Business

Here’s what you could do with your money after cash ISA cut in Reeves’s Budget

.jpeg?width=1200&height=800&crop=1200:800)

Rachel Reeves is set to cut the cash ISA limit in Wednesday’s Budget, with the cap poised to drop from £20,000 to £12,000.

The proposed move, seen as a bid to encourage more people towards investing rather than only saving in cash, has prompted a mixed reaction from consumers and businesses.

Many savers will not feel the impact of a cut on a day to day (or year to year, more specifically) limit, bearing in mind the difficulty many people have in saving upwards of £1,000 per month. But they could still be hit when they come into a lump sum – through inheritance, for example, or a property sale.

Either way, some people clearly want to move money before limits are cut. One cash ISA provider, Plum, told The Independent they’d seen a 49 per cent spike in the amount deposited into accounts between 15 October and 15 November.

Follow our live Budget updates HERE

So what are the next possible moves for your cash, what are the rules around the different options and – the question the chancellor wants people to answer “yes” to – should you be starting to invest?

ISA limits and rules

First things first, the full ISA limit of £20,000 is not being reduced. It’s just the cash ISA limit which is (apparently) coming down.

Similar to how you can put a maximum of £4,000 into a lifetime ISA and still put another £16,000 elsewhere, you will still be able to utilise the additional £8,000 of your annual allowance in different tax-free products.

So, for example, if you had the full amount to use, you might opt to save £12,000 in a cash ISA, £4,000 in a lifetime version and the remaining £4,000 in a stocks and shares investing ISA.

Saving still an option

If you have more than £12,000 annually to put away into savings and you want it to stay in accessible cash, you still can – you just need to be aware of tax implications.

Get a free fractional share worth up to £100.

Capital at risk.

Terms and conditions apply.

ADVERTISEMENT

Get a free fractional share worth up to £100.

Capital at risk.

Terms and conditions apply.

ADVERTISEMENT

Basic rate taxpayers can earn £1,000 in interest before paying any tax, which is known as the personal savings allowance.

Given that top interest-paying easy access accounts right now are about 4.5 per cent, it means you could have £22,000 in an account paying that rate and yielding £990 in interest. Nothing would be payable on that (assuming it didn’t push you into the next tax band, added to your total income).

For higher rate taxpayers, it’s a £500 limit, and additional rate payers get no PSA at all.

Interest earned beyond that threshold becomes taxable – and remember it’s all interest earned, so if you have multiple accounts or income from trust funds, government bonds and even some life insurance contracts, that all goes towards the total.

The wider question from these amounts is how much you need in accessible savings. There’s more on that below.

Pension payments

Although many people have a workplace pension, that is one area which also faces probable disruption during the Budget, with limits set on how much salary sacrifice can be made before national insurance contributions are no longer exempt.

But you can also put spare cash towards your retirement if you don’t need it in savings.

Self-invested personal pensions (SIPPs) are ones you manage yourself, while many providers offer ready-made pensions or different styles depending on your age and other factors – you just pay in, and they decide where your money goes, to grow over time before you need it in retirement.

Pending any changes to this type of pension in the Budget, it remains tax-efficient over time as gains inside pensions are tax-free – though be aware of rules around tax for when it comes time to take money out of your pension.

Investing and ‘risk’

And so to investing. Some people have an aversion to the word itself and think “it’s not for me” – sometimes without realising it’s already what they do when they have a pension.

It simply means your money is in other types of assets rather than just cash – but if you are risk-averse and want £20,000 in your ISA each year, there are still ways around that.

For example, some providers pay interest on uninvested cash in an investing ISA. Or, you could buy what’s known as money market funds – these are designed to be low-risk assets made up of things like Treasury bonds, short-term securities and other things. They are seen as short-term options if you don’t want to leave cash earning nothing at all, as you can still get a return and the market for them is usually liquid – in other words, you can sell them quickly when you need the cash.

But this misses the wider point of investing, which is that over time, it usually can give better returns than just cash alone.

Experts generally agree that people need between three and six months of essential costs in easily accessible cash – exactly how much depends on your circumstances (secure job industry, how many dependents, and so on) and your tolerance of having a safety net.

Beyond that, extra cash which you don’t need in the next few years – if you plan to buy a house next year, for example, it’s probably not for you – can often be better put to use by investing.

When products, adverts or companies talk about investing being more risky, it’s because they are legally obligated to. It doesn’t mean “you risk losing everything”; it’s more that when you take on more risk with your money, you expect to be paid more in return for that additional risk.

As such, while it can carry more risk to invest in a single company which could lose value on the stock market – or could double in value – it’s less risk to invest in a fund, a group of companies which share a common trait, such as being listed on the London Stock Exchange. So a fund is less likely to go up or down in value by as much as a single stock might do.

Whatever you decide to do with your money, it’s important to get all the details and facts first, have a clear assessment of your own needs and likely requirements in the future, and then act with a plan in mind.

Business

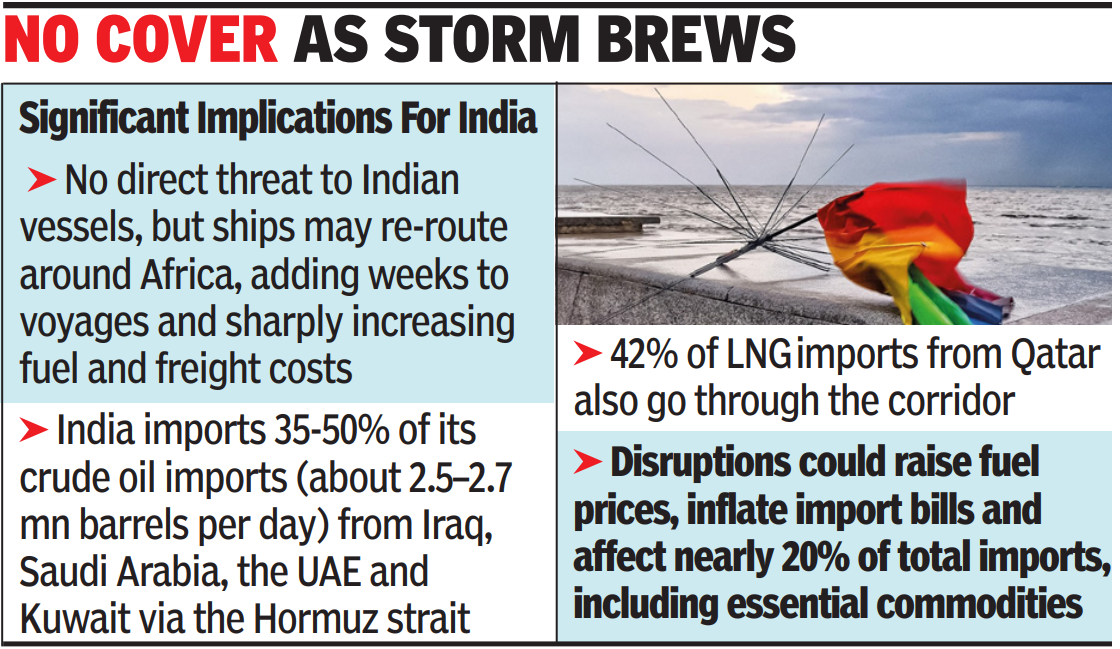

Iran Conflict: Middle East tensions: Global insurers exit Iranian waters as conflict deepens – The Times of India

MUMBAI: India’s trade and energy supplies face fresh risks after reinsurers and Protection & Indemnity (P&I) clubs announced cancellation of war risk insurance for vessels transiting the Strait of Hormuz and Iranian waters, following an escalation in the Iran conflict. The cancellations, effective from this week, have left over 150 vessels stranded and disrupted a corridor that handles nearly one-fifth of global oil flows.P&I clubs are mutual, non-profit insurance associations owned by shipowners. They provide third-party liability cover through a pooled premium for risks such as cargo damage, pollution, crew injuries and collisions that are not covered under hull insurance. The clubs also provide legal support and dispute resolution across jurisdictions.“The industry is currently in a wait-and-watch mode, as much depends on how long the conflict persists. If it turns prolonged, insurers are likely to come together to create additional capacity for war-risk cover. Typically, there is an immediate surge in demand when hostilities break out, but that demand tends to ease quickly if the situation stabilises in a short span,” said Tapan Singhel, MD & CEO, Bajaj General Insurance.

Brokers said that in the past when international reinsurers ceased to provide cover for some risks like terrorism the Indian market had provided the capacity by building an insurance pool where domestic companies come together and share the risks. However, this tie state-owned reinsurer GIC Re, which leads domestic marine pools, has itself issued cancellation notices for marine hull war risk covers effective March 3, 2026, mirroring global reinsurers and P&I clubs. The crisis has brought marine insurance centerstage, the share of this line of non-life had shrunk to around 2% of industry premium as risks ebbed due to containarisation and more safety in transport. The size of the premium also determines the capacity of the industry to provide large covers.Their role is central to global shipping. Without P&I cover, shipowners face potentially unlimited liabilities in the event of accidents, pollution or war-related damage. In high-risk zones, the absence of insurance effectively halts voyages, as operators are unwilling to expose vessels to uninsured losses. In previous crises in the Red Sea, war risk exclusions by insurers sharply curtailed traffic and drove up freight rates.In the current episode, major P&I clubs and reinsurers have issued notices cancelling war risk cover for Iranian waters, the Persian Gulf and the Strait of Hormuz, citing tanker damage, casualties and threats from Iranian forces. Reports of VHF warnings and GPS disruptions have added to concerns. Insurers have invoked standard cancellation clauses following US and Israeli strikes on Iran, with broader policy implications if the conflict further widens.Fresh war risk cover may be available, but at sharply higher premiums. Rates that were around 0.25% of vessel value have surged multiple times, rendering transits commercially unviable for many operators. Even where cover is available, shipowners remain wary of risks such as seizures or missile strikes.

Business

UK economy could face ‘very significant’ impact from Iran conflict – OBR

The UK economy could face a “very significant” hit from the conflict in Iran, the official budget watchdog has warned.

The Office for Budget Responsibility (OBR) said that the outlook for inflation would be “particularly uncertain” following spikes in gas and oil prices in recent days following attacks in the Middle East.

It came as the budget watchdog reduced its inflation forecast for this year, indicating that UK inflation will drop to target levels quicker than previously expected.

The OBR also cut its economic growth forecast for this year and revealed a worsening unemployment outlook for the next three years.

In its latest projections alongside the Chancellor’s spring statement, the organisation however highlighted that recent volatility in the Middle East could have an impact on a number of its projections.

The forecasts were prepared before days of recent attacks as part of an intensifying conflict between US-Israeli forces and Iran.

On Tuesday, the OBR said: “Conflict in the Middle East, which escalated as we were finalising this document, could have very significant impacts on the global and UK economies.”

David Miles, from the OBR’s budget responsibility committee, said its predictions that inflation will fall to target levels early this year have become more uncertain after jumps in oil and gas prices linked to recent attacks in the Middle East.

He said: “I think what will happen to inflation is particularly uncertain in the past few days.

“Our central expectation had been that inflation would fall back towards the Bank of England’s 2% target early this year and will be around that level at the end of the year.

“There must be more uncertainty around that right now.”

The trimmed-down inflation projections indicated that this will slow to 2.3% for 2026, down from a previous 2.5% forecast.

Experts said the lower-than-expected rate is partly down to “greater slack in the economy” and falling food and energy prices.

As a result, the OBR indicated that inflation will drop to the 2% target rate set by the Bank of England and the Government later this year.

The Bank has already suggested that inflation – the rate at which the price of goods and services rises – could fall below 2% by April.

The OBR said inflation is expected to remain at the 2% target from 2027 onwards, assuming this is not knocked off course by the potential jump in energy costs.

It came as the Chancellor Rachel Reeves told MPs in Parliament that the OBR said the UK economy would grow more slowly than previously expected in 2026, although growth will pick up in the following years.

UK gross domestic product (GDP) is expected to grow by 1.1% in 2026, as the OBR cut its previous prediction of 1.4% from last November.

The budget watchdog said the downgrade was linked to a growth slowdown late last year, loosening in the labour market and subdued data from recent business surveys.

However, it also lifted its forecasts for growth for both 2027 and 2028, with the economy to expand by 1.6% in both years.

The Chancellor said she had the “right economic plan” for the UK as she laid out her spring statement on Tuesday.

Ms Reeves also said that unemployment is “set to peak later this year” before reducing over the following years.

The OBR said that the UK unemployment rate is on track to peak at about 5.33% in 2026.

Latest data from the Office for National Statistics (ONS) showed that unemployment lifted to a five-year-high of 5.2% in the three months to December.

The OBR had previously predicted that the jobless rate would increase to 4.9% in 2026.

New forecasts show that unemployment is then on track to hit 4.9% in 2027 and 4.4% in 2028.

It had previously forecast it would be 4.6% in 2027 and 4.3% the following year.

The new forecasts have also reduced the Government’s borrowing projections for each year until 2031, in a potential boost for the Chancellor.

Reduced borrowing costs, linked to an easing in the yield on Government bonds, also meant that the Government’s headroom to meet its fiscal rules widened to £23.6 billion, compared with £21.7 billion in November’s budget.

Elliott Jordan-Doak, senior UK economist at Pantheon Macroeconomics, said: “There were few major surprises in today’s spring statement, with the Chancellor delivering the well-flagged ‘boring budget’ that we and the market were expecting.”

He added: “Chunks of the fiscal forecasts now look dated because of the rapid escalation of events in the Middle East.”

Peter Arnold, EY UK chief economist, said: “The underlying improvement in the UK’s fiscal position was supported by higher actual and expected tax receipts, driven in large part by a stronger equity market performance since November.

“There may now be doubts around how long this stock market performance can be sustained if the conflict in the Middle East is prolonged and global equity market volatility continues.”

Business

IMF says ‘too early’ to gauge West Asia conflict impact as energy prices, markets turn volatile – The Times of India

With tensions escalating in West Asia, the International Monetary Fund on Tuesday said it is closely tracking the situation but cautioned that it is “too early to assess the economic impact on the region and the global economy,” as disruptions to trade and energy markets intensify.In a statement, the IMF said it has “observed disruptions to trade and economic activity, surges in energy prices, and volatility in financial markets.”“The situation remains highly fluid and adds to an already uncertain global economic environment,” it said, reported ANI.“It is too early to assess the economic impact on the region and the global economy. That impact will depend on the extent and duration of the conflict,” the IMF added.The remarks come as governments evaluate the fallout of the widening hostilities in the region, particularly on oil supplies and global financial stability.In India, Petroleum and Natural Gas Minister Hardeep Singh Puri earlier said the country is “fully prepared amid evolving situation in the Middle East and energy supplies are robust.”He stated that “the country is well stocked with crude oil and inventories of key petroleum products including petrol, diesel and ATF to deal with short-term disruptions arising from the Middle East.”According to the minister, Indian energy companies have access to supplies that are not routed through the Strait of Hormuz, and such cargoes will remain available to mitigate any temporary disruptions affecting shipments passing through the strait.The Petroleum ministry has also set up a 24×7 Control Room to continuously monitor supply and stock positions of petroleum products across the country.The government is “reasonably comfortable in terms of stocks,” the minister said, adding that safeguarding the interests of Indian consumers remains the highest priority. Based on continuous monitoring, the government is cautiously optimistic that phased measures can be taken, if required, to further mitigate the situation.Government sources said India currently holds about eight weeks of crude oil and petroleum product inventories, including strategic reserves. They added that only about 40 per cent of India’s crude oil imports transit through the Strait of Hormuz, limiting exposure to regional disruptions.Sources maintained that the country remains in a comfortable position on energy security and is closely monitoring developments, while being prepared to manage potential supply-side challenges through adequate inventory levels and diversified sourcing.

-

Politics5 days ago

Politics5 days agoWhat are Iran’s ballistic missile capabilities?

-

Politics6 days ago

Politics6 days agoUS arrests ex-Air Force pilot for ‘training’ Chinese military

-

Business7 days ago

Business7 days agoHouseholds set for lower energy bills amid price cap shake-up

-

Sports1 week ago

Sports1 week agoTop 50 USMNT players of 2026, ranked by club form: USMNT Player Performance Index returns

-

Business7 days ago

Business7 days agoLucid widely misses earnings expectations, forecasts continued EV growth in 2026

-

Fashion5 days ago

Fashion5 days agoPolicy easing drives Argentina’s garment import surge in 2025

-

Sports6 days ago

Sports6 days agoSri Lanka’s Shanaka says constant criticism has affected players’ mental health

-

Fashion5 days ago

Fashion5 days agoTexwin Spinning showcasing premium cotton yarn range at VIATT 2026