Entertainment

Jim Carrey once stopped ‘Grinch’ filming for child costar Taylor Momsen

Taylor Momsen has opened up about a tense moment on the set of How the Grinch Stole Christmas, recalling how Jim Carrey once stopped production to ensure her safety during a stunt.

Momsen, who was just 7 years old when she filmed her feature debut, described the scene in Vulture’s oral history of the movie.

“I remember when we were shooting the scene coming down the mountain on the sled. It was this real sled that was up on a giant spring that was being controlled and moving from side to side, very aggressively,” Momsen said.

“There was a moment where I almost fell out of the sled, and he freaked out. He called cut and started checking in on me. I was having a great time. I was laughing; I wasn’t thinking about the fact that I just almost fell very high off the ground.”

She added that Carrey’s presence made her feel safe on set.

“At such a young age, to watch an artist who is that serious at what they’re doing even while playing this very over-the-top character, it was clear to me how much he was putting into it and how much of an artist he was.”

Carrey praised Momsen’s early talent, calling her “an incredibly precocious child” with “comedy timing [that] was impeccable. A total pro. I don’t think she ever went up on a line or missed a cue or anything like that.”

The two recently reunited for the first time in 25 years at the Rock and Roll Hall of Fame Induction Ceremony, sparking nostalgia for fans.

Carrey shared that seeing Momsen again was a joy.

“She has a really powerful manner. I was so glad she’s done so well for herself. She’s been through some challenges in her life and come out the other side. And she brought me a Crunchie, which is my favourite chocolate bar. That was awesome.”

From a young co-star to a successful adult, Momsen’s journey alongside Carrey highlights the bond formed behind the scenes of the beloved holiday classic.

Entertainment

Over Rs540m worth of kites sold ahead of Basant in Lahore

- 500,000 kites sold in Lahore markets on Tuesday alone: officials.

- Two-day public holiday announced in Punjab on Feb 6-7.

- Met Office says weather to remain suitable for kite-flying.

More than Rs540 million worth of kite string and kites were sold in Lahore over three days ahead of Basant, reflecting strong public enthusiasm as the historic festival returns to the city after 25 years.

According to the Kite Association, over 500,000 kites were sold in city markets on Tuesday alone, as buying activity for Basant continued for the third consecutive day.

The festival is set to be celebrated in Lahore from February 6 to 8, following the lifting of a long-standing ban under strict conditions.

Markets designated for kite-flying material remained crowded as enthusiasts prepared for the festival’s return after more than two decades.

A large number of buyers thronged the Mochi Gate market to purchase kite strings and kites of their choice. The festive mood was heightened by the district administration’s Basant float, where the beats of dhol added to the excitement of shoppers.

Some citizens, however, complained that the prices of kites and string were too high, calling on the government to take steps to bring prices down.

Senior Provincial Minister Maryam Aurangzeb also visited Mochi Gate to review Basant shopping arrangements. Speaking to the media, she said that preparations for a safe Basant had been completed and urged citizens to strictly follow SOPs while celebrating the festival.

Meanwhile, Punjab Chief Minister Maryam Nawaz announced a Basant celebration at Liberty Chowk on February 7.

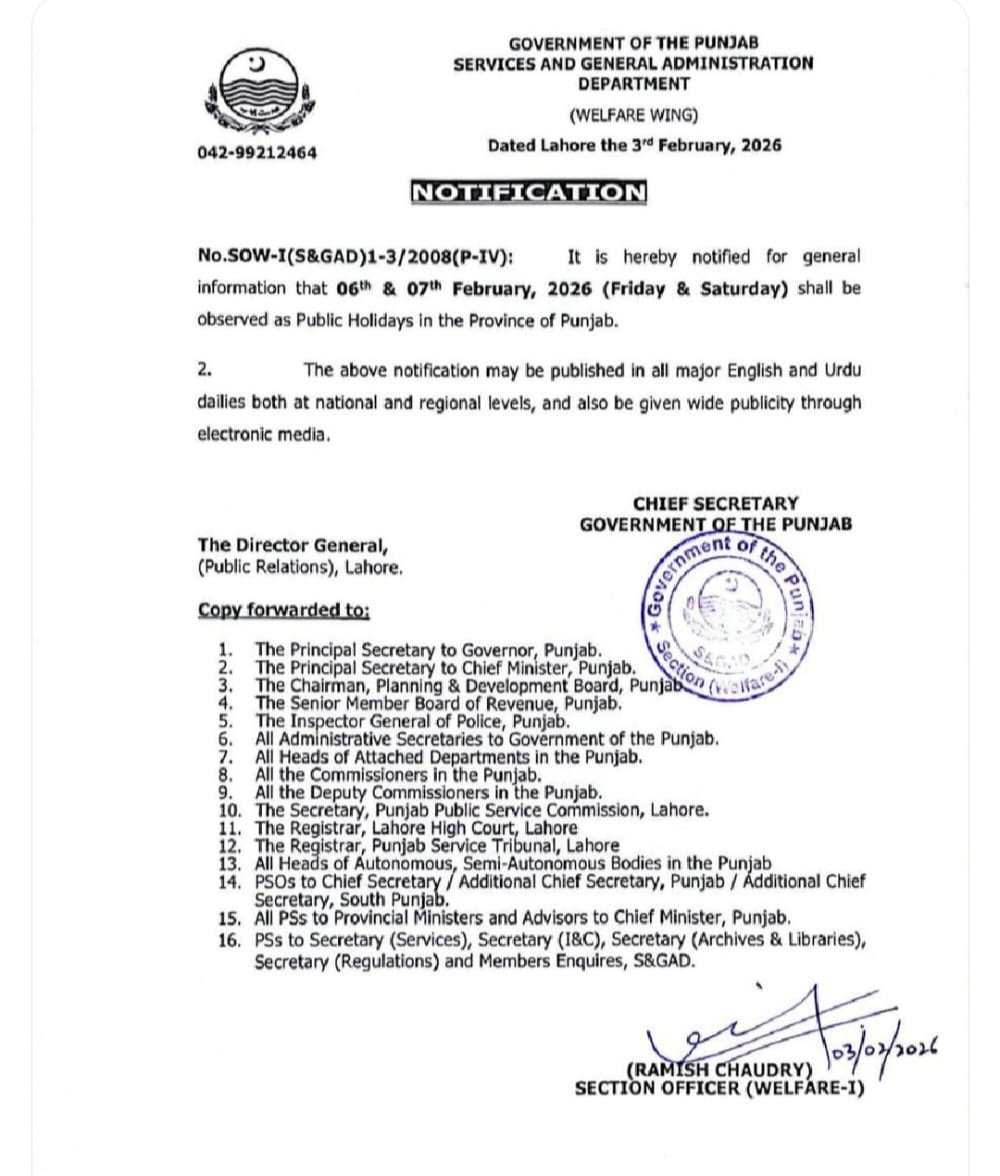

Moreover, public holiday has been announced across the province on February 6 and 7, according to an official notification issued by the Punjab administration.

Lahore has been swept in colours as the Basant preparations peaked, with a giant kite installed at Liberty Chowk as part of the celebrations.

It may be noted that the Punjab cabinet allowed the manufacturing of kite-flying material not only in Lahore but also in four other districts. The provincial government has said foolproof security arrangements are being put in place to ensure safety during the event.

According to the Pakistan Meteorological Department, Lahore’s weather during Basant will remain cold and dry on February 6 and 7, while partly cloudy conditions are expected on February 8. The department said the weather conditions from

February 6 to 8 will be suitable for kite flying, with winds blowing at 10 to 15 kilometres per hour.

The Met Office has advised kite flyers to avoid electricity wires.

Entertainment

Nelson Peltz offers his stance amid Brooklyn Beckham’s bombshell claims

Nicola Peltz’s billionaire father, Nelson, has weighed in on the Beckham feud.

Nelson’s son-in-law Brooklyn, 26, released a bombshell statement last week in which he criticised his parents, Sir David 51, and Lady Victoria Beckham 50, and accused them of mistreating his wife, 30.

Now, the business magnate, 83, who was previously reported to give his daughter $1 million a-month allowance spoke about the family drama during a Q and A at WSJD’s Invest Live in West Beach event on Tuesday.

Nelson said: ‘My daughter and the Beckhams are a whole other story and that’s not for coverage here today. But I’ll tell you my daughter is great, my son-in-law Brooklyn is great and I look forward to them having a long, happy marriage together.’

Nelson was also asked if he gave the couple advice in how to navigate a difficult situation.

He replied: ‘I do. Sometimes they give me advice.’

For context, Nicola’s father is a businessman with an estimated net worth of $1.6billion, compared with the Beckhams’ reported $680million.

Meanwhile, Brooklyn’s family have maintained silence since the aspiring chef penned his frustrations about his parents, sharing his reasons for cutting ties with them.

Brooklyn’s parents Sir David and Victoria and his siblings Romeo, 23, Cruz, 20, and Harper, 14, instead put on their own show of unity at Haute Couture Fashion Week last week.

Entertainment

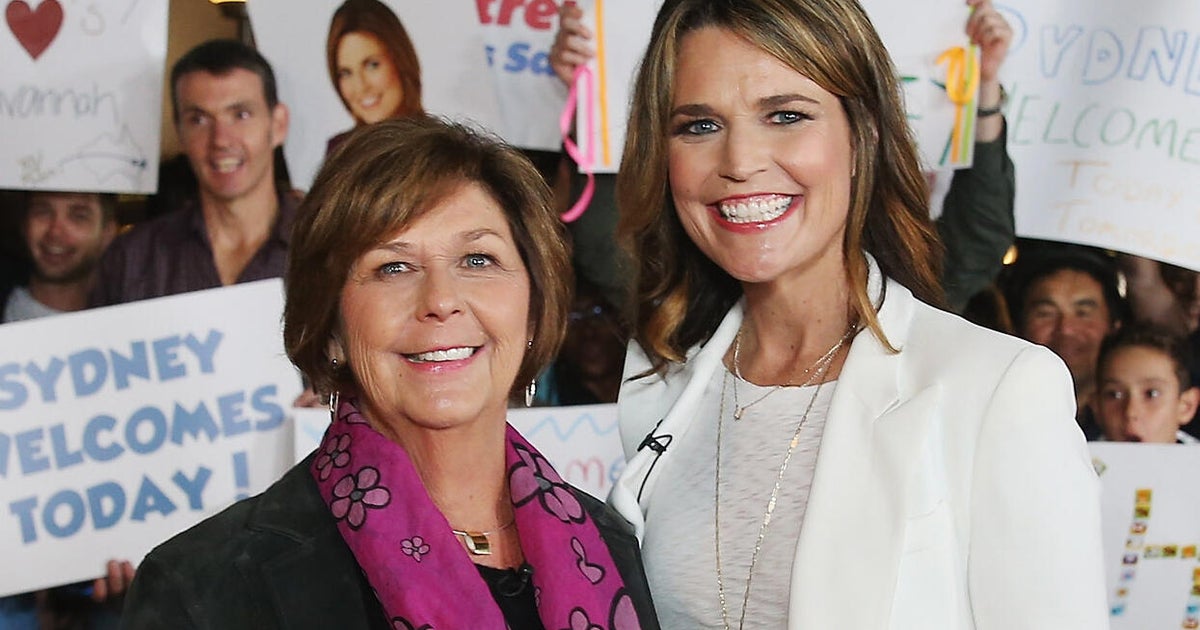

Sheriff says ransom note being investigated in disappearance of Nancy Guthrie, Savannah Guthrie’s mother

A ransom note was sent to a local Arizona news station following the disappearance of “Today” show co-host Savannah Guthrie’s mother, Nancy Guthrie, the Pima County sheriff told CBS News.

The note, which the station received Monday and agreed not to report on, contained specific details about the home and what Nancy Guthrie was wearing that night, Pima County Sheriff Chris Nanos said, although he would not confirm the accuracy of that information or the legitimacy of the note.

“It’s like any piece of evidence,” Nanos told CBS News. “You give it to us, you give us a lead, we’re going to look at every aspect of that lead.”

Nanos did not specify which station the note was sent to, but CBS affiliate KOLD-TV reported Tuesday it had received an email that “appears to be one of the alleged ransom notes,” which it forwarded to the sheriff’s office.

Investigators have analyzed the note and are taking it seriously, Nanos said.

He said the FBI reviewed the note and made the decision to share it with Savannah Guthrie. Authorities had hoped to keep the information from becoming public, but the note was obtained by TMZ, which reported on it before contacting the sheriff’s office, Nanos said.

The Pima County Sheriff’s Department had earlier said on social media it was aware of “reports circulating about possible ransom note(s),” adding, “Anything that comes in, goes directly to our detectives who are coordinating with the FBI.”

Surveillance video from a home security system has yielded nothing so far, Nanos told CBS News. He said investigators believe the system may have been set to automatically delete footage after a short period of time, and they are now attempting to recover it through forensic means.

Nanos previously told CBS News that investigators believe the 84-year-old was abducted from her home in the middle of the night over the weekend, and he described it as “a crime scene.” Authorities have been searching for her since Sunday.

Nancy Guthrie was last seen at her home Saturday night, but no one knew she was missing until she didn’t show up for church the next morning, Nanos said.

The sheriff has repeatedly said Guthrie, who lives alone, could not have wandered away from her home because she has no cognitive issues and very limited mobility.

He also expressed concern that she needs access medication that she must take daily, telling CBS News, “The clock is literally ticking.”

“You’ve placed her in great jeopardy without giving her meds that are critical to her,” Nanos said. “Again, like I’ve said, could be fatal if she doesn’t get those meds.”

The sheriff has said it’s unclear how many people may have been involved in the apparent abduction.

“It could be one, it could’ve been more, I don’t know,” he said.

A little bit of blood was found inside Nancy Guthrie’s Tucson home, a law enforcement source familiar with the case told CBS News, and what appeared to be a small amount of dried blood was seen next to a doormat outside the front door of the home on Tuesday.

-

Sports1 week ago

Sports1 week agoPSL 11: Local players’ category renewals unveiled ahead of auction

-

Entertainment1 week ago

Entertainment1 week agoClaire Danes reveals how she reacted to pregnancy at 44

-

Sports1 week ago

Sports1 week agoCollege football’s top 100 games of the 2025 season

-

Business1 week ago

Business1 week agoBanking services disrupted as bank employees go on nationwide strike demanding five-day work week

-

Politics1 week ago

Politics1 week agoTrump vows to ‘de-escalate’ after Minneapolis shootings

-

Sports1 week ago

Sports1 week agoTammy Abraham joins Aston Villa 1 day after Besiktas transfer

-

Tech1 week ago

Tech1 week agoBrighten Your Darkest Time (of Year) With This Smart Home Upgrade

-

Entertainment1 week ago

Entertainment1 week agoK-Pop star Rosé to appear in special podcast before Grammy’s