – what it means

Business

Limited flights leave UAE while disruption continues amid Iran strikes

From the UK, flights have also been cancelled for many Middle East destinations, including all flights to Israel and Bahrain, three-quarters of the day’s scheduled flights to the United Arab Emirates, and more than two-thirds (69%) of flights to Qatar.

-

Politics1 week ago

Politics1 week agoPakistan carries out precision strikes on seven militant hideouts in Afghanistan

-

Tech1 week ago

Tech1 week agoThese Cheap Noise-Cancelling Sony Headphones Are Even Cheaper Right Now

-

Entertainment1 week ago

Entertainment1 week agoViral monkey Punch makes IKEA toy global sensation: Here’s what it costs

-

Sports1 week ago

Mike Eruzione and the ‘Miracle on Ice’ team are looking for some company

-

Business6 days ago

Business6 days agoHouseholds set for lower energy bills amid price cap shake-up

-

Entertainment1 week ago

Entertainment1 week agoTalking minerals and megawatts

-

Business6 days ago

Business6 days agoLucid widely misses earnings expectations, forecasts continued EV growth in 2026

-

Fashion1 week ago

Fashion1 week agoIndia, Switzerland review TEPA implementation & boost investment ties