Business

Loan repayment cuts FX to $15.5b | The Express Tribune

Commercial loans rose by $1.7b to $7.2b by end 2025; IMF mission to arrive on 25th

The finance ministry said that the exchange value of the rupee was maintained at an artificially high level in the past, which triggered the balance of payments crisis. PHOTO: REUTERS

ISLAMABAD:

Pakistan has repaid a $700 million Chinese commercial loan this week, temporarily reducing foreign exchange reserves to $15.5 billion, as it now faces a decision on whether to return bilateral cash deposit loans or seek their extension, a move that may limit its policy choices.

The development comes ahead of the third review talks scheduled with the International Monetary Fund (IMF).

An IMF mission will visit Pakistan from February 25 to March 11 to hold discussions for the approval of a $1 billion tranche under the Extended Fund Facility, along with over $200 million under a climate facility. The IMF team will spend three days in Karachi before beginning talks with the federal government in Islamabad from March 2. Central bank sources told The Express Tribune that Islamabad repaid the $700 million loan to the China Development Bank. China had earlier rolled over the same loan for a period of three years.

The sources said another $1 billion loan from the China Development Bank is maturing in June this year, which the government may repay ahead of schedule in the hope of securing refinancing before the close of the current financial year.

Pakistan remains heavily dependent on China, the United Arab Emirates (UAE) and Saudi Arabia, as financial support from these three countries, combined with higher foreign remittances, has so far helped the country avoid a sovereign default.

China has extended $6.6 billion in foreign commercial loans, $4 billion in cash deposits and a $4.5 billion credit swap facility. These three instruments are critical for staying afloat in the middle of shrinking exports and weak foreign direct investment. Following the repayment of the $700 million loan, gross official foreign exchange reserves held by the central bank fell to $15.5 billion as of February 10. The State Bank of Pakistan (SBP) is expected to bridge the gap through increased dollar purchases from the domestic market.

Total commercial loans rose by $1.7 billion to $7.2 billion by the end of the last fiscal year after the government also secured a costly loan backed by Asian Development Bank guarantees. Pakistan’s low sovereign credit rating continues to be a major constraint and a key factor behind the high cost of external borrowing. In its annual debt policy statement issued this month, the Ministry of Finance said external public debt increased by 6% to $91.8 billion as of June 2025, reflecting an annual rise of $5 billion. The largest increase in the external debt came from multilateral development partners, including the IMF, whose lending rose by 8.7%, or nearly $4 billion. Borrowing from commercial banks increased by $1.6 billion, largely due to a $1 billion loan secured against an ADB policy-based guarantee, the ministry added.

The ministry said it hoped to prioritise long-term concessional and commercial financing, including the planned Panda Bond issuance. However, all deadlines to raise $250 million through Panda Bonds in the Chinese market have so far lapsed.

The sources said the government was also reviewing its policy on seeking extensions of bilateral cash deposits after the UAE recently rolled over a $2 billion deposit for just one month. Pakistan had hoped the UAE would extend the deposit for two years and reduce the interest rate from 6.5% to around 3%. However, those expectations were dashed last month when the UAE approved only a one-month rollover.

Addressing a gathering of industrialists, Prime Minister Shehbaz Sharif recently said that reliance on loans was a heavy burden on national self-respect and forced the country to bow its head in shame. He said seeking external financing compromised national dignity and autonomy, making it difficult to refuse conditions imposed by lenders. A senior government official said earlier this week that discussions with the UAE were continuing for a longer-term extension of the deposit. Deputy Prime Minister Ishaq Dar resolved part of the issue with UAE authorities on Thursday, indicating that some non-economic factors were also delaying the rollover.

Finance Minister Muhammad Aurangzeb said last week that Pakistan’s external financing requirements were fully met and that there was no financing gap.

The IMF is expected to reassess Pakistan’s gross external financing needs in light of recent developments.

The sources said internal discussions were also taking place about how long Pakistan could continue with the policy of seeking annual rollovers of $12.5 billion in cash deposits from China, Saudi Arabia and the UAE. Chinese cash deposits are also approaching maturity, requiring the government to once again seek rollovers at the highest level.

The sources added that any new financing from Standard Chartered Bank and the Islamic Development Bank could provide short-term relief by helping repay some near-term obligations. So far, no country has formally asked Pakistan to return its deposits, the sources said.

Business

India has committed to stop buying Russian oil: US secy of state Marco Rubio – The Times of India

Business

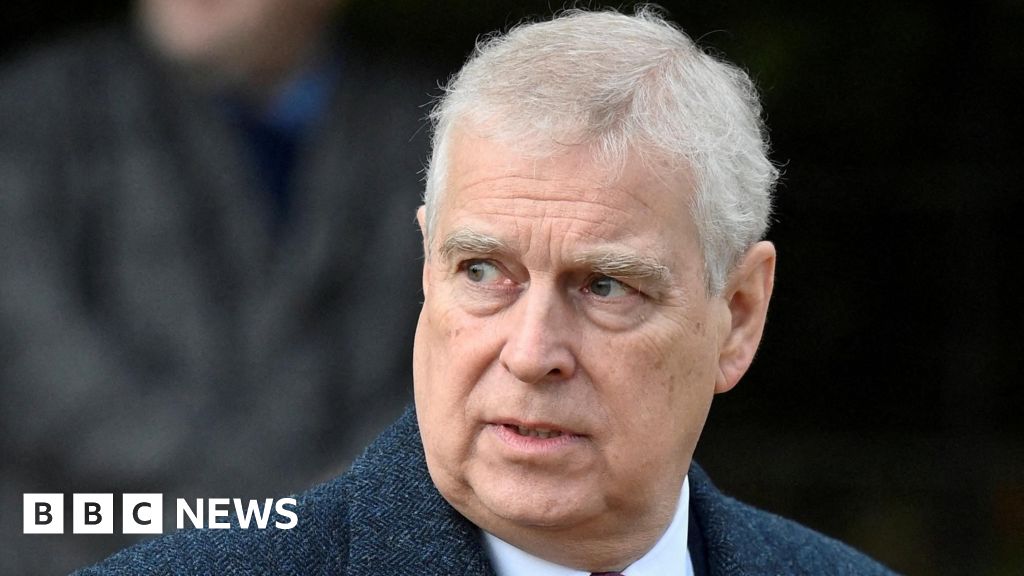

Andrew’s time as trade envoy should be investigated, says Vince Cable

The former prince’s alleged actions were “totally unacceptable”, the ex-business secretary says.

Source link

Business

Gender pay gap won’t close until 2056, warns Trades Union Congress

The average woman employee “effectively works for 47 days of the year for free,” according to the Trades Union Congress.

Source link

-

Business5 days ago

Business5 days agoAye Finance IPO Day 2: GMP Remains Zero; Apply Or Not? Check Price, GMP, Financials, Recommendations

-

Fashion5 days ago

Fashion5 days agoComment: Tariffs, capacity and timing reshape sourcing decisions

-

Tech6 days ago

Tech6 days agoRemoving barriers to tech careers

-

Fashion5 days ago

Fashion5 days agoADB commits $30 mn to support MSMEs in Philippines

-

Entertainment6 days ago

Entertainment6 days ago‘Harry Potter’ star David Thewlis doesn’t want you to ask him THIS question

-

Fashion5 days ago

Fashion5 days agoSaint Laurent retains top spot as hottest brand in Q4 2025 Lyst Index

-

Sports6 days ago

Sports6 days agoWinter Olympics opening ceremony host sparks fury for misidentifying Mariah Carey, other blunders

-

Entertainment1 week ago

Entertainment1 week agoVictoria Hervey calls out Andrew’s powerful circle in Epstein revelations