Business

‘India makes more coaches than US, Europe’: PM Modi flags off Vande Bharat sleeper; calls it self-reliance push – The Times of India

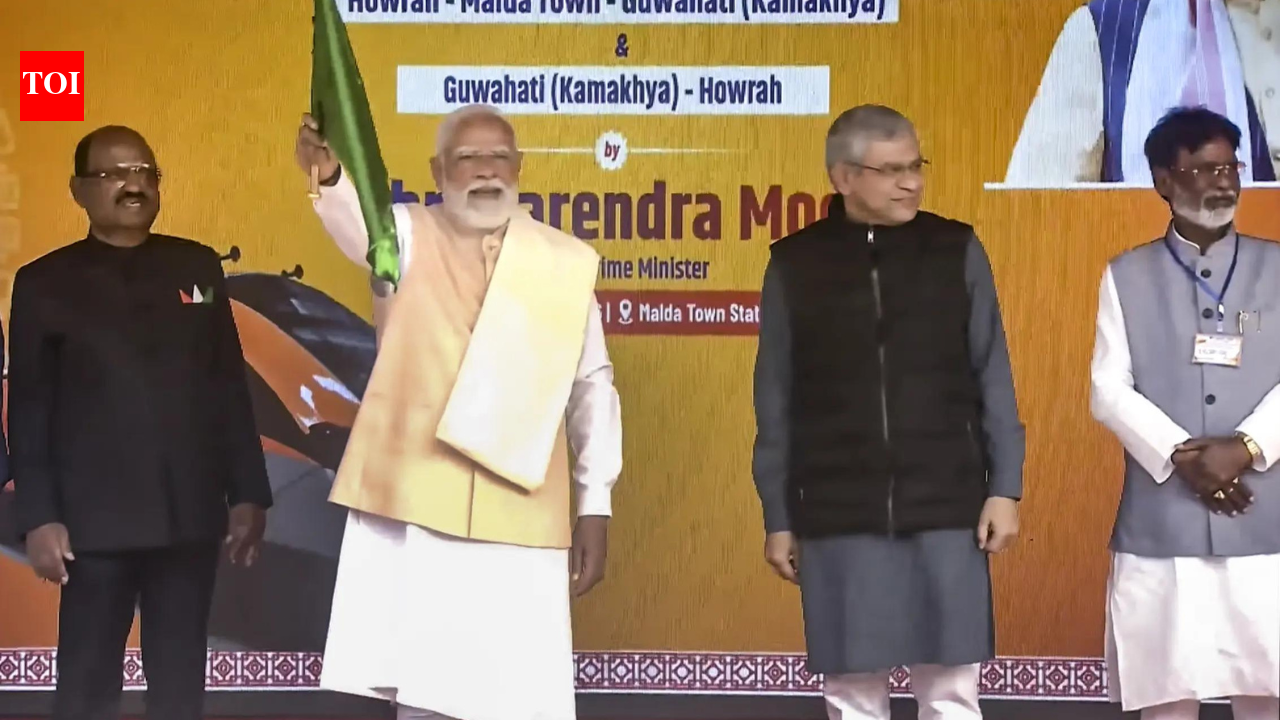

Prime Minister Narendra Modi on Saturday said India is now manufacturing more railway coaches than the United States and Europe, highlighting the country’s growing self-reliance. He made the remarks while flagging off India’s first Vande Bharat sleeper train from Malda in West Bengal.Addressing a public gathering after inaugurating the sleeper version of the Vande Bharat Express on the Howrah–Guwahati (Kamakhya) route, PM Modi said India’s expanding railway manufacturing capacity was strengthening the economy and generating jobs. “Today, India is manufacturing more locomotives than America and Europe. We are exporting passenger and metro train coaches to many countries. This strengthens our economy and generates employment. Connecting India is our priority, and reducing distance is our mission,” he said.The Prime Minister said the country was not only modernising its transport infrastructure but also becoming self-reliant in the process. Referring to the Vande Bharat trains, he said, “There was a time when we watched videos and pictures of foreign trains and wondered if India could ever have such facilities. Today, we are living that reality. Now, foreigners make videos of Indian Railways and tell the world about the revolution taking place here.”Highlighting the cultural and regional significance of the new service, PM Modi said, “Vande Bharat is Made in India and will connect the land of Maa Kali to Maa Kamakhya. Indian Railways is going through a major phase of modernisation.” He added that Vande Bharat sleeper trains would soon operate across the country, making long-distance travel more comfortable.“From today, Vande Bharat Sleeper Class trains will start operating from this pious land of West Bengal. It will make people’s journeys memorable, comfortable, and magnificent,” the Prime Minister said. He added that the newly unveiled projects, especially new trains, would empower the youth.The launch of the Vande Bharat sleeper train marks a major milestone in Indian Railways’ modernisation drive and is part of a broader push to improve connectivity between eastern India and the Northeast. The Howrah–Guwahati service is expected to significantly reduce travel time while offering modern onboard amenities.During his visit to Malda, PM Modi also interacted with students, railway staff and train drivers who were present for the inaugural run. He is set to dedicate to the nation and lay the foundation stone of multiple rail and road infrastructure projects worth over Rs 3,250 crore aimed at boosting connectivity and development in West Bengal and the North-Eastern region.Railway minister Ashwini Vaishnaw described the initiatives as a “gift” to West Bengal.“PM Modi is giving West Bengal a gift of more than one dozen new trains. The first service of Vande Bharat sleeper trains will start from Guwahati to Kolkata. PM Modi will inaugurate it. Amrit Bharat Express trains are going to run. Along with it, 101 stations are being reconstructed in West Bengal. Under this, the New Jalpaiguri (NJP) Railway Station is in the process of turning into a world-class station, with the addition of two new platforms,” Vaishnaw said. After West Bengal, the Prime Minister is scheduled to visit Assam, where he will participate in cultural events celebrating the heritage of the Bodo community. He will also perform the bhoomi pujan for the Kaziranga Elevated Corridor project, a major highway initiative aimed at improving connectivity while ensuring environmental protection and wildlife movement.

Business

Disney dominated the 2025 box office. Here’s how it could keep the crown in 2026

Courtesy of Disney Enterprises Inc.

Blue aliens, a family of superheroes and a city of talking animals boosted the Walt Disney Company to the top of the domestic box office in 2025.

Full-year ticket sales in the United States and Canada rose about 4% from 2024 to $9.05 billion. Disney accounted for the highest share of that haul with $2.49 billion in ticket sales, or 27.5%, according to data from Comscore.

It’s closest competitors were Warner Bros. Discovery, which tallied $1.9 billion domestically, or 21%, and Universal, which took in $1.7 billion, or 19.7%. Together, these three studios accounted for nearly 70% of the domestic box office market share.

No other studio surpassed $1 billion in domestic ticket sales or accounted for more than 7% of the total box office haul.

“[Warner Bros., Disney and Universal] have the advantage of having at least two or more distinct and successful sub-brands labels — such as Marvel under Disney, New Line under WB and Illumination under Universal — under their corporate umbrella that enables these studios to dominate at least in terms of the overall box office and percentage of the marketplace that they control,” said Paul Dergarabedian, head of marketplace trends at Comscore.

Disney’s standout performance came on the backs of already popular intellectual property. Four of its films were part of the top 10 highest-grossing domestic releases of the year, including the live-action remake of “Lilo & Stitch,” a sequel to 2016’s “Zootopia,” another entrant in the Marvel Cinematic Universe with “Fantastic Four: First Steps” and a third “Avatar” film.

“Most years at the box office are dominated by known IP and non-original content; films that have the baked in brand name recognition that theoretically gives those films a leg up in terms of marketing and potential box office success,” Dergarabedian said.

In fact, nine of the 10 biggest movies at the domestic box offices were from existing IP. Warner Bros.’ “Sinners” was the only original title to make the list.

“In 2025 there were some big budget originals that did incredibly well … but lest anyone think that trend is going away, 2026 looks to eclipse 2025 in terms of the number of high-profile sequels and known IP on the slate for the year,” Dergarabedian said.

That’s especially true for Disney.

The studio is set to release its first Star Wars film in theaters since 2019 called “The Mandalorian and Grogu” after the popular characters of its “The Mandalorian” series on Disney+; “Toy Story 5” is will hit theaters in June followed by a live-action “Moana” in July; then the hotly anticipated “Avengers: Doomsday” arrives in December.

A new Spider-Man film will also sling into theaters in 2026, but as part of a deal with Sony to have the character as part of Disney’s MCU, Sony keeps the majority of box office profits while Disney gets merchandise sales.

The box office will also get a boost from Warner Bros.’ “Supergirl” and “Dune: Part Three,” Universal’s “Minions 3,” “The Super Mario Galaxy Movie” and “The Odyssey,” Lionsgate’s “Hunger Games: Sunrise on the Reaping” and Sony’s third “Jumanji” film.

“As we look into 2026, there’s plenty of optimism to go around,” said Shawn Robbins, director of analytics at Fandango and founder of Box Office Theory “The slate is packed with top-tier franchises, some fan-driven and others family-oriented, alongside filmmaker-driven tentpoles … plus an inevitable crop of strong or potentially surprising performers out of horror, comedy, indie, and other genres.”

Disclosure: Versant is the parent company of CNBC and Fandango.

Business

ICICI Bank Q3 Net Profit Falls 4 Percent to Rs 11317.86 Crore

Last Updated:

ICICI Bank’s interest income stands at Rs 41,966 crore in Q3 FY26, reflecting a 1.6% year-on-year increase from Rs 41,300 crore in the same quarter last year.

ICICI Bank Q3 Results.

Private sector lender ICICI Bank on Saturday reported a 4.02 per cent fall in its standalone net profit to Rs 11,317.86 crore for the third quarter ended December 31, 2025. Its net profit had stood at Rs 11,792.42 crore in the corresponding period last year, according to a regulatory filing.

The lender reported interest income of Rs 41,966 crore in Q3 FY26, reflecting a 1.6% year-on-year increase from Rs 41,300 crore in the same quarter last year. Interest expenses declined 4.3% to Rs 20,034 crore during the quarter, compared with Rs 20,929 crore in the year-ago period.

Operating expenses increased 13.2% year-on-year to Rs 11,944 crore from Rs 10,552 crore. The bank said this figure includes Rs 145 crore of estimated provisions made in line with the new Labour Codes. The quarter was also impacted by treasury performance, with the bank posting a treasury loss of Rs 157 crore, compared with a gain of Rs 371 crore in Q3 FY25.

Core operating profit rose 6.0% year-on-year to Rs 17,513 crore in Q3 FY26, driven by steady growth in net interest income and fee-based income. Net interest income increased 7.7% year-on-year to Rs 21,932 crore, supported by loan expansion and stable margins.

Asset quality showed marginal improvement during the quarter. The gross NPA ratio declined to 1.53% as of December 31, 2025, from 1.58% at September 30, 2025 and 1.96% a year earlier. The net NPA ratio eased to 0.37% at end-December 2025, compared with 0.39% in the preceding quarter and 0.42% at December 31, 2024.

Provisions, excluding tax-related provisions, rose to Rs 2,556 crore in Q3 FY26 from Rs 1,227 crore in Q3 FY25. The bank said this included an additional standard asset provision of Rs 1,283 crore, made following the Reserve Bank of India’s annual supervisory review, relating to a portfolio of agricultural priority sector loans that were found to be not fully compliant with regulatory norms.

The domestic loan book expanded 11.5% year-on-year to Rs 14,30,895 crore as of December 31, 2025. Including profits for the nine months ended December 31, 2025, the bank said its total capital adequacy ratio stood at 17.34%, while the CET-1 ratio was 16.46% on a standalone basis at end-December 2025.

January 17, 2026, 15:28 IST

Read More

Business

Trump sanctions fail to stop inflow! Some Indian refiners step up Russian crude oil intake; Indian Oil, Nayara boost purchases – The Times of India

State-run Indian Oil Corp and Rosneft-backed Nayara Energy have increased their purchases of Russian crude in January. This comes even as India’s overall imports from Russia have declined under US sanctions.Reliance Industries, India’s largest buyer over the past year, along with several other refiners, has not received any supplies this month. This leaves Indian Oil, Nayara and Bharat Petroleum Corporation (BPCL) as the main importers so far, according to ET.India’s imports of Russian oil averaged 1.18 million barrels per day in the first half of January, down about 30 per cent from both the same period last year and the 2025 average, according to Kpler, a global real-time data and analytics provider. Imports were roughly 3 per cent lower compared with December 2025.US sanctions have significantly narrowed the buyer pool for Russian crude, restricting shipments to just a few Indian refiners. Indian Oil received about 500,000 barrels per day, accounting for nearly 43 per cent of total Russian crude shipped to India. This was Indian Oil’s highest average intake since May 2024 and 64 per cent higher than its 2025 average.Nayara Energy, which has become fully reliant on Russian oil since being sanctioned by the European Union last year, was the second-largest buyer in January. Its imports of approximately 471,000 barrels per day—about 40 per cent of Russian volumes shipped to India this month—were the highest in at least two years and 56 per cent above its 2025 average intake. BPCL received around 200,000 barrels per day, slightly above its average of 185,000 barrels in 2025.Other major refiners, including Hindustan Petroleum Corporation, HPCL-Mittal Energy Ltd, Mangalore Refinery & Petrochemicals Ltd and Reliance Industries, did not receive any Russian cargoes in the first half of January.Reduced demand from some Indian and Chinese buyers has prompted Russian suppliers to increase discounts on crude. Industry executives said discounts on Russia’s flagship Urals crude for delivery to Indian ports now trades at $5-6 per barrel, up from $2 before US sanctions on Rosneft and Lukoil last October.Indian Oil has increased its intake this month to take advantage of these discounts.Indian refiners began recalibrating their strategy on discounted Russian crude after the US criticised India’s purchases last year and threatened additional tariffs. Some refiners moderated imports after an additional 25 per cent tariff took effect in late August on Indian exports to the US.However, US sanctions on Rosneft and Lukoil have intensified caution among Indian refiners. Most have stopped receiving cargoes from sanctioned suppliers, with the exception of Rosneft-backed Nayara, according to industry executives. Reliance Industries, which has a term deal with Rosneft, has halted shipments from both Rosneft and other Russian suppliers, Kpler data showed.

-

Tech5 days ago

Tech5 days agoNew Proposed Legislation Would Let Self-Driving Cars Operate in New York State

-

Sports6 days ago

Sports6 days agoClock is ticking for Frank at Spurs, with dwindling evidence he deserves extra time

-

Sports1 week ago

Commanders go young, promote David Blough to be offensive coordinator

-

Entertainment4 days ago

Entertainment4 days agoX (formerly Twitter) recovers after brief global outage affects thousands

-

Fashion6 days ago

Fashion6 days agoSouth India cotton yarn gains but market unease over US tariff fears

-

Fashion6 days ago

Fashion6 days agoChina’s central bank conducts $157-bn outright reverse repo operation

-

Business1 week ago

Business1 week agoSoftBank reduces Ola Electric stake to 13.5% from 15.6% – The Times of India

-

Sports6 days ago

Sports6 days agoUS figure skating power couple makes history with record breaking seventh national championship