Business

Japan hikes interest rate to highest level since 1995 as inflation bites

Japan’s central bank has raised its main interest rate to the highest level in 30 years as the country faces a cost-of-living squeeze.

In a widely expected decision, the Bank of Japan’s policy board, led by governor Kazuo Ueda, increased its benchmark rate by a quarter of a percentage point to “around 0.75%” on Friday.

The move comes as new Prime Minister Sanae Takaichi is keen that inflation comes down but also needs the cost of government borrowing to be cheap.

It marks both the first time the BOJ has hiked rates since January and the first rise since both Takaichi and Ueda took up their current roles.

When a central bank raises interest rates it tends to have the effect of increasing the value of the country’s currency.

In Japan’s case, it has the potential of easing inflation as the yen’s low value versus other major currencies, like the US dollar and the euro, has pushed up the cost of imports, which in turn has helped to fuel inflation.

At the same time, higher interest rates push up government borrowing costs because when rates go up governments, like anyone else, have to pay more to borrow money.

Last year, Takaichi described the idea of a rate hike as “stupid” although she has not publicly criticised Ueda’s policies since she took office in October.

Still, Takaichi has made the fight against inflation a priority as rising costs have eroded support for her party, the LDP.

On Friday, official figures showed Japan’s inflation, excluding food and fuel, rose by 3% in November. That remains above the bank’s target rate of 2%.

But Shoki Omori, chief strategist at Mizuho in Tokyo, told the BBC that the interest rate rise will do little to ease inflation as it has already been priced in by currency markets and the yen remains relatively weak.

Most economists expect the BOJ to raise its benchmark interest rate once more next year to hit 1%.

It marks a major change in Japanese policy makers’ approach to interest rates.

“What we’re seeing is a historic shift after nearly three decades of long standing low rates in Japan,” said Julia Lee from Pacific FTSE Russell, part of the London Stock Exchange Group.

But Takaichi’s stance on monetary policy may make it harder for the bank to hike again, said Shigeto Nagai, head of Japan economics at Oxford Economics.

“The BoJ will need time, probably around six months, to monitor the impact of the rate hike on the real economy before it makes its final move,” he said.

The BOJ’s latest rate rise comes as other major central banks around the world are moving in the opposite direction – lowering the cost of borrowing.

On Thursday, the Bank of England cut its main interest rate to 3.75%, the lowest level since February 2023.

Last week, the US Federal Reserve lowered interest rates for the third time this year, even as internal divisions create uncertainty about additional cuts in the coming months.

The central bank said it was lowering the target for its key lending rate by 0.25 percentage points, putting it in a range of 3.50% to 3.75% – its lowest level in three years.

Business

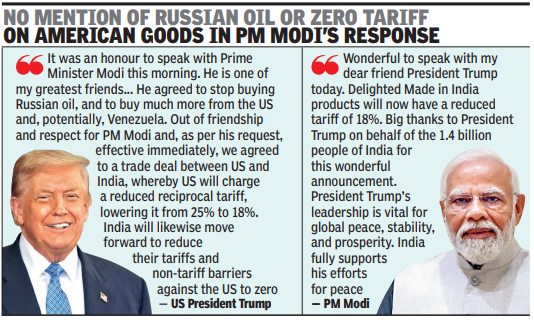

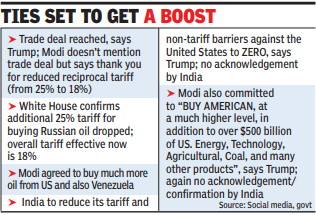

Trade deal done, says Trump; PM Modi thanks him for cutting tariff to 18% – The Times of India

NEW DELHI/ WASHINGTON: After months of bruising trade tensions, India and the US on Monday announced a bilateral trade deal that will see Washington slash additional tariffs on Indian imports to 18%, from the current 50%, making it more competitive for textiles, leather and seafood exporters.While PM Narendra Modi, in a post on X, which followed US President Donald Trump’s announcement on Truth Social, said he had a wonderful conversation with “dear friend” Trump and thanked him on behalf of 1.4 billion people for the reduced tariff of 18% on Indian goods, he did not mention the trade deal at all in his post on X that followed Trump’s “wonderful” announcement.

PM Modi and Trump

Modi also did not comment on Trump’s claim that in their conversation the PM had agreed to stop buying Russian oil and purchase much more energy from the US, and potentially Venezuela. Trump had said Modi had agreed to stop buying Russian oil and to buy much more from the US — $500 billion of energy, technology and farm products — a step that the President claimed would help end the war in Ukraine.According to the American President, Modi also agreed to bring down tariff and non-tariff barriers against the US to zero. A US embassy spokesperson confirmed that the final tariff now on India is 18%, down from the earlier 50%. This is a better deal for India than countries such Vietnam, Bangladesh, Indonesia, South Korea and China, which face higher tariffs. The Trump-Modi conversation coincided with the visit of EAM S Jaishankar to US for a critical minerals ministerial that will be chaired by Secretary of State Marco Rubio this week.The announcement came six days after India and the EU announced the completion of talks for a comprehensive trade agreement.Trump leadership vitalfor global peace: ModiThe deal had drawn sharp comments from some members of the Trump administration, including attacks on the EU.In his X post, PM said, “When two large economies and the world’s largest democracies work together, it benefits our people and unlocks immense opportunities for mutually beneficial cooperation”. He added that Trump’s leadership was vital for global peace, stability, and prosperity. India fully supports his efforts for peace. Modi said he was looking forward to working closely with Trump to take the partnership to unprecedented heights.Apart from reciprocal tariff, Trump had announced an additional 25% tariff on India for its purchase of Russian oil.Trump said the US had agreed to the trade deal with India out of friendship and respect for Modi, and at the latter’s request. “Our amazing relationship with India will be even stronger going forward. PM Modi and I are two people that GET THINGS DONE, something that cannot be said for mos,” he added.Trump in his social media post also said that it was an honour to speak with Modi whom he described as “one of my greatest friends and, a Powerful and Respected Leader of his Country”.

Ties set to get boost

While the US had acknowledged in past few months that India had cut down its Russian purchase, it had not eliminated the additional tariff.Trump also said, “We spoke about many things, including Trade, and ending the War with Russia and Ukraine. He agreed to stop buying Russian Oil, and to buy much more from the US and, potentially, Venezuela. This will help END THE WAR in Ukraine, which is taking place right now, with thousands of people dying each and every week!”Following the announcement last week of the successful conclusion of FTA negotiations with EU, India had suggested that India and US might be close to finalising the trade agreement they have been discussing since Feb last year.Trump’s disclosure of the trade deal was preceded by two India-related posts a few hours before, one of which featured him and Modi on a magazine cover with the caption “The Mover and the Shaker”. Another post featured New Delhi’s India Gate, which Trump called “India’s beautiful Triumphal Arch” and said, “Ours will be the greatest of them all!” — referring to a similar monument he wants to build in Washington DC.

Business

New York AG issues warning around prediction markets ahead of Super Bowl

New York Attorney General Letitia James speaks to the media, after she attended a hearing and pleaded not guilty to charges that she defrauded her mortgage lender, outside the U.S. District Court for the Eastern District of Virginia, in Norfolk, Virginia, U.S., Oct. 24, 2025.

Jonathan Ernst | Reuters

Days before Super Bowl 60, New York Attorney General Letitia James has a message for consumers: Be careful about placing trades on prediction markets.

“New Yorkers need to know the significant risks with unregulated prediction markets,” James said in a statement Monday. “It’s crystal clear: so-called prediction markets do not have the same consumer protections as regulated platforms. I urge all New Yorkers to be cautious of these platforms to protect their money.”

Prediction platforms like Kalshi and Polymarket are expected to generate billions of dollars in trading volume around the Super Bowl.

Consumers can make trades on game events — similar to online sportsbooks like DraftKings or FanDuel — as well as on predetermined outcomes, such as which companies will advertise during the Super Bowl, an issue CNBC Sport reported on last week.

James said the platforms’ products are bets “masquerading” as event contracts.

She warned there are concerns about the nascent prediction market industry, including “upholding prohibitions against insider betting and requiring regulatory review to ensure the financial stability and integrity of gambling operators.”

“Prediction markets may appear as modern, high-tech platforms for speculation or ‘forecasting,’ but in practice, many operate as unregulated gambling without the basic protections New York consumers both deserve and expect from properly licensed operators,” James said in the statement.

Prediction market contracts trade somewhat similarly to all-or-nothing options, with contracts priced between $0 and $1. The contracts trade up or down depending on the action.

In addition to contracts on Super Bowl commercials, both Polymarket and Kalshi are offering other trades related to the game, including on matters like “What songs will be played at the halftime show?,” “Who will attend the big game?,” and more traditional sportsbook “bets” such as “Seattle vs. New England: Most Rushing Yards,” as CNBC reported last week.

There are laws that prohibit insider trading on prediction markets, just as on traditional financial markets. But industry experts say they’re skeptical that the Commodity Futures Trading Commission, recently gutted as part of widespread government cuts, has the will or the means to police those problems.

Last week, CFTC Chairman Michael Selig said he had directed agency staff to withdraw a proposed rule that would have banned prediction trades on sports and politics. He said new rules would be coming.

Disclosure: CNBC has a commercial relationship with Kalshi.

Business

Gold and silver prices fall but FTSE 100 hits record high

Precious metal prices hit record highs in January as investors parked their money in “safe havens”.

Source link

-

Sports6 days ago

Sports6 days agoPSL 11: Local players’ category renewals unveiled ahead of auction

-

Entertainment6 days ago

Entertainment6 days agoClaire Danes reveals how she reacted to pregnancy at 44

-

Business7 days ago

Business7 days agoBanking services disrupted as bank employees go on nationwide strike demanding five-day work week

-

Fashion1 week ago

Fashion1 week agoSpain’s apparel imports up 7.10% in Jan-Oct as sourcing realigns

-

Sports6 days ago

Sports6 days agoCollege football’s top 100 games of the 2025 season

-

Politics6 days ago

Politics6 days agoTrump vows to ‘de-escalate’ after Minneapolis shootings

-

Sports6 days ago

Sports6 days agoTammy Abraham joins Aston Villa 1 day after Besiktas transfer

-

Entertainment6 days ago

Entertainment6 days agoK-Pop star Rosé to appear in special podcast before Grammy’s