Business

Houses without lounges are a reality for renters

Kevin PeacheyCost of living correspondent

Ella Murray

Ella MurrayHomes without lounges are becoming a reality for renters on tight budgets faced with a lack of available lets.

Nearly a third of homes advertised on flat-sharing website SpareRoom in the first half of the year had no living room.

Ella Murray, aged 22, who shares with three other people in London, said: “At this stage in my life I’m not willing to sacrifice money for more space.”

Landlords say turning a lounge into a bedroom helps them cover their higher mortgages and other extra costs, while meeting demand from tenants.

But a lack of communal space means many renters are living and working in one bedroom putting them at risk of social isolation.

Some also point out the “false economy” of being forced to go out to socialise which can cost more than a night in with friends.

Cost-of-living pressures

Students living away from home might expect to rent in a property where the front room has been converted into a bedroom.

But these latest figures suggest this is a reality for young professionals renting in their 20s and 30s.

Analysis by SpareRoom, shared with the BBC, shows:

- Some 30% of adverts for a room posted on the platform in the first half of the year were for places without a living room

- That proportion was higher in London, at 41%

- Birmingham saw an increase from 16% to 22% of adverts with no living room in the five years from 2020

The data covers flat or house shares only, and does not include any studio, or one-bedroom listings.

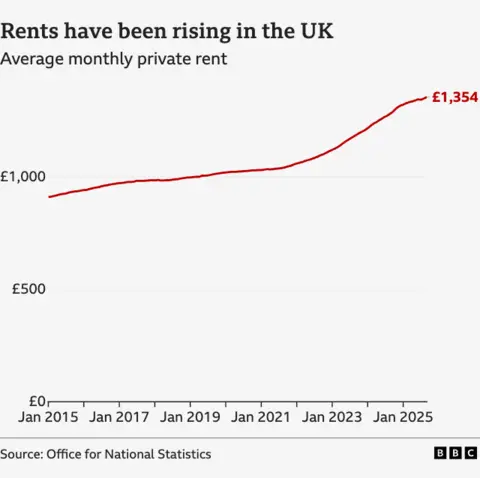

Official figures show average UK monthly private rents increased by 5.5%, to £1,354, in the year to September.

As costs rise, there are 10 prospective tenants on average chasing every available rental property, according to the latest Rightmove data.

A landlord turning a lounge into a bedroom provides an extra place for a tenant. It could also mean lower rent payments for each tenant but potentially more rent overall for landlords covering higher mortgage repayments seen in recent years.

Ella and her three housemates split the rent of £3,000 a month dependant on the size of their bedrooms, but their home does not have a living room.

“We have a decent-sized kitchen with a dining table which is where we hang out instead. We would definitely socialise more if we had a living room,” she said.

She said the rent was cheaper as a result, and – living in London – it was the norm among her friends in other rental properties in the city.

She works in musical theatre, and said she would be more inclined to rent somewhere with a living room were her wage to increase and were she to move in with a partner.

Hannah Carney

Hannah CarneyHannah Carney, 26, also shares a property without a lounge and says none of the places she had rented since she was 18 had a living room.

She says she misses having a “chill place that is social” and it means she and her flatmates probably spend more on going out for dinner and drinks.

“I’d love to say that all properties should have a communal area. I wish that was the norm, but I know it’s not realistic,” she said.

The best she and her flatmate could do, she says, is to have movie nights in a box room that they also use to hang their washing.

Matt Hutchinson, director of SpareRoom said: “We’ve had so many messages from people who met their best friends and partners in flatshares, who’ve raised families or started businesses together.

“Those kinds of stories will become rarer if communal, sociable spaces within homes are not protected. Sadly, loneliness is alarmingly common.

“With rents as unaffordable as they are now, it’s understandable people are looking for ways to cut the cost of living.”

Chris Norris, chief policy officer at the National Residential Landlords Association (NRLA) said the “root of the challenges” was too few rental homes to meet demand.

The NRLA said some landlords, facing a difficult outlook, were moving into offering multi-occupancy homes so their businesses remained viable enough to carry on.

“With rising costs and the expectation of smaller margins to contend with, some landlords will certainly be looking at how to use their investments most efficiently and meet demand effectively whilst delivering high-quality private rented homes,” Mr Norris said.

At the more extreme end of the scale, the BBC has previously uncovered illegal house-sharing in multi-occupancy homes.

Business

How inflation rebound is set to affect UK interest rates

Interest rates are widely expected to remain at 3.75% as Bank of England policymakers prioritise curbing above-target inflation while also monitoring economic growth, according to expert analysis.

The Bank’s Monetary Policy Committee (MPC) is anticipated to leave borrowing costs unchanged when it announces its latest decision on Thursday, marking its first interest rate setting meeting of the year.

This follows a rate cut delivered before Christmas, which was the fourth such reduction.

At the time, Governor Andrew Bailey noted that the UK had “passed the recent peak in inflation and it has continued to fall”, enabling the MPC to ease borrowing costs. However, he cautioned that any further cuts would be a “closer call”.

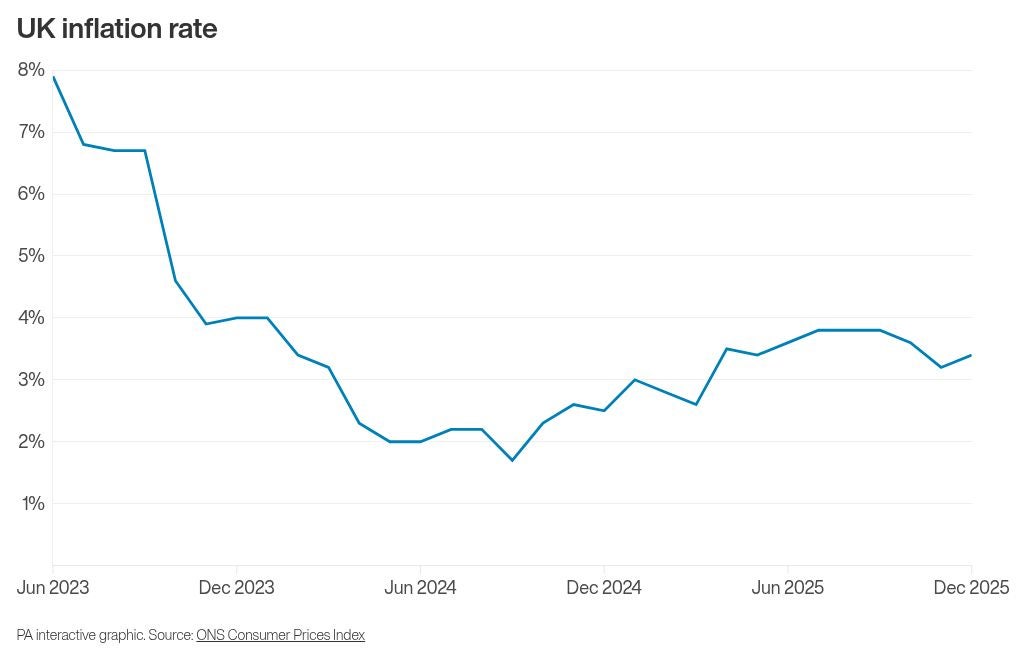

Since that decision, official data has revealed that inflation unexpectedly rebounded in December, rising for the first time in five months.

The Consumer Prices Index (CPI) inflation rate reached 3.4% for the month, an increase from 3.2% in November, with factors such as tobacco duties and airfares contributing to the upward pressure on prices.

Economists suggest this inflation uptick is likely to reinforce the MPC’s inclination to keep rates steady this month.

Philip Shaw, an analyst for Investec, stated: “The principal reason to hold off from easing again is that at 3.4% in December, inflation remains well above the 2% target.”

He added: “But with the stance of policy less restrictive than previously, there are greater risks that further easing is unwarranted.”

Shaw also highlighted other data points the MPC would consider, including gross domestic product (GDP), which saw a return to growth of 0.3% in November – a potentially encouraging sign for policymakers.

Matt Swannell, chief economic advisor to the EY ITEM Club, affirmed: “Keeping bank rate unchanged at 3.75% at next week’s meeting looks a near-certainty.”

He noted that while some MPC members who favoured a cut in December still have concerns about persistent wage growth and inflation, recent data has not been compelling enough to prompt back-to-back reductions.

Edward Allenby, senior economic advisor at Oxford Economics, forecasts the next rate cut to occur in April.

He explained: “The MPC will continue to face a delicate balancing act between supporting growth and preventing inflation from becoming entrenched, with forthcoming data on pay settlements likely to play a decisive role in shaping the next policy move.”

The Bank’s policymakers have consistently voiced concerns regarding the pace of wage increases in the UK, which can fuel overall inflation.

Business

Budget 2026: India pushes local industry as global tensions rise

India’s budget focuses on infrastructure and defence spending and tax breaks for data-centre investments.

Source link

Business

New Income Tax Act 2025 to come into effect from April 1, key reliefs announced in Budget 2026

New Delhi: Finance Minister Nirmala Sitharaman on Sunday said that the Income Tax Act 2025 will come into effect from April 1, 2026, and the I-T forms have been redesigned such that ordinary citizens can comply without difficulty for ease of living.

The new measures include exemption on insurance interest awards, nil deduction certificates for small taxpayers, and extension of the ITR filing deadline for non-audit cases to August 31.

Individuals with ITR 1 and ITR 2 will continue to file I-T returns till July 31.

“In July 2024, I announced a comprehensive review of the Income Tax Act 1961. This was completed in record time, and the Income Tax Act 2025 will come into effect from April 1, 2026. The forms have been redesigned such that ordinary citizens can comply without difficulty, for) ease of living,” she said while presenting the Budget 2026-27

In a move that directly eases cash-flow pressure on individuals making overseas payments, the Union Budget announced lower tax collection at source across key categories.

“I propose to reduce the TCS rate on the sale of overseas tour programme packages from the current 5 per cent and 20 per cent to 2 per cent without any stipulation of amount. I propose to reduce the TCS rate for pursuing education and for medical purposes from 5 per cent to 2 per cent,” said Sitharaman.

She clarified withholding on services, adding that “supply of manpower services is proposed to be specifically brought within the ambit of payment contractors for the purpose of TDS to avoid ambiguity”.

“Thus, TDS on these services will be at the rate of either 1 per cent or 2 per cent only,” she mentioned during her Budget speech.

The Budget also proposes a tax holiday for foreign cloud companies using data centres in India till 2047.

-

Sports5 days ago

Sports5 days agoPSL 11: Local players’ category renewals unveiled ahead of auction

-

Tech1 week ago

Tech1 week agoStrap One of Our Favorite Action Cameras to Your Helmet or a Floaty

-

Sports1 week ago

Sports1 week agoWanted Olympian-turned-fugitive Ryan Wedding in custody, sources say

-

Entertainment1 week ago

Entertainment1 week agoThree dead after suicide blast targets peace committee leader’s home in DI Khan

-

Tech1 week ago

Tech1 week agoThis Mega Snowstorm Will Be a Test for the US Supply Chain

-

Sports1 week ago

Sports1 week agoStorylines shaping the 2025-26 men’s college basketball season

-

Fashion1 week ago

Fashion1 week agoSpain’s apparel imports up 7.10% in Jan-Oct as sourcing realigns

-

Entertainment1 week ago

Entertainment1 week agoUFC Head Dana White credits Trump for putting UFC ‘on the map’