Business

Hospitality bosses urge government to lower taxes as ‘shocking’ data revealed

Almost four-fifths of pubs, restaurants and bars say they have increased their prices after Budget cost hikes, while more than half of firms have axed jobs in a bid to help their finances.

The new data from the UK hospitality sector’s trade bodies have led industry bosses to warned that firms across the UK are being squeezed by “unsustainable” taxes.

They have now urged the government to relax taxation on the sector at the autumn Budget.

The survey of members of the British Institute of Innkeeping (BII), the British Beer & Pub Association (BBPA), UKHospitality and Hospitality Ulster shed light on the pressures being felt by hospitality operators.

It found that 79 per cent of operators have increased prices as a direct result of increases to operating costs in April.

It also showed that 73 per cent of respondents have less than six months of cash reserves, with one in five having no cash reserves at all.

The data comes after firms were impacted by increases to the national minimum wage, national insurance payments and business rates payments.

In April, the national living wage rose by 6.7 per cent to £12.21 an hour for workers aged 21 and older.

At the same time, the government increased the rate of employer national insurance contributions (NICs) from 13.8 per cent to 15 per cent and also lowered the threshold at which firms would pay the tax.

Many pubs were also hit by changes to discounts on business rates, the property tax affecting high street businesses.

Hospitality businesses received a 75 per cent discount on their business rates bills up to a cap of £110,000 but saw this cut to only 40 per cent in April.

Earlier this week, analysis of separate government data showed that 209 pubs shut their doors for good in the first six months of this year.

Bosses said the Chancellor needs to look at changes to VAT, business rates and NICs to ease the burden of firms.

In a joint statement, the trade bodies said: “This shocking data reinforces the urgent need for government to recognise the incredible pressure hospitality businesses have been put under, particularly since April, and illustrates why it should come forward with measures to support this vital sector at the Budget.

“Unsustainable tax increases are squeezing businesses, stifling growth and investment, and threatening local employment, especially for young people.

“It is forcing businesses across the sector to make impossible decisions to cut jobs, put up prices, reduce opening hours and sadly limit the support they desperately want to give their communities.

“Hospitality is united in which measures will reverse this trend and drive growth: a reduction in VAT for hospitality, changes to employer NICs and permanently lower business rates for the sector.”

Business

West Asia conflict: Govt may ask companies to cut exports, increase auto fuel, LPG supplies – The Times of India

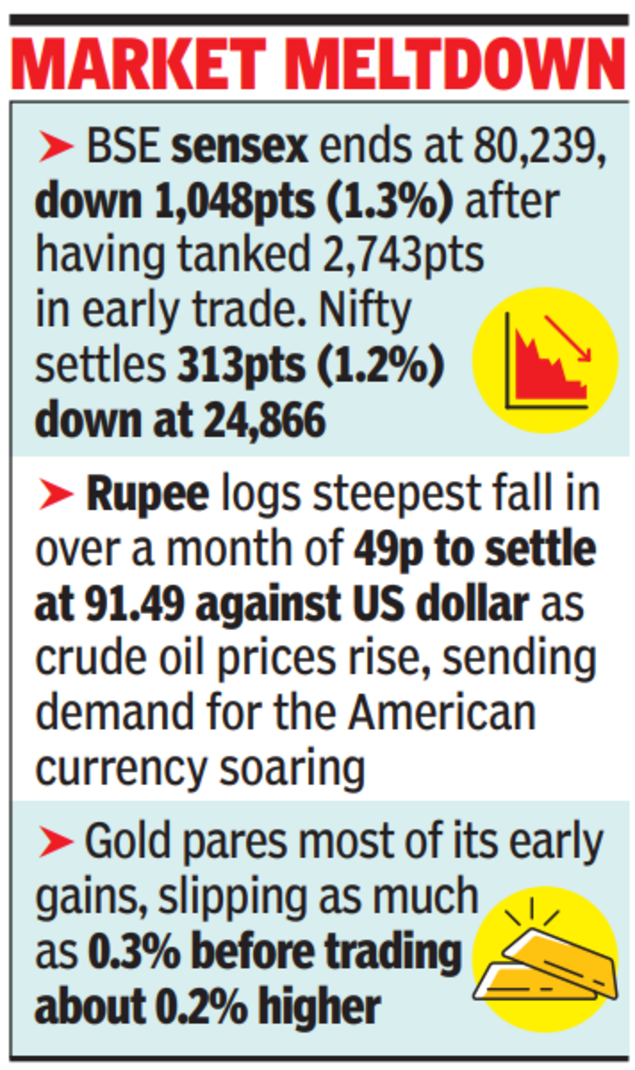

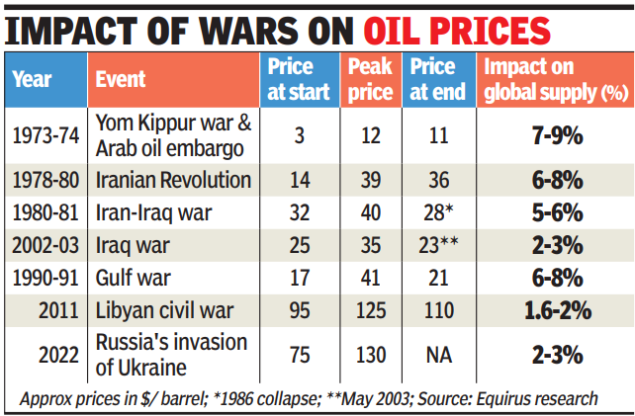

NEW DELHI: Amid fears of a shortage in crude supplies, govt is looking to nudge refiners to divert more auto fuel and LPG to the domestic market by cutting on exports and also increase cooking gas production so that there is no disruption in local supplies.While govt and oil companies insisted there’s no shortage, refiners are looking at alternate sources to partly compensate for crude coming from war-hit West Asia.

The tension has led to a spike in oil and gas prices, and given India’s dependence on imports, inflating the import bill and stoking inflationary pressures. Officials, however, said retail fuel prices may not rise immediately, as oil marketing companies follow a calibrated approach — absorbing losses when global prices are high and recouping them when prices soften. Retail petrol and diesel prices have remained unchanged since April 2022.Mantri meets oil cos to assess availability of crude and gasOn a day when Iranian drones damaged part of Saudi Aramco refinery and Qatar Energy’s facilities, the world’s largest LNG producer, announced an export pause, petroleum minister Hardeep Singh Puri and his team of officials met oil companies on Monday to assess the availability of crude and gas. “We are continuously monitoring the evolving situation, and all steps will be taken to ensure availability and affordability of major petroleum products in the country,” the oil ministry said in a post on X.India imports nearly 90% of its crude requirement. It also meets 60-65% of its LPG demand and about 60% of its LNG needs through imports, largely from West Asia, with shipments routed via Strait of Hormuz, which risks being choked due to the war.

According to the International Energy Agency, in 2023, 5.9% of the country’s production was being exported. Between April and Dec 2025, India exported petroleum products worth nearly $330 billion, with the Netherlands, UAE, the US, Singapore, Australia and China being the main destinations. In 2024, it also exported petroleum gas worth $454 million, mostly to Nepal, China, and Myanmar. The Reliance refinery in Jamnagar is the largest exporter in the country.An oil company executive said refiners are already in contact with traders to tie up capacities amid fears of the blockade of Strait of Hormuz. By Monday, the global market had caught the jitters from Qatar’s decision to suspend gas shipments.An oil executive said while disruption could cause difficulties in the immediate term, Indian players had a wide portfolio that they can tap for LNG, including the US, with vessels being routed through the Suez Canal.“Even if there is a force majeure, we have other sources of supply, which we can tap. Besides, no one is going to stop supplies indefinitely,” the executive said. While oil and gas prices rose Monday, the focus is on ensuring that supply lines remain open.

Business

Travel stocks fall after thousands of flights grounded following Iran strikes

A display board shows canceled flights to Dubai and Doha amid regional airspace closures at Noi Bai International Airport, amid the U.S.-Israel conflict with Iran, in Hanoi, Vietnam, March 2, 2026. Picture taken with a mobile phone.

Thinh Nguyen | Reuters

Airline and travel stocks slipped Monday after airspace closures throughout the Middle East forced carriers to cancel thousands of flights, disrupting trips as far as Brazil and the Philippines.

Cruise lines stocks also fell sharply, with Royal Caribbean Cruises dropping 3% and Carnival Corp. losing more than 7%.

Norwegian Cruise Line Holdings‘ stock fell 10% after its earnings call disappointed investors. Elliott Investment Management said last month that it had built a more than 10% stake in the company and that it’s seeking changes. New CEO John Chidsey told analysts that “our strategy is sound, our execution and coordination have not been, and a culture of accountability is essential and necessary going forward.”

Oil prices also rose, potentially driving up airlines’ biggest cost after labor. Flights through the Middle East were grounded, including to destinations like Tel Aviv and Dubai.

United Airlines, which has the most international exposure of the U.S. carriers, fell nearly 3%. Service to Tel Aviv, Israel, one of the airline’s most profitable routes, was halted, but airlines were also was forced to pause flights to Dubai, in the United Arab Emirates, one of the busiest airport hubs in the world. Dubai is also a home base for the airline Emirates.

Shares of American Airlines lost 4% while Delta Air Lines fell 2%.

More than 11,000 Middle East flights have been canceled since the U.S.-Israeli strikes this weekend, according to aviation-data firm Cirium.

International travel has been a bright spot in the travel sector. In January, international air travel demand jumped 5.9% from a year ago while domestic flight demand was nearly flat, the International Air Transport Association, an airline industry group, said in a report Monday.

— CNBC’s Contessa Brewer contributed to this report.

Business

Brewdog: Bars close and hundreds lose jobs as beer firm sold in £33m deal

Beverage and cannabis company Tilray acquires the brewery, the brand and 11 bars after Brewdog went into administration.

Source link

-

Business6 days ago

Business6 days agoHouseholds set for lower energy bills amid price cap shake-up

-

Entertainment1 week ago

Entertainment1 week agoTalking minerals and megawatts

-

Politics5 days ago

Politics5 days agoWhat are Iran’s ballistic missile capabilities?

-

Sports1 week ago

Sports1 week agoEileen Gu comments on Alysa Liu’s historic gold medal

-

Business6 days ago

Business6 days agoLucid widely misses earnings expectations, forecasts continued EV growth in 2026

-

Sports5 days ago

Sports5 days agoSri Lanka’s Shanaka says constant criticism has affected players’ mental health

-

Tech6 days ago

Tech6 days agoHere’s What a Google Subpoena Response Looks Like, Courtesy of the Epstein Files

-

Politics1 week ago

Politics1 week agoSupreme Court ruling angers Trump: Global tariffs to rise from 10% to 15%