Business

Hurun Rich List 2025: Mukesh Ambani reclaims spot as India’s richest with Rs 9.55 lakh crore wealth; beats Gautam Adani – The Times of India

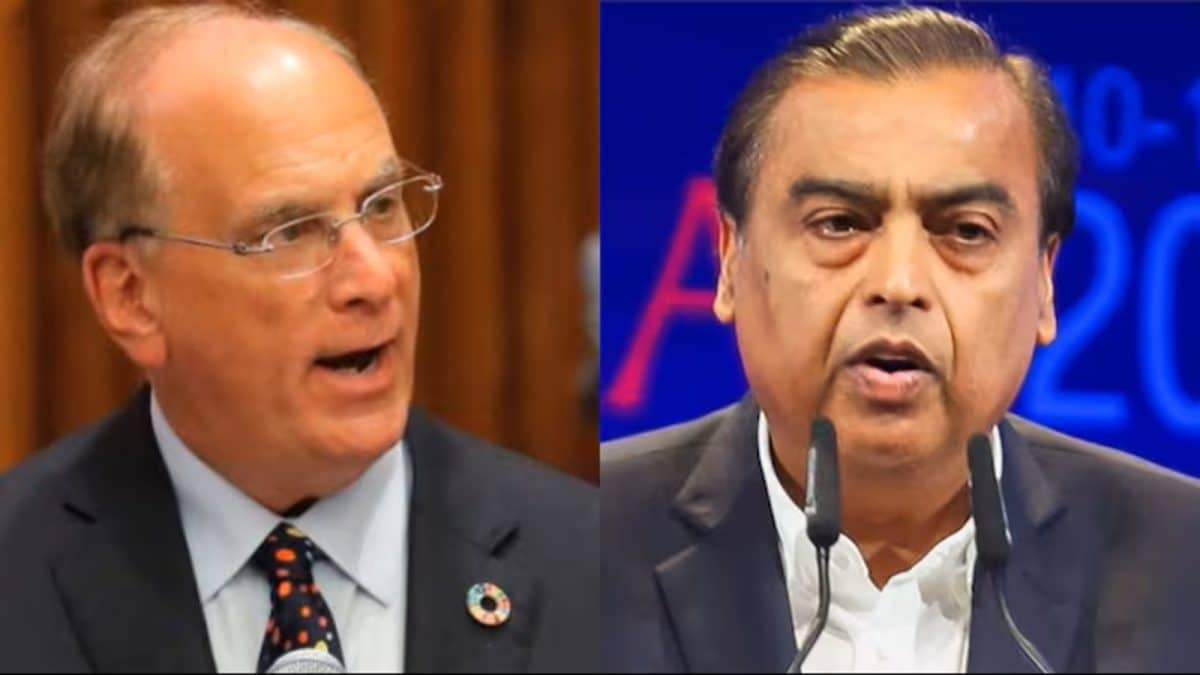

Mukesh Ambani and his family have beaten Gautam Adani to become India’s richest, according to the latest M3M Hurun India Rich List 2025. With a wealth of Rs 9.55 lakh crore, Ambani has reclaimed the top spot, while Adani family stands second with a wealth of Rs 8.15 lakh crore.Making history in the rankings, Roshni Nadar Malhotra and family have achieved the third position with Rs 2.84 lakh crore, establishing her as India’s richest woman. The report acknowledges the significant impact of newcomers on the nation’s wealth distribution.India’s affluent class has experienced substantial expansion, with the country now housing more than 350 billionaires, representing a dramatic increase since the list’s inception 13 years prior. The combined wealth of all listed individuals totals Rs 167 lakh crore, approximating half of India’s gross domestic product.Fresh entrepreneurs are leading wealth creation trends. At age 31, Perplexity’s Aravind Srinivas has become India’s youngest billionaire with Rs 21,190 crore wealth. Actor Shah Rukh Khan made his debut in the billionaire category, amassing Rs 12,490 crore.The Niraj Bajaj family achieved the highest wealth increase, growing their fortune by Rs 69,875 crore to Rs 2.33 lakh crore, according to an ET report quoting the list.With 451 billionaires, Mumbai remains India’s wealth capital, whilst New Delhi follows with 223 and Bengaluru with 116. Industries showing highest representation include pharmaceuticals with 137 entries, industrial products with 132, and chemicals & petrochemicals contributing 125 entries.Women’s participation in wealth creation shows promising growth, with 101 women appearing on the 2025 list, including 26 dollar billionaires. Self-made individuals constitute 66% of the total list, demonstrating strong entrepreneurial spirit, whilst 74% of newcomers built their wealth independently.

Business

RBI’s Rs 25,000-Crore Switch Auction On March 2nd And Its Impact On Bond Markets, Government Debt Strategy | Explained

Last Updated:

RBI Switch Auction On March 2: The Reserve Bank of India will conduct a government securities switch auction worth Rs 25,000 crore on March 2 between 10:30 AM and 11:30 AM

In the latest exercise, all securities, having maturities in FY27, are being replaced with bonds maturing after FY32.

RBI Switch Auction On March 2: The Reserve Bank of India (RBI) will conduct a government securities switch auction worth Rs 25,000 crore on March 2 between 10:30 AM and 11:30 AM, with results to be declared the same day and settlement scheduled for March 4. The move marks the third such operation this month and is aimed at smoothing India’s future debt repayment profile.

What is a switch auction?

A switch auction is a debt management tool through which the government exchanges bonds that mature soon with bonds that mature later. Instead of repaying investors in cash when near-term securities mature, the government offers them longer-dated securities. This effectively postpones repayment obligations without increasing total debt.

In the latest exercise, all securities, having maturities in FY27, are being replaced with bonds maturing after FY32, according to RBI data.

Why is RBI conducting it now?

The key trigger is the heavy redemption pressure expected in FY27, when government securities worth about Rs 5.47 lakh crore are scheduled to mature. By replacing these with bonds maturing after FY32, the authorities are spreading repayment obligations across future years. This reduces refinancing risk and prevents sudden spikes in borrowing needs.

How does it help the government?

India has already budgeted gross market borrowing of Rs 17.2 lakh crore. Large redemptions in a single year would force the government either to borrow more or use fiscal resources for repayment. Switch auctions smooth this maturity profile, making debt servicing more predictable and fiscally manageable.

What has happened so far this month?

Before this latest announcement, the RBI conducted two switch auctions in which securities worth Rs 84,804 crore were bought back and replaced. The repeated use of this tool signals a proactive debt-management strategy rather than a reactive measure.

Why markets watch switch auctions closely

Bond investors track such operations because they affect liquidity, yield curves and supply of long-term securities. Extending maturities can reduce pressure on near-term yields while increasing supply at the long end, influencing pricing across the sovereign curve.

The broader takeaway

The latest switch auction is part of a deliberate strategy to manage India’s rising debt stock more efficiently. By pushing repayments further into the future and avoiding bunching of maturities, policymakers aim to maintain stability in government borrowing costs and ensure smoother fiscal operations in coming years.

Follow News18 on Google. Join the fun, play games on News18. Stay updated with all the latest business news, including market trends, stock updates, tax, IPO, banking finance, real estate, savings and investments. To Get in-depth analysis, expert opinions, and real-time updates. Also Download the News18 App to stay updated.

February 26, 2026, 11:11 IST

Read More

Business

Vellayan Subbiah To Exit Cholamandalam Investment Finance Under Murugappa Family Pact

Last Updated:

Vellayan Subbiah, a scion of the Murugappa family, has reached a settlement with other promoter branches to realign ownership

Cholamandalam Investment Finance

Vellayan Subbiah, a scion of the Murugappa family, has reached a settlement with other promoter branches to realign ownership across key group companies, according to a report by Moneycontrol.com, citing people familiar with the matter. The agreement is expected to see Subbiah give up stake exposure linked to Cholamandalam Investment and Finance Company while consolidating his position in Tube Investments of India and CG Power and Industrial Solutions.

The arrangement, finalised after more than two years of negotiations, forms part of a broader plan by the Murugappa Group to separate ownership of the century-old conglomerate among three promoter factions while ensuring business continuity. Under the settlement, Subbiah is expected to relinquish exposure to Cholamandalam Investment — the group’s flagship lending arm — and instead retain and strengthen his alignment with Tube Investments and CG Power, including taking over or retaining stakes tied to those companies within the extended promoter structure, the report said. Emails sent to Subbiah and the Murugappa Group did not receive a response until publication.

The realignment follows prolonged internal discussions over the division of the diversified business empire, which reported revenue of more than $9 billion in FY23, after five generations of joint ownership through the family holding company Ambadi Investments.

Negotiations had earlier faced hurdles due to significant valuation divergences across group companies. As previously reported by The Economic Times on August 19, 2024, the turnaround of businesses overseen by Subbiah — particularly CG Power, Tube Investments and Cholamandalam Finance — had emerged as a sticking point in share-swap discussions among family factions.

The revival of CG Power proved especially pivotal. Since Tube Investments acquired control in 2020, CG Power has deleveraged, restored profitability and benefited from investor interest in domestic manufacturing, railways, power equipment and electronics supply chains. Its stock has surged since the takeover, making it one of the group’s most valuable listed assets. Tube Investments has also diversified beyond its legacy engineering base into green mobility, contract manufacturing and specialised industrial segments, strengthening its market position.

Cholamandalam Investment, meanwhile, has grown into one of India’s most valuable non-bank lenders, with a market capitalisation exceeding Rs 1 lakh crore. The uneven appreciation in these businesses complicated efforts to carve out three equal promoter blocs, with one faction seeking revisions to earlier share-swap assumptions and another resisting reopening agreed terms, people cited by Moneycontrol.com said.

Promoter ownership across Murugappa companies is largely routed through holding vehicles rather than direct individual shareholdings, but the concentration of value highlights why these firms were central to negotiations. The promoter group’s roughly 51–52 percent stake in Cholamandalam Investment is estimated to be worth about Rs 55,000–60,000 crore at current market levels. In Tube Investments, promoter ownership of around 45–46 percent translates into holdings valued at approximately Rs 20,000–22,000 crore. Through Tube Investments’ controlling position in CG Power, the promoter group effectively holds about 58–59 percent of that company, valued at roughly Rs 45,000–50,000 crore.

Beyond these, the family controls about 56–57 percent in Coromandel International, worth around Rs 18,000–20,000 crore; 42–43 percent in Carborundum Universal, valued near Rs 9,000–10,000 crore; and 44–45 percent in EID Parry, worth roughly Rs 3,500–4,000 crore. Tube Investments also indirectly controls about 70 percent of Shanti Gears, valued at approximately Rs 2,500–3,000 crore.

The final arrangement appears to align ownership more closely with operational leadership. Subbiah, a fourth-generation member of the family, is widely credited within the group for steering the revival of CG Power and expanding Tube Investments into new manufacturing and mobility segments, making these businesses natural anchors for his promoter bloc under the new structure.

The Murugappa Group, which comprises nearly 30 companies across fertilisers, engineering, financial services, abrasives, sugar and mobility solutions, operates under a long-standing governance charter that separates ownership from management, the Moneycontrol.com report noted.

Follow News18 on Google. Join the fun, play games on News18. Stay updated with all the latest business news, including market trends, stock updates, tax, IPO, banking finance, real estate, savings and investments. To Get in-depth analysis, expert opinions, and real-time updates. Also Download the News18 App to stay updated.

February 26, 2026, 10:51 IST

Read More

Business

Yes Bank Under Scanner As RBI Summons Executives Over Forex Card Breach

Last Updated:

RBI has summoned senior officials of Yes Bank following a major data breach involving the Yes Bank–BookMyForex multi-currency forex card

Reserve Bank of India headquarters in Mumbai.

The Reserve Bank of India (RBI) has summoned senior officials of Yes Bank following a major data breach involving the Yes Bank–BookMyForex multi-currency forex card, two people aware of the development told The Economic Times (ET).

According to the report, card details and CVV numbers of several users were allegedly compromised. The central bank has sought a detailed explanation from the bank on how its systems may have been breached and the sequence of events that led to the exposure of sensitive customer data.

“The RBI has sought a comprehensive briefing from Yes Bank’s senior management on the root cause of the breach, the timeline of events, and the adequacy of the bank’s cybersecurity framework,” one of the persons cited by ET said. “The regulator wants clarity on how sensitive card data, including CVV numbers, may have been exposed and what immediate containment measures have been implemented.”

Yes Bank declined to comment on the RBI’s queries but said an internal investigation had identified fraudulent transactions involving 15 merchants in a Latin American country on February 24. Transactions worth Rs 2.54 crore were approved across 5,000 customers, while 688 unauthorised attempts amounting to around Rs 90 lakh were blocked. The bank said it is working with the card network to initiate chargebacks and ensure that affected customers do not face financial losses.

Separately, BookMyForex said it does not store customers’ sensitive card information and that its systems were neither breached nor compromised during the period in question.

The RBI has also sought details on how sensitive card data—particularly CVVs—was stored and protected, whether encryption and prescribed security protocols were followed, and why existing cyber controls failed to prevent the breach. In addition, the regulator is reviewing the timeline of detection and reporting, the robustness of third-party risk management and oversight, the number of customers impacted, and the steps taken to block cards, prevent misuse and mitigate losses. It has also asked for clarity on internal accountability, supervisory lapses and remedial measures to prevent a recurrence, ET reported.

Follow News18 on Google. Join the fun, play games on News18. Stay updated with all the latest business news, including market trends, stock updates, tax, IPO, banking finance, real estate, savings and investments. To Get in-depth analysis, expert opinions, and real-time updates. Also Download the News18 App to stay updated.

February 26, 2026, 07:53 IST

Read More

-

Entertainment1 week ago

Entertainment1 week agoQueen Camilla reveals her sister’s connection to Princess Diana

-

Tech1 week ago

Tech1 week agoRakuten Mobile proposal selected for Jaxa space strategy | Computer Weekly

-

Politics1 week ago

Politics1 week agoRamadan moon sighted in Saudi Arabia, other Gulf countries

-

Entertainment1 week ago

Entertainment1 week agoRobert Duvall, known for his roles in "The Godfather" and "Apocalypse Now," dies at 95

-

Politics1 week ago

Politics1 week agoTarique Rahman Takes Oath as Bangladesh’s Prime Minister Following Decisive BNP Triumph

-

Business1 week ago

Business1 week agoTax Saving FD: This Simple Investment Can Help You Earn And Save More

-

Tech1 week ago

Tech1 week agoBusinesses may be caught by government proposals to restrict VPN use | Computer Weekly

-

Sports1 week ago

Sports1 week agoUsman Tariq backs Babar and Shaheen ahead of do-or-die Namibia clash