Business

MPs urge Reeves to tax online betting games to reflect the harm they cause

The government has been told by MPs that it should not “cave in to industry scaremongering” about the negative effects of taxing online betting games, and that it should tax them at a rate that reflects the harm they can cause.

The recommendation from the cross-party Treasury committee comes just weeks ahead of Rachel Reeves’s Budget, in which she will be looking to plug a substantial gap in the public finances.

In its report, released on Friday, the committee warned that online betting can lead to harmful, addictive, high-frequency gambling that delivers no benefit to the people taking part, their families or their communities.

The report urged the government to “more sharply recognise that different types of gambling inflict different levels of harm”, and recommended that this be reflected in its approach to taxing the activity.

The committee’s report said that while various forms of gambling, ranging from seaside arcades and bingo through to betting on the races and football, are safely enjoyed by many people, there is “another side to the industry”.

The shift towards online betting games has picked up pace in recent years, with the proportion of the “gross gambling yield” associated with remote gaming rising from 12 per cent in 2014 to 44 per cent in 2024.

The committee had called for evidence of the possible effects of taxing the activity, as it held a series of sessions examining the choices faced by the chancellor in her forthcoming Budget. It said it rejected the industry’s assertion that gambling causes no social ills. It also heard evidence that it said both supported and challenged the gambling industry’s concern that increased taxation could drive more customers to the black market.

The committee said it recommends that the government examine how to tackle black-market gambling, and consider whether additional anti-tax-avoidance measures were needed.

The chair of the Treasury select committee, Dame Meg Hillier, said: “Whether at a local racetrack or a seaside arcade, for many people, gambling is a fun pastime enjoyed with family and friends. But we heard that the industry is hiding its more insidious parts behind the friendly facade of its traditional, cultural forms.

“For too many people, the highly addictive and harmful nature of online betting games has seriously impacted their lives and the lives of those around them. The impacts of problem gambling in our communities are plain to see, and the industry’s boldfaced claim to our inquiry that it does no social harm is staggering.

“Online betting games are extracting huge amounts of money from people who have been funnelled into the most addictive, harmful corners of the industry via their love of sports or the occasional game of bingo. We are urging the government not to cave in to industry scaremongering, and to tax online betting games at a rate that reflects the level of harm they inflict.”

The chief executive of the Betting and Gaming Council (BGC), Grainne Hurst, said: “Further tax increases on the regulated online sector risk undermining consumer protections by pushing players towards the unsafe, unregulated black market – while reducing Treasury revenues and cutting the vital funding our members provide to British sport, including horseracing, football, rugby league, darts and snooker.

“We have always recognised that betting and gaming can lead to harm for a small minority, which is why our members are investing more than ever in safer gambling – including new stake limits on online gaming, enhanced affordability checks, swift data-driven interventions, robust advertising safeguards, and funding for a new £100m statutory levy for research, prevention, and treatment to tackle problem gambling and related harm.”

Ms Hurst added: “BGC members contribute £6.8bn to the economy, generate £4bn in tax, and support 109,000 jobs, while facing an effective tax rate of up to 80 percent when duties are combined with corporation tax, business rates, national insurance, VAT, and the new statutory and economic crime levies.

“Much is at stake in the chancellor’s Budget. Get it wrong, and it’s not just jobs and growth that will suffer, it’s safer gambling itself. To protect consumers and support a safer, stronger industry, we must keep gamblers playing within the regulated market.”

A spokesperson for Flutter UK and Ireland, whose brands include Paddy Power, Sky Betting & Gaming, Sportsbet and Tombola, said: “It’s not scaremongering to suggest that tax rates of 50 per cent on machine games and online games such as bingo – as demanded by the Institute for Public Policy Research – could have a significant impact on the industry, jobs and investment.

“A tax rise is not a free hit.”

Business

Gold, iPhone, Laptop From Dubai: How Much Can You Bring To India Without Paying Customs Duty?

Last Updated:

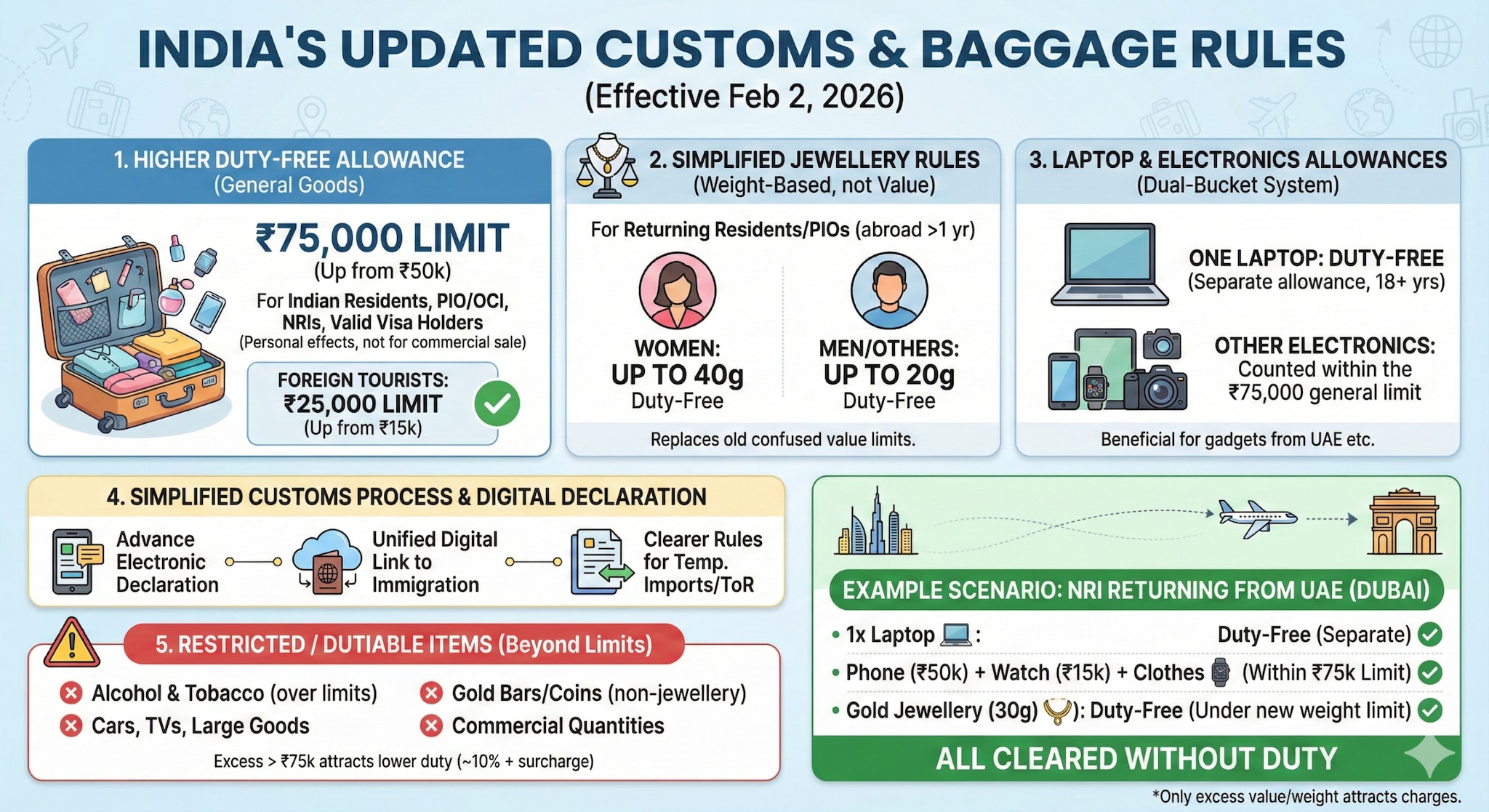

India’s Baggage Rules 2026 raise duty-free limits to Rs 75,000, introduce weight-based jewellery allowances, allow one laptop duty-free, and simplify customs for arrivals.

Items that exceed the Rs 75,000 limit will attract customs duty (typically around 10% + social welfare surcharge on the duty), which is significantly lower than earlier effective rates.

India has updated its customs and baggage rules affecting what international passengers, including people arriving from the UAE, can bring into the country without paying duty. These changes are part of the Baggage Rules, 2026, and the Customs Baggage (Declaration & Processing) Regulations, 2026, which came into effect from February 2, 2026, following announcements in the Union Budget 2026.

Here’s a detailed breakdown of what’s changed and what it means:

1. Higher Duty-Free Allowance for Personal Items

Passengers arriving by air or sea can now bring goods worth up to Rs 75,000 duty-free, higher than the Rs 50,000 limit earlier.

This limit applies to Indian residents, people of Indian origin (PIO/OCI), NRIs, and foreign nationals with valid visas. It covers personal effects and items carried in bona fide accompanied baggage — personal use items, not for commercial sale.

Foreign tourists have a separate duty-free cap of Rs 25,000 (up from Rs 15,000 earlier).

For crew members, the limit is Rs 2,500.

2. Simplified Jewellery Rules

The old value-based limits on jewellery imports have been replaced with weight-based allowances for returning residents/PIOs:

• Women: up to 40 grams of jewellery duty-free

• Men/Others: up to 20 grams duty-free

This applies to passengers who have stayed abroad for at least a year and are bringing jewellery in bona fide baggage.

Earlier, jewellery allowances were defined by value rather than weight, which often caused confusion and disputes at customs.

3. Laptop and Electronics Allowances

• One laptop can be brought in duty-free, separate from the Rs 75,000 general limit, for travellers aged over 18 years (excluding airline crew).

• Other electronics (smartphones, watches, cameras, etc.) are counted within the Rs 75,000 allowance.

This dual-bucket system (laptop + Rs 75,000 limit) is particularly beneficial for travellers bringing gadgets from the UAE, where prices are often lower.

4. Simplified Customs Process

The new regulations also introduce:

• Advance and electronic baggage declaration to streamline arrival processing.

• Unified digital declaration linked to immigration systems, reducing paperwork.

• Clearer rules around temporary imports / re-imports and Transfer of Residence (ToR) benefits for long-term expatriates.

5. What Still Requires Duty or Has Restrictions

Even under the new rules, certain items remain outside duty-free allowances and must be declared:

• Alcohol beyond allowed limits

• Tobacco products above the limits

• Cars, TVs, and other large goods

• Gold bars/coins or precious metals in non-jewellery form

• Commercial quantities of any item

Items that exceed the Rs 75,000 limit will attract customs duty (typically around 10% + social welfare surcharge on the duty), which is significantly lower than earlier effective rates.

Example (From UAE To India)

If an NRI returning from Dubai brings:

• One laptop: duty-free separate allowance

• A phone (Rs 50,000), watch (Rs 15,000) & clothes: these total Rs 65,000 — all duty-free within the Rs 75,000 limit

• Gold jewellery (30 g): duty-free under the new weight limits

The above would be cleared without duty. Only items or values above these thresholds may attract charges. However, for updated and item-specific rules, check customs rules from official government website.

February 08, 2026, 16:01 IST

Read More

Business

PM Kisan 22nd instalment update: Is farmer ID mandatory to receive Rs 2,000 payment?

New Delhi: Farmers across India are waiting for the 22nd instalment of the PM Kisan Samman Nidhi scheme, under which eligible beneficiaries receive Rs 2,000 directly in their bank accounts. While the government has not officially announced the release date, the next payment is expected between February and March 2026, based on the scheme’s usual schedule.

The PM Kisan scheme provides Rs 6,000 per year in three equal instalments to landholding farmer families through direct benefit transfer.

Farmer ID Requirement

A key update this year is the growing importance of the Farmer ID, which is being introduced as part of the government’s farmer-registry initiative. The ID is mandatory for new registrations in several states where the registry system has already started, though it may not yet be required everywhere in the country.

Authorities say the Farmer ID will help verify beneficiaries, prevent duplication, and ensure that financial assistance reaches genuine farmers.

e-KYC Still Essential

Along with the Farmer ID, e-KYC remains compulsory for all registered PM Kisan beneficiaries. Farmers who fail to complete e-KYC or update their records may face delays in receiving the next instalment.

The government has also introduced new methods such as OTP-based and facial-authentication e-KYC to make the process easier for farmers.

What Farmers Should Do

To avoid missing the next instalment, farmers should:

Complete e-KYC verification

Ensure Aadhaar is linked to their bank account

Update land and registration details

Obtain a Farmer ID if required in their state

Business

Gold rally pauses: Investors brace for volatile week in MCX gold & silver

New Delhi: India’s bullion market saw a pause in its recent rally on February 8, with gold prices easing slightly after touching record highs in late January. The price of 24-carat gold was around Rs 1.56 lakh per 10 grams, while 22-carat gold traded close to Rs 1.43 lakh per 10 grams in major markets across the country.

Silver prices remained volatile but stable compared to recent swings, trading at about Rs 2.85 lakh per kilogram. The metal has seen sharp movements in recent weeks, reflecting changing global demand and investor sentiment.

The correction in gold prices comes after the metal reached an all-time high of nearly Rs 1.79 lakh per 10 grams last month, driven by strong global demand for safe-haven assets. Since then, some investors have booked profits, leading to a decline in prices.

Market experts say precious-metal prices are currently being influenced by international economic conditions, currency fluctuations, and expectations around interest-rate decisions by major central banks. These factors often affect global bullion prices, which in turn impact domestic rates in India.

Despite the recent dip, demand for gold remains steady, especially with the wedding season and festive purchases supporting jewellery sales. Analysts believe gold and silver prices may continue to move cautiously in the coming weeks as global markets remain uncertain.

Overall, the bullion market is entering a phase of consolidation after a strong rally, with investors closely watching global trends for the next direction in prices.

-

Tech6 days ago

Tech6 days agoHow to Watch the 2026 Winter Olympics

-

Business6 days ago

Business6 days agoPost-Budget Session: Bulls Push Sensex Up By Over 900 Points, Nifty Reclaims 25,000

-

Tech1 week ago

Tech1 week agoRight-Wing Gun Enthusiasts and Extremists Are Working Overtime to Justify Alex Pretti’s Killing

-

Fashion6 days ago

Fashion6 days agoCanada could lift GDP 7% by easing internal trade barriers

-

Tech1 week ago

Tech1 week agoI Tested 10 Popular Date-Night Boxes With My Hinge Dates

-

Entertainment6 days ago

Entertainment6 days agoThe Traitors’ winner Rachel Duffy breaks heart with touching tribute to mum Anne

-

Business6 days ago

Business6 days agoInvestors suffer a big blow, Bitcoin price suddenly drops – SUCH TV

-

Tech6 days ago

Tech6 days agoThe Best Floodlight Security Cameras for Your Home