Business

Learner drivers may have to wait six months before taking test

Katy Austin,Transport correspondentand

Emer Moreau,Business reporter

Getty Images

Getty ImagesLearner drivers in England and Wales could face a minimum learning period of up to six months between sitting their theory and practical tests, the BBC can reveal.

The government will unveil the measure, which will be subject to consultation, as part of its wider road safety strategy launched on Wednesday.

The strategy will include proposals for a lower drink-driving limit in England and Wales, to bring them in line with Scotland.

The shake-up of driving laws is aimed at reducing the number of people killed or badly injured on Britain’s roads by 65% over the next decade, and by 70% for children under 16.

A fifth of all deaths or serious injuries from crashes involved a young car driver in 2024, according to official figures.

The government believes a minimum period between sitting the theory test and the practical test would help learner drivers develop their skills, including driving in different conditions.

The Department for Transport will consult on three or six months for the minimum learning period.

It would include any informal learning they may do with parents or guardians as well as formal lessons with a driving instructor.

Evidence from other countries suggests minimum learning periods could reduce collisions by up to 32%. Currently, learner drivers can take lessons from 17 and book a practical test as soon as they have passed a theory exam.

The majority of driving tests in Britain are taken by under-25s. In 2024-25, about 55% of tests were taken by drivers aged 17-24.

Learner drivers currently face a waiting time of around six months to take their practical tests anyway, due to a backlog from the Covid pandemic. The backlog is expected to last until late 2027.

The proposed changes could see an end to teenagers passing their tests days after turning 17, meaning the youngest drivers would be at least 17 and a half.

The road safety strategy is also expected to propose reducing the alcohol limit in for novice motorists and those within their two-year probation period from 80mg per 100ml of blood to around 20mg.

For all other drivers, the level would be lowered to around 50mg.

But some in the pub industry said it could hurt the sector.

The British Beer and Pub Association said the government would need to consider how to “mitigate the significant impact further restrictions would have for pubs, jobs and community hubs in rural areas, which may already suffer from little to no public transport”.

Graduated driving licences

There have been vociferous campaigns for “graduated driving licences” (GDLs) to be introduced in the UK. Different countries have varying types of GDLs, such as not allowing newly qualified drivers to carry passengers or not letting them drive at night.

Proponents of GDLs include some parents of young people who have died on the roads.

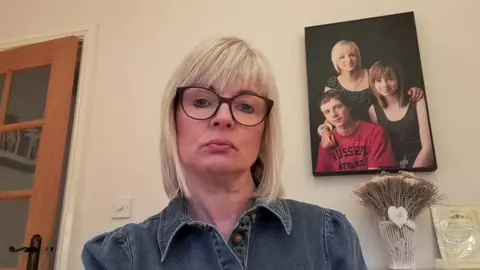

Sharron Huddleston started campaigning for GDLs to be introduced eight years ago after her daughter Caitlin was killed in a crash aged 18.

Sharron supports the proposed minimum learning period but said: “We need the post-test safety precautions as well.”

The driver, Skye Mitchell, who was also killed, had passed her test four months earlier.

Sharron believes Caitlin “would still be here” if the UK had graduated driving licences which forbade newly qualified, young drivers from carrying passengers their own age.

“All the girls [in the car] were 18,” she said.

“This is the strongest element of a graduated driving licence that would save many young lives.”

The AA has welcomed the measures announced by the government, but said not introducing GDLs was “a missed opportunity”.

Its president Edmund King told the BBC that “all the evidence, from Australia, from Canada, from other countries” shows that limiting the number of same-age passengers in a car for six months “will save lives”.

He said of the learning period: “That will help, but the question is: does it go far enough?”

The road safety strategy also contains plans to cut deaths by reducing speeding, drink and drug driving, not wearing seat belts and mobile phone use.

Technology, including built-in breathalysers that would prevent drunk drivers starting cars, will form a key plank of the strategy.

The government is also proposing new powers to suspend driving licences for people suspected of drink or drug-driving offences.

The BBC revealed in October that further research into headlight glare would be included in the strategy.

Alisa Fielder, 22 from Surrey, passed her test as a teenager but crashed a year ago as she was trying to overtake a lorry on a motorway. Nobody was injured, but her car was written off.

“I took too long checking the blind spot and all the cars in front had stopped,” she said.

“If I had maybe taken some more lessons then I would know that you can’t really take that long.”

She didn’t drive for a year after the crash. She has since done an informal assessment with charity IAM RoadSmart to boost her confidence and figure out what she needs to work on.

“I wasn’t driving to the best standard and that’s why I had a crash.”

Alisa said the process of becoming a better driver should continue after a person passes their test. “Maybe more lessons that you’re required to take with a professional.”

Local Transport Minister Lilian Greenwood said young people make up just 6% of all drivers, but are involved in nearly a quarter of fatal and serious collisions.

“Inexperience puts drivers, their passengers, and other road users at greater risk,” she said.

The proposed learning period “is all about supporting young drivers to develop the confidence they need to stay safe and giving them more time to build their skills and gain experience in different driving conditions”.

Get our flagship newsletter with all the headlines you need to start the day. Sign up here.

Business

PSX Plunges Over 5,400 Points as US-Iran Tensions Weigh on Market – SUCH TV

The equity market came under heavy pressure on Monday, with investors remaining cautious amid escalating tensions between the United States and Iran, while the start of the roll-over period added to volatility.

The benchmark Pakistan Stock Exchange (PSX) KSE-100 Index closed at 167,691.08 points, falling 5,478.63 points or 3.16% from the previous session’s close of 173,169.71.

During intraday trading, the index touched a high of 174,336.85 before sliding to a low of 166,886.63, reflecting sharp swings throughout the session.

Market analysts attributed the decline to geopolitical uncertainty. Huzaifa Riaz, Director at Mayari Securities, said investors adopted a cautious stance due to rising US-Iran tensions and the absence of strong near-term market triggers.

US President Donald Trump recently stated he would decide within “10 to 15 days” whether to order strikes on Iran if nuclear negotiations fail.

Reports indicated that military options were presented to him, including potential actions targeting Iran’s leadership.

On the economic front, data from the State Bank of Pakistan (SBP) showed that profit and dividend repatriation by foreign investors rose to $1.677 billion during the first seven months of FY26, compared to $1.328 billion a year earlier.

Pakistan recorded a current account surplus of $121 million in January, supported by strong remittances and controlled imports.

However, the cumulative current account balance showed a deficit of $1.07 billion in 7MFY26, compared to a $564 million surplus in the same period last year.

Meanwhile, weekly inflation measured by the Sensitive Price Indicator (SPI) rose 1.16% for the week ended February 19, according to the Pakistan Bureau of Statistics (PBS), with year-on-year inflation recorded at 5.19%.

The previous session had seen the KSE-100 gain nearly 1,000 points, but Monday’s sharp sell-off reversed those gains as geopolitical concerns dominated investor sentiment.

Business

RBI Says No Systemic Risk After Rs 590-Crore IDFC First Bank Fraud

Last Updated:

RBI Governor Sanjay Malhotra confirmed no systemic risk from the Rs 590 crore fraud at IDFC First Bank’s Chandigarh branch linked to Haryana government accounts.

RBI Monitoring Rs 590 Crore Fraud At IDFC First Bank, Assures No Wider Impact

The Reserve Bank of India (RBI) is closely monitoring developments surrounding the Rs 590 crore fraud reported by IDFC First Bank, with no broader systemic concern arising from the incident, said Governor Sanjay Malhotra told reporters during a press briefing held after the customary post-Budget address by Finance Minister Nirmala Sitharaman to the RBI’s Central Board of Directors.

“We are watching the development, there is no systemic issue,” Malhotra said, after being asked upon IDFC First Bank’s fraud case, in which the private lender has reported a fraud of Rs 590 crore with an account linked with the Haryana government at the Chandigarh branch.

The irregularities were linked to a defined set of Haryana state government accounts handled at that branch. The Haryana government has de-empaneled IDFC First Bank and AU Small Finance Bank with immediate effect.

Following the update, the bank’s shares crashed 20 per cent on Monday, bearing a heavy loss.

Bank Assures Limited Impact

IDFC First Bank clarified in its disclosure that the fraud is “confined to a specific group of government-linked accounts within Haryana government” operated through the Chandigarh branch. The bank emphasized that the issue does not extend to other customers serviced by the same branch.

The lender’s statement sought to reassure stakeholders that the matter is restricted in scope and does not reflect a wider operational breakdown. The RBI’s remarks further underlined that, from a regulatory standpoint, the episode does not pose systemic risks to the banking sector.

The development comes amid heightened regulatory focus on governance standards and internal controls within financial institutions. While investigations and internal reviews are expected to continue, the central bank’s position signals confidence that the broader banking system remains stable.

(With PTI Inputs)

February 23, 2026, 12:59 IST

Read More

Business

‘It’s cheaper to ship gluten-free food from UK than buy it in Guernsey’

A Guernsey mum is calling for cheaper and a greater choice of gluten-free foods for her family.

Source link

-

Entertainment6 days ago

Entertainment6 days agoQueen Camilla reveals her sister’s connection to Princess Diana

-

Tech6 days ago

Tech6 days agoRakuten Mobile proposal selected for Jaxa space strategy | Computer Weekly

-

Politics6 days ago

Politics6 days agoRamadan moon sighted in Saudi Arabia, other Gulf countries

-

Entertainment6 days ago

Entertainment6 days agoRobert Duvall, known for his roles in "The Godfather" and "Apocalypse Now," dies at 95

-

Politics6 days ago

Politics6 days agoTarique Rahman Takes Oath as Bangladesh’s Prime Minister Following Decisive BNP Triumph

-

Business6 days ago

Business6 days agoTax Saving FD: This Simple Investment Can Help You Earn And Save More

-

Tech6 days ago

Tech6 days agoBusinesses may be caught by government proposals to restrict VPN use | Computer Weekly

-

Sports6 days ago

Sports6 days agoUsman Tariq backs Babar and Shaheen ahead of do-or-die Namibia clash