Business

Rethinking Safety In High-Rise Development: How Technology Is Shaping Urban Real Estate

Last Updated:

Delhi-NCR faces frequent earthquakes due to active faults and high-rise growth. HTMD technology, used in Statue of Unity, is vital for seismic safety in real estate.

Unlike low-rise structures, tall buildings are more flexible and tend to sway under wind and earthquake loads.

Authored By Lalit Aggarwal:

As Indian cities grow vertically, the meaning of safety in real estate is changing. In the past, safety mainly meant strong foundations and compliance with basic building codes. Today, safety also means understanding how buildings behave during earthquakes and strong winds. This shift is especially important in regions like Delhi-NCR, where large areas fall under Seismic Zone IV, classified as a high-risk zone.

Earthquake risk is not limited to a few pockets of the country. Nearly 59% of India’s land area is vulnerable to earthquakes, and the Bureau of Indian Standards (BIS) has divided the country into four seismic zones based on risk levels. This makes seismic safety a national concern, not just a regional one. In fast-growing urban clusters like NCR, where population density and building heights are increasing rapidly, this risk becomes even more critical.

Delhi-NCR lies close to several active and semi-active fault systems such as the Delhi-Haridwar Ridge, the Mahendragarh-Dehradun Fault, and the Sohna Fault. In the last year alone, multiple earthquakes have been recorded across Gurugram, New Delhi, and surrounding areas. Most of these were moderate in magnitude, but they clearly show that seismic activity in this region is frequent and cannot be ignored.

High-rise buildings are especially sensitive to such forces. Unlike low-rise structures, tall buildings are more flexible and tend to sway under wind and earthquake loads. One of the biggest risks is structural resonance, which occurs when the frequency of wind or seismic motion matches the natural frequency of the building. When this happens, vibrations increase rapidly, leading to excessive movement, discomfort for occupants, and higher stress on structural elements. Over time, this can reduce the building’s usable life even if there is no visible damage.

To manage this challenge, modern engineering now focuses not only on strength but also on controlling movement. One of the most effective technologies used worldwide for this purpose is the High-Performance Tuned Mass Damper (HTMD).

HTMD is an advanced vibration control system installed within a building. It consists of a heavy mass connected through springs and damping systems, carefully tuned to the building’s natural frequency. When the building moves due to wind or an earthquake, the HTMD moves in the opposite direction. This opposite motion absorbs and dissipates vibrational energy, reducing the overall sway of the structure.

The advantage of HTMD technology is that it works silently and continuously. It does not block forces but manages them in a controlled way. This helps protect the structure, improves occupant comfort, and reduces damage during extreme events.

Globally, such systems are already a standard solution for important and tall structures. A well-known Indian example is the Statue of Unity in Gujarat, one of the tallest statues in the world. Due to its height and exposure to strong winds, the structure uses a pendulum-type tuned mass damper to control wind-induced vibrations and improve stability. This shows that vibration control is not limited to buildings alone but is essential for any tall structure exposed to dynamic forces.

Internationally, buildings like Taipei 101 in Taiwan and Shanghai Tower in China also use tuned mass damping systems to manage wind and earthquake movements. These projects demonstrate that such technology is reliable, proven, and critical for safety in tall structures.

In the Indian real estate sector, especially for residential high-rise projects, the use of HTMD has been rare. However, this approach is now evolving. This reflects a growing awareness that seismic safety must be built into the structure from the design stage itself.

As Indian cities continue to rise upward, technologies like HTMD will play an increasingly important role. In seismic regions, controlling how buildings move is just as important as making them strong. The future of real estate safety lies in intelligent design choices that respect the forces of nature while protecting people and long-term urban development.

(The author is co-founder & vice-chairman of Signature Global India. Views are personal.)

Check JEE Mains Result 2026 Link Here

February 21, 2026, 15:27 IST

Read More

Business

Pharma exports grow 9.4% to $30.47 billion in FY25; industry eyes double-digit expansion by 2026-27 – The Times of India

India’s pharmaceutical exports rose 9.4 per cent in 2024–25 to $30.47 billion, with the industry targeting double-digit growth in 2026–27 amid efforts to expand global market access, the commerce ministry said on Saturday, PTI reported. Issues related to pharmaceutical exports were discussed during a Chintan Shivir held in Ahmedabad between government officials and industry representatives, the ministry said.“The interaction underlined the government’s focus on enabling conditions for sustained export acceleration, with industry indicating readiness to target double-digit growth in 2026-27,” it said.The domestic pharmaceutical sector, currently valued at around $60 billion, is projected to grow to $130 billion by 2030.India ranks third globally in pharmaceutical production by volume, exporting medicines to more than 200 markets worldwide. Over 60 per cent of exports are shipped to stringent regulatory markets, according to the ministry.The United States accounts for 34 per cent of India’s pharmaceutical exports, while Europe contributes 19 per cent.Exporters were also briefed on opportunities emerging from recent trade engagements with key partners, including the European Union and the United States.“Engagement with the European Union was discussed in the context of a $572.3 billion pharmaceuticals and medical devices market, while a bilateral trade arrangement with the United States can further improve market access and price competitiveness for Indian pharmaceutical companies,” the ministry said.The commerce ministry added that it will continue consultations with exporters, regulators and Indian Missions abroad to ensure timely identification and resolution of sectoral issues, with the aim of supporting sustained growth in pharmaceutical exports across global markets.

Business

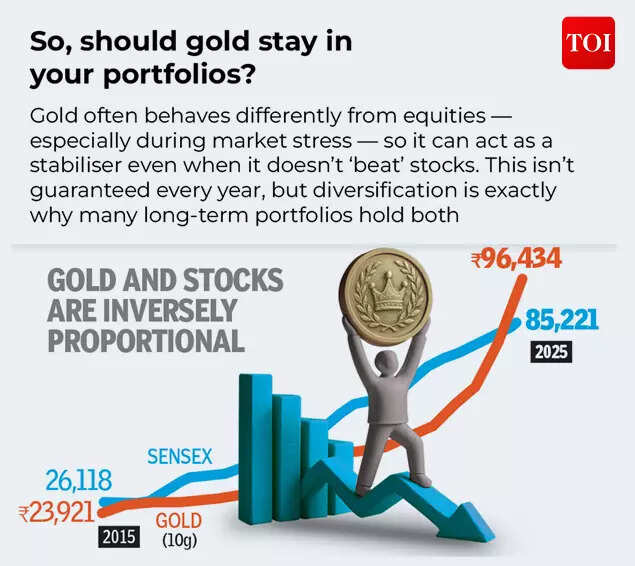

Eye-popping rise in one year: Betting on just gold and silver for long-term wealth creation? Think again! – The Times of India

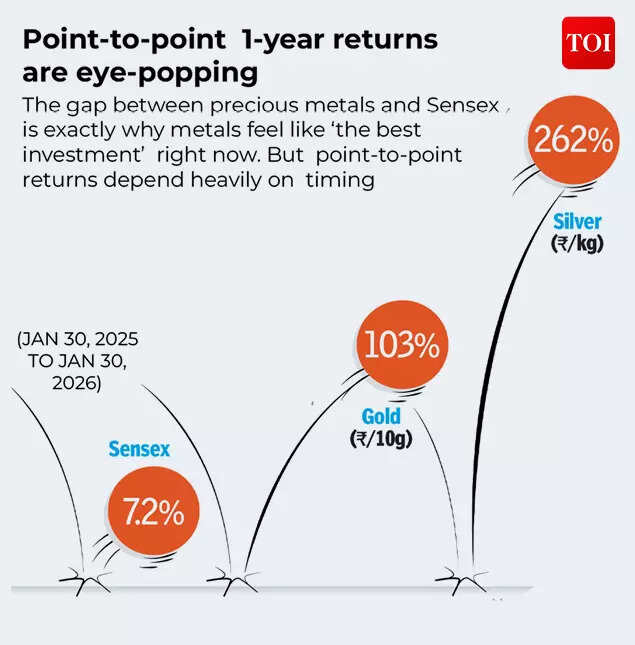

Gold and silver have delivered eye-popping returns over the last one year. In contrast, Sensex and Nifty have delivered a muted performance. Gold and silver have already delivered an exceptional run over the past year, with silver posting gains of around 160% and gold posting over 80% gains domestically in 2025. Over the past one year, precious metals have clearly outpaced equities. Gold in India is hovering around Rs 1.55–1.60 lakh per 10 grams and silver is near Rs 2.60–2.70 lakh per kg after a sharp rally driven by geopolitical tensions, strong central bank buying, inflation concerns and currency weakness. In comparison, the Nifty 50 and Sensex have delivered relatively moderate single-year returns, reflecting a more measured earnings environment.This has prompted investors to wonder if their portfolios should be oriented more towards gold and silver, than equities. But gold and silver have also seen a brutal selloff in the recent weeks, dropping from their record highs, though the precious metals are still sitting on decent returns. Before you make the decision on which asset class to invest in, experts believe it’s prudent to look at historical data to understand how returns in gold, silver and equities shape up over longer time periods.

Gold, silver, stocks: How do the returns compare over a 1-year, 5-years, 10-years time period?

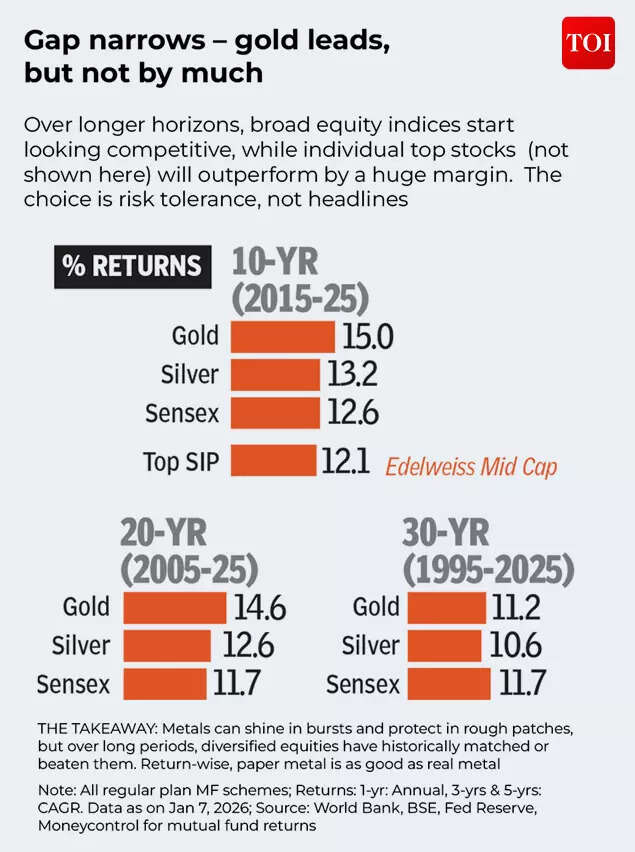

A commonly asked question in the minds of investors is: where should the hard earned money be put to earn the best returns? Over a 1-year, 5-year and 10-year time period, which asset class has offered the highest returns – gold, silver or equities?Looking at performance across time periods gives useful perspective, and a deeper understanding into investments should ideally be allocated.According to Somil Mehta, Head of Retail Research at Mirae Asset Sharekhan, equity markets tend to be volatile. Stocks can outperform sharply in good years, but also see corrections. Gold and silver usually provide stability, especially during global uncertainty, he tells TOI.Over a 5-year time frame, equities (Nifty and Sensex) generally outperform precious metals, supported by earnings growth and economic expansion. Gold performs well during risk-off phases, while silver remains more volatile, Mehta says.However, according to Mehta, over a decade, equities clearly emerge as the strongest wealth creators. Gold delivers steady returns, acting more as a hedge than a growth asset. Silver’s performance is uneven due to its industrial demand cycle.

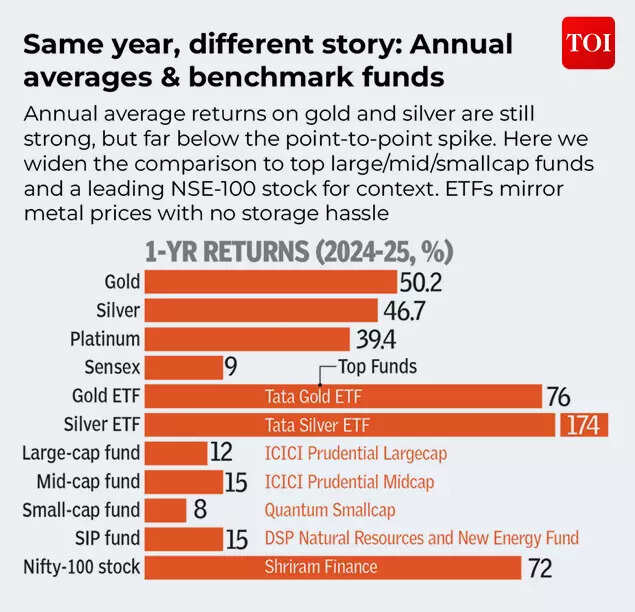

Experts note that the last one year has been an outlier for precious metals as they significantly outperformed equities, with silver and gold delivering strong gains amid safe-haven demand due to global trade concerns (US tariffs) and geopolitical uncertainty, while Nifty returns remained relatively muted. An analysis by TOI on gold, silver and stock markets over various time-frames notes that annual averages smooth out the ups and downs within the year — closer to how most people actually experience prices.

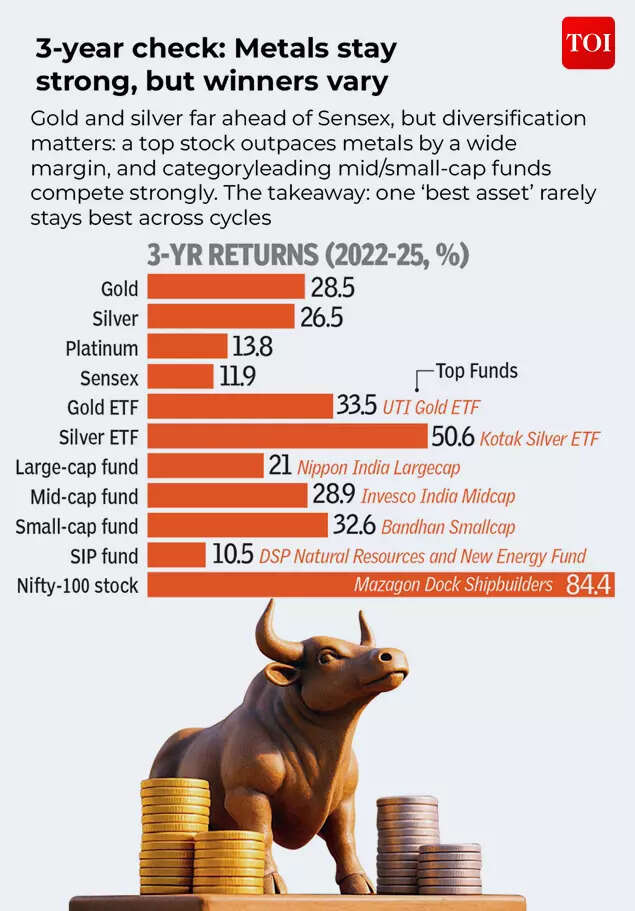

On a 3-year horizon check the TOI analysis notes: “A top stock outpaces metals by a wide margin, and category-leading mid/small-cap funds compete strongly. The takeaway: one ‘best asset’ rarely stays best across cycles.”

For a 5-year period the winners look different: strong equity funds (mid/small-cap leaders near the high-20s CAGR) look better than metals, and the top-performing NSE-100 stock is in a different league. Message: metals can be easy; equity wealth often comes from riding volatility, says the TOI analysis.

Akshat Garg, Head of Research and Product at Choice Wealth notes that when the time frame is expanded, equities continue to demonstrate the power of compounding. “Businesses grow revenues, expand margins and reinvest profits, which creates sustainable wealth over long periods. Gold and silver, on the other hand, do not generate earnings; they primarily act as stores of value and crisis hedges. They outperform during uncertainty, but over full economic cycles equities tend to lead,” he tells TOI.

Will gold and silver outperform stock markets in 2026 as well?

According to Somil Mehta, Head of Retail Research at Mirae Asset Sharekhan, this year equities are likely to outperform precious metals, provided economic growth remains stable.“Gold may deliver moderate returns if global uncertainty, geopolitical risks, or currency volatility persist. Silver could underperform gold due to higher volatility and dependence on industrial demand,” he tells TOI.However, Maneesh Sharma, AVP – Commodities & Currencies, Anand Rathi Shares and Stock Brokers still sees gold and silver outperforming equites.“As far as equity outlook is concerned, fundamental growth numbers remain crucial for the current year. This is evident from the fact that as the Nifty’s price-to-earnings (P/E) ratio hovers around 22.5 as of mid-February 2026, it trades near its 3-year average of 25.2x, but with the Sensex P/E exceeding its 15-year average, it leaves little room for multiple expansion without fundamental earnings acceleration. Hence cautious optimism persists for Nifty returns this year,” he tells TOI.“Gold & Silver are still expected to outperform equities amid persistent global uncertainties, including geopolitical tensions & structural imbalances in developed economies leading to growing deficits. Central bank demand remains a bullish pillar for gold prices, with many central banks indicating plans to increase their holdings this year although pace of increase is expected to moderate,” he says.While anticipating a good year for gold and silver, Sneha Poddar, VP-Research, Wealth Management, Motilal Oswal Financial Services sees equities giving a 10% return.“Broader commodities space, especially precious metals, could continue to stay resilient in 2026, though not in a one-way rally like last year; instead, may see phases of consolidation with the price levels subject to revision as per evolving macro and liquidity conditions,” she says.The expert anticipates that equities will return to the forefront with an expected 10% price return for Nifty over one year, considering improving earnings trajectory with PAT expected to grow at around 12% CAGR over FY25-27E. “We anticipate improved earnings growth, given the supportive domestic policies (both fiscal and monetary) and strengthening global trade opportunities following recent announcements of trade deals (US, EU) and foreign trade agreements,” she told TOI.Akshat Garg, Head of Research and Product at Choice Wealth sees volatility in the prices of gold and silver this year. “Metals may remain supported if global risks and liquidity trends persist, but after a strong rally volatility cannot be ruled out,” he says.“The bigger lesson for investors is that leadership rotates. Instead of chasing the recent outperformer, diversification and disciplined rebalancing work better,” he tells TOI.Taking a different view, Jateen Trivedi, VP Research Commodity, LKP Securities sees both gold and silver performing due to ongoing global uncertainties. “Given continued geopolitical tensions, trade uncertainties, currency volatility, and sustained central bank buying, bullion may remain structurally supported into 2026. At the same time, equity markets could face sectoral challenges, particularly from global AI disruption and earnings pressures,” Trivedi tells TOI.Broadly he sees gold in the Rs 1,75,000 – Rs 1,85,000 range; silver in the Rs 3,00,000 – 3,25,000 range and Nifty at around 27,000 (assuming no major geopolitical escalation).“Metals may continue to outperform if uncertainty persists, though volatility will remain high,” he says.

Time is a greater teacher: What’s the biggest lesson?

The biggest lesson from the historical performance of gold, silver and equities is clear: don’t chase the recent winner, don’t bet blindly on last year’s outperformer!“This is perhaps the oldest mistake in investing, and also the most common. Investors who rushed into silver after its 2025 rally are taking on far more risk than they realise. Those who ignored gold for years before 2025 paid a price too. The data across decades tells us clearly: no single asset stays on top forever,” says InCred Money.Somil Mehta, Head of Retail Research, Mirae Asset Sharekhan

- No single asset wins every year.

- Equities create long-term wealth, but gold protects portfolios during uncertainty.

- Timing markets is difficult, asset allocation matters more than asset selection

For a 5-10 year time horizon, Somil recommends a portfolio that has 55-65% in equities (focus on quality large caps and structural sectors); 10-15% for gold and silver with gold as the main hedge; 20-30% in debt or fixed income for stability and liquidity.Somil Mehta says: “Equities remain the best long-term wealth creator, while gold plays a supporting role. A balanced portfolio, not chasing short-term winners, is the most reliable way to build wealth over time.”For Sneha Poddar of MOFSL the sure-shot way to win in the long-term is that investing ultimately hinges on discipline, diversification and a clear understanding of the asset class.

Source: Anand Rathi Shares & Stockbrokers“While metals often outperform during volatile macro phases, equities deliver steadier returns and should remain the core long-term allocation, with gold and silver serving as strategic hedges within a well-balanced portfolio,” she says.“For a balanced and relatively stable portfolio, gold should ideally carry a slightly higher weight than silver depending on investors risk profile and tenure of investment. Therefore, portfolios can ideally comprise 85-90% equities and 10–15% gold/silver. Over longer periods, equities historically deliver steady wealth creation, while metals act as portfolio stabilisers rather than return drivers,” she says.Akshat Garg of Choice Wealth is of the view that a portfolio with roughly 60–70% equities, 20–30% debt and 5–10% allocation to gold and silver offers a balanced blend of growth, stability and protection for a 5-10 year time period.The important thing to understand is that equities, metals, bonds — all carry cycles of outperformance and correction. “The key lesson is diversification. Chasing recent winners without balance increases portfolio risk. A balanced mix helps capture upside while managing long-term volatility,” says LKP Securities’ Jateen Trivedi.InCred Money notes that there is no one-size-fits-all allocation, but a simple rule of thumb is this: over a 5-year horizon, lean balanced, around 50–60% equities and 40–50% high-quality fixed income, so you participate in growth without exposing near-term goals (like a home down payment or business capital) to excessive volatility. Over a 10-year horizon, you can afford to tilt more toward growth, 60–75% equities and the rest in bonds or other stable assets, because time smooths out market cycles and compounds returns. The real driver is your risk appetite and goal clarity: if a 15–20% drawdown keeps you up at night, dial down equities; if your goals are long-term wealth creation and you can stay invested through volatility, lean into growth. Allocation should protect your sleep first, and then grow your wealth, says InCred Money.As InCred Money concludes: Gold is your safety net. When stock markets fall, gold tends to hold its ground or rise. It doesn’t make you rich overnight, but it protects what you already have. Silver is more of a wild card, unfortunately, because of speculators. It can shoot up in good times, but it can fall just as hard. Stocks, over time, are the real wealth builders, but they demand patience.The investor who wins over the long run is rarely the one who picked the hottest asset of the year. It’s the one who stayed diversified, stayed calm, and didn’t let headlines drive their decisions.(Disclaimer: Recommendations and views on the stock market, other asset classes or personal finance management tips given by experts are their own. These opinions do not represent the views of The Times of India)

Business

‘Studying all developments’: India reacts after US Supreme Court strikes down Trump’s tariffs – The Times of India

NEW DELHI: The government on Saturday said that India is closely “studying all developments and implications” of the US Supreme Court’s ruling striking down President Donald Trump’s sweeping tariffs across the world.In its first statement, the ministry of commerce & industry said, “We have noted the US Supreme Court judgement on tariffs yesterday. President Trump has also addressed a press conference in that regard. Some steps have been announced by the US administration.”“We are studying all these developments for their implications,” it added.The remarks come a day after the Supreme Court of the United States, in a 6–3 verdict, ruled that Trump’s sweeping global tariffs violated federal law. Chief Justice John Roberts, writing for the majority, held that the tariffs exceeded the scope of the law.Following the setback, Trump termed the ruling a “terrible decision” and announced a new 10% global tariff “effective immediately.”Invoking Section 122 of the Trade Act of 1974, Trump said he would sign an executive order imposing the additional levy.This provision allows the US president to impose a temporary import surcharge of up to 15% for 150 days to address balance-of-payments deficits.“Effective immediately, all the national security tariffs under Section 232 and existing Section 301 tariffs remain in place… Today, I will sign an order to impose a 10% global tariff under Section 122 over and above our normal tariffs already being charged,” Trump said.Trump also asserted that the India-US trade deal would remain unaffected.“Nothing changes, they’ll be paying tariffs, and we will not be paying tariffs. So, the deal with India is they pay tariffs. This is a reversal for what it used to be,” said Trump.“I think Prime Minister Modi is a great gentleman, a great man, actually, but he was much smarter than the people that he was against in terms of the United States. He was ripping us off, India. So we made a deal with India, it’s a fair deal now, and we are not paying tariffs to them and they are paying tariffs. We did a little flip,” he added.However, when further asked whether India will have to pay a 10% tariff and whether it would replace previous tariffs imposed under the International Emergency Economic Powers Act (IEEPA), a White House official said, “Yes, 10% until another authority is invoked.”

-

Business1 week ago

Business1 week agoTop stocks to buy today: Stock recommendations for February 13, 2026 – check list – The Times of India

-

Fashion1 week ago

Fashion1 week ago$10→ $12.10 FOB: The real price of zero-duty apparel

-

Tech4 days ago

Tech4 days agoRakuten Mobile proposal selected for Jaxa space strategy | Computer Weekly

-

Entertainment4 days ago

Entertainment4 days agoQueen Camilla reveals her sister’s connection to Princess Diana

-

Politics4 days ago

Politics4 days agoRamadan moon sighted in Saudi Arabia, other Gulf countries

-

Entertainment4 days ago

Entertainment4 days agoRobert Duvall, known for his roles in "The Godfather" and "Apocalypse Now," dies at 95

-

Politics4 days ago

Politics4 days agoTarique Rahman Takes Oath as Bangladesh’s Prime Minister Following Decisive BNP Triumph

-

Tech1 week ago

Tech1 week ago‘Uncanny Valley’: ICE’s Secret Expansion Plans, Palantir Workers’ Ethical Concerns, and AI Assistants