Business

Paramount questions Warner Bros. Discovery on ‘fairness and adequacy’ of sale process: Read the full letter

A bus passes near Warner Bros. Studio on Sept. 12, 2025 in Burbank, California.

Mario Tama | Getty Images

Paramount Skydance is calling foul on how Warner Bros. Discovery has conducted its sale process.

In a letter reviewed by CNBC, Paramount attorneys told Warner Bros. Discovery CEO David Zaslav that Paramount was questioning the “fairness and adequacy” of the process, which officially launched in October. This week, Paramount, Netflix and Comcast submitted second-round bids to acquire some or all of Warner Bros. Discovery’s assets, CNBC previously reported.

“It has become increasingly clear, through media reporting and otherwise, that WBD appears to have abandoned the semblance and reality of a fair transaction process, thereby abdicating its duties to stockholders, and embarked on a myopic process with a predetermined outcome that favors a single bidder,” reads the letter from attorneys at Quinn Emanuel. “We specifically request and expect this letter will be shared and discussed with the full board of directors of WBD.”

In particular, Paramount’s letter calls out reports that WBD’s management appears to favor Netflix’s offer.

Netflix has made an offer of mostly cash, while Paramount’s latest bid was all cash, according to people close to the matter who declined to be named speaking about confidential dealings. All three companies submitted higher bids than their initial offers, the people told CNBC.

As of Thursday morning, Netflix was the leading bidder based on how WBD is valuing the offers, people familiar told CNBC. Comcast executives, for their part, continue to be disciplined in the company’s offer as to not anger shareholders by taking on additional debt and risking its balance sheet, according to people familiar with that company’s thinking. Comcast leadership has previously said that its bar for M&A is generally high.

Warner Bros. Discovery told CNBC it confirmed to Paramount that it had received the letter and would share it with members of the WBD board.

“Please be assured that the WBD Board attends to its fiduciary obligations with the utmost care, and that they have fully and robustly complied with them and will continue to do so,” the company said in its response to Paramount.

WBD requested third-round bids from the potential buyers, due Thursday, sources told CNBC. The company expects to announce a winner as early as next week, sources said.

While first-round bids arrived in mid-November, Paramount has been vying to acquire the entirety of Warner Bros. Discovery — which includes its streaming service HBO Max, film studio Warner Bros. and a portfolio of cable TV networks like TNT and TBS — since September, CNBC previously reported.

Warner Bros. Discovery rebuffed three offers made by Paramount, the last of the those for $23.50 a share, before launching a formal sale process to beckon other buyers, CNBC previously reported.

Netflix and Comcast are interested only in WBD’s streaming and film studio business, CNBC has reported. Prior to the sale process Warner Bros. Discovery had begun the process of splitting its company into two — Warner Bros., the streaming and studio businesses which would be led by Zaslav, and Discovery Global, the cable TV networks division that would be run by current WBD CFO Gunnar Wiedenfels.

Paramount attorneys sent the letter as the company suspects that Zaslav has been biased against a merger with Paramount since the outset, and instead, would rather complete its path toward a separation, some of the people familiar told CNBC. Paramount and its advisors have viewed WBD’s contact with them as more obstructionist rather than constructive, two of the people said.

Before the sale process, Zaslav had been known to tell colleagues that Amazon’s Prime Video or Netflix would likely be interested suitors in Warner Bros. Discovery, or specifically HBO Max and the film studio, the people said. In the letter, Paramount asks the WBD board if reporting that WBD management has “chemistry” with Netflix management is accurate.

Paramount is seeking confirmation, according to the letter, of whether Warner Bros. Discovery appointed an independent special committee of disinterested members of its board to steer the sale process and consider offers.

“If not, we strongly urge you to empower such a special committee comprised of directors with no potential appearance of bias or beholdenness to others whose interests may differ from those of the stockholders,” the letter reads. “This would seem to be an important step at this stage, to ensure the fairness and unimpeachability of the transaction process and to maximize the value of whatever outcome WBD determines to pursue.”

Read the full letter from Paramount to WBD:

Dear Mr. Zaslav: We write on behalf of Paramount Skydance Corporation (“Paramount”, “we” or “us”) to express our serious concerns about the fairness and adequacy of the bidding process for a potential combination with Warner Bros. Discovery (“WBD” or “you”). It has become increasingly clear, through media reporting and otherwise, that WBD appears to have abandoned the semblance and reality of a fair transaction process, thereby abdicating its duties to stockholders, and embarked on a myopic process with a predetermined outcome that favors a single bidder. We specifically request and expect this letter will be shared and discussed with the full board of directors of WBD.

We have recently seen reporting in the U.S. and foreign media that gives serious cause for concern. The German newspaper Handelsblatt recently reported on a meeting that reportedly took place in Brussels between Gerhard Zieler, President of WBD’s International Business and a direct report to WBD’s Chief Executive Officer, who “arrived with a three-person team,” with the E.U. Commission Vice President Hena Virkkunen, to discuss the potential merger prospects for WBD. In that conversation, the article reports that “concerns were raised that the Ellison family’s planned acquisition of Warner Bros. Discovery could lead to excessive media concentration,” and that the E.U. Commission would consider intervening in a potential merger with Paramount for this reason. The article quotes “sources close” to Zeiler as saying “that the talks with the Commission were important because both Warner and the EU wanted to preserve media diversity.” The implications of such a meeting, if it occurred, are clear and evince a tacit resistance to, if not active sabotage of, a Paramount offer.

While this report is concerning in itself, this is not an isolated report regarding purported WBD resistance to a combination with Paramount. Several U.S. media outlets have reported on the enthusiasm by WBD management for a transaction with Netflix, and on statements by management that a transaction between WBD and Netflix would be a “slam dunk,” while also referring to Paramount’s bid in a negative light. Additional reporting since the submission of revised bids on December 1 has indicated that WBD’s “board has really warmed to” a transaction with Netflix due to the “chemistry between” WBD management and Netflix management. We have come to you first to inquire whether this reporting is accurate, and to engage in a productive discussion with you around any actual or perceived issues that it may reflect.

Moreover, these media reports echo similar indications that we have been hearing throughout this process, despite what we viewed as otherwise productive conversations that we have had with WBD leadership. Paramount has a credible basis to believe that the sales process has been tainted by management conflicts, including certain members of management’s potential personal interests in post-transaction roles and compensation as a result of the economic incentives embedded in recent amendments to employment arrangements. These concerns are amplified by indications of director bias and beholdenness to others whose interests may not align with the stockholders’, and the fact that alternatives involving only certain WBD assets are being prioritized notwithstanding their heightened regulatory risk and potential to deprive stockholders of consideration for the entirety of WBD’s enterprise value.

Further, as you know, Paramount agreed to certain standstill arrangements in exchange for the opportunity to participate in a truly competitive and unbiased bidding process. Paramount did not bargain for WBD to foster, whether intentionally or unintentionally, a tilted and unfair process. We believe that all parties to this process should have a shared desire for, and will mutually benefit from, an unimpeachable transaction process. As we assume you agree, even discounting the accuracy of any media reports, just the appearance of a flawed process imperils any potential transaction that might result and may undermine the potential value maximization to WBD stockholders from any prospective transaction.

In light of our grave concerns regarding the integrity of WBD’s process, we seek confirmation as to whether WBD has appointed an independent special committee of disinterested members of its board to consider the potential transaction opportunities and to make a final determination regarding a sale or break-up of all or part of the company. If not, we strongly urge you to empower such a special committee comprised of directors with no potential appearance of bias or beholdenness to others whose interests may differ from those of the stockholders. This would seem to be an important step at this stage, to ensure the fairness and unimpeachability of the transaction process and to maximize the value of whatever outcome WBD determines to pursue. Engaging with WBD throughout this process, we have been encouraged by the enormous potential from a combination of our entities. We remain confident that the Paramount offer would provide the maximum value to WBD stockholders and look forward to the opportunity to continue to engage with you productively in this process. But at this point we must insist on assurances and steps taken to ensure that a truly fair and independent process is being conducted, both for Paramount’s benefit and in the interest of WBD’s stockholders.

Disclosure: Comcast is the parent company of NBCUniversal, which owns CNBC. Versant would become the new parent company of CNBC upon Comcast’s planned spinoff of Versant.

Business

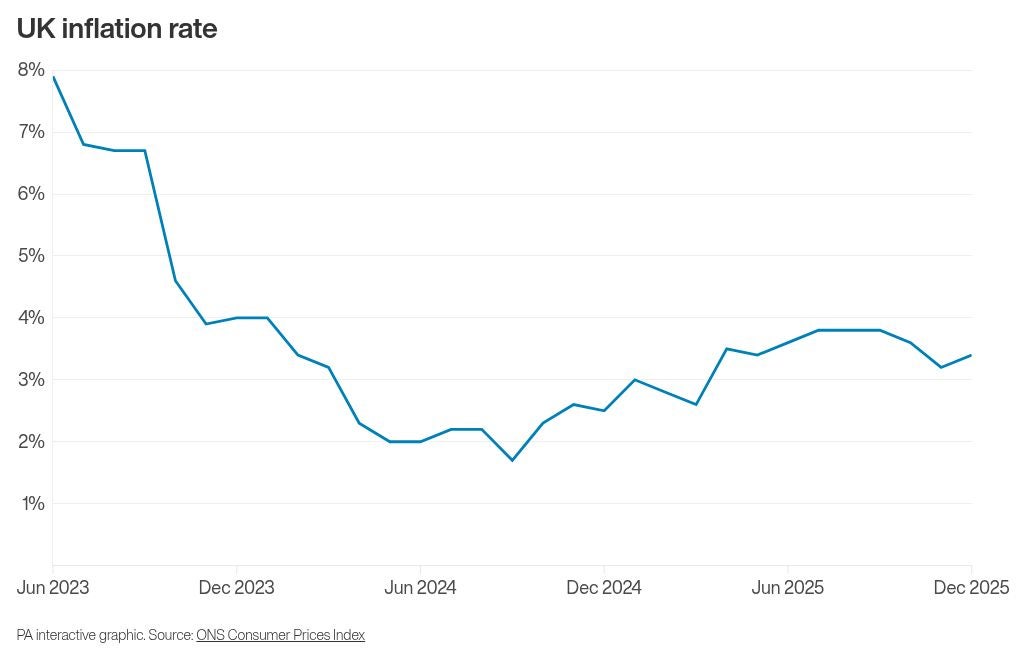

How inflation rebound is set to affect UK interest rates

Interest rates are widely expected to remain at 3.75% as Bank of England policymakers prioritise curbing above-target inflation while also monitoring economic growth, according to expert analysis.

The Bank’s Monetary Policy Committee (MPC) is anticipated to leave borrowing costs unchanged when it announces its latest decision on Thursday, marking its first interest rate setting meeting of the year.

This follows a rate cut delivered before Christmas, which was the fourth such reduction.

At the time, Governor Andrew Bailey noted that the UK had “passed the recent peak in inflation and it has continued to fall”, enabling the MPC to ease borrowing costs. However, he cautioned that any further cuts would be a “closer call”.

Since that decision, official data has revealed that inflation unexpectedly rebounded in December, rising for the first time in five months.

The Consumer Prices Index (CPI) inflation rate reached 3.4% for the month, an increase from 3.2% in November, with factors such as tobacco duties and airfares contributing to the upward pressure on prices.

Economists suggest this inflation uptick is likely to reinforce the MPC’s inclination to keep rates steady this month.

Philip Shaw, an analyst for Investec, stated: “The principal reason to hold off from easing again is that at 3.4% in December, inflation remains well above the 2% target.”

He added: “But with the stance of policy less restrictive than previously, there are greater risks that further easing is unwarranted.”

Shaw also highlighted other data points the MPC would consider, including gross domestic product (GDP), which saw a return to growth of 0.3% in November – a potentially encouraging sign for policymakers.

Matt Swannell, chief economic advisor to the EY ITEM Club, affirmed: “Keeping bank rate unchanged at 3.75% at next week’s meeting looks a near-certainty.”

He noted that while some MPC members who favoured a cut in December still have concerns about persistent wage growth and inflation, recent data has not been compelling enough to prompt back-to-back reductions.

Edward Allenby, senior economic advisor at Oxford Economics, forecasts the next rate cut to occur in April.

He explained: “The MPC will continue to face a delicate balancing act between supporting growth and preventing inflation from becoming entrenched, with forthcoming data on pay settlements likely to play a decisive role in shaping the next policy move.”

The Bank’s policymakers have consistently voiced concerns regarding the pace of wage increases in the UK, which can fuel overall inflation.

Business

Budget 2026: India pushes local industry as global tensions rise

India’s budget focuses on infrastructure and defence spending and tax breaks for data-centre investments.

Source link

Business

New Income Tax Act 2025 to come into effect from April 1, key reliefs announced in Budget 2026

New Delhi: Finance Minister Nirmala Sitharaman on Sunday said that the Income Tax Act 2025 will come into effect from April 1, 2026, and the I-T forms have been redesigned such that ordinary citizens can comply without difficulty for ease of living.

The new measures include exemption on insurance interest awards, nil deduction certificates for small taxpayers, and extension of the ITR filing deadline for non-audit cases to August 31.

Individuals with ITR 1 and ITR 2 will continue to file I-T returns till July 31.

“In July 2024, I announced a comprehensive review of the Income Tax Act 1961. This was completed in record time, and the Income Tax Act 2025 will come into effect from April 1, 2026. The forms have been redesigned such that ordinary citizens can comply without difficulty, for) ease of living,” she said while presenting the Budget 2026-27

In a move that directly eases cash-flow pressure on individuals making overseas payments, the Union Budget announced lower tax collection at source across key categories.

“I propose to reduce the TCS rate on the sale of overseas tour programme packages from the current 5 per cent and 20 per cent to 2 per cent without any stipulation of amount. I propose to reduce the TCS rate for pursuing education and for medical purposes from 5 per cent to 2 per cent,” said Sitharaman.

She clarified withholding on services, adding that “supply of manpower services is proposed to be specifically brought within the ambit of payment contractors for the purpose of TDS to avoid ambiguity”.

“Thus, TDS on these services will be at the rate of either 1 per cent or 2 per cent only,” she mentioned during her Budget speech.

The Budget also proposes a tax holiday for foreign cloud companies using data centres in India till 2047.

-

Sports5 days ago

Sports5 days agoPSL 11: Local players’ category renewals unveiled ahead of auction

-

Tech1 week ago

Tech1 week agoStrap One of Our Favorite Action Cameras to Your Helmet or a Floaty

-

Sports1 week ago

Sports1 week agoWanted Olympian-turned-fugitive Ryan Wedding in custody, sources say

-

Entertainment1 week ago

Entertainment1 week agoThree dead after suicide blast targets peace committee leader’s home in DI Khan

-

Tech1 week ago

Tech1 week agoThis Mega Snowstorm Will Be a Test for the US Supply Chain

-

Sports1 week ago

Sports1 week agoStorylines shaping the 2025-26 men’s college basketball season

-

Entertainment1 week ago

Entertainment1 week agoUFC Head Dana White credits Trump for putting UFC ‘on the map’

-

Entertainment5 days ago

Entertainment5 days agoClaire Danes reveals how she reacted to pregnancy at 44