Business

Reeves says Budget will be ‘fair’ as tax rises expected

Jennifer Meierhans,Business reporter and

Henry Zeffman,Chief political correspondent

PA Media

PA MediaChancellor Rachel Reeves has said she will make “necessary choices” in the Budget after the “world has thrown more challenges our way”.

Her Downing Street speech did not rule out a U-turn on Labour’s general election manifesto pledge not to hike income tax, VAT or National Insurance.

When journalists explicitly asked if the government was set to break that pledge she did not answer directly but said she was “setting the context for the Budget”.

Ahead of the speech, shadow chancellor Sir Mel Stride dubbed it an “emergency press conference”, adding “higher taxes are on the way” and called for Reeves to be sacked if she “breaks her promises yet again”.

If there was any doubt about tax rises before this speech, there isn’t now.

Yet Reeves repeatedly refused to get into the specifics of which taxes might go up.

Instead she began the work of explaining why a year after delivering a tax-raising Budget and vowing not to come back for more, she is in fact coming back for more.

The chancellor said she would do what is necessary, not what is popular.

The reasons she gave were poor productivity, for which she blamed Conservative government policy including Brexit, austerity and short-sighted decisions to cut infrastructure spending, persistently high global inflation and the uncertainty unleashed by Donald Trump’s tariffs.

In short, Reeves’ argument is that the failings of others are being visited upon this government, and that it falls to her to confront decisions her predecessors ducked.

She pledged to come up with a “Budget for growth with fairness at its heart” aimed at bringing down NHS waiting lists, the national debt and the cost of living.

“It is important that people understand the circumstances we are facing, the principles guiding my choices – and why I believe they will be the right choices for the country,” she said.

There are some in government who want this to be a one-and-done Budget, in that they do not want to come back again and again every year, eking out a bit more money in tax to meet the requirements of the independent forecast.

That is seen as an argument for raising billions of pounds through increasing at least one of the income tax rates.

However, no chancellor has increased the basic rate in 50 years and it would be a big risk politically, especially with public trust in politics in general, and Prime Minister Sir Keir Starmer in particular, so low.

There is also the question of whether the prime minister and chancellor could land the argument that none of this was foreseeable before last year’s Budget.

The message from Reeves echoed comments made by Sir Keir to a group of Labour MPs on Monday night.

He told those gathered that the Budget would be “a Labour Budget built on Labour values” and that the government would “make the tough but fair decisions to renew our country and build it for the long term”.

It comes as the Resolution Foundation, which has close links to Labour and was previously run by Treasury minister Torsten Bell, said avoiding changes to VAT, NI or income tax “would do more harm than good”.

Hiking income tax would be the “best option” for raising cash, it said, but suggested it should be offset by a 2p cut to employee national insurance, which would “raise £6 billion overall while protecting most workers from this tax rise”.

Extending the freeze in personal tax thresholds for two more years beyond April 2028 would also raise £7.5 billion, its pre-Budget analysis suggested.

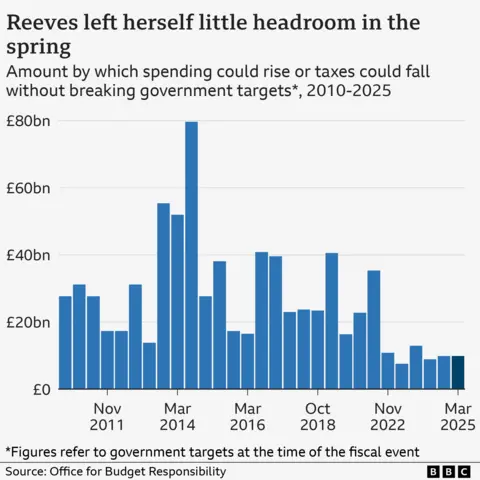

The government’s official forecaster, the Office for Budget Responsibility (OBR), is widely expected to downgrade its productivity forecasts for the UK at the end of the month. That could add as much as £20bn to the amount the chancellor will need to find if she is to meet her self-imposed “non-negotiable” rules for government finances.

The two main rules are:

- Not to borrow to fund day-to-day public spending by the end of this parliament

- To get government debt falling as a share of national income by the end of this parliament

The Treasury declined to comment on “speculation” ahead of the OBR’s final forecast, which will be published on 26 November alongside the Budget.

However, the chancellor confirmed last week that both tax rises and spending cuts are options as she aims to give herself “sufficient headroom” against future economic shocks.

Reeves said in her speech on Tuesday that her commitment to her fiscal rules was “iron-clad”.

The Resolution Foundation urged the chancellor to use the Budget to give herself more fiscal headroom, meaning how much leeway she has to increase spending or cut taxes without being forced to break her own rules.

After the last Budget, Reeves had £9.9bn of headroom – but the think tank said subsequent policy U-turns and changes in the economic outlook have turned that into a £4bn black hole.

The group said Reeves should double the level of headroom to £20bn in order to “send a clear message to markets that she is serious about fixing the public finances, which in turn should reduce medium-term borrowing costs and make future fiscal events less fraught”.

Last month, the Institute for Fiscal Studies (IFS) said there was a “strong case” to increase fiscal headroom.

The think tank said the lack of a bigger buffer created instability, and could leave the chancellor “limping from one forecast to the next”.

Business

Younger and lower-paid workers hit hardest by rising labour costs, figures show

Younger and entry-level workers are being squeezed the hardest by higher employment costs slowing the rate that firms are hiring, new analysis shows.

Some UK businesses have seen the cost of employing workers rise on the back of recent policy measures, including tax and minimum wage increases and reforms to employment rights, the National Institute of Economic and Social Research (Niesr) said in its latest economic outlook.

These factors have raised the marginal cost of hiring by around 7%, in real terms, for an entry level position, according to its findings.

Niesr warned that sectors most exposed to cost increases were experiencing a bigger impact, pointing to data showing a link between exposure to the national minimum wage and rising unemployment.

This includes typically lower-paid industries such as hotels, hospitality and food chains, which also have a greater concentration of younger and early-career workers.

Its analysis found that, rather than cutting existing jobs, many firms have chosen to slow the rate that they hire staff.

Therefore younger workers and those “at the margins of the labour market” are being disproportionately squeezed, the think tank said.

Official figures at the end of last year showed that the unemployment rate rose to its highest level since early 2021 over the three months to September.

The Office for National Statistics (ONS) said that young people especially were struggling in the tougher hiring climate, with an 85,000 increase in those unemployed aged between 18 to 24 in the three months to October – the biggest jump since November 2022.

The number of young people not in employment, education or training – so-called Neets – has been rising since 2021, and hit the highest level since 2014.

In its report, Niesr said it was “hard to escape the conclusion that the rising cost of labour has deterred full-time job creation, particularly for younger workers”.

Lord Frost, director general of the Institute of Economic Affairs, said the findings “laid bare the costs of the Government’s national insurance and minimum wage hikes, and Employment Rights Act: a spike in the cost of hiring entry-level workers, meaning fewer jobs and opportunities for young people”.

Business

Chipotle stock sinks as restaurant chain reports falling traffic, weak guidance

A Chipotle store stands in the Bronx in New York City on April 23, 2025.

Spencer Platt | Getty Images

Chipotle Mexican Grill on Tuesday reported quarterly earnings and revenue that topped analysts’ expectations, although traffic to its restaurants fell for the fourth straight quarter.

For 2026, the company is projecting flat same-store sales growth, signaling that the burrito chain’s woes are not expected to disappear quickly. Chipotle ended a bumpy 2025 with a full-year same-store sales decline of 1.7%.

Shares of the company fell as much as 11% in extended trading.

Here’s what the company reported compared with what Wall Street was expecting, based on a survey of analysts by LSEG:

- Earnings per share: 25 cents adjusted vs. 24 cents expected

- Revenue: $2.98 billion vs. $2.96 billion expected

The fast-casual chain reported fourth-quarter net income of $330.9 million, or 25 cents per share, down from $331.8 million, or 24 cents per share, a year earlier.

Excluding impairment costs, gains from terminating restaurant leases and other items, Chipotle earned 25 cents per share.

Net sales rose 4.9% to $2.98 billion.

The company’s same-store sales fell 2.5% for the quarter, making this reporting period the third quarter of the year with same-store sales declines. However, Wall Street was anticipating a steeper same-store sales decrease of 3%, according to StreetAccount estimates.

Traffic to Chipotle restaurants fell by 3.2%. Executives have previously said they have seen a pullback in spending from consumers of all income cohorts, although low-income diners have made the most significant shift to their behavior.

Over the past year, shares of Chipotle have lost roughly a third of their value, dragging the company’s market value down to about $51 billion. Investor enthusiasm for the stock waned after the fast-casual chain began reporting shrinking traffic to its restaurants.

To bring back customers, Chipotle is focusing on improving the chain’s operations and adding new menu items, rather than leaning into discounts. In December, at the tail end of the quarter, the company unveiled “protein cups,” with the goal of convincing protein-obsessed customers to stop by for a snack, not just lunch or dinner.

Chipotle opened 132 company-owned locations and seven restaurants run by international licensees during the quarter. That brought its total to 334 company-owned locations and 11 international partner restaurants opened for the year.

In 2026, the company is projecting that it will open 350 to 370 new restaurants, including 10 to 15 international locations that will be run by licensees.

Business

India–US trade deal: Textile, leather players see revival in volumes – The Times of India

CHENNAI: India’s textile, apparel and leather exporters are expecting a sustained recovery in orders from the US, following tariff reductions under the proposed India–US trade deal. Industry representatives said the move will restore competitiveness, improve margins and revive volumes that were under pressure over the past year.Textile and apparel exporters are now expecting an increased sourcing by global brands as India will now enjoy one of the lowest tariff regimes among major Asian manufacturing hubs, with a marginal advantage over competitors, such as Bangladesh, Sri Lanka, Vietnam and China. The tariff relief is expected to create a level-playing field, particularly for small and medium exporters in clusters such as Surat, Gurugram and Tirupur.Prabhu Dhamodharan, convenor of the Indian Texpreneurs Federation, said sourcing interest of US from India is rising and exports are likely to improve steadily. “The apparel and home textile exports will witness month-on-month double-digit growth from the 2026–27 fiscal, lifting the monthly apparel export run rate to $1.5 to $1.6 billion, from the current $1.3 billion.”

Eyeing a level-playing field

A Sakthivel, chairman of the Apparel Export Promotion Council, said improved trade terms would significantly enhance the competitiveness of Indian apparel products in the US market.The leather sector has termed the US decision to reduce tariffs to 18% a “double dhamaka”, coming soon after India’s strategic trade deal with the European Union. Israr Ahmed, former vice-president of the Federation of Indian Export Organisations (Fieo) and managing director of the Farida Group, said exporters had been absorbing the impact of high tariffs by offering discounts of 20–30%. “With the US now reducing tariffs on Indian goods to 18%— a rate lower than those faced by key South Asian competitors, such as Bangladesh and Vietnam — these heavy discounts are no longer necessary,” he said, adding that this would help restore pricing and margins.Rafiq Ahmed, chairman of Kothari Industrial Corporation, noted that competition in the US market has intensified over the past year but said long-standing relationships would help Indian exporters regain lost ground. “The orders from the US, which got reduced in the past one year, will start flowing,” he said.Yavar Dhala, vice-president of the Indian Shoe Federation and CEO of Infinite Leather, said India’s share of leather exports to the US could rise from about 22% to nearly 30% this year, adding that factories operating fewer days due to high tariffs could return to a six-day work week.

-

Sports1 week ago

Sports1 week agoPSL 11: Local players’ category renewals unveiled ahead of auction

-

Sports1 week ago

Sports1 week agoCollege football’s top 100 games of the 2025 season

-

Entertainment1 week ago

Entertainment1 week agoClaire Danes reveals how she reacted to pregnancy at 44

-

Business1 week ago

Business1 week agoBanking services disrupted as bank employees go on nationwide strike demanding five-day work week

-

Politics1 week ago

Politics1 week agoTrump vows to ‘de-escalate’ after Minneapolis shootings

-

Sports1 week ago

Sports1 week agoTammy Abraham joins Aston Villa 1 day after Besiktas transfer

-

Entertainment1 week ago

Entertainment1 week agoK-Pop star Rosé to appear in special podcast before Grammy’s

-

Tech1 week ago

Tech1 week agoBrighten Your Darkest Time (of Year) With This Smart Home Upgrade