Business

Jaguar Land Rover cyber attack cost company nearly £200m

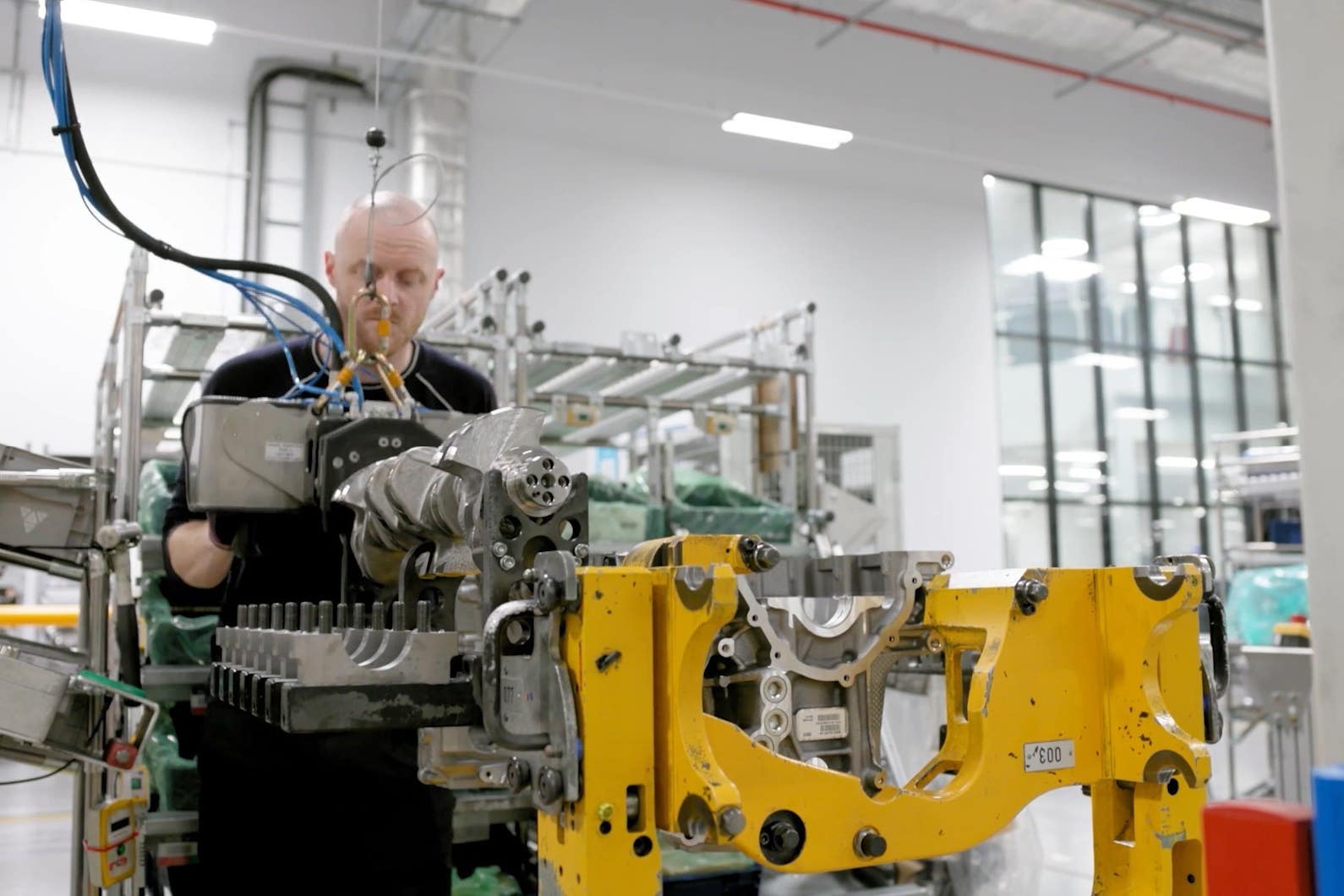

A cyber attack on Jaguar Land Rover (JLR) cost it nearly £200m, the company has announced.

The UK’s largest car manufacturer said it has “made strong progress” in recovering its operations at pace since the attack.

JLR stopped production across its UK factories for five weeks from 1 September after being targeted by hackers a day earlier.

All of the group’s manufacturing sites – including factories in Solihull, West Midlands, and Halewood, Merseyside – restarted operations last month.

JLR has revealed it swung to an underlying loss of £485m over the second quarter of the year as earnings were knocked following a severe cyber attack.

The British luxury carmaker had made a profit before tax and exceptional items of nearly £400m over the same period in 2024.

It also reported a £134m loss for the six months to the end of September, from a £1.1bn profit the prior year.

JLR’s chief executive Adrian Mardell said the company’s financial performance was “impacted by significant challenges, including a cyber incident that stopped our vehicle production in September and the impact of US tariffs”.

The manufacturer revealed costs of £196m relating to the cyber attack.

The cyber attack on Jaguar Land Rover is thought to have been the UK’s most economically damaging hack and is estimated to have cost the country £1.9bn.

Research from the Cyber Monitoring Centre indicates that around 5,000 businesses nationwide have been hit by the fallout.

Its experts analysed the incident’s broad impact across the economy and supply chain to arrive at the figure.

Jaguar Land Rover halted production at its UK factories for five weeks from 1 September after being targeted the previous day.

This disruption led to warnings from suppliers that many faced collapse without rapid trading resumption or financial aid.

Business

FPI Inflows Hit Rs 19,675 Cr In First 15 Days Of Feb On US-India Trade Boost

Last Updated:

Foreign Portfolio Investors put Rs 19,675 crore into Indian equities in early February, ending three months of selling amid global cues and a US-India trade pact.

US-India trade deal hopes lift FPI inflows to Rs 19,675 cr in early Feb

Foreign Portfolio Investors Reverse Trend With Rs 19,675 Crore February Buying: Foreign Portfolio Investors (FPIs) made a notable comeback in early February, infusing Rs 19,675 crore into Indian equities during the first half of the month, aided by improving global conditions and the US-India trade agreement.

This marks a clear shift after three consecutive months of net selling. Depository data shows FPIs withdrew Rs 35,962 crore in January, Rs 22,611 crore in December, and Rs 3,765 crore in November.

Even with the renewed buying in February, the broader trend for 2025 remains negative. So far this year, foreign investors have pulled out a net Rs 1.66 lakh crore (USD 18.9 billion) from Indian equities, making it one of the weakest periods for overseas inflows in recent times. Currency volatility, global trade tensions, concerns over potential US tariffs, and elevated valuations had weighed heavily on flows earlier.

Global Cues And Domestic Stability Support Recovery

Himanshu Srivastava, Principal Manager–Research at Morningstar Investment Research India, as quoted by PTI, said the latest inflows were largely driven by easing global macro pressures. Softer US inflation data improved expectations around the interest rate cycle, helping stabilise bond yields and the US dollar. This, in turn, enhanced investor appetite for emerging markets such as India.

On the domestic front, stable inflation, resilient macro indicators, and corporate earnings largely in line with expectations strengthened confidence in India’s economic trajectory, he noted.

Vaqarjaved Khan, Senior Fundamental Analyst at Angel One, also attributed the renewed interest to the US-India trade pact, the growth-oriented Union Budget 2026, easing global trade uncertainties, and steady domestic interest rates.

Volatility Persists Despite Net Buying Days

FPIs were net buyers in seven out of eleven trading sessions in February up to the 13th, turning sellers on four occasions. However, cumulative data indicates a net equity outflow of ₹1,374 crore so far this month.

The divergence was largely due to a sharp sell-off of Rs 7,395 crore on February 13, when the Nifty dropped 336 points. The period also witnessed substantial selling in IT stocks amid the so-called “Anthropic shock.” VK Vijayakumar, Chief Investment Strategist at Geojit Investments, said as quoted by PTI, foreign investors likely reduced exposure to IT stocks aggressively in the cash market, as the IT index fell 8.2 percent in the week ended February 13.

(With PTI Inputs)

February 15, 2026, 16:54 IST

Read More

Business

From first salary to first investment — Why young Indians are choosing gold

New Delhi: Gold continues to remain the most trusted investment option among young Indians, even as access to financial products like mutual funds, stocks, and cryptocurrencies expands, according to a recent consumer survey.

The Smytten PulseAI survey, conducted among 5,000 consumers aged 18–39, found that 62 percent of respondents chose gold as their preferred investment, highlighting the metal’s enduring appeal among Gen Z and Millennials.

When asked how they would invest Rs 25,000, about 61.9 percent said they would choose gold, far ahead of mutual funds (16.6 percent), fixed deposits (13 percent), stocks (6.6 percent), and crypto (1.9 percent), the survey showed.

The findings also indicate that gold buying is becoming more personal and investment-driven rather than tradition-led. Around 66.7 percent of respondents said their gold purchases were primarily their own decision, reflecting a shift in mindset among younger investors.

Another notable trend is the move toward smaller and more frequent purchases. Nearly 62 percent of recent gold purchases were below 5 grams, suggesting that younger buyers are entering the market gradually instead of making large, occasional purchases.

Gold’s appeal becomes even stronger during uncertain economic conditions. The survey found that 65.7 percent of respondents consider gold the safest investment option compared with bank savings, mutual funds, or equities.

For many young earners, gold is no longer bought only for weddings or family occasions. Nearly 24 percent said their first gold purchase was linked to receiving their first salary, while 23.9 percent bought gold as an investment decision, signalling changing motivations behind gold ownership.

Overall, the survey highlights that while investment behaviour among young Indians is evolving, gold continues to play a central role as a trusted store of value and financial safety net.

Business

PPF account rules: Why you can open only one PPF account and what it means for your tax savings

New Delhi: The Public Provident Fund (PPF) is one of India’s most popular long-term, government-backed savings schemes. But many investors often wonder whether they can open multiple PPF accounts to increase their tax-saving investments. The government’s rules are clear — an individual can hold only one PPF account in their own name.

Opening additional PPF accounts in different banks or post offices is not permitted under the PPF Scheme. If more than one account is discovered in the same person’s name, the extra account will be treated as irregular and may have to be closed, with interest on the additional account typically not paid.

However, the rules allow parents or guardians to open a separate PPF account for a minor child. Even in such cases, the total annual contribution across the individual’s own account and the minor’s account cannot exceed Rs 1.5 lakh in a financial year, which is the maximum investment limit under Section 80C.

The PPF scheme remains a long-term savings instrument with a 15-year maturity period, offering tax-free interest and government-guaranteed returns. Investors can deposit a minimum of Rs 500 and up to Rs 1.5 lakh annually, making it a widely used option for retirement and tax planning.

In short, while you cannot open more than one PPF account in your own name, you can still invest in separate accounts for eligible family members such as minor children, within the overall contribution limits set by the government.

-

Entertainment1 week ago

Entertainment1 week agoHow a factory error in China created a viral “crying horse” Lunar New Year trend

-

Business5 days ago

Business5 days agoAye Finance IPO Day 2: GMP Remains Zero; Apply Or Not? Check Price, GMP, Financials, Recommendations

-

Tech1 week ago

Tech1 week agoNew York Is the Latest State to Consider a Data Center Pause

-

Tech1 week ago

Tech1 week agoNordProtect Makes ID Theft Protection a Little Easier—if You Trust That It Works

-

Fashion5 days ago

Fashion5 days agoComment: Tariffs, capacity and timing reshape sourcing decisions

-

Business1 week ago

Business1 week agoMandelson’s lobbying firm cuts all ties with disgraced peer amid Epstein fallout

-

Tech5 days ago

Tech5 days agoRemoving barriers to tech careers

-

Fashion5 days ago

Fashion5 days agoADB commits $30 mn to support MSMEs in Philippines