Business

Navratri sales hit 10-year high on GST cuts: Officials – The Times of India

NEW DELHI: On the back of a fillip provided by a reduction in GST on 375 items, Indian consumers flocked to stores and car dealerships resulting in the highest Navratri sales in over a decade, govt officials said, citing industry data.They argued that the move lowered prices, helping families upgrade vehicles, buy white goods and spend more freely on lifestyle products, “turning festive cheer into record-breaking consumption”.GST rates for food items, daily-use products, white goods, cement and automobiles have been slashed as the Centre and the states agreed to reduce the number of slabs and end cess on all luxury and sin products, barring tobacco. Apart from making the indirect tax regime simpler, the idea was to boost consumption, even if it resulted in a temporary impact on tax collections.

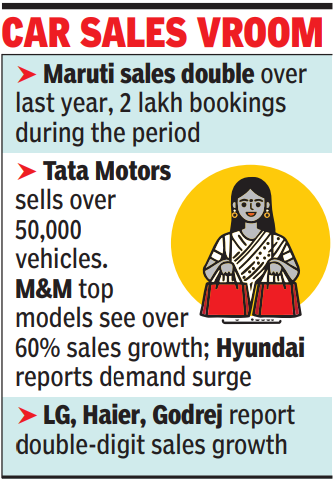

Car sales vroom

“By rationalising GST slabs and easing the tax burden on both essential and aspirational items, govt fostered an environment of confident spending. As a result, brands and retailers reported sales growth ranging from 25% to 100%, marking a major boost for India’s consumption-driven economy,” an official said.

GST reset, pent-up demand driving sales over last 10 days

Although companies had complained about an adverse impact on sales after PM Narendra Modi first announced the plan for GST rate rationalisation in his Independence Day speech, collections in Sept – based on transactions in Aug – grew at over 9%, the fastest pace of growth in four months, according to the data released on Wednesday.While goods and services are more affordable, especially after govt nudged businesses to pass on the benefits to consumers, pent up demand is also a factor behind a surge in sales over the last 10 days.As a result, companies such as Maruti Suzuki, the country’s largest carmaker, reported 3.5 lakh bookings with nearly 2.5 lakh pending orders. By the end of Navratri, it was expected to deliver 2 lakh vehicles, 2.3 times last year’s level of 85,000 cars. Similarly, M&M has reported a 60% jump in its top selling XUV700 and Scorpio N sales, while demand for Hyundai’s Creta and Venue are also seen to be strong.In the consumer electronics space, companies and top retailers are reporting significant rise in sales.

Business

Vellayan Subbiah To Exit Cholamandalam Investment Finance Under Murugappa Family Pact

Last Updated:

Vellayan Subbiah, a scion of the Murugappa family, has reached a settlement with other promoter branches to realign ownership

Cholamandalam Investment Finance

Vellayan Subbiah, a scion of the Murugappa family, has reached a settlement with other promoter branches to realign ownership across key group companies, according to a report by Moneycontrol.com, citing people familiar with the matter. The agreement is expected to see Subbiah give up stake exposure linked to Cholamandalam Investment and Finance Company while consolidating his position in Tube Investments of India and CG Power and Industrial Solutions.

The arrangement, finalised after more than two years of negotiations, forms part of a broader plan by the Murugappa Group to separate ownership of the century-old conglomerate among three promoter factions while ensuring business continuity. Under the settlement, Subbiah is expected to relinquish exposure to Cholamandalam Investment — the group’s flagship lending arm — and instead retain and strengthen his alignment with Tube Investments and CG Power, including taking over or retaining stakes tied to those companies within the extended promoter structure, the report said. Emails sent to Subbiah and the Murugappa Group did not receive a response until publication.

The realignment follows prolonged internal discussions over the division of the diversified business empire, which reported revenue of more than $9 billion in FY23, after five generations of joint ownership through the family holding company Ambadi Investments.

Negotiations had earlier faced hurdles due to significant valuation divergences across group companies. As previously reported by The Economic Times on August 19, 2024, the turnaround of businesses overseen by Subbiah — particularly CG Power, Tube Investments and Cholamandalam Finance — had emerged as a sticking point in share-swap discussions among family factions.

The revival of CG Power proved especially pivotal. Since Tube Investments acquired control in 2020, CG Power has deleveraged, restored profitability and benefited from investor interest in domestic manufacturing, railways, power equipment and electronics supply chains. Its stock has surged since the takeover, making it one of the group’s most valuable listed assets. Tube Investments has also diversified beyond its legacy engineering base into green mobility, contract manufacturing and specialised industrial segments, strengthening its market position.

Cholamandalam Investment, meanwhile, has grown into one of India’s most valuable non-bank lenders, with a market capitalisation exceeding Rs 1 lakh crore. The uneven appreciation in these businesses complicated efforts to carve out three equal promoter blocs, with one faction seeking revisions to earlier share-swap assumptions and another resisting reopening agreed terms, people cited by Moneycontrol.com said.

Promoter ownership across Murugappa companies is largely routed through holding vehicles rather than direct individual shareholdings, but the concentration of value highlights why these firms were central to negotiations. The promoter group’s roughly 51–52 percent stake in Cholamandalam Investment is estimated to be worth about Rs 55,000–60,000 crore at current market levels. In Tube Investments, promoter ownership of around 45–46 percent translates into holdings valued at approximately Rs 20,000–22,000 crore. Through Tube Investments’ controlling position in CG Power, the promoter group effectively holds about 58–59 percent of that company, valued at roughly Rs 45,000–50,000 crore.

Beyond these, the family controls about 56–57 percent in Coromandel International, worth around Rs 18,000–20,000 crore; 42–43 percent in Carborundum Universal, valued near Rs 9,000–10,000 crore; and 44–45 percent in EID Parry, worth roughly Rs 3,500–4,000 crore. Tube Investments also indirectly controls about 70 percent of Shanti Gears, valued at approximately Rs 2,500–3,000 crore.

The final arrangement appears to align ownership more closely with operational leadership. Subbiah, a fourth-generation member of the family, is widely credited within the group for steering the revival of CG Power and expanding Tube Investments into new manufacturing and mobility segments, making these businesses natural anchors for his promoter bloc under the new structure.

The Murugappa Group, which comprises nearly 30 companies across fertilisers, engineering, financial services, abrasives, sugar and mobility solutions, operates under a long-standing governance charter that separates ownership from management, the Moneycontrol.com report noted.

Follow News18 on Google. Join the fun, play games on News18. Stay updated with all the latest business news, including market trends, stock updates, tax, IPO, banking finance, real estate, savings and investments. To Get in-depth analysis, expert opinions, and real-time updates. Also Download the News18 App to stay updated.

February 26, 2026, 10:51 IST

Read More

Business

Yes Bank Under Scanner As RBI Summons Executives Over Forex Card Breach

Last Updated:

RBI has summoned senior officials of Yes Bank following a major data breach involving the Yes Bank–BookMyForex multi-currency forex card

Reserve Bank of India headquarters in Mumbai.

The Reserve Bank of India (RBI) has summoned senior officials of Yes Bank following a major data breach involving the Yes Bank–BookMyForex multi-currency forex card, two people aware of the development told The Economic Times (ET).

According to the report, card details and CVV numbers of several users were allegedly compromised. The central bank has sought a detailed explanation from the bank on how its systems may have been breached and the sequence of events that led to the exposure of sensitive customer data.

“The RBI has sought a comprehensive briefing from Yes Bank’s senior management on the root cause of the breach, the timeline of events, and the adequacy of the bank’s cybersecurity framework,” one of the persons cited by ET said. “The regulator wants clarity on how sensitive card data, including CVV numbers, may have been exposed and what immediate containment measures have been implemented.”

Yes Bank declined to comment on the RBI’s queries but said an internal investigation had identified fraudulent transactions involving 15 merchants in a Latin American country on February 24. Transactions worth Rs 2.54 crore were approved across 5,000 customers, while 688 unauthorised attempts amounting to around Rs 90 lakh were blocked. The bank said it is working with the card network to initiate chargebacks and ensure that affected customers do not face financial losses.

Separately, BookMyForex said it does not store customers’ sensitive card information and that its systems were neither breached nor compromised during the period in question.

The RBI has also sought details on how sensitive card data—particularly CVVs—was stored and protected, whether encryption and prescribed security protocols were followed, and why existing cyber controls failed to prevent the breach. In addition, the regulator is reviewing the timeline of detection and reporting, the robustness of third-party risk management and oversight, the number of customers impacted, and the steps taken to block cards, prevent misuse and mitigate losses. It has also asked for clarity on internal accountability, supervisory lapses and remedial measures to prevent a recurrence, ET reported.

Follow News18 on Google. Join the fun, play games on News18. Stay updated with all the latest business news, including market trends, stock updates, tax, IPO, banking finance, real estate, savings and investments. To Get in-depth analysis, expert opinions, and real-time updates. Also Download the News18 App to stay updated.

February 26, 2026, 07:53 IST

Read More

Business

The family-owned soda firm that stuck to returnable glass bottles

Soft drinks company Twig’s Beverage has a loyal following for its old-fashioned approach.

Source link

-

Entertainment1 week ago

Entertainment1 week agoQueen Camilla reveals her sister’s connection to Princess Diana

-

Tech1 week ago

Tech1 week agoRakuten Mobile proposal selected for Jaxa space strategy | Computer Weekly

-

Politics1 week ago

Politics1 week agoRamadan moon sighted in Saudi Arabia, other Gulf countries

-

Entertainment1 week ago

Entertainment1 week agoRobert Duvall, known for his roles in "The Godfather" and "Apocalypse Now," dies at 95

-

Politics1 week ago

Politics1 week agoTarique Rahman Takes Oath as Bangladesh’s Prime Minister Following Decisive BNP Triumph

-

Business1 week ago

Business1 week agoTax Saving FD: This Simple Investment Can Help You Earn And Save More

-

Tech1 week ago

Tech1 week agoBusinesses may be caught by government proposals to restrict VPN use | Computer Weekly

-

Sports1 week ago

Sports1 week agoUsman Tariq backs Babar and Shaheen ahead of do-or-die Namibia clash