Business

Publishers fear AI summaries are hitting online traffic

Suzanne BearneTechnology Reporter

Getty Images

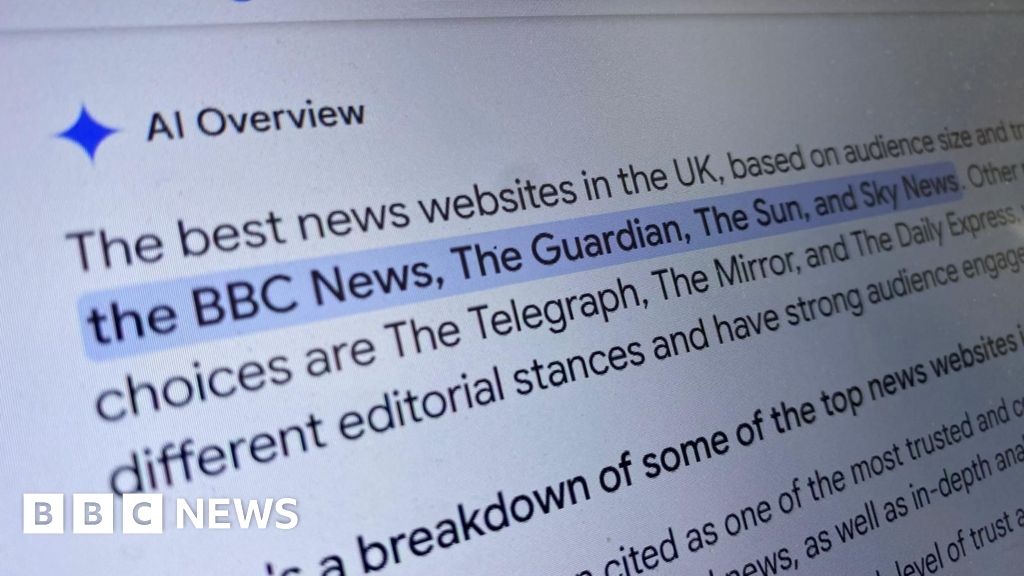

Getty ImagesWhen actress Sorcha Cusack left the BBC drama Father Brown in January, it made headlines, including for the newspapers owned by Reach, among them The Mirror, and the Daily Express.

But the story did not generate the traction the Reach newspapers would have expected a year ago, or even at the start of the year.

Reach put this down to AI Overviews (AIO) – the AI summary at the top of the Google results page.

Instead of clicking through to the story on a Reach newspaper site, readers were happy with the AI overview.

The feature is a concern for newspapers and other media publishers, who have already seen much of their advertising revenue siphoned off by social media.

In a tough market, readers coming via Google search is a valuable source of traffic.

“A major worry, backed by some individual datapoints, has been that AI overviews would lead to fewer people clicking through to the content behind them, with negative knock-on effects for publishers,” says Dr Felix Simon, research fellow in AI and news at the Reuters Institute for the Study of Journalism, University of Oxford.

He points out that it’s hard to know the scale of the problem, as Google does not publish data on click-through rates.

DMG Media, owner of MailOnline, Metro and other outlets, said AIO resulted in a fall in click-through-rates by as much as 89%, in a statement to the Competition and Markets Authority made in July.

It means publishers are not being fairly rewarded for their work, says David Higgerson, chief digital publisher at Reach.

“Publishers provide the accurate, timely, trustworthy content that basically fuels Google, and in return we get a click… that hopefully we can monetise to our subscription service.

“Now with Google Overviews it’s reducing the need for somebody to click through to us in the first place, but for no financial benefit for the publisher.”

“It’s another example of the distributor of information not being the creator of information but taking all the financial reward for it.”

There is also concern over Google’s new tool called AI Mode, which shows search results in a conversational style with far fewer links than traditional search.

“If Google flips onto full AI Mode, and there is a big uptake in that…that [will be] completely quite devastating for the industry,” says Mr Higgerson.

Getty Images

Getty Images“We are definitely moving into the era of lower clicks and lower referral traffic for publishers,” says Stuart Forrest, global director of SEO digital publishing at Bauer Media.

“For most of the last decade Google has introduced more and more features into the SERP [Search Engine Results Page], which reduces the need for consumers to visit a website. That is the challenge that we as a sector face.”

Mr Forrest says he hasn’t noticed a drop in traffic across Bauer’s sites, which include brands Grazia and Empire, as a result of the overview feature. But that could change.

“I absolutely think that as time goes on, as consumers get used to these panels, it’s without doubt going to be a challenge. We are absolutely behaving as if we have to respond to that threat.”

In its defence, a Google spokesperson said: “More than any other company, Google prioritises sending traffic to the web, and we continue to send billions of clicks to websites every day.

In an August blog post, Google’s head of search Liz Reid said the volume of clicks from Google search to websites had been “relatively stable” year-over-year.

She also said the number of quality of clicks had improved slightly compared to a year ago – quality clicks are when a user does not immediately click back from the link.

“With AI Overviews, people are searching more and asking new questions that are often longer and more complex. In addition, with AI Overviews people are seeing more links on the page than before. More queries and more links mean more opportunities for websites to surface and get clicked,” she said in the blog.

Some in the publishing industry are turning to the courts for redress.

In July, a group of organisations including the Independent Publishers Alliance, tech justice non-profit Foxglove, and the campaign group Movement for an Open Web filed a legal complaint to the UK’s Competition and Markets Authority alleging that Google AI Overviews is using publishers’ content at a cost to the newspapers.

It is asking the CMA to introduce interim measures to prevent Google from “misusing” publisher content in AI-generated responses.

In the meantime publishers are trying to understand how to feature in AIO and hopeful win some click-throughs.

“Google doesn’t give us a manual on how to do it. We have to run tests and optimise copy in a way that doesn’t damage the primary purpose of the content, which is to satisfy a reader’s desire for information,” explains Mr Higgerson.

“We need to make sure that it’s us being cited and not our rivals,” says Mr Forrest. “Things like writing good quality content… it’s amazing the number of publishers that just give up on that.”

Like other publishers, Reach is looking at other ways to build traffic to its news platforms.

“We need to go and find where audiences are elsewhere and build relationships with them there. We’ve got millions of people who receive our alerts on WhatsApp,” Mr Higgerson says.

“We’ve built newsletters. It’s all about giving people what they want when they’re on our website and our brand, so the next time they’re looking, hopefully they aren’t going to a third party to get to us.”

Business

Budget 2026: India pushes local industry as global tensions rise

India’s budget focuses on infrastructure and defence spending and tax breaks for data-centre investments.

Source link

Business

New Income Tax Act 2025 to come into effect from April 1, key reliefs announced in Budget 2026

New Delhi: Finance Minister Nirmala Sitharaman on Sunday said that the Income Tax Act 2025 will come into effect from April 1, 2026, and the I-T forms have been redesigned such that ordinary citizens can comply without difficulty for ease of living.

The new measures include exemption on insurance interest awards, nil deduction certificates for small taxpayers, and extension of the ITR filing deadline for non-audit cases to August 31.

Individuals with ITR 1 and ITR 2 will continue to file I-T returns till July 31.

“In July 2024, I announced a comprehensive review of the Income Tax Act 1961. This was completed in record time, and the Income Tax Act 2025 will come into effect from April 1, 2026. The forms have been redesigned such that ordinary citizens can comply without difficulty, for) ease of living,” she said while presenting the Budget 2026-27

In a move that directly eases cash-flow pressure on individuals making overseas payments, the Union Budget announced lower tax collection at source across key categories.

“I propose to reduce the TCS rate on the sale of overseas tour programme packages from the current 5 per cent and 20 per cent to 2 per cent without any stipulation of amount. I propose to reduce the TCS rate for pursuing education and for medical purposes from 5 per cent to 2 per cent,” said Sitharaman.

She clarified withholding on services, adding that “supply of manpower services is proposed to be specifically brought within the ambit of payment contractors for the purpose of TDS to avoid ambiguity”.

“Thus, TDS on these services will be at the rate of either 1 per cent or 2 per cent only,” she mentioned during her Budget speech.

The Budget also proposes a tax holiday for foreign cloud companies using data centres in India till 2047.

Business

Budget 2026 Live Updates: TCS On Overseas Tour Packages Slashed To 2%; TDS On Education LRS Eased

Union Budget 2026 Live Updates: Union Budget 2026 Live Updates: Finance Minister Nirmala Sitharaman is presenting the Union Budget 2026-27 in Parliament, her record ninth budget speech. During her Budget Speech, the FM will detail budgetary allocations and revenue projections for the upcoming financial year 2026-27. Sitharaman is notably dressed in a Kanjeevaram Silk saree, a nod to the traditional weaving sector in poll-bound Tamil Nadu.

The budget comes at a time when there is geopolitical turmoil, economic volatility and trade war. Different sectors are looking to get some support with new measures and relaxations ahead of the budget, especially export-oriented industries, which have borne the brunt of the higher US tariffs being imposed last year by the Trump administration.

On January 29, 2026, Sitharaman tabled the Economic Survey 2025-26, a comprehensive snapshot of the country’s macro-economic situation, in Parliament, setting the stage for the budget and showing the government’s roadmap. The survey projected that India’s economy is expected to grow 6.8%-7.2% in FY27, underscoring resilience even as global economic uncertainty persists.

Budget 2026 Expectations

Expectations across key sectors are taking shape as stakeholders look to the Budget for support that sustains growth, strengthens jobs and eases financial pressures:

Taxpayers & Households: Many taxpayers want practical improvements to the income tax structure that preserve simplicity while supporting long-term financial planning — including broader deductions for home loan interest and diversified retirement savings options.

New Tax Regime vs Old Tax Regime | New Income Tax Rules | Income Tax 2026

Businesses & Industry: With industrial output and investment showing resilience, firms are looking for policies that bolster capital formation, ease compliance, and expand infrastructure spending — especially in manufacturing and technology-driven sectors that promise jobs and exports.

Startups & Innovation: The startup ecosystem expects incentives around employee stock options and capital access, along with regulatory tweaks that encourage risk capital and talent retention without increasing compliance burdens.

Also See: Stock Market Updates Today

The Budget speech will be broadcast live here and on all other news channels. You can also catch all the updates about Budget 2026 on News18.com. News18 will provide detailed live blog updates on the Budget speech, and political, industry, and market reactions.

We are providing a full, detailed coverage of the union budget 2026 here, with a lot of insights, experts’ views and analyses. Stay tuned with us to get latest updates.

Also Read: Budget 2026 Live Streaming

Here are the Live Updates of Union Budget 2026:

-

Fashion1 week ago

Fashion1 week agoSouth Korea tilts sourcing towards China as apparel imports shift

-

Sports5 days ago

Sports5 days agoPSL 11: Local players’ category renewals unveiled ahead of auction

-

Sports1 week ago

Sports1 week agoWanted Olympian-turned-fugitive Ryan Wedding in custody, sources say

-

Tech1 week ago

Tech1 week agoStrap One of Our Favorite Action Cameras to Your Helmet or a Floaty

-

Entertainment1 week ago

Entertainment1 week agoThree dead after suicide blast targets peace committee leader’s home in DI Khan

-

Tech1 week ago

Tech1 week agoThis Mega Snowstorm Will Be a Test for the US Supply Chain

-

Sports1 week ago

Sports1 week agoStorylines shaping the 2025-26 men’s college basketball season

-

Fashion1 week ago

Fashion1 week agoSpain’s apparel imports up 7.10% in Jan-Oct as sourcing realigns