Business

Houses without lounges are a reality for renters

Kevin PeacheyCost of living correspondent

Ella Murray

Ella MurrayHomes without lounges are becoming a reality for renters on tight budgets faced with a lack of available lets.

Nearly a third of homes advertised on flat-sharing website SpareRoom in the first half of the year had no living room.

Ella Murray, aged 22, who shares with three other people in London, said: “At this stage in my life I’m not willing to sacrifice money for more space.”

Landlords say turning a lounge into a bedroom helps them cover their higher mortgages and other extra costs, while meeting demand from tenants.

But a lack of communal space means many renters are living and working in one bedroom putting them at risk of social isolation.

Some also point out the “false economy” of being forced to go out to socialise which can cost more than a night in with friends.

Cost-of-living pressures

Students living away from home might expect to rent in a property where the front room has been converted into a bedroom.

But these latest figures suggest this is a reality for young professionals renting in their 20s and 30s.

Analysis by SpareRoom, shared with the BBC, shows:

- Some 30% of adverts for a room posted on the platform in the first half of the year were for places without a living room

- That proportion was higher in London, at 41%

- Birmingham saw an increase from 16% to 22% of adverts with no living room in the five years from 2020

The data covers flat or house shares only, and does not include any studio, or one-bedroom listings.

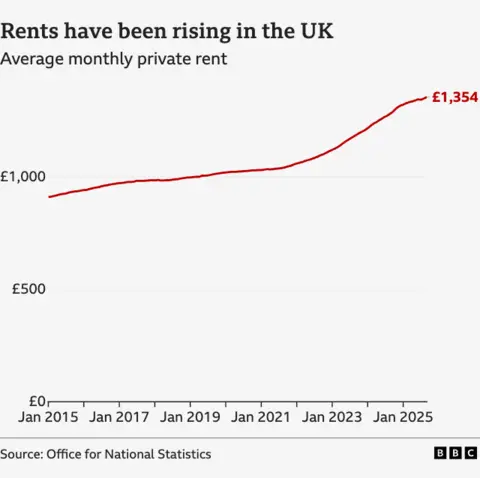

Official figures show average UK monthly private rents increased by 5.5%, to £1,354, in the year to September.

As costs rise, there are 10 prospective tenants on average chasing every available rental property, according to the latest Rightmove data.

A landlord turning a lounge into a bedroom provides an extra place for a tenant. It could also mean lower rent payments for each tenant but potentially more rent overall for landlords covering higher mortgage repayments seen in recent years.

Ella and her three housemates split the rent of £3,000 a month dependant on the size of their bedrooms, but their home does not have a living room.

“We have a decent-sized kitchen with a dining table which is where we hang out instead. We would definitely socialise more if we had a living room,” she said.

She said the rent was cheaper as a result, and – living in London – it was the norm among her friends in other rental properties in the city.

She works in musical theatre, and said she would be more inclined to rent somewhere with a living room were her wage to increase and were she to move in with a partner.

Hannah Carney

Hannah CarneyHannah Carney, 26, also shares a property without a lounge and says none of the places she had rented since she was 18 had a living room.

She says she misses having a “chill place that is social” and it means she and her flatmates probably spend more on going out for dinner and drinks.

“I’d love to say that all properties should have a communal area. I wish that was the norm, but I know it’s not realistic,” she said.

The best she and her flatmate could do, she says, is to have movie nights in a box room that they also use to hang their washing.

Matt Hutchinson, director of SpareRoom said: “We’ve had so many messages from people who met their best friends and partners in flatshares, who’ve raised families or started businesses together.

“Those kinds of stories will become rarer if communal, sociable spaces within homes are not protected. Sadly, loneliness is alarmingly common.

“With rents as unaffordable as they are now, it’s understandable people are looking for ways to cut the cost of living.”

Chris Norris, chief policy officer at the National Residential Landlords Association (NRLA) said the “root of the challenges” was too few rental homes to meet demand.

The NRLA said some landlords, facing a difficult outlook, were moving into offering multi-occupancy homes so their businesses remained viable enough to carry on.

“With rising costs and the expectation of smaller margins to contend with, some landlords will certainly be looking at how to use their investments most efficiently and meet demand effectively whilst delivering high-quality private rented homes,” Mr Norris said.

At the more extreme end of the scale, the BBC has previously uncovered illegal house-sharing in multi-occupancy homes.

Business

New Income Tax Act 2025 to come into effect from April 1, key reliefs announced in Budget 2026

New Delhi: Finance Minister Nirmala Sitharaman on Sunday said that the Income Tax Act 2025 will come into effect from April 1, 2026, and the I-T forms have been redesigned such that ordinary citizens can comply without difficulty for ease of living.

The new measures include exemption on insurance interest awards, nil deduction certificates for small taxpayers, and extension of the ITR filing deadline for non-audit cases to August 31.

Individuals with ITR 1 and ITR 2 will continue to file I-T returns till July 31.

“In July 2024, I announced a comprehensive review of the Income Tax Act 1961. This was completed in record time, and the Income Tax Act 2025 will come into effect from April 1, 2026. The forms have been redesigned such that ordinary citizens can comply without difficulty, for) ease of living,” she said while presenting the Budget 2026-27

In a move that directly eases cash-flow pressure on individuals making overseas payments, the Union Budget announced lower tax collection at source across key categories.

“I propose to reduce the TCS rate on the sale of overseas tour programme packages from the current 5 per cent and 20 per cent to 2 per cent without any stipulation of amount. I propose to reduce the TCS rate for pursuing education and for medical purposes from 5 per cent to 2 per cent,” said Sitharaman.

She clarified withholding on services, adding that “supply of manpower services is proposed to be specifically brought within the ambit of payment contractors for the purpose of TDS to avoid ambiguity”.

“Thus, TDS on these services will be at the rate of either 1 per cent or 2 per cent only,” she mentioned during her Budget speech.

The Budget also proposes a tax holiday for foreign cloud companies using data centres in India till 2047.

Business

Budget 2026 Live Updates: TCS On Overseas Tour Packages Slashed To 2%; TDS On Education LRS Eased

Union Budget 2026 Live Updates: Union Budget 2026 Live Updates: Finance Minister Nirmala Sitharaman is presenting the Union Budget 2026-27 in Parliament, her record ninth budget speech. During her Budget Speech, the FM will detail budgetary allocations and revenue projections for the upcoming financial year 2026-27. Sitharaman is notably dressed in a Kanjeevaram Silk saree, a nod to the traditional weaving sector in poll-bound Tamil Nadu.

The budget comes at a time when there is geopolitical turmoil, economic volatility and trade war. Different sectors are looking to get some support with new measures and relaxations ahead of the budget, especially export-oriented industries, which have borne the brunt of the higher US tariffs being imposed last year by the Trump administration.

On January 29, 2026, Sitharaman tabled the Economic Survey 2025-26, a comprehensive snapshot of the country’s macro-economic situation, in Parliament, setting the stage for the budget and showing the government’s roadmap. The survey projected that India’s economy is expected to grow 6.8%-7.2% in FY27, underscoring resilience even as global economic uncertainty persists.

Budget 2026 Expectations

Expectations across key sectors are taking shape as stakeholders look to the Budget for support that sustains growth, strengthens jobs and eases financial pressures:

Taxpayers & Households: Many taxpayers want practical improvements to the income tax structure that preserve simplicity while supporting long-term financial planning — including broader deductions for home loan interest and diversified retirement savings options.

New Tax Regime vs Old Tax Regime | New Income Tax Rules | Income Tax 2026

Businesses & Industry: With industrial output and investment showing resilience, firms are looking for policies that bolster capital formation, ease compliance, and expand infrastructure spending — especially in manufacturing and technology-driven sectors that promise jobs and exports.

Startups & Innovation: The startup ecosystem expects incentives around employee stock options and capital access, along with regulatory tweaks that encourage risk capital and talent retention without increasing compliance burdens.

Also See: Stock Market Updates Today

The Budget speech will be broadcast live here and on all other news channels. You can also catch all the updates about Budget 2026 on News18.com. News18 will provide detailed live blog updates on the Budget speech, and political, industry, and market reactions.

We are providing a full, detailed coverage of the union budget 2026 here, with a lot of insights, experts’ views and analyses. Stay tuned with us to get latest updates.

Also Read: Budget 2026 Live Streaming

Here are the Live Updates of Union Budget 2026:

Business

Budget 2026: Cabinet gives green signal to Union Budget 2026–27

New Delhi: The Cabinet on Sunday approved the Union Budget 2026-27 during a meeting in Parliament chaired by Prime Minister Narendra Modi. A meeting of the Union Cabinet was held at Sansad Bhawan at 10 a.m., and after the Cabinet’s approval, Finance Minister Nirmala Sitharaman proceeded to Parliament to present the Budget.

Earlier, FM Sitharaman met President Droupadi Murmu and offered her a copy of the digital budget. The President also offered ‘dahi-cheeni’ (curd and sugar) to Sitharaman when she arrived at the Rashtrapati Bhavan. The Finance Minister was seen carrying her trademark ‘bahi-khata’, a tablet wrapped in a red-coloured cloth bearing a golden-coloured national emblem on it.

Minister of State for Finance Pankaj Chaudhary, Chief Economic Advisor Dr V. Anantha Nageswaran, Central Board of Direct Taxes (CBDT) Chairman Ravi Agrawal and other officials were seen accompanying the Finance Minister. Sitharaman was set to present her ninth consecutive Union Budget in the Lok Sabha. In 2021, she switched to using a digital tablet to carry the Budget papers, further promoting a modern and eco-friendly approach.

The ‘bahi-khata’ is a red pouch that holds the digital tablet containing the Budget documents. This year, Sitharaman opted for a deep maroon Kanjeevaram saree from Tamil Nadu. The saree featured a deep maroon base with a contrasting border and subtle gold detailing, paired with a yellow blouse.

The Budget is likely to strike a deft balance of sustaining growth momentum and maintaining fiscal consolidation. It also needs to address near-term challenges emanating from unprecedented geopolitical flux, said economists. According to economists, the budget is likely to focus more on capital expenditure, especially in sectors deemed to be strategically important owing to prevailing geopolitical compulsions.

While the FY26 Budget was more tilted towards stimulating middle-class consumption with tax reliefs, the FY27 Budget’s approach to stimulating consumption will be selective, they added.

-

Business1 week ago

Business1 week agoSuccess Story: This IITian Failed 17 Times Before Building A ₹40,000 Crore Giant

-

Fashion1 week ago

Fashion1 week agoSouth Korea tilts sourcing towards China as apparel imports shift

-

Sports5 days ago

Sports5 days agoPSL 11: Local players’ category renewals unveiled ahead of auction

-

Sports1 week ago

Sports1 week agoWanted Olympian-turned-fugitive Ryan Wedding in custody, sources say

-

Tech1 week ago

Tech1 week agoStrap One of Our Favorite Action Cameras to Your Helmet or a Floaty

-

Entertainment1 week ago

Entertainment1 week agoThree dead after suicide blast targets peace committee leader’s home in DI Khan

-

Tech1 week ago

Tech1 week agoThis Mega Snowstorm Will Be a Test for the US Supply Chain

-

Sports1 week ago

Sports1 week agoStorylines shaping the 2025-26 men’s college basketball season